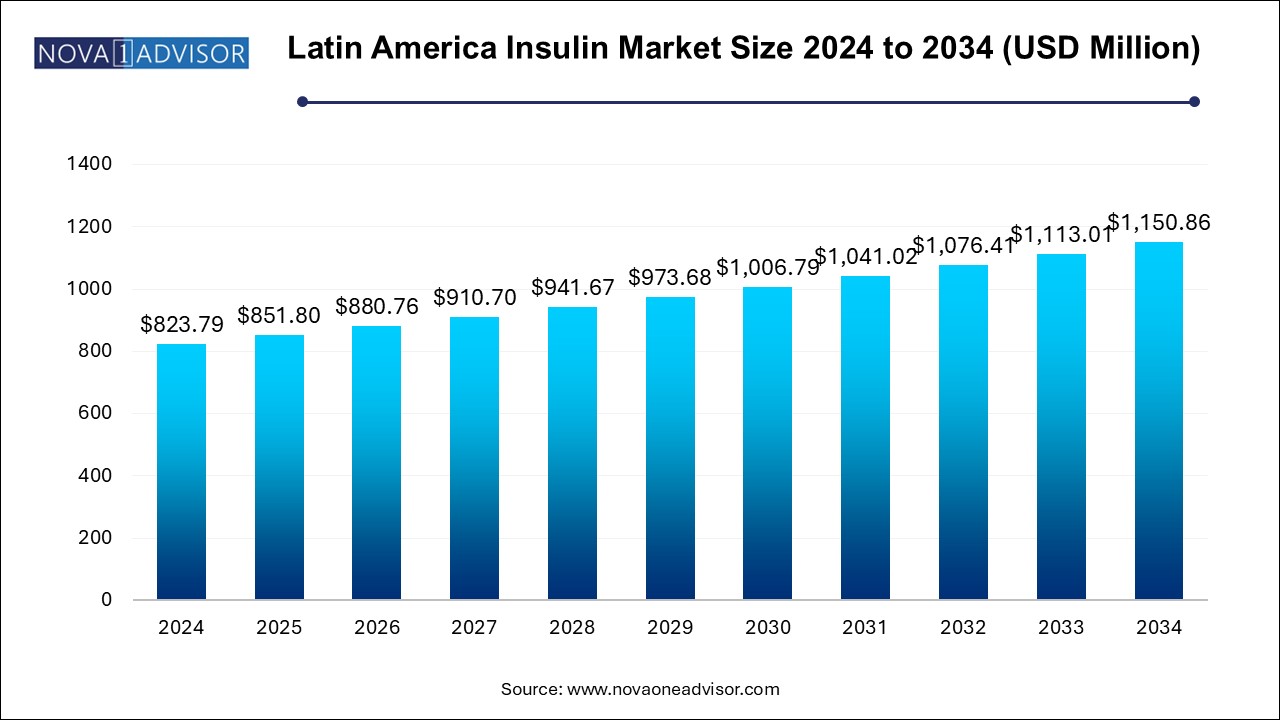

The Latin America insulin market size was exhibited at USD 823.79 million in 2024 and is projected to hit around USD 1150.86 million by 2034, growing at a CAGR of 3.5% during the forecast period 2025 to 2034.

The projected growth is attributed to multiple factors, such as the increasing prevalence of diabetes, lifestyles characterized by a lack of physical activity and unhealthy diets, and growing technological advancements in insulin delivery methods and medical equipment manufacturing. Ease of use and availability, increasing awareness regarding the need for continuous attention and care for diabetes patients, and growing obesity rates in numerous countries are expected to generate an upsurge in demand for the insulin market in Latin America.

One of the most prominent factors accelerating demand for insulin in this market is the rising rate of newly diagnosed diabetes cases. In addition, the continuous increase in a group of individuals diagnosed with diabetes and aged 60 or more is contributing to the growing use of insulin. The increasing obesity rate and a genetic tendency for Type-2 diabetes are anticipated to play a significant role in the rise of the Type-2 diabetic population in the next few years. According to the International Diabetes Federation, nearly 537 million individuals are diagnosed with diabetes; this number is projected to reach approximately 700 million by 2045.

Patient awareness initiatives by government agencies, the healthcare industry, and other welfare organizations have also contributed to the growing use of insulin. The availability of technologically advanced devices such as continuous glucose monitoring and others has also influenced this market in recent years. Increasing market penetration attained by the key industry participants is expected to assist this market in generating greater growth during the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 851.8 Million |

| Market Size by 2034 | USD 1150.86 Million |

| Growth Rate From 2025 to 2034 | CAGR of 3.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Product, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Novo Nordisk A/S; Eli Lilly and Company.; Sanofi; Biocon.; Wockhardt; Boehringer Ingelheim International GmbH.; Julphar; United Laboratories International Holdings Limited.; Tonghua Dongbao Pharmaceutical Co. Ltd.; Xinbai Pharmaceutical |

The insulin analog segment has dominated the global market and accounted for a revenue share of 86.5% in 2024. This high percentage is attributed to insulin analogs developed to mimic natural insulin by improving their pharmacodynamic effects and faster impact capacities than insulin analogs on the body. The market is driven by a growing demand for insulin analogs compared to traditional insulin products due to the advantages such as the decreased likelihood of glycemic control or hypoglycemia, long-lasting impacts, and fewer side effects. Additionally, government policies and healthcare initiatives are anticipated to influence access to medications such as insulin analogs.

The human insulin segment is expected to experience a significant CAGR during the forecast period. The growth of this segment is driven by cost-effectiveness, the rising prevalence of diabetes, and changing lifestyles. Moreover, the availability of human insulin in various formulations such as solution, suspension, and subcutaneous injections allows diabetic patients to ingest insulin according to convenience. According to the World Health Organization (WHO) guidelines, using human insulin products, such as short-acting regular insulin and intermediate-acting Neutral Protamine Hagedorn (NPH) insulin, in low-resource settings is the primary choice for adults with type 1 DM and the third treatment option for those with type 2 DM.

Based on product, the long-acting insulin segment accounted for the largest revenue share in 2024. This is attributable to its ability to maintain normal blood sugar levels for longer periods and slow and steady insulin release. Insulin, detemir, Insulin degludec, and insulin glargine are some examples of long-acting insulin. These insulins mimic the body's natural basal insulin secretion and can remain effective for up to 36 hours. Ease of use, convenience factor assisting patients in enhanced adherence to treatment routines, increasing inclusion in treatment protocols by healthcare professionals and steady or prolonged insulin release through these products are expected to generate higher demand for this segment during forecast period.

The biosimilar products segment is projected to experience a significant CAGR during the forecast period. Biosimilars closely resemble reference products, showing no significant differences in safety or effectiveness. FDA-approved biosimilars and interchangeable biosimilars are nearly identical to FDA-approved reference products. Biosimilars offer additional medication choices to patients. They are available at potentially lower costs, as their manufacturers use the FDA's approval of the original biologics to streamline their drug development processes, driving the demand for the market. Moreover, these biosimilar products are anticipated to enhance insulin treatment availability, lower expenses for diabetes care, and broaden the range of insulin brands for individuals with diabetes.

The type 1 diabetes segment dominated the Latin America insulin market in 2024. The growth of this segment is attributed to the growing number of cases of Type 1 diabetes in the region, especially among young people. Population in Brazil is expected to record more than 11 million individuals with condition of diabetes in next few years. The growing prevalence of type 1 diabetes among young population, sedentary lifestyles, increasing awareness leading to growth in diagnostics, and ease of use associated with multiple insulin delivery devices is expected to generate growth for this segment in approaching years.

The type 2 diabetes segment is projected to grow at the fastest CAGR over the forecast period. According to the NCBI 2024 report, Type 2 diabetes mellitus (T2DM) accounts for about 90% of all diabetes cases. The individuals over the age of 45 most commonly experience type 2 diabetes. However, it is becoming more common among children, teenagers, and young adults due to the growing prevalence of obesity, lack of physical exercise, and unhealthy diets. In addition, increasing occurrence of conditions such as gestational diabetes mellitus (GDM) also affects 7% of pregnancies. Women with gestational diabetes and their children are more prone to risks of type 2 diabetes in later stages of life. These aspects are anticipated to influence the growth of this segment in approaching years.

The retail & specialty pharmacies segment dominated the Latin America insulin market share of 89.0% in 2024. This is attributed to factors such as enhanced availability and accessibility, ease of transaction, and effective distribution by the key market participants in the insulin industry. The brands operating in this market focus on offline distribution channels such as retail & specialty pharmacies as this results in improved brand visibility and greater customer engagement.

The hospital pharmacies segment is projected to grow at a significant CAGR over the forecast period. Direct patient care drives the market, and hospital pharmacies contribute a major share in this category. Multiple regional care providers have adopted this strategy to provide enhanced patient assistance by providing pharmacies within the premises. The facility looks after tasks such as inventory management and prevention of shortages. Growing new cases of emergency care and unexpected health intricacies triggered by insulin are expected to drive demand for this segment during the forecast period. Guidelines and regulations regarding glucose levels for critically ill patients in ICU and other patients admitted to the facility for surgery and non-ICU treatments play a vital role in insulin distribution through hospital pharmacies.

Brazil Insulin Market Trends

Brazil insulin market dominated the regional insulin industry with a revenue share of 31.3% in 2024. The factors contributing to this growth are the increasing newly diagnosed cases of diabetes, rising awareness regarding the requirement of continuous insulin monitoring, growing availability of technologically advanced products and rising hospitalization of patients with diagnosed diabetic condition. Enhancements in healthcare industry and improvements in availability of diabetes treatment products and services has contributed to growth of this market in recent years. Public welfare organizations' involvement has also been a key factor in growing awareness regarding the use and availability of diligent care for diabetes patients. For Instance, the SUS (Sistema Único de Saúde), the public health system in Brazil, has focused on continuously increasing the assistance available for diabetes care.

Peru Insulin Market Trends

Peru insulin market is expected to experience the fastest CAGR of 3.7% from 2024 to 2030. This market is primarily driven by factors such as the rising prevalence of diabetes in the country, ease of availability through public and private pharmacies, and enhanced government initiatives to support diabetes treatments and care. Steady growth in the adoption of technological advancements in diabetes care is projected to contribute to the growth of this market during the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Latin America insulin market

By Type

By Product

By Application

By Distribution Channel

By Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Latin America (Brazil, Argentina, Chile, Mexico, Colombia, Venezuela) Insulin Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Latin America Insulin Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Latin America (Brazil, Argentina, Chile, Mexico, Colombia, Venezuela) Insulin Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Latin America Insulin Market: Type Movement Analysis, 2024 & 2034 (USD Million)

4.3. Insulin Analog

4.3.1. Insulin Analog Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Human Insulin

4.4.1. Human Insulin Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Latin America (Brazil, Argentina, Chile, Mexico, Colombia, Venezuela) Insulin Market: Product Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Latin America Insulin Market: Product Movement Analysis, 2024 & 2034 (USD Million)

5.3. Rapid-Acting Insulin

5.3.1. Rapid-Acting Insulin Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4. Long-Acting Insulin

5.4.1. Long-Acting Insulin Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Combination Insulin

5.5.1. Combination Insulin Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Biosimilar

5.6.1. Biosimilar Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.7. Other

5.7.1. Other Insulin Products Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Latin America (Brazil, Argentina, Chile, Mexico, Colombia, Venezuela) Insulin Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Latin America Insulin Market: Application Movement Analysis, 2024 & 2034 (USD Million)

6.3. Type 1 Diabetes

6.3.1. Type 1 Diabetes Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4. Type 2 Diabetes

6.4.1. Type 2 Diabetes Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Latin America (Brazil, Argentina, Chile, Mexico, Colombia, Venezuela) Insulin Market: Distribution Channel Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Latin America Insulin Market: Distribution Channel Movement Analysis, 2024 & 2034 (USD Million)

7.3. Hospital Pharmacies

7.3.1. Hospital Pharmacies Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4. Retail & Specialty Pharmacies

7.4.1. Retail & Specialty Pharmacies Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5. Others

7.5.1. Other Distribution Channels Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8. Latin America (Brazil, Argentina, Chile, Mexico, Colombia, Venezuela) Insulin Market: Regional Estimates & Trend Analysis

8.1. Latin America Insulin Market Share, By Region, 2024 & 2034 (USD Million)

8.2. Brazil

8.2.1. Brazil Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3. Argentina

8.3.1. Argentina Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4. Chile

8.4.1. Chile Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5. Colombia

8.5.1. Colombia Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6. Peru

8.6.1. Peru Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7. Venezuela

8.7.1. Venezuela Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8. Rest of Latin America

8.8.1. Rest of Latin America Insulin Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Heat Map Analysis

9.4. Company Profiles

9.4.1. Novo Nordisk A/S

9.4.1.1. Participant’s Overview

9.4.1.2. Financial Performance

9.4.1.3. Product Benchmarking

9.4.1.4. Recent Developments/ Strategic Initiatives

9.4.2. Eli Lilly and Company

9.4.2.1. Participant’s Overview

9.4.2.2. Financial Performance

9.4.2.3. Product Benchmarking

9.4.2.4. Recent Developments/ Strategic Initiatives

9.4.3. Sanofi

9.4.3.1. Participant’s Overview

9.4.3.2. Financial Performance

9.4.3.3. Product Benchmarking

9.4.3.4. Recent Developments/ Strategic Initiatives

9.4.4. Biocon.

9.4.4.1. Participant’s Overview

9.4.4.2. Financial Performance

9.4.4.3. Product Benchmarking

9.4.4.4. Recent Developments/ Strategic Initiatives

9.4.5. Wockhardt

9.4.5.1. Participant’s Overview

9.4.5.2. Financial Performance

9.4.5.3. Product Benchmarking

9.4.5.4. Recent Developments/ Strategic Initiatives

9.4.6. Boehringer Ingelheim International GmbH.

9.4.6.1. Participant’s Overview

9.4.6.2. Financial Performance

9.4.6.3. Product Benchmarking

9.4.6.4. Recent Developments/ Strategic Initiatives

9.4.7. Julphar

9.4.7.1. Participant’s Overview

9.4.7.2. Financial Performance

9.4.7.3. Product Benchmarking

9.4.7.4. Recent Developments/ Strategic Initiatives

9.4.8. United Laboratories International Holdings Limited.

9.4.8.1. Participant’s Overview

9.4.8.2. Financial Performance

9.4.8.3. Product Benchmarking

9.4.8.4. Recent Developments/ Strategic Initiatives

9.4.9. Tonghua Dongbao Pharmaceutical Co. Ltd.

9.4.9.1. Participant’s Overview

9.4.9.2. Financial Performance

9.4.9.3. Product Benchmarking

9.4.9.4. Recent Developments/ Strategic Initiatives

9.4.10. Xinbai Pharmaceutical

9.4.10.1. Participant’s Overview

9.4.10.2. Financial Performance

9.4.10.3. Product Benchmarking

9.4.10.4. Recent Developments/ Strategic Initiatives