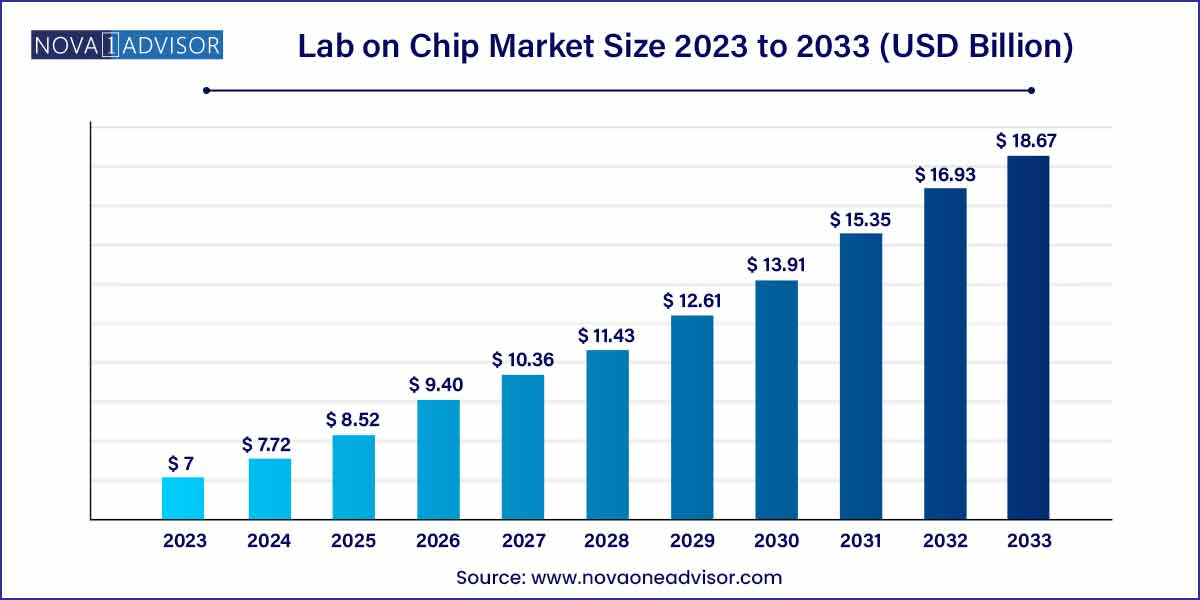

The global lab on chip market size was exhibited at USD 7.0 billion in 2023 and is projected to hit around USD 18.67 billion by 2033, growing at a CAGR of 10.31% during the forecast period of 2024 to 2033.

The Lab-on-Chip (LoC) market is undergoing transformative growth, driven by the rising demand for miniaturized, portable, and highly efficient diagnostic and analytical tools across healthcare, biotechnology, pharmaceutical, and environmental monitoring industries. LoC devices integrate one or multiple laboratory functions on a single chip, ranging from a few millimeters to a few square centimeters in size. These devices are capable of handling extremely small fluid volumes typically in the nanoliter to picoliter range and perform various processes such as sample preparation, mixing, reaction, separation, and detection.

This technology is revolutionizing traditional laboratory operations by significantly reducing the time, cost, and complexity associated with sample analysis. It holds immense potential for rapid diagnostics, especially in point-of-care settings, enabling timely treatment and disease control. For example, during the COVID-19 pandemic, the need for rapid and decentralized diagnostic solutions surged, pushing LoC technology into the spotlight. Devices like Abbot's ID NOW, a rapid molecular test platform, showcased the real-world applicability of LoC-based diagnostics.

Moreover, the convergence of microfluidics, nanotechnology, and biotechnology has opened new pathways for innovation in this field. Lab-on-chip devices are not limited to medical diagnostics but are increasingly applied in sectors like food safety, environmental testing, and forensic science. With continuous advancements in materials science and microfabrication techniques, the manufacturing of LoC systems is becoming more scalable and cost-effective.

The global Lab-on-Chip market is expected to experience robust growth in the coming decade, driven by a combination of technological innovation, rising healthcare expenditure, and the growing need for rapid diagnostic tools. However, despite the favorable landscape, challenges related to integration, regulatory approvals, and high initial development costs remain.

Growing Demand for Point-of-Care Testing (POCT): LoC devices are increasingly being adopted for real-time diagnostics at the point of care, particularly in remote and underserved areas.

Integration with Wearable Devices: There is a notable trend toward integrating LoC systems with wearable biosensors for continuous health monitoring.

Advancement in Microfluidics and 3D Printing: These innovations are improving the scalability and precision of LoC devices, enhancing performance.

Increased Funding and Collaboration: Academic institutions, government bodies, and private enterprises are investing in collaborative R&D for LoC technologies.

Shift Toward Personalized Medicine: LoC platforms are enabling faster genomic and proteomic analysis, thus supporting tailored therapeutic approaches.

Expansion in Veterinary and Agricultural Diagnostics: LoC systems are being utilized for monitoring livestock health and food quality, offering new market verticals.

Emergence of AI-Enabled LoC Devices: Artificial Intelligence is being used for real-time data interpretation and remote diagnostics.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.0 Billion |

| Market Size by 2033 | USD 18.67 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.31% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Technology, Application, End-Use, Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Micronit, MIMETAS, BEOnChip, Nortis Bio, TisssUse, InSphero, Elvesys, Mesobiotech, AxoSim, Emulate Bio, Tara Biosystems, Hepregen, Hurel Corporation, Cherry Biotech, Alveolix, BiomimiX, BioIVT, 4D Cell, Fluigent |

One of the most significant drivers for the Lab-on-Chip market is the growing prevalence of chronic and infectious diseases globally. With conditions such as cancer, diabetes, and cardiovascular disorders becoming increasingly common, there is a pressing need for diagnostic tools that can provide rapid, accurate, and on-site results. LoC systems fulfill this need by offering quick turnaround times, high throughput, and minimal sample requirements. For example, LoC-based liquid biopsy systems allow for non-invasive cancer screening through blood samples, facilitating early detection and improving survival rates. The ability to monitor disease biomarkers in real-time enables more effective disease management and treatment personalization.

Moreover, the global spread of infectious diseases such as tuberculosis, malaria, and COVID-19 has exposed the limitations of traditional lab-based testing methods. LoC devices, with their portability and speed, have emerged as essential tools for mass screening and real-time diagnostics, especially in resource-limited settings. Their usage in pandemic control efforts has further validated their efficacy and underscored the need for broader deployment.

Despite the vast potential of Lab-on-Chip systems, their development is fraught with challenges, particularly in terms of cost and complexity. The miniaturization of laboratory functions onto a chip requires advanced fabrication technologies, often involving cleanroom environments, specialized materials, and skilled labor. These factors significantly increase the cost of prototyping and manufacturing, making it difficult for small companies and academic institutions to commercialize their innovations.

Additionally, integrating various functional components—such as valves, sensors, and actuators—onto a single chip while maintaining performance consistency is technically demanding. The need for biocompatibility and regulatory approvals adds further layers of complexity. As a result, many promising innovations struggle to make the transition from lab to market. Without standardized manufacturing platforms and cost-effective scalability solutions, the widespread adoption of LoC systems may be hindered.

The increasing focus on personalized medicine offers a promising opportunity for the Lab-on-Chip market. Personalized medicine involves tailoring healthcare based on an individual’s genetic profile, lifestyle, and environmental exposures. LoC systems are ideally suited for this paradigm, as they can rapidly analyze small samples to deliver precise molecular-level data, enabling the customization of therapies.

For instance, LoC-based genomic analysis tools can identify genetic mutations responsible for certain diseases, allowing for the development of targeted drugs. In oncology, this can mean choosing a specific chemotherapeutic agent that is most likely to be effective for a given tumor genotype. The real-time feedback and multiplexing capabilities of LoC platforms ensure that physicians can make informed decisions quickly. As healthcare systems shift towards value-based care, technologies that support efficient, individualized treatment will gain significant traction, positioning LoC as a critical enabler.

Reagents and consumables emerged as the leading segment under the product category, largely due to their recurring demand in laboratory processes. These components are essential for the functioning of LoC devices and are consumed with each test, resulting in continuous revenue streams for suppliers. Diagnostic and research laboratories regularly purchase reagents tailored for specific assays, including enzymes, substrates, and buffers. Their importance was especially highlighted during the pandemic, where the demand for COVID-19 testing reagents surged globally.

Software, although less dominant in terms of market share, is the fastest-growing segment. As Lab-on-Chip systems evolve, the complexity of data interpretation increases, necessitating advanced software solutions. AI-powered platforms and cloud-based analytics are being integrated into LoC systems to provide real-time diagnostics, automate data collection, and enhance result accuracy. This trend is expected to accelerate as personalized medicine and telehealth applications gain momentum.

The microfluidics segment holds the lion’s share in the technology category. This dominance is attributed to its wide application in manipulating small volumes of fluids with high precision. Microfluidic platforms are used across diagnostics, drug development, and environmental monitoring. Their scalability and compatibility with various detection methods make them the backbone of most LoC systems today. For instance, paper-based microfluidic devices are being deployed in rural healthcare for affordable diagnostic services.

On the other hand, the tissue biochip segment is witnessing the fastest growth, driven by advancements in organ-on-chip technologies. These chips replicate the microenvironment of human organs, making them invaluable in drug testing and disease modeling. Companies like Emulate Inc. and TissUse are pioneering tissue chip models for liver, lung, and kidney applications. This innovation reduces the reliance on animal testing and accelerates drug development timelines.

Point-of-care diagnostics is the dominant application area due to the increasing need for rapid, decentralized healthcare solutions. LoC devices used in POC settings enable clinicians to perform diagnostic tests at the patient’s bedside, reducing the dependency on central labs. These systems are crucial in managing diseases such as diabetes and infectious diseases like HIV and COVID-19, where immediate results can make a life-saving difference.

Genomics is rapidly emerging as the fastest-growing segment. LoC platforms are being used to perform complex genomic sequencing and analysis, which were previously restricted to large labs. Companies are developing chip-based platforms capable of single-cell RNA sequencing and CRISPR-based detection. As personalized medicine becomes more mainstream, demand for portable and precise genomic tools is set to soar.

Hospitals and clinics represent the largest end-use segment for Lab-on-Chip technologies. The adoption of LoC devices in these settings is propelled by the need for rapid diagnostics and efficient patient management. Devices for blood analysis, infection detection, and biomarker screening are commonly used in emergency and critical care departments. Additionally, LoC systems are being integrated with electronic medical records for real-time monitoring and treatment optimization.

Academic and research institutes are the fastest-growing end-users, benefiting from increased funding and collaborative initiatives. Universities and research centers are actively using LoC devices for drug discovery, tissue engineering, and biomolecular research. The flexibility and modularity of LoC platforms make them ideal for experimentation, further accelerating innovation in this space.

North America Dominates the Global Lab-on-Chip Market

North America holds the dominant share in the Lab-on-Chip market, led primarily by the United States. The region's leadership can be attributed to its robust healthcare infrastructure, high adoption of advanced technologies, and strong presence of leading market players such as Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer. Moreover, significant government investments in R&D and precision medicine initiatives are fueling innovation in LoC technologies. The presence of top academic institutions and biotech hubs also facilitates faster development and commercialization of novel devices.

Asia-Pacific is the Fastest Growing Region

Asia-Pacific is emerging as the fastest-growing market for Lab-on-Chip devices, fueled by rising healthcare needs, growing investments in life sciences research, and expanding diagnostic infrastructure. Countries like China, India, and South Korea are making strategic efforts to enhance their biotechnology sectors. For example, in India, startups such as Achira Labs are developing LoC systems tailored for regional healthcare challenges. Meanwhile, China is leveraging its strong manufacturing base to scale up production of diagnostic chips. The increasing focus on affordable and decentralized healthcare in the region provides fertile ground for the expansion of LoC technologies.

March 2025 – Bio-Rad Laboratories announced the launch of its next-generation droplet digital PCR (ddPCR) LoC platform, designed for oncology and infectious disease testing. The platform provides high sensitivity with minimal sample input.

January 2025 – Agilent Technologies partnered with a biotech startup to develop a chip-based solution for environmental water monitoring, expanding its application portfolio.

November 2024 – Danaher Corporation’s subsidiary Cepheid received regulatory approval in Europe for a new LoC-based multiplex test for respiratory infections, enhancing its offerings in infectious disease diagnostics.

August 2024 – Thermo Fisher Scientific launched a new suite of LoC-based sample preparation kits for genomic analysis, targeting personalized medicine researchers.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2033. For this study, Nova one advisor, Inc. has segmented the global Lab on chip market.

By Product

Reagents & Consumables

Software

IV Needles

By Technology

By Application

By End-Use

By Region