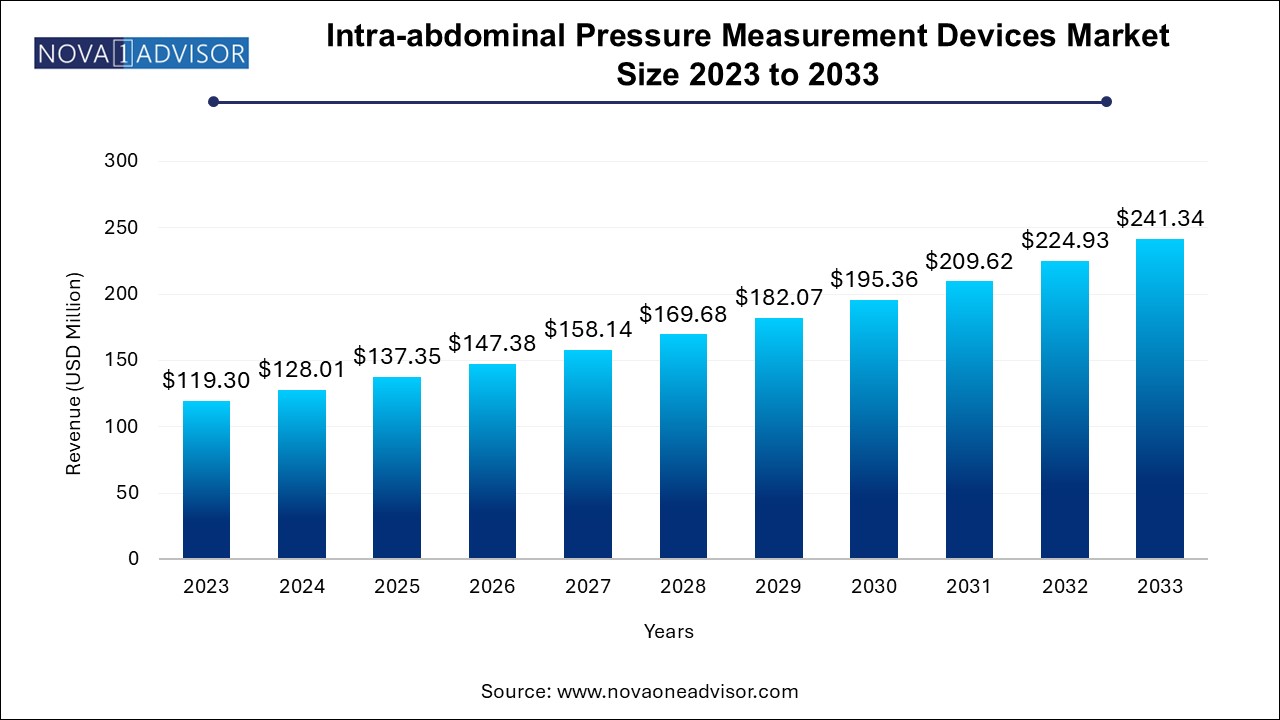

The global intra-abdominal pressure measurement devices market size was exhibited at USD 119.3 million in 2023 and is projected to hit around USD 241.34 million by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 128.01 Million |

| Market Size by 2033 | USD 241.34 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Procedure, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | C. R. Bard, Inc. (BD); Convatec Group Plc; Potrero Medical; Biometrix; Holtech Medical; Gaeltec Devices Ltd.; Speigelberg GmbH & Co. KG.; C2Dx Inc.; Centurion Medical Products (Medline Industries, Inc.) |

High prevalence of Intra-abdominal Hypertension (IAH) and Abdominal Compartment Syndrome (ACS) among ICU patients as well as adoption of technologically advanced products are the major factors expected to drive the market for intra-abdominal pressure measurement devices. Intra-abdominal hypertension refers to a pressure greater than 12 mmHg and is based on the pressure at which organ dysfunction occurs. The normal Intra-abdominal Pressure (IAP) for critically ill adults should range between 5-7 mmHg.

IAH is mainly caused by too much intra-abdominal volume within the abdominal cavity. In addition, elevated IAP occurs more often in patients suffering from acute abdominal syndromes such as intestinal perforation, peritonitis, ileus, acute pancreatitis, or trauma.IAPMD is used to measure IAP to identify individuals at the risk of IAH/ACS. There is high prevalence of IAH/ACS among patients in intensive care units across the world. The incidence of IAH and ACS is associated with significantly increased mortality and morbidity. The rise in intra-abdominal pressure causes tissue hypoperfusion which can lead to impaired hepatic blood flow, multiple organ dysfunction syndromes, respiratory failure, increased intracranial pressure, renal failure, and impair the function of nearly every organ. For instance, according to the article published in the Critical Care Medicine Journal in 2023, 38-45% of the patients develop intra-abdominal hypertension who are treated in ICU settings. Thus, increasing demand for intra-abdominal pressure measurement devices for early recognition and treatment of IAH and ACS are majorly driving the market.

Several initiatives are being undertaken by various organizations for the awareness related to real-time measurement of IAH in ICU patients. For instance, the World Society of the Abdominal Compartment Syndrome (WSACS) is an international not-for-profit organization consists of group of worldwide surgeons and physicians who promotes research, encouraging education, and revamping the treatment of patients with IAH/ACS. Moreover, in 2023, WSACS has organized 9th WCACS congress Campinas on Abdominal Compartment, in Brazil to increase partnerships around the world and focus on the treatment and management of abdominal compartment. This growing awareness among people regarding the treatment and initiatives taken by government to prevent the rate of associated disorders is likely to boost the growth of the market for intra-abdominal pressure measurement devices.

Countries such as the U.S. and Canada have witnessed increasing cases of ICU admissions and urological disorders such as interstitial cystitis, bladder cancer, prostate cancer, and bowel syndrome in the recent years. As per the Society of Critical Care Medicine (SCCM) 2023, in the U.S. approximately 5.0 million patients are admitted to ICUs for invasive or intensive monitoring every year. Furthermore, according to the Canadian Cancer Society Statistics 2020, it is estimated that in 2020, 23,300 men will be diagnosed with prostate cancer. Therefore, increasing prevalence of IAH and ACS among ICU patients and associated disorders is anticipated to boost the growth of the market for intra-abdominal pressure measurement devices over the forecast period.

Additionally, increasing number of cases of IAH and ACS in the developed and developing countries has driven the launch of technologically advanced products in the market for intra-abdominal pressure measurement devices. For instance, Potrero Medical’s Accuryn Monitoring System which is next generation diagnostic tool helps to precisely monitor patients' vital signs in real-time and integrates with the hospital Electronic Medical Record (EMR) system. This system can transform a traditional Foley catheter into a next-generation diagnostic tool that can automatically measure urine output, intra-abdominal pressure, and core body temperature. In addition, ConvaTec’s AbViser AutoValve intra-abdominal pressure monitoring device automatically integrates with all Foley catheters, transducers, and patient monitors in any ICU or operation room. Thus, market players are making constant efforts for introducing technologically advanced products in the market for intra-abdominal pressure measurement devices.

The equipment segment has dominated the market for intra-abdominal pressure measurement devices with a revenue share of 65.1% in 2023. As intra-abdominal hypertension measurement via indirect methods (equipment) has been considered as the gold standard method and has achieved widespread acceptance due to its simplicity and cost effectiveness. Technologically advanced monitors are used to help surgeons to closely monitor the patient and provide efficient treatment with IAH. Thus, benefits offered by the equipment segment are expected to fuel the growth of the market for intra-abdominal pressure measurement devices.

However, the disposables segment is expected to grow at the highest CAGR of 8.1% from 2024 to 2033. As sometimes indirect measurement via equipment is not feasible in some patients with bladder trauma, outflow obstruction, and neurogenic bladders which will require direct IAP measurement through disposables such as, intraperitoneal catheter, tubing pumps, and needles. Thus, the increasing application of disposables devices for the real time monitoring of intra-abdominal pressure is anticipated to boost the growth of the market for intra-abdominal pressure measurement devices in the forecast period.

The abdomen segment has dominated the intra-abdominal pressure measurement devices market with a revenue share of 76.9% in 2023. This is attributed to the increasing cases of intra-abdominal hypertension in critically ill patients. As elevated intra-abdominal pressure affects the organ functionality in such patients, and this may lead to abdominal compartment syndrome. IAH measurement is obtained by direct needle puncture within the abdominal cavity. Thus, these factors are anticipated to increase the demand for intra-abdominal pressure measurement devices during the forecast period.

Whereas, the muscle segment is expected to grow at a highest CAGR of 8.3% in the market for intra-abdominal pressure measurement devices from 2024 to 2033. This is attributed to the increasing cases of trauma, burns, abdominal surgeries, and sports injuries. This results in large amount of pressure inside a muscle compartment causes pain, swelling, and sometimes disability in the affected muscles. Thus, these factors are expected to increase the demand for intra-abdominal pressure measurement devices during the forecast period.

Intra-abdominal hypertension segment has dominated the market for intra-abdominal pressure measurement devices with a revenue-share of 91.6% in 2023 and is also expected to grow at the highest CAGR of 8.0% from 2024 to 2033. As IAH directly affects the abdominal organs such as liver and kidney, it may also affect the function of brain, lungs, and cardiovascular system. Patients receiving mechanical ventilation are more likely to have IAH. Thus, increasing ICU admissions is expected to boost segment growth in the coming years.

In addition, IAH frequently occurs in patients suffering from acute abdominal syndromes such as peritonitis, ileus, intestinal perforation, acute pancreatitis, or trauma. Several other factors such as surgical and medical factors are responsible for increased intra-abdominal hypertension. Surgical factors include omphalocele, postoperative hemorrhage, ileus, gastroschisis, primary trauma, or burns. Other factors that may induce IAH include acute pancreatitis, edema, acute respiratory failure with raised intra-thoracic pressure, and intra-abdominal tumor. Thus, increasing prevalence of acute abdominal syndromes and surgical procedures induces the IAH, which in turn, is expected to drive the segment.

North America dominated the market with a share of 60.2% in 2023. This is attributable to the presence of well-established healthcare facilities in the region, increasing government initiatives, and rising cases of ICU admissions. Furthermore, availability of technologically advanced products and presence of major key players such as BD, C2DX, Inc, and Medline Industries are also contributing towards the growth of the market for intra-abdominal pressure measurement devices in the region.

Asia Pacific is expected to grow at a highest CAGR of 8.8% from 2024 to 2033 due to the factors such as growth in aging population, huge population base, and unmet needs regarding the IAH diagnosis and treatment in this region. Moreover, improvements in clinical development framework of developing economies such as Japan, India, and China are likely to contribute to the growth of the market for intra-abdominal pressure measurement devices.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global intra-abdominal pressure measurement devices market

Product

Procedure

Application

Regional