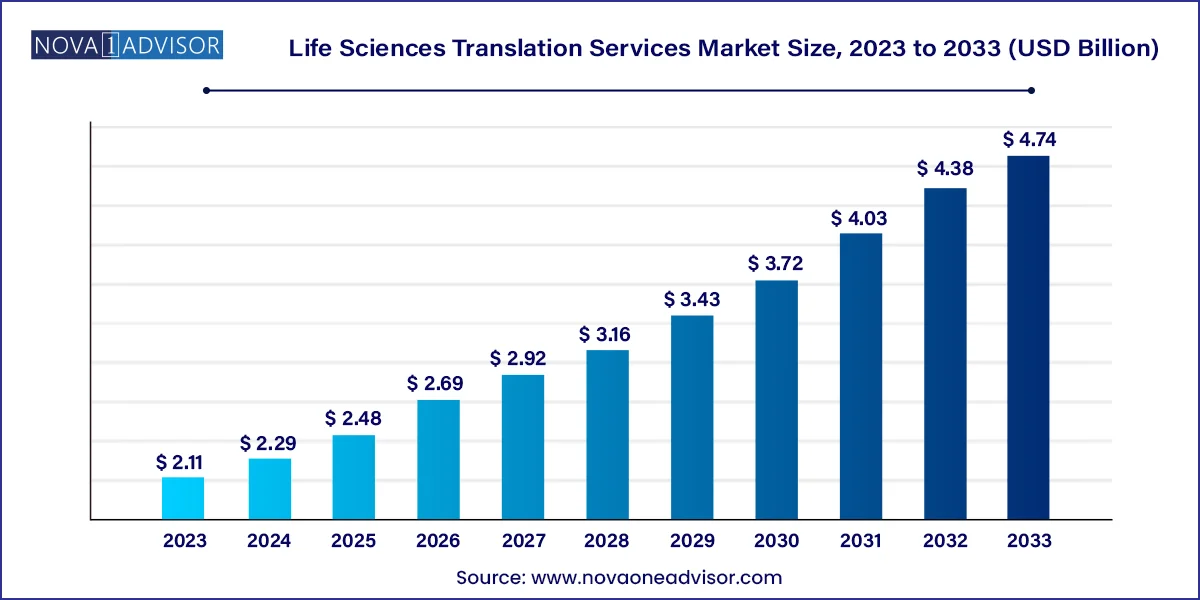

The global life sciences translation services market size was valued at USD 2.11 billion in 2023 and is anticipated to reach around USD 4.74 billion by 2033, growing at a CAGR of 8.44% from 2024 to 2033.

Based on end use, the Clinical Research Organizations (CRO) segment dominated the market with a revenue share of 26.99% in 2023 and is expected to have the fastest growth rate during the forecast period.

The market growth is expected to be driven by several key factors, such as the growing demand for clinical trials, the increasing need for Good Clinical Practice (GCP) and regulation compliance, and the globalization of the life sciences industry. Translation and localization are integral to the life sciences industry due to its extensive scope. This encompasses translating regulatory documents, Instructions for Use (IFUs), package labeling, marketing materials, and more.

Key drivers such as technological innovations in interpretation tools, increasing demand for interpreting services, and the growing need for culturally adapted medical marketing content are shaping the market. These factors are expected to drive the adoption of translation services in the coming years. Furthermore, advancements in translation technology, such as Neural Machine Translation (NMT) and Computer-Assisted Translation (CAT) tools powered by natural language processing (NLP), are increasingly narrowing the gap between human and automated translations, improving efficiency. For instance, according to a survey by ProZ conducted in 2019, 88% of full-time translators use CAT tools, with 76% using multiple tools.

Moreover, the rise of virtual medical practices and globalization have increased the demand for language interpreting services. Video Remote Interpretation (VRI) has become essential, providing a practical solution for multilingual patient communication and on-demand access while also providing contextual and non-verbal signs. Thus, as life sciences organizations expand into international markets, the need for culturally accurate medical marketing interpretations grows, which is expected to boost the market's growth.

| Report Attribute | Details |

| Market Size in 2024 | USD 2.29 Billion |

| Market Size by 2033 | USD 4.74 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.44% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, category, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Vistatec, Language Scientific, marstranslation, BayanTech., Lionbridge Technologies, LLC., Conversis, Morningside, Inc, Crimson Interactive Inc., Welocalize Life Sciences, ALM Translations Ltd, Stepes, Questel., and BURG Translations |

The U.S. life sciences translation services market size was valued at USD xx billion in 2023 and is projected to surpass around USD xx billion by 2033, registering a CAGR of xx% over the forecast period of 2024 to 2033.

North America life sciences translation services market dominated globally, with the largest revenue share of 46.28% in 2023. The growing need for regulatory compliance, among other factors, is driving the regional market growth. For instance, in February 2024, KERN Global Language Services started to provide HIPAA-certified translation services as part of quality management. This new offering ensures that sensitive medical and patient information is translated while adhering to HIPAA regulations, enhancing trust and compliance in healthcare communications.

U.S. Life Sciences Translation Services Market Trends

The life sciences translation services market in the U.S. held the largest share in 2023 in the North America region, owing to the diverse population in the country. According to the US Census Bureau, over 350 languages are spoken in the U.S., and nearly one in five individuals speak a language other than English at home. This trend emphasizes the importance of language services in ensuring that non-English-speaking patients can understand their medication instructions, which is critical for proper adherence and patient safety. In August 2024, RxTran, a division of Language Scientific, announced a new initiative to support the Limited English Proficiency (LEP) population.

Asia Pacific Life Sciences Translation Services Market Trends

The Asia Pacific life sciences translation services market is expected to witness the fastest CAGR over the forecast period. The market in the region is expanding due to increased healthcare investments, the growth of pharmaceutical and biotech industries, a rising patient population, and medical tourism. Strict regulatory requirements and technological advancements also contribute to market growth. In addition, the region’s diverse population, which speaks various languages, drives the demand for comprehensive and accurate translation services to address varied linguistic needs.

Japan life sciences translation services market held the largest revenue share in 2023. The market growth is attributed to the partnerships and collaborations undertaken to introduce various healthcare documents requiring translation into the native language. For instance, in September 2023, iPark Institute Co., Ltd., in collaboration with Eleven Industry Partners, translated and released “A-CELL,” a crucial document on cellular drug manufacturing. The Japanese version will be an essential resource for researchers and manufacturing staff, providing comprehensive guidance on cellular drug production, regulations, quality control, and related topics.

Life sciences translation services market India is driven by the increasing globalization of the pharmaceutical and healthcare industries, which requires accurate and regulatory-compliant translations of clinical trial documents, research materials, and patient information. India's expanding role as a hub for clinical trials and pharmaceutical research, coupled with a diverse linguistic landscape, amplifies the demand for specialized translation services. Furthermore, the need to meet stringent international regulatory standards and improve access to healthcare information for India's multilingual population fuels market growth.

Europe Life Sciences Translation Services Market Trends

The life sciences translation services market in Europe is anticipated to grow significantly due to funding initiatives undertaken to increase the adoption of translation services in the region. For instance, in February 2022, the Swedish start-up Care to Translate, supported by EIT Health, secured USD 2.7 million (EUR 2.5 million) in early-stage venture capital funding. This investment would facilitate the app's expansion and address the shortage of interpreters in healthcare through its digital translation service.

UK life sciences translation services market is expected to grow significantly over the forecast period. The growth is driven by increasing investments and innovations in translation solutions. For instance, in January 2024, RWS launched Evolve, a linguistic AI solution designed to enhance efficiency for global enterprises with extensive translation needs. Evolve represents a significant advancement in the translation industry by integrating human expertise with AI, streamlining translation processes, and reducing the time required to achieve high-quality results.

Life sciences translation services market Germany held the largest share in 2023. The market is experiencing significant advancements marked by initiatives to collaborate with various research institutes, further requiring effective translational services. For instance, in April 2021, Evotec SE announced the launch of beLAB2122, a translational BRIDGE initiative with an investment of USD 20 million in collaboration with Bristol-Myers Squibb. This project unites prominent academic institutions from the Rhine-Main-Neckar region of Germany to advance innovative therapeutic options across various areas into viable drug discovery and early.

Latin America Life Sciences Translation Services Market Trends

The life sciences translation services market in Latin America is experiencing significant growth, driven by the increasing demand for accurate and culturally relevant translations in the pharmaceutical, biotechnology, and medical device sectors. The market is also being used more to ensure compliance with local regulations and facilitate effective communication across diverse linguistic and cultural areas.

Brazil life sciences translation services market is expected to grow significantly over the forecast period. Translation services are essential for navigating Brazil's complex regulatory environment, governed by agencies like Anvisa. These services ensure that pharmaceutical and clinical documents meet local requirements, which is critical for product approval and market access. In addition, Morningside has established an advanced range of life sciences translation services to ensure regulatory compliance and facilitating market entry. The company emphasized the importance of culturally relevant materials and employed a rigorous quality control process through a multi-tier language review. This positions them as a key player in helping life sciences companies navigate the complexities of the Brazilian market

Middle East & Africa Life Sciences Translation Services Market Trends

The life sciences translation services market in in the Middle East and Africa is primarily fueled by the expansion of pharmaceutical and biotechnology companies. These companies require accurate translations to meet regulatory standards and facilitate clinical trials across diverse languages and cultures

Life sciences translation services market UAE is expected to grow significantly over the forecast period. The integration of advanced technologies in translation processes, such as Machine Translation Post-Editing (MTPE) and AI-driven tools, has enhanced the effectiveness. Companies like Lionbridge and BayanTech leverage these technologies to provide rapid and reliable translation services, catering to the fast-paced life sciences industry.

Life Sciences Translation Services Market By Type Insights

Based on type, the technical translation segment dominated the market with the largest revenue share of 39.75% in 2023. The growth is attributed to the increasing need for precise and specialized translation of complex scientific and technical documents. These documents include software strings, user manuals, patents, financial documents, and health and safety documents. Life sciences companies often require technical translations that exceed the standard medical services, engaging subject matter experts to ensure compliance and effectiveness. This specialized approach effectively addresses complex terminology and regulatory requirements, driving the market's growth.

However, the clinical/document translation segment is expected to experience significant growth in the forecast period. As businesses expand internationally, the need for accurate and culturally relevant translation services has increased. Therefore, companies are increasingly focusing on localizing their services to cater to diverse markets to enhance their competitive edge. This is expected to drive the segment's growth during the forecast period.

Furthermore, effective translation of trial documents is essential for patient recruitment and retention, ensuring that participants fully understand trial protocols and informed consent forms. Various documents are required to be translated, such as the Clinical Study Protocol, Clinical Study Reports, Investigator's Manual, Development Safety Update Reports, and Dossiers, among others. This precision facilitates smoother international trials and adherence to regulatory requirements, thus driving demand for specialized clinical document translation services.

Life Sciences Translation Services Market By Category Insights

Based on category, the technology/AI-based segment dominated the market with the largest revenue share of 67.87% in 2023 and is expected to grow at the fastest CAGR during the forecast period. AI and machine learning technologies improve translation efficiency and accuracy by automating complex processes and adapting to diverse linguistic needs. AI-powered tools can handle large amounts of data with precision, leading to faster and more reliable translations of clinical trial documents, regulatory submissions, and other technical operations. This has increased the availability of more advanced services in the market.

Furthermore, key companies are developing advanced AI solutions that address specific industry needs. For instance, in January 2024, Argos Multilingual introduced an enhanced version of its AI-driven Translation Memory (TM) cleanup service. This upgraded service facilitates the automatic analysis and large-scale cleanup of content within Translation Memories. Moreover, as the demand for fast and accurate translation services increases, AI and machine learning offer scalable solutions that support global life sciences operations and drive market expansion.

The manual segment is expected to grow at a significant CAGR during the forecast period. Manual translation involves human translators carefully handling complex and specialized documents such as clinical trial reports, regulatory submissions, and medical research. This approach ensures high accuracy and cultural relevance, addressing the nuanced terminology and context-specific requirements that automated systems may not fully comprehend. Manual translation is essential for maintaining the integrity of scientific content and meeting stringent regulatory standards.

Life Sciences Translation Services Market By End Use Insights

Based on end use, the Clinical Research Organizations (CRO) segment dominated the market with a revenue share of 26.99% in 2023 and is expected to have the fastest growth rate during the forecast period. The growth is attributed to its increased application in coordinating clinical trials, regulatory submissions, and global research activities. CROs require precise and accurate translations of complex documents, such as informed consent forms, patient information leaflets, and trial protocols, to comply with international regulations and ensure the success of multi-country studies. Thus, the increasing number of clinical trials is expected to drive the segment's growth. For instance, according to the WHO's latest updated data, in June 2024, almost 1.0 million clinical trials were conducted globally. Their reliance on specialized translation services to maintain quality and consistency across various markets drives the demand in this segment, making it a key factor in market growth.

The pharmaceutical manufacturers segment is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by the need for accurate translation services to improve patient outcomes. Pharmaceutical companies must adhere to strict regulations imposed by local and international authorities when entering new markets. This includes translating all documentation related to a product's safety, efficacy, and quality into the target language. Regulatory bodies require that these translations meet specific safety and quality control standards before approving a product for sale. Failure to provide accurate translations can result in delays, increased costs, and potential rejections of product applications.

The following are the leading companies in the life sciences translation services market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Life Sciences Translation Services market.

By Type

By Category

By End Use

By Region