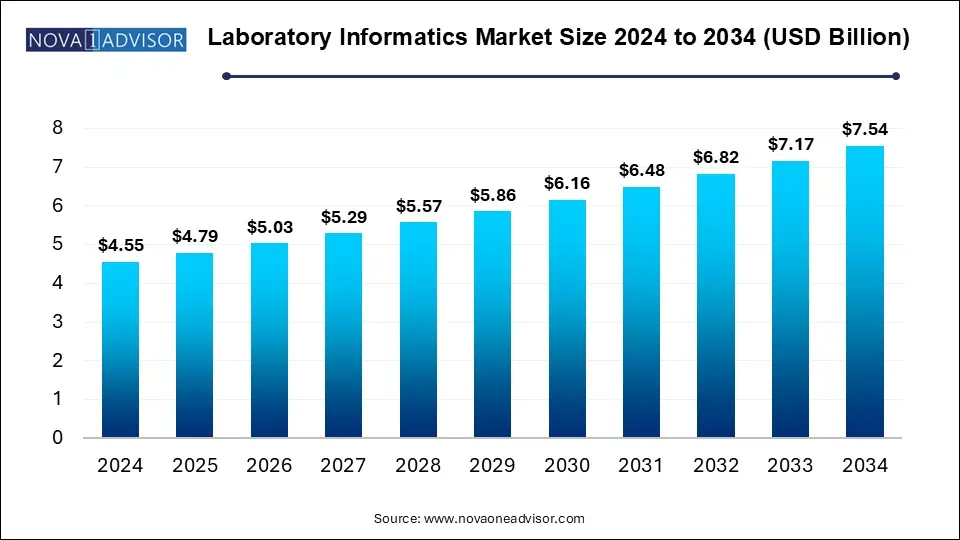

The Laboratory Informatics Market size was exhibited at USD 4.55 billion in 2024 and is projected to hit around USD 7.54 billion by 2034, growing at a CAGR of 5.18% during the forecast period 2025 to 2034.

The U.S. Laboratory Informatics Market size was valued at USD 1.47 billion in 2024 and is expected to reach around USD 2.43 billion by 2034, growing at a CAGR of 9.25% from 2025 to 2034.

.webp)

In 2024, North America led the global laboratory informatics market, securing the highest share of 43%. The laboratory informatics landscape in this region has experienced notable evolution in recent years, propelled by multiple influencing factors. Breakthroughs in digital, communication, measurement, and transportation technologies have significantly altered the configuration, staffing, and equipment of clinical laboratories. The growing demand for point-of-care and critical care diagnostics has intensified the need for instant data access and efficient information systems to facilitate clinical decision-making.

U.S. Laboratory Informatics Market Insights

The United States dominated the regional market in 2024, supported by advancements in technology, increasing regulatory requirements, and the complexity of laboratory workflows. Innovations like artificial intelligence (AI), machine learning (ML), and cloud-based systems are transforming data handling, enhancing operational efficiency, and accelerating processes across industries such as healthcare and environmental testing.

Europe Laboratory Informatics Market Outlook

The European market is poised for strong growth, fueled by ongoing automation, digitization of lab data, robust R&D investments, and the need for scalable laboratory management systems. The European Commission’s Digital Single Market Strategy is aimed at improving cross-border access to digital services and fostering infrastructure growth—further promoting digital transformation in laboratory environments.

For example, in April 2021, LabVantage Solutions, a leading provider of lab informatics platforms, partnered with Holo4Med, a medical technology firm, to strengthen its presence in Europe. This alliance aims to improve the delivery and effectiveness of LabVantage Medical Suite across the region.

In the United Kingdom, the laboratory informatics market is expected to grow steadily, driven by rising disposable income, escalating healthcare costs, and the increasing incidence of chronic illnesses. Labs are transitioning from isolated informatics systems to integrated, user-friendly platforms. There’s a growing shift toward merging lab informatics with AI and automation, with investments pouring into LIMS, AI technologies, and data optimization tools. Notably, 17% of decision-makers in European and U.S. labs plan to adopt or upgrade LIMS between June 2024 and June 2025.

Germany accounted for the largest share in Europe’s lab informatics market in 2024, driven by heightened lab automation, digital data transformation, and stringent compliance standards across industries. Strategic moves like mergers and acquisitions are expanding technological capabilities. For instance, in October 2022, LabVantage Solutions joined forces with Germany-based Biomax Informatics to enhance offerings for the life sciences and biomanufacturing segments.

Asia Pacific Laboratory Informatics Market Trends

The Asia Pacific region is forecasted to record the fastest growth during the projection period, spurred by increasing demand from pharmaceutical firms aiming to boost productivity and minimize operational costs. The region benefits from a high concentration of Contract Research Organizations (CROs) in rapidly developing countries like India and China, supported by the adoption of sophisticated lab information systems.

In April 2024, Autoscribe Informatics, Inc. expanded its footprint in the region by opening a new office in Australia, aiming to support its growing LIMS business and better serve regional clients in their digital transformation efforts.

China led the Asia Pacific market in 2024, driven by government initiatives promoting electronic health records and digital health. Emerging technologies such as AI, automation, and blockchain are significantly elevating lab informatics performance, with a focus on predictive analytics and improved patient outcomes. For instance, in February 2022, Sanomede Medical Technology Co., Ltd. partnered with Roche Diagnostics China to introduce RS600 Lab Automation Software—highlighting China’s increasing focus on lab automation.

In India, the market is expanding rapidly due to a rise in cardiovascular and infectious disease prevalence, leading to higher demand for eClinical and informatics solutions. Government policies, such as lifting import taxes on clinical trial materials and allowing the export of trial samples, are accelerating market development. Additionally, efforts to enhance healthcare infrastructure and the digital health ecosystem, along with corporate expansions, are contributing to growth.

Latin America Laboratory Informatics Market Overview

The Latin American lab informatics sector is expected to grow steadily, driven by an aging population, a rising chronic disease burden, and growing investments from both public and private sectors. As awareness of the benefits of lab automation rises, demand for LIMS and ELN systems is expected to climb.

In Brazil, market expansion is supported by rising incomes, increased public healthcare funding, greater access to private medical services, and accelerating R&D activities in the healthcare sector.

Middle East & Africa Laboratory Informatics Market Trends

In the Middle East & Africa, the laboratory informatics market is experiencing significant momentum. Governments are implementing informatics systems to enhance healthcare quality, while hospitals and medical institutions are increasingly adopting automated solutions. Market growth is being driven by improvements in healthcare infrastructure, increased automation in laboratories, and rising public-private partnerships.

South Africa’s market is projected to expand rapidly, underpinned by government-led modernization initiatives in lab operations. These efforts aim to improve data precision and healthcare quality, addressing the escalating burden of both infectious and chronic diseases.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.79 Billion |

| Market Size by 2034 | USD 7.54 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.18% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Delivery Mode, Component, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbott; Agilent Technologies, Inc.;IDBS; LabLynx, Inc.; LabVantage Solutions, Inc.; LabWare; McKesson Corporation; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Waters |

In terms of product type, Laboratory Information Management Systems (LIMS) held the dominant position in 2024, accounting for 51% of the total market revenue. This leadership is driven by the growing need for streamlined data handling and automation across sectors like healthcare, pharmaceuticals, biotechnology, and environmental sciences. LIMS platforms offer robust features such as sample management, advanced analytics, regulatory compliance, and seamless integration with lab equipment, which collectively improve workflow efficiency, precision, and data reliability.

A notable development in this space occurred in October 2023, when Sapio Sciences launched Sapio Jarvis, the first scientific data cloud tailored for scientists. Sapio Jarvis centralizes diverse laboratory data and enriches it with scientific context to accelerate drug discovery through the use of artificial intelligence and advanced analytics.

The Enterprise Content Management (ECM) segment is projected to witness substantial growth in the upcoming years. ECM systems are increasingly being adopted as they provide all-in-one solutions for the complex challenges faced by healthcare providers. These systems enable centralized handling of digital content—including media files, documents, and knowledge assets—through a structured process of capturing, organizing, retrieving, and analyzing data. ECM service providers typically offer end-to-end support, including consulting, system design, implementation, and maintenance.

In 2024, web-based solutions led the laboratory informatics market by delivery mode, claiming a 43% revenue share. The use of web platforms enables unmatched remote access, allowing laboratory activities to be managed and supervised from virtually any location using internet-connected devices. This is particularly beneficial for research teams that operate across multiple geographic locations or manage several lab facilities.

Cloud-based platforms are expected to register the highest growth rate in the forecast period. Their popularity is due to their cost-effectiveness, scalability, reliability, and capacity to handle the increasing data storage and computational needs of modern laboratories. The emergence of cloud-based labs opens opportunities for applying AI and machine learning to refine experiments and boost data accuracy. Additionally, these platforms support collaboration, reduce redundancy, and simplify system integration, resulting in more effective and productive research processes.

On the basis of components, the services segment captured the largest share of 57% in 2024. This trend is fueled by rising demand for adaptable and user-friendly service-oriented LIMS systems that support efficient process and data workflows. Large pharmaceutical firms and research institutions frequently outsource analytics and compliance services due to in-house limitations. The services offered include regulatory compliance, social and manufacturing analytics, predictive maintenance, benchmarking, and preventive analytics.

The software segment is expected to exhibit the fastest growth during the forecast period. The availability of advanced software—particularly Software as a Service (SaaS)—is boosting the segment’s growth. These platforms support laboratories in capturing, storing, interpreting, and analyzing data. Additionally, regular software updates are essential to keep pace with the evolving landscape of laboratory analytics and data processing methodologies.

By end-use, life science companies held the leading position in 2024, accounting for 29% of the market revenue. The adoption of lab informatics is rapidly increasing in the life sciences sector to foster innovation, ensure higher product quality, and streamline operations. The shift toward more digitized and virtual labs is driven by the need to manage massive volumes of research data effectively. Informatics tools like LIMS are helping break down data silos in R&D, while growing healthcare R&D investment continues to boost the segment. Moreover, LIMS is being widely adopted in hospitals and clinical labs for functions such as patient record tracking, billing, workflow management, and quality control, which is further propelling demand.

Contract Research Organizations (CROs) are projected to grow at the fastest rate in the coming years. Their increasing reliance on sophisticated lab informatics platforms such as ELN (Electronic Lab Notebooks), LIMS, and SDMS (Scientific Data Management Systems) is driven by the need for efficient data control, regulatory adherence, and streamlined operations. These tools allow CROs to improve collaboration, ensure data consistency, and accelerate the drug discovery lifecycle. As the life sciences industry continues to expand, the demand for cost-effective and high-quality research support from CROs is expected to rise accordingly.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Laboratory Informatics Market

By Product

By Delivery Mode

By End-use

By Regional