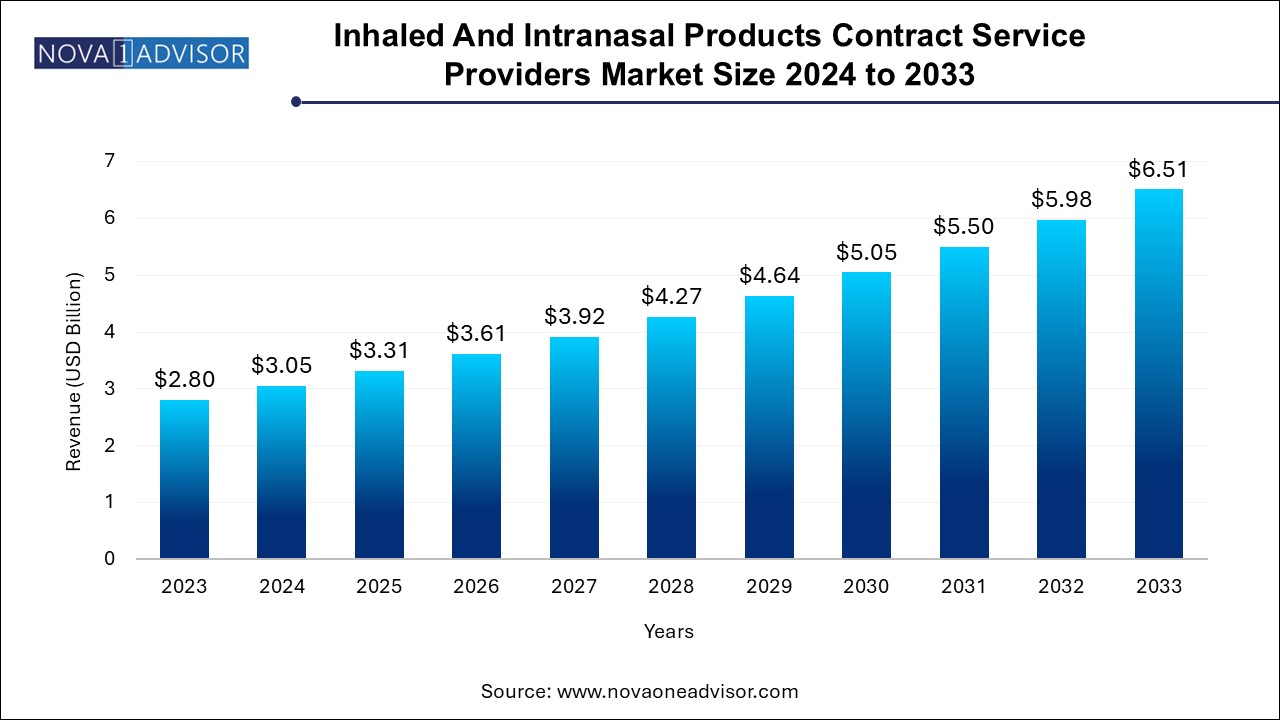

The global inhaled and intranasal products contract service providers market size was exhibited at USD 2.80 billion in 2023 and is projected to hit around USD 6.51 billion by 2033, growing at a CAGR of 8.8% during the forecast period of 2024 to 2033.

The inhaled and intranasal products contract service providers market is an essential and fast-evolving segment of the pharmaceutical outsourcing industry, driven by the growing demand for targeted, non-invasive drug delivery systems. Inhalation and intranasal drug delivery routes have become increasingly favored in both acute and chronic disease management due to their rapid onset of action, high bioavailability, and patient-friendly administration. These delivery forms are critical in managing respiratory illnesses such as asthma, COPD, allergic rhinitis, and increasingly in systemic therapies including migraine, diabetes, pain management, and even vaccines.

As the pharmaceutical industry experiences heightened demand for specialized delivery formats, contract development and manufacturing organizations (CDMOs) and contract research organizations (CROs) have stepped in to fill the capability and capacity gaps faced by drug sponsors. These service providers offer a broad suite of functions including product development, quality assurance, regulatory consulting, manufacturing, and lifecycle management specifically tailored to inhaled and intranasal formats.

The market has become increasingly dynamic as innovation in inhalation devices and intranasal formulations accelerates. The COVID-19 pandemic further intensified interest in nasal drug delivery as a route for vaccines and antivirals, due to its potential for mucosal immunity and self-administration. Consequently, companies are investing in contract services to navigate the complexity of device integration, dose uniformity, and regulatory compliance. As smaller biotech firms lack the in-house expertise or infrastructure, outsourcing to specialized providers is becoming the norm, making this market indispensable for pharmaceutical innovation and scalability.

Rise in Demand for Intranasal CNS and Vaccine Delivery: Ongoing research is expanding intranasal applications to CNS disorders, vaccines, and even cancer therapies.

Increased Outsourcing by Small and Mid-sized Biopharma Companies: To reduce costs and accelerate time-to-market, firms are increasingly relying on CDMOs and CROs for end-to-end services.

Emergence of Digital and Smart Inhalers: Integration of digital sensors and app-connected inhalers is prompting new demands for device-testing, software compliance, and tech-support services.

Regulatory Convergence and Global Expansion: Regulatory harmonization is helping service providers offer standardized packages across markets, especially in North America and Europe.

Adoption of Dry Powder Inhalers (DPIs): DPIs are becoming popular due to their stability and ease of use, creating specialized contract service needs for formulation and device compatibility.

Sustainability in Inhaler Manufacturing: With concerns over propellants in MDIs, companies are innovating around eco-friendly devices, increasing the need for reformulation and revalidation support.

Personalized Inhalation Therapy: Advances in pharmacogenomics and AI are driving demand for customizable delivery systems, which service providers must help develop and validate.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.80 Billion |

| Market Size by 2033 | USD 6.51 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Drug Delivery Product, Services, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Lonza; Catalent Inc. ; Kindeva Drug Delivery; Recipharm; Quotient Services; Hovione; Colep; Beximo Pharmaceuticals; DPT Laboratories; Orion |

A key driver propelling the inhaled and intranasal products contract service providers market is the rising prevalence of respiratory and systemic conditions that benefit from these drug delivery routes. Chronic respiratory diseases such as asthma and COPD affect over 500 million people globally, creating sustained demand for inhalation-based treatment. Meanwhile, intranasal drug delivery is gaining traction in managing central nervous system conditions like epilepsy, migraine, and depression, due to its ability to bypass the blood-brain barrier.

In parallel, the appeal of self-administered, non-invasive alternatives to injectables—particularly in the aging population—has made nasal and pulmonary delivery increasingly desirable for vaccines, analgesics, and hormone therapies. As pharma companies expand their pipelines in these areas, the demand for outsourced expertise in device compatibility, formulation stability, and patient usability is surging, making contract service providers indispensable partners in the product development lifecycle.

Despite the market’s growth, a major restraint is the technical and regulatory complexity associated with developing inhaled and intranasal therapies. These delivery formats require specialized expertise in device engineering, aerosol physics, and formulation science to ensure accurate dosing, stability, and bioavailability. Variations in patient technique such as breath coordination or nasal mucosa health can affect performance, adding layers of complexity in clinical trials and product design.

Regulatory agencies like the FDA and EMA have stringent requirements for bioequivalence, dose uniformity, and human factor studies in inhalation products. Additionally, device and drug must be developed in an integrated manner, with simultaneous testing and validation. For smaller CDMOs or pharma sponsors, these requirements can increase costs, prolong timelines, and create entry barriers unless they partner with highly specialized service providers.

An exciting opportunity within this market lies in the emergence of intranasal vaccines and systemic drug delivery applications. Intranasal vaccines, which stimulate mucosal immunity, have been explored for diseases like influenza and COVID-19. Their ease of administration and potential for needle-free mass immunization make them especially attractive in pediatric and elderly populations. Likewise, intranasal delivery of medications for pain, seizures, or opioid overdose (e.g., naloxone) offers rapid absorption and user-friendliness.

Pharmaceutical firms developing such innovative applications increasingly require specialized services in nasal formulation design, nasal deposition studies, and compatibility testing with atomizers or nasal sprays. CDMOs that can offer end-to-end solutions, including regulatory navigation for new indications and delivery systems, stand to benefit significantly from this trend.

Metered-Dose Inhalers (MDIs) dominate this segment, owing to their historical prevalence and widespread use in asthma and COPD treatment. MDIs are pressurized canisters that deliver medication in aerosol form, and they continue to be a mainstay due to their affordability, portability, and physician familiarity. As such, contract service providers are commonly engaged for valve compatibility testing, propellant optimization, and stability assessment under varied humidity and temperature conditions. CDMOs offering propellant reformulation and dose-finding services are particularly in demand as the industry shifts to environmentally friendly HFA propellants.

Dry Powder Inhalers (DPIs) are the fastest-growing product type, driven by their breath-actuated mechanism and propellant-free operation. These devices are more environmentally sustainable and often preferred by patients for their simplicity. DPIs are particularly useful in pediatric and geriatric care, where breath coordination can be challenging. Contract developers are increasingly focused on flow resistance calibration, powder dispersion testing, and user handling studies. With the rise of personalized respiratory therapies and biologic delivery via DPI, service providers with advanced simulation labs and DPI-specific regulatory knowledge are experiencing rapid demand growth.

Contract Manufacturing dominates the services segment, as drug sponsors increasingly outsource the production of inhaled and nasal formulations to reduce capital costs, minimize regulatory risk, and accelerate timelines. CDMOs provide everything from small-batch GMP manufacturing to large-scale fill-finish operations, including device assembly and packaging. Given the integration of drug and device, expertise in sterile filling, leak testing, and automated packaging is critical. Major players also offer cold chain logistics and serialization, making them preferred partners for both clinical and commercial phases.

Product Design & Development is the fastest-growing service, as innovation in delivery systems drives demand for preclinical development support. This service includes device prototyping, formulation compatibility, nasal deposition modeling, and user interface design. As more drugs including biologics and peptides are adapted for inhaled or intranasal delivery, sponsors need help from early development to design optimal delivery systems. Providers offering in-house engineering and simulation platforms, such as 3D modeling or computational fluid dynamics (CFD), are witnessing rising interest, especially from startups and university spin-offs.

North America dominates the inhaled and intranasal contract services market, driven by a robust biopharmaceutical ecosystem, advanced regulatory infrastructure, and the presence of several global CDMOs. The U.S. in particular is home to leading service providers offering both drug-device combination development and GMP-certified manufacturing. Furthermore, the FDA's streamlined pathways for combination product approval provide clarity and support for innovators. High prevalence of respiratory diseases, combined with a mature reimbursement structure, encourages continual investment in novel inhalation therapies, reinforcing the region's leadership.

Asia-Pacific is the fastest-growing region, with countries like India, China, South Korea, and Japan investing in pharmaceutical outsourcing and advanced drug delivery R&D. The growing middle class, rising chronic disease burden, and increasing demand for self-administered treatments are driving adoption of inhaled and intranasal products. Governments are providing incentives for domestic CDMO capacity expansion, while global pharma companies are forming joint ventures with regional players to meet both local and international needs. The relative cost advantage, coupled with improving regulatory frameworks, is accelerating the region’s role in the global contract services value chain.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global inhaled and intranasal products contract service providers market.

Drug Delivery Product

Services

By Region