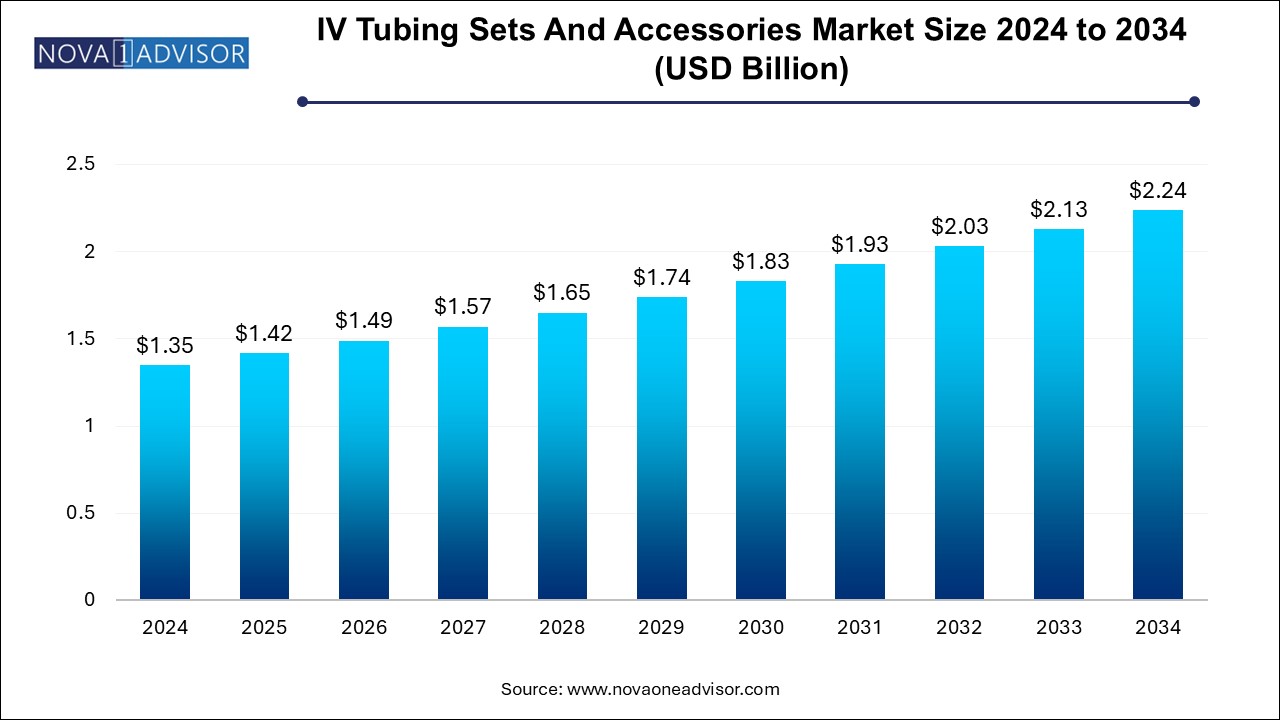

The IV tubing sets and accessories market size was exhibited at USD 1.35 billion in 2024 and is projected to hit around USD 2.24 billion by 2034, growing at a CAGR of 5.2% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.42 Billion |

| Market Size by 2034 | USD 2.24 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 5.2% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | B. Braun Medical Inc.; ICU Medical, Inc.; Baxter; BD; Fresenius Kabi AG; Zyno Medical (Intuvie Holdings LLC); Nipro Medical Corporation; Polymedicure |

Market growth worldwide is driven by the escalating prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions. With the NCBI’s reports of around 129 million people in the U.S. requiring long-term intravenous therapies, there is increasing demand for reliable and efficient IV solutions for effective patient management.

Advancements in healthcare infrastructure and the rising trend toward home-based care are significantly influencing the IV tubing sets market. The COVID-19 pandemic has accelerated the transition to home healthcare services, providing patients with a cost-effective alternative to prolonged hospital stays for IV therapy. Companies such as B. Braun Melsungen AG have effectively leveraged this trend by launching portable and user-friendly IV devices tailored for at-home use. As the elderly population increases, the preference for home healthcare further enhances the demand for these innovative products.

Furthermore, the introduction of features such as needleless connectors, anti-kink tubing, and smart IV pumps enhances the safety and efficiency of IV therapy. For instance, in July 2023, BD announced FDA 510(k) clearance for the updated BD Alaris Infusion System, optimizing infusion therapy to improve health system efficiency. Such systems ensure accurate medication delivery, enhance patient outcomes, and encourage healthcare providers to upgrade their IV administration capabilities, increasing operational efficiency.

Moreover, robust regulatory frameworks in regions such as North America ensure the highest quality standards for medical devices, instilling confidence among healthcare providers and patients alike. The well-established healthcare infrastructures in these regions facilitate the efficient adoption of advanced IV tubing systems and accessories.

Primary IV tubing sets led the market with a revenue share of 32.2% in 2024. Primary IV tubing sets are vital in acute and chronic care settings, facilitating the rapid delivery of lifesaving medications and supporting long-term treatments such as chemotherapy. Their continuous design advancements and cost-effectiveness make them crucial, enabling hospitals and clinics to procure in bulk without financial strain, ensuring availability for diverse medical procedures.

Extension IV tubing sets are expected to grow at the fastest CAGR of 5.8% over the forecast period. Extension IV tubing sets enhance patient maneuverability in critical care and surgical environments. In ICUs, they enable efficient management of multiple IV lines while minimizing entanglement risks. Innovations from companies such as ICU Medical and Smiths Medical incorporate advanced materials and safety features, such as anti-reflux valves and needleless connectors, to reduce infection and injury risks.

Peripheral intravenous catheter insertion dominated the market with a revenue share of 48.5% in 2024, driven by its extensive application across various medical settings and the rising adoption of minimally invasive procedures. Recent technological advancements have yielded improved biocompatible designs that enhance patient safety and comfort, incorporating features such as closed-system configurations, needleless connectors, and anti-reflux valves to reduce the risks of infections and needle-stick injuries.

Central venous catheter (CVC) placement is expected to register the fastest CAGR of 5.4% over the forecast period, owing to the essential role of central venous catheters (CVCs) in managing acute and chronic medical conditions, alongside the increasing demand for long-term intravenous therapy. For example, patients with chronic kidney disease and those needing long-term parenteral nutrition rely on tunneled or non-tunneled CVCs for reliable vascular access.

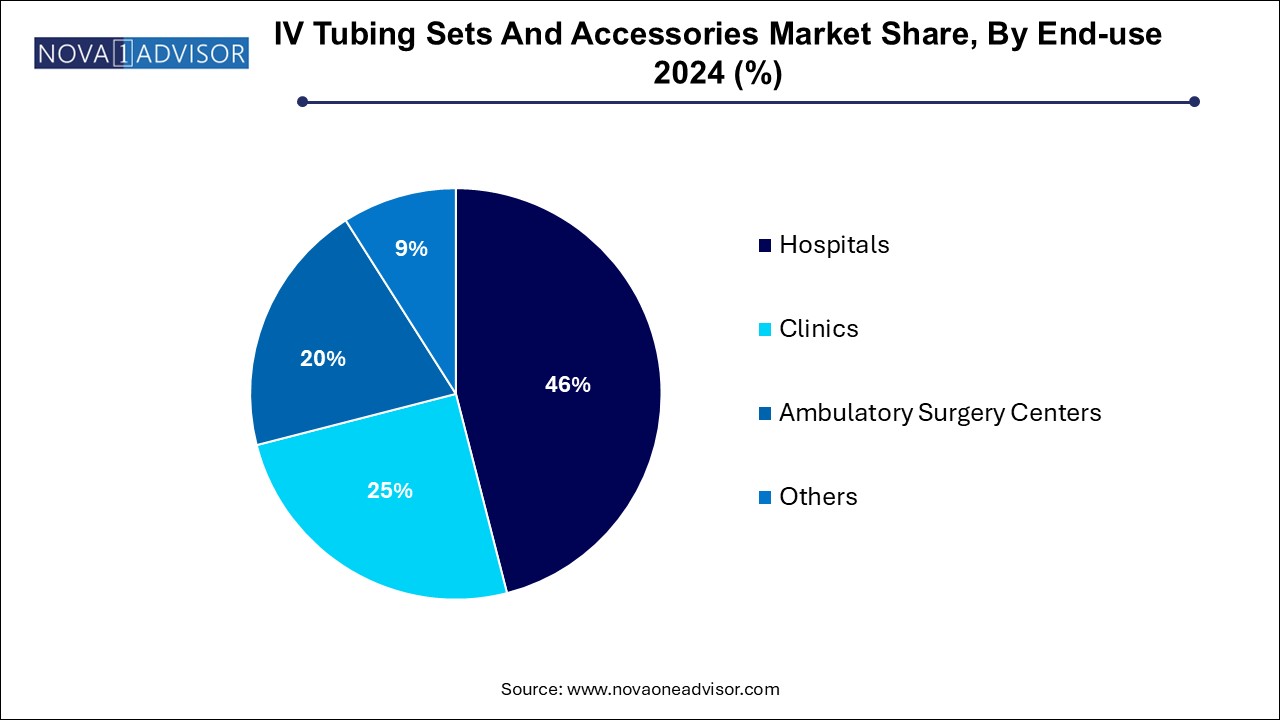

Hospitals held the largest market share of 46.0% in 2024 due to the high volume of surgical procedures, the prevalence of chronic diseases, and the availability of advanced healthcare infrastructure and specialized medical personnel. Hospitals play a crucial role in managing complex cases, resulting in heightened demand for intravenous tubing sets and accessories for anesthesia and medication administration.

Ambulatory surgical centers (ASCs) are projected to the fastest growth of 5.8% over the forecast period. are gaining popularity for their cost-effectiveness and convenience, allowing outpatient procedures that previously required hospital stays. This transition reduces healthcare costs, enhances patient turnover, and optimizes hospital resources for critical cases, thereby increasing the demand for intravenous tubing sets for anesthesia, fluids, and medication administration in ASCs.

The North America IV tubing sets and accessories market dominated the global market with a revenue share of 46.9% in 2024. Market growth in the region is driven by the high prevalence of chronic diseases, an aging demographic, technological advancements, and an expansion of home healthcare services, influenced by the COVID-19 pandemic. Approximately 14,714 urgent care centers in the U.S. provide care to over 100 million patients annually, supported by stringent FDA regulations.

U.S. IV Tubing Sets And Accessories Market Trends

The IV tubing sets and accessories market in U.S. dominated the North America IV tubing sets & accessories market with a revenue share of 83.5% in 2024. As the population ages, the demand for effective and reliable intravenous treatments is increasing, driving market growth. According to the National Library of Medicine, nearly nine major surgeries were performed per 100 older individuals in the U.S. in July 2021, highlighting the need for high-quality IV tubing sets amidst ongoing medical technology advancements.

Europe IV Tubing Sets And Accessories Market Trends

The Europe IV tubing sets and accessories market held substantial market share in 2024. The region is defined by advancements in medical technology, demographic shifts, and evolving healthcare practices. The European Medicines Agency (EMA) and national regulatory bodies implement stringent standards for the safety and efficacy of medical devices, such as IV tubing sets, fostering trust among healthcare providers and patients while driving market growth.

Asia Pacific IV Tubing Sets And Accessories Market Trends

The Asia Pacific IV tubing sets and accessories market is expected to register the fastest CAGR of 5.7% in the forecast period, driven by its rapidly expanding population and rising prevalence of chronic diseases, such as diabetes, cancer, and cardiovascular conditions, driving demand for intravenous therapies. Economic development in countries such as China and India is also escalating healthcare expenditures, further enhancing the market potential.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the IV tubing sets and accessories market

Product

Application

End Use

Regional