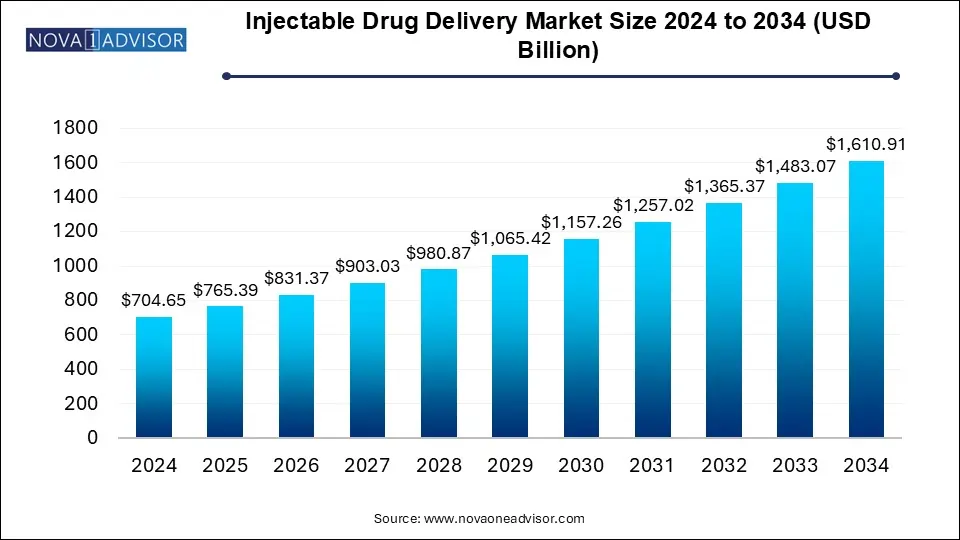

The injectable drug delivery market size was exhibited at USD 704.65 billion in 2024 and is projected to hit around USD 1610.91 billion by 2034, growing at a CAGR of 8.62% during the forecast period 2025 to 2034.

Artificial intelligence, deep learning, and machine learning technologies are utilized in drug discovery and delivery while optimizing treatment regimens and patient outcomes. AI also helps in target identification and validation, selection of targets, supply chain optimization, prediction of the synthetic route, predictive maintenance, and monitoring during continuous manufacturing processes. AI enhances efficiency, reduces costs, and improves the quality of medicines and patient health. In drug discovery, AI is used for molecular modeling and chemical structure prediction. Machine learning algorithms can analyze complex datasets which help streamline the drug discovery process by predicting molecular interactions and optimizing drug formulations.

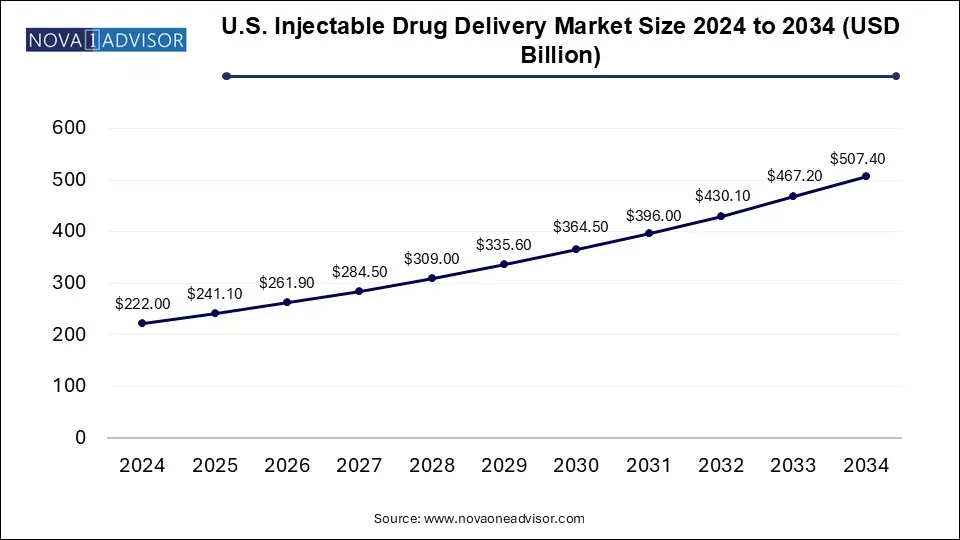

The U.S. injectable drug delivery market size reached USD 222.0 billion in 2024 and is anticipated to be worth around USD 507.4 billion by 2034, poised to grow at a CAGR of 7.8% from 2025 to 2034.

North America dominated the injectable drugs delivery market in 2022. The growth of injectable drugs delivery market in North America region is being attributed to the growing prevalence of various disorders. In addition, rising adoption of strategies by market players are also supporting the growth of North America injectable drugs delivery market.

The North America market is growing due to the rising incidence of diabetes, cancer, and autoimmune disorders in the North American region. The need for long-term treatments with injectable medications is fueling the demand for advanced drug delivery devices. Furthermore, the growing adoption of self-administration devices among patients boosts the market’s growth in this region. The adoption of such advanced devices empowers people in managing their own health conditions more effectively. The expansion of autoinjectors, needle-free injectors, and wearable injectors is driving this market significantly.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the injectable drugs delivery market in Europe region. The Europe injectable drugs delivery market is attributed to the factors such as the rise of the biologics market, rising incidence of chronic disorders, and the rising demand for self-injection devices are all contributing to this trend. The other factors propelling the growth of injectable drugs delivery market in Europe region are rising disposable income, rising number of partnerships, and rising awareness about safety and comfort.

The rising geriatric population in Europe along with the growing cases of diabetes, cancer, etc. boosts the need for injectable drug delivery systems and devices in this region. A large healthcare expenditure and a strong shift towards personalized medicine are expected to drive the market in this region. The United Kingdom’s Medicines and Healthcare Products Regulatory Agency approved the injectable diabetes medication of Eli Lilly for its use in weight loss and management for adults aged 18 and above.

| Report Coverage | Details |

| Market Size in 2025 | USD 765.39 Billion |

| Market Size by 2034 | USD 1610.91 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.62% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Formulation Packaging, Therapeutic Application, Usage Pattern, Site of Administration, Distribution Channel, Facility of Use, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | The major players operating in the injectable drug delivery market are Becton, Dickinson and Company, Pfizer Inc., Teva Pharmaceuticals Industries Ltd., Eli Lilly and Company, Baxter International, Inc., Sandoz, Terumo, Schott AG, Gerresheimer, Ypsomed, Bespak, B. Braun Melsungen |

Driver

The rise of biopharmaceuticals and the growing consumption of sterile injectables all around the world are majorly contributing to the market’s growth. The biopharmaceuticals are increasingly preferred to treat chronic conditions like diabetes and arthritis which surges the need for injectable drug delivery systems. A growing focus towards enhancing patient experiences by improving the quality of patient-centric healthcare approaches boosts the demand for these advanced systems.

Restraint

The rising need for precise dosages and the potential risks of infections in drug-administered areas can impose remarkable challenges in front of healthcare professionals. Scaling up injectable formulations is another challenge in these systems and processes. Inadequate biological resources also impact the expansion of the market worldwide.

Opportunity

Scientists could find strategies for selecting the right CDMO to ensure the growth of nasal drug projects and nasal drug delivery. They would also be able to improve aerosol delivery, nanosuspension, and mesh technology. Hospitals, home-care settings, and other healthcare facilities would expand this market by being potential end users.

The devices segment accounted largest revenue share in 2024. The growing prevalence of chronic disorders is leadingto an increase in overall syringe practice, predominantly disposable syringes. The cardiovascular illnesses, diabetes, and obesity have been found to be leading causes of death from chronic disorders. As populacesurge is believed to be the critical factor in emerging nations, this is likely to have the highest impact all around the world.

The formulations segment is fastest growing segment of the injectable drugs delivery market in 2024. The growing prevalence of chronic disorders, increased acceptance of self-injection, patient adherence, biologics, and innovative technologies are all factors driving this segment’s rapid rise.

The auto-immune diseases segment accounted revenue share in 2024. The immune system attacks and destroys its own body tissue in autoimmune diseases. The diabetes, lupus, rheumatoid arthritis, and other auto-immune diseases are among the most frequent. Immune suppressants, anti-inflammatory medicines, and other medications have been licensed to treat auto-immune illness.

The oncology segment is fastest growing segment of the injectable drugs delivery market in 2024. The growing prevalence of cancer is driving the growth of the segment. As per the American Cancer Society, by 2024, there will be roughly 1,806,590 cancer patients in the U.S. alone, up 31% from 2010.

The hospitals segment dominated the injectable drugs delivery market in 2024. This is attributed to an increase in the number of people admitted to hospitals with acute and chronic wounds. In addition, expansion of the segment is also being driven by the surge in the number of standalone clinics in established and developing nations.

The retail pharmacy stores segment is expected to strong growth over the forecast period. The retail pharmacy stores sell pharmaceutical medications and drugs. These stores offer generic and branded medications, as well as other pharmaceutical supplies. The growing preference of patients for buying injectable drugs delivery from these stores is driving the growth of the segment. In addition, growing consumption of over the counter drugs is also contributing towards the expansion of the retail pharmacy stores segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the injectable drug delivery market

By Type

By Formulation Packaging

By Therapeutic Application

By Usage Pattern

By Site of Administration

By Distribution Channel

By Facility of Use

By Regional