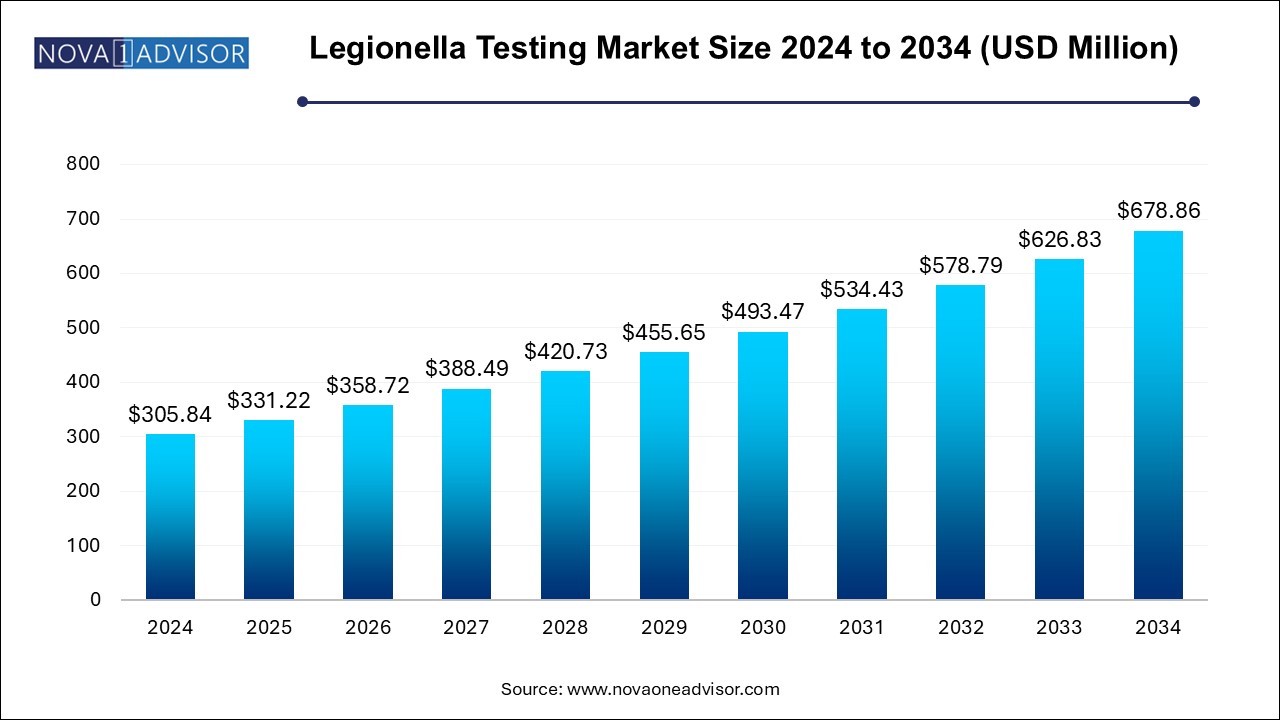

The legionella testing market size was exhibited at USD 305.84 million in 2024 and is projected to hit around USD 678.86 million by 2034, growing at a CAGR of 8.3% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 331.22 Million |

| Market Size by 2034 | USD 678.86 Million |

| Growth Rate From 2025 to 2034 | CAGR of 8.3% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbott; Beckman Coulter, Inc.; BD; Bio-Rad Laboratories, Inc.; BIOMÉRIEUX; Eiken Chemical Co., Ltd.; Hologic, Inc.; Pro Lab Diagnostics Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Takara Bio Inc.; Thermo Fisher Scientific Inc. |

The increasing incidence of Legionella-related disorders and rising awareness about their preventive management is expected to drive market growth. Legionella can cause Legionellosis, a respiratory disorder (a form of pneumonia). It requires intensive care and hospitalization; hence, it is considered one of the public health concerns. According to the Centers for Disease Control and Prevention, approximately 10,000 cases of Legionnaires’ disease were reported in 2034.

As Legionella bacteria grow in hot water conditions, various industries that rely on water storage are prone to developing Legionella in water. These waterborne bacteria can harm schools, restaurants, hospitals, and large plumbing systems. Therefore, industries increasingly demand accurate and on-time diagnosis of Legionella and related infections.In September 2024, four deaths and 11 instances of severe pneumonia were reported in San Miguel de Tucumán, Argentina. Later, the epidemic of severe pneumonia was linked to Legionella, particularly the bacterium L. pneumophila. In addition, in June 2024, the New York Attorney General signed an agreement with Verizon to ensure the company takes prompt and thorough action to stop the Legionnaires' disease from spreading throughout New York State.

On the basis of type, the market is segmented into water testing and IVD testing. The water testing segment held the largest revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The factors contributing to the segment growth mainly include government laws that mandate the testing for Legionella. For instance, in many European countries, Legionella testing is mandatory by law and must be conducted.

Time constraint is the most important drawback of conventional testing methods, as it can take weeks to deliver the results and fail to provide accurate results on time. The absence of accurate diagnostics can lead to presumptive treatment or delay it. It can further hamper the treatment measures and cause outbreaks. Therefore, there is a need for the development of new and advanced diagnostics tools.

The conventional testing methods are labor-intensive and involve manual interference, which can cause contamination and affect the outputs. The diagnostic technological advancements in terms of automation and digitization are responsible for market growth.

Automation facilitates up to 50% timesaving in diagnostic procedures, as it reduces the burden of manual efforts. In addition, results are reliable, precise, and sensitive. Diagnostic lab automation generates standardized and reproducible results. Therefore, advanced rapid diagnostic methods are gaining popularity, and their demand will continue to expand in the coming years. However, a limited number of manufacturing companies can challenge market growth.

Based on end use, the market is segmented into microbial culture, direct fluorescent antibody (DFA) stain, PCR, and others. The microbial culture segment accounted for the largest revenue share of 38.0% in 2024. Microbial culture offers high specificity and sensitivity, accurately identifying Legionella bacteria. Regulatory guidelines often recommend or require its use, ensuring water safety in various settings.

The PCR segment is expected to grow at the fastest CAGR of 8.8% during the forecast period. PCR provides benefits such as timely and accurate diagnosis along with reproducible results. Hence, it is preferred as a bacterial testing method. PCR offers rapid results, often within hours, compared to the days required by microbial culture. It can detect non-viable and VBNC Legionella cells, enhancing accuracy.

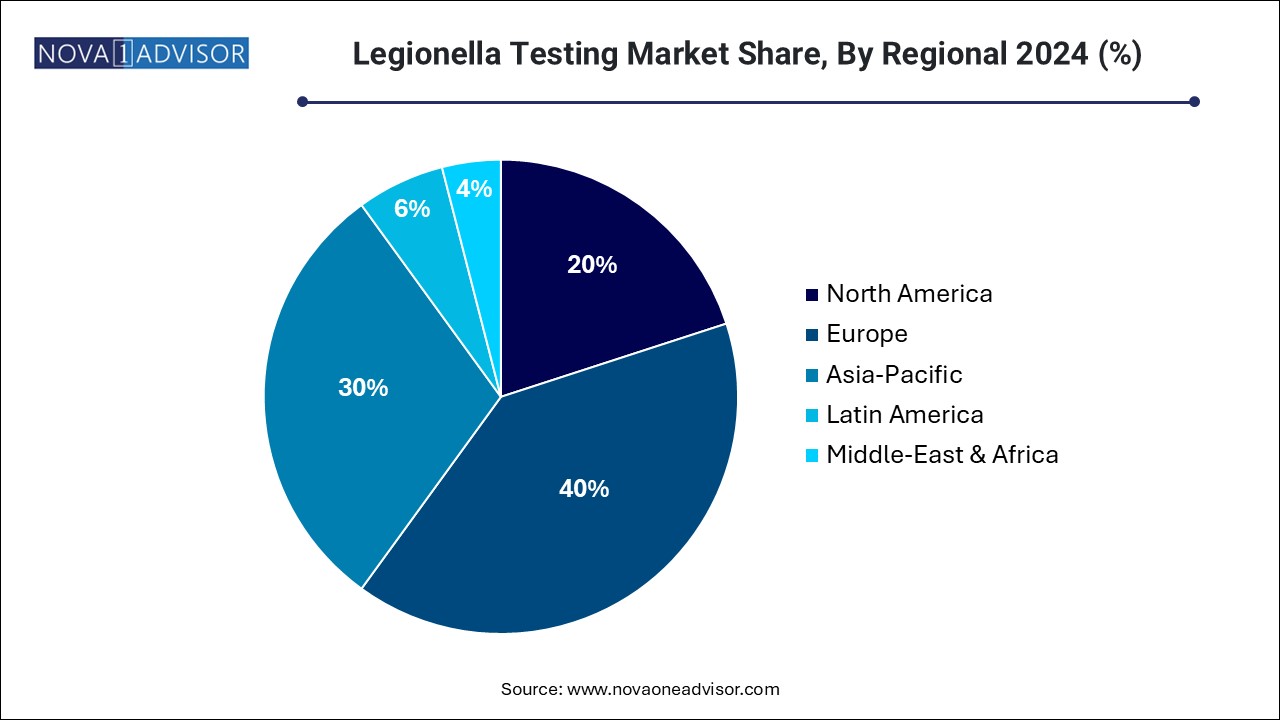

Europe dominated the market and accounted for the largest revenue share of 40.0% in 2024. The governments in some countries, such as the UK and Germany, have made Legionella testing compulsory. This is primarily due to the high levels of awareness regarding Legionellosis and related diseases. In European countries, Europe’s well-established healthcare system prioritizes water safety and disease prevention, boosting market growth.

Asia Pacific is expected to grow at the fastest CAGR of 9.6% during the forecast period. The rising geriatric population in this region, which is more prone to infections, increasing disposable income, and increasing penetration of Legionella testing products via a global distribution network, are expected to drive market growth over the forecast period. According to the World Health Organization (WHO), roughly 10 to 15 instances per million people in Europe, Australia, and the U.S. are reported for Legionellosis each year. In addition, 60-70% of reported cases are male, and 75-80% are above 50.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the legionella testing market

By Type

By End-use

By Regional