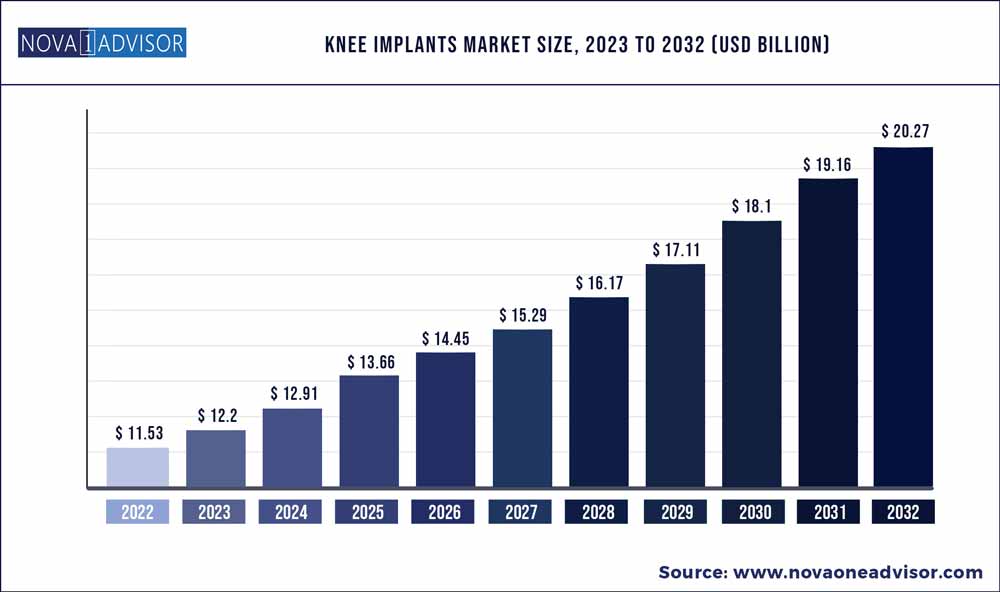

The global knee implants market size was exhibited at USD 11.53 billion in 2022 and is projected to hit around USD 20.27 billion by 2032, growing at a CAGR of 5.8% during the forecast period 2023 to 2032.

Key Pointers:

This growth can be attributed to the increasing adoption of minimally invasive surgeries and the rising prevalence of arthritis. These factors are anticipated to increase the adoption of replacement devices, which is expected to propel market growth during the forecast period. According to the Lancet Publications, approximately 654⋅1 million people worldwide suffered from knee Osteoarthritis (OA) in 2020. As the geriatric population grows, so will the need for knee surgeries and, as a result, the demand for these implants, as older people are more prone to knee-related issues.

This growth is attributed to the growing elderly population and the surging prevalence of chronic rheumatic conditions, such as osteoarthritis, rheumatoid arthritis, and post-traumatic arthritis. Primary factors that lead to the occurrence of arthritis are aging, physical injuries, genetic inheritance factors, abnormal metabolism, infections, and immune system abnormalities.

The introduction of advanced technologies and products is anticipated to keep the industry rivalry and market growth at par over the forecast period. For example, X3 Advanced Bearing Technology and Mako Robotic-Arm Assisted Technology have the capabilities of providing a patient-specific 3D model to plan partial knee replacement surgeries. In addition, in March 2016, Zimmer Biomet launched the Persona Medial Congruent Bearing, which is designed to enable more natural motion of the knee by maximizing joint stability.

Increasing investment in the healthcare sector, the growing geriatric population, and the rising demand for minimally invasive surgeries are the major factors driving the adoption of joint replacement procedures. Untapped opportunities in developing economies, such as China and India, are further anticipated to impel market growth. To combat COVID-19, the governments took the initiative of allowing only the necessary surgical procedures and the majority of knee arthroplasty surgery did not meet the definition of essential surgery. Such restrictions then hampered the demand for knee implant devices.

For instance, according to a study published by the NCBI, in July 2020, the total daily Medicare revenue from arthroplasty hospitals decreased by 89% and surgeon revenue by 86%. Thus, the initial phase of the COVID-19 outbreak negatively impacted the market. The medical product supply chain also faced difficulty due to the lockdown, as many countries banned the import and export of medical products. New key developments such as partnerships, product approvals, acquisitions, and product launches are expected to positively impact the market in the coming years. For instance, in November 2021, OrthAlign, Inc., a firm based in the U.S., launched Lantern, which is a surgical technology, used to perform total and partial knee replacements.

North America held the largest revenue share of around 50% in 2022. The region is estimated to be the predominant regional market. The U.S. represented the largest market in North America in 2021. The growing geriatric population and rising prevalence of arthritis and other joint deformities are expected to propel the growth in the U.S. market. In addition, the presence of well-established healthcare infrastructure and access to technologically advanced implant surgeries are anticipated to boost the market growth.

The Asia Pacific region is expected to showcase the highest growth rate over the forecast period, owing to the untapped growth opportunities, rising incorporation of implants in orthopedic procedures coupled with rising prevalence of arthritis and rapidly improving healthcare infrastructure. In addition, increasing healthcare awareness among individuals and technological advancements in emerging economies are anticipated to contribute to market growth.

Knee Implants Market Segmentation

| By Procedure Type | By Component |

|

Total Knee Replacement Partial Knee Replacement Revision Knee Replacement |

Fixed-bearing Implants Mobile-bearing Implants |

Knee Implants Market Key Players And Regions

| Companies Profiled | Regions Covered |

|

DePuy Synthes Zimmer Biomet Stryker Smith+Nephew Aesculap Implants Systems, LLC Exactech, Inc. Medacta MicroPort Scientific CONMED Kinamed, Inc. ConforMIS OMNIlife science, Inc. |

North America Europe Asia-Pacific Latin America Middle East & Africa (MEA) |