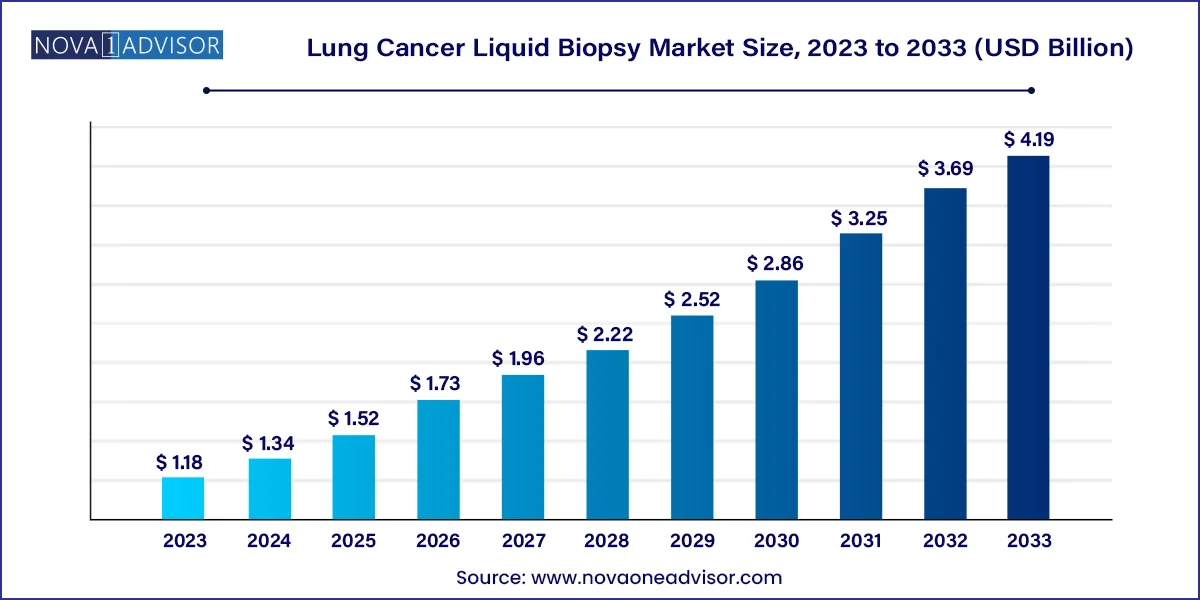

The global lung cancer liquid biopsy market size was valued at USD 1.18 billion in 2023 and is anticipated to reach around USD 4.19 billion by 2033, growing at a CAGR of 13.5% from 2024 to 2033.

The global lung cancer liquid biopsy market is rapidly transforming the clinical oncology landscape, ushering in a new era of non-invasive diagnostics and personalized treatment. Unlike traditional tissue biopsies—which are often invasive, time-consuming, and limited by tumor accessibility—liquid biopsy offers a revolutionary alternative by analyzing biomarkers like circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes through blood and other body fluids. This diagnostic advancement is particularly valuable in lung cancer, where the detection of actionable mutations can significantly impact therapy decisions and survival outcomes.

Lung cancer remains one of the most prevalent and deadliest cancers worldwide, accounting for nearly 2.2 million cases and 1.8 million deaths globally, according to the WHO. The aggressive nature of non-small cell lung cancer (NSCLC), which comprises approximately 85% of all lung cancer cases, often necessitates rapid diagnostic interventions. Liquid biopsy has emerged as a clinical game-changer, offering real-time, repeatable insights into tumor evolution, heterogeneity, treatment response, and minimal residual disease.

With growing reliance on precision medicine, targeted therapies, and immunotherapies in the treatment of lung cancer, liquid biopsies are becoming indispensable tools for oncologists. They support early detection, guide drug selection, monitor therapeutic efficacy, and assess cancer recurrence—all through a simple blood draw. Technological advancements in next-generation sequencing (NGS) and digital PCR are further accelerating adoption, making this market one of the most dynamic in oncology diagnostics. As pharmaceutical companies, diagnostic developers, and research institutions collaborate to refine liquid biopsy tools, the market is expected to experience exponential growth through 2034 and beyond.

Rising preference for non-invasive diagnostics: Clinicians are increasingly opting for liquid biopsy over tissue biopsy due to ease of sampling, especially in late-stage or inaccessible tumors.

Integration with precision oncology platforms: Companion diagnostics using liquid biopsy are being co-developed with targeted drugs, enhancing patient stratification.

Adoption of multi-gene parallel analysis: NGS platforms are becoming standard for detecting a broad spectrum of actionable mutations in lung cancer patients.

Growing research in exosomes and microvesicles: Emerging interest in exosome-based liquid biopsies is enabling analysis of tumor-derived RNA, proteins, and lipids for better tumor profiling.

Real-time treatment monitoring: Liquid biopsies are being used to dynamically track tumor response, resistance mutations, and relapse during and after therapy.

Regulatory approvals and reimbursement expansions: Several FDA approvals and payer reimbursements have validated the clinical utility of liquid biopsy tests, especially in NSCLC.

Partnerships between biotech firms and academic centers: Collaborative research and data sharing are accelerating clinical validation and product development pipelines.

| Report Attribute | Details |

| Market Size in 2024 | USD 1.34 Billion |

| Market Size by 2033 | USD 4.19 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Sample type, biomarker, technology, end-use, clinical application, product, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Eurofins Scientific; MDxHealth; CareDx; Immucor; Thermo Fisher Scientific Inc.; Menarini Silicon Biosystems; Qiagen; Guardant Health; Exact Sciences Corporation; Myriad Genetics, Inc.; LungLife AI, Inc.; Bio-Rad Laboratories; Agilent Technologies |

A key driver of the lung cancer liquid biopsy market is the escalating demand for personalized oncology, where treatments are tailored based on individual tumor genetics. Lung cancer treatment has shifted away from one-size-fits-all chemotherapy to targeted therapies such as EGFR inhibitors, ALK inhibitors, and PD-L1 checkpoint inhibitors. However, identifying the right therapy necessitates comprehensive and timely molecular profiling—a gap that liquid biopsy effectively fills.

By detecting actionable mutations like EGFR, ALK, ROS1, and KRAS in ctDNA, liquid biopsy enables rapid therapeutic decision-making without subjecting patients to invasive procedures. In cases where tissue biopsy is infeasible due to tumor location, comorbidities, or patient frailty, liquid biopsy becomes a critical alternative. Moreover, as tumors evolve and develop drug resistance, repeat biopsies are often required. Liquid biopsy allows for serial sampling to track genetic changes over time, improving outcomes through adaptive therapy strategies. As more targeted therapies enter the market, the demand for real-time molecular diagnostics will further escalate, reinforcing liquid biopsy's role as an indispensable companion diagnostic.

Despite its promise, liquid biopsy faces significant restraints in terms of analytical accuracy and clinical validation. One of the core challenges is detecting extremely low levels of tumor-derived biomarkers, especially in early-stage lung cancer or after curative treatments. Technical variability across different platforms, lack of assay standardization, and sample handling inconsistencies can affect test reliability. False negatives or false positives can lead to misinformed treatment decisions, undermining clinical confidence in liquid biopsy results.

Furthermore, regulatory agencies demand robust evidence of clinical utility, reproducibility, and cost-effectiveness before approving tests for routine clinical use. While leading companies have received FDA approvals for specific tests in advanced NSCLC (e.g., Guardant360 and FoundationOne Liquid CDx), broader applications—especially in early screening and recurrence detection—still require extensive validation. Reimbursement policies in many countries are still evolving, limiting widespread adoption in public healthcare settings. Overcoming these barriers will require harmonized clinical guidelines, rigorous quality control, and improved assay sensitivity.

One of the most transformative opportunities in the lung cancer liquid biopsy market lies in early cancer screening. Detecting lung cancer at Stage I or II dramatically improves survival rates, yet most diagnoses occur at advanced stages due to the lack of symptoms and effective screening tools. Traditional methods like low-dose CT (LDCT) have limitations in sensitivity, specificity, and overdiagnosis risks.

Liquid biopsy offers the potential to fill this gap through early detection of ctDNA or exosomal RNA associated with lung malignancies in asymptomatic individuals. Initiatives such as Grail’s Galleri test and Exact Sciences' early detection programs are pioneering multi-cancer screening using liquid biopsies. Clinical trials such as the Circulating Cell-free Genome Atlas (CCGA) and NILE have already demonstrated promising results in identifying early-stage lung tumors. As screening programs shift toward population-based risk assessment, integrating liquid biopsy could become standard practice in high-risk groups, such as smokers or individuals with occupational exposures. This expansion into the preventive care space represents a multibillion-dollar opportunity for diagnostic firms.

The blood sample-based segment dominated the market with a revenue share of more than 71% in 2023. minimally invasive nature, and compatibility with high-throughput technologies. Blood-derived ctDNA provides rich genomic material for detecting oncogenic mutations, copy number variations, and methylation patterns in lung tumors. The convenience of venipuncture allows for repeat monitoring over time, enabling clinicians to evaluate treatment efficacy and detect resistance mechanisms. Leading tests like Guardant360 and FoundationOne Liquid CDx have been validated using blood samples, further driving adoption across hospitals and clinics.

However, other sample types such as pleural effusion, urine, and saliva are emerging as the fastest-growing segment, particularly for patients where blood ctDNA yield is insufficient. Pleural fluid, for instance, offers a high concentration of tumor DNA in cases of advanced lung adenocarcinoma with pleural involvement. Similarly, urine and saliva tests are being explored for non-invasive lung cancer screening and surveillance. While still in early stages, these sample types offer promise in improving sensitivity and expanding testing options, especially in combination with blood-based assays.

The circulating nucleic acids segment accounted for the largest revenue share in 2023.

primarily due to their established utility in detecting actionable mutations in lung cancer. These nucleic acids reflect the tumor’s genomic alterations and can be easily amplified and sequenced. Advanced platforms like NGS and digital PCR are specifically designed to detect minute quantities of ctDNA with high accuracy, making them the biomarker of choice in current clinical practice.

Conversely, exosomes and microvesicles are witnessing the fastest growth, driven by their unique ability to carry proteins, lipids, and RNA fragments within a protective lipid bilayer. These vesicles offer a more stable biomarker reservoir, preserving valuable molecular information that may be lost in ctDNA. Research institutions are increasingly investigating exosomal RNA for lung cancer diagnosis, prognosis, and therapy selection. Although still under development, exosome-based assays are expected to significantly enhance diagnostic precision in the coming years.

The multi-gene-parallel analysis (NGS) segment dominated the market in 2023 and is projected to grow at the fastest CAGR from 2024 to 2033.

It enables simultaneous analysis of multiple gene alterations, providing a comprehensive view of the tumor’s mutational landscape. This capability is critical in NSCLC, where mutations in EGFR, ALK, MET, BRAF, and KRAS can dictate treatment strategies. NGS-based platforms are integral to companion diagnostics and are commonly used in both initial profiling and resistance monitoring.

On the other hand, single gene analysis technologies such as PCR and microarrays are growing at a rapid pace, particularly in low-resource settings or for quick verification of known mutations. Digital droplet PCR (ddPCR), for example, offers ultra-sensitive detection of specific mutations with a fast turnaround. These techniques are also employed in surveillance and post-treatment follow-ups, where cost-effectiveness and speed are paramount.

The therapy selection segment accounted for the largest revenue share in 2023.

where liquid biopsy results directly inform the choice of targeted therapies and immunotherapies. Identifying mutations such as EGFR, ALK, and MET not only determines drug eligibility but also predicts response and resistance. Many targeted therapies now require liquid biopsy results as part of the companion diagnostic process.

Early cancer screening is the fastest-growing application, driven by increasing research into population-level cancer detection using liquid biopsy. Companies are developing pan-cancer screening tools that include lung cancer as a primary target due to its high mortality rate. With growing interest in preventive oncology and risk-based screening, this segment is expected to experience exponential growth in the next decade.

The instruments segment accounted for the largest revenue share in 2023 given the recurring demand for sample preparation, DNA extraction, and sequencing reagents in diagnostic workflows. These products ensure continued revenue for manufacturers and are essential for test reproducibility and scalability.

Software and services are witnessing rapid growth, fueled by the need for robust bioinformatics platforms to analyze complex genomic data. Cloud-based analytics tools, artificial intelligence algorithms, and automated reporting systems are helping clinicians interpret results with higher accuracy, making this segment an essential component of the modern liquid biopsy ecosystem.

The hospitals and laboratories segment accounted for the largest revenue share in 2023. accounting for the bulk of liquid biopsy test volumes. These settings offer integrated diagnostic and treatment services, enabling physicians to quickly utilize test results for clinical decision-making. Many hospitals have partnerships with diagnostic companies to conduct on-site testing or send samples to centralized labs. Furthermore, hospital-based molecular pathology labs are increasingly incorporating NGS-based liquid biopsy panels into their testing menus.

Specialty clinics, however, represent the fastest-growing end-use segment, as personalized cancer care centers and precision medicine clinics adopt in-house liquid biopsy capabilities. These facilities offer specialized oncology care with dedicated resources for molecular profiling, enabling faster turnaround and higher patient satisfaction. Moreover, they cater to high-income patients and those seeking second opinions, which boosts demand for advanced diagnostics.

North America dominated the market and accounted for a revenue share of approximately 51% in 2023. driven by high lung cancer incidence, strong reimbursement infrastructure, and early adoption of precision oncology. The U.S., in particular, is a hub for liquid biopsy innovation, with major players like Guardant Health, Thermo Fisher Scientific, and Roche Diagnostics leading product development. The presence of clinical guidelines supporting liquid biopsy in NSCLC, favorable FDA regulatory pathways, and strategic partnerships between diagnostic firms and cancer centers have all contributed to market dominance.

Asia-Pacific is the fastest-growing region, fueled by rising cancer awareness, increasing access to healthcare, and strong government initiatives in countries like China, Japan, and South Korea. China's National Cancer Center and private firms like Burning Rock and Geneseeq are aggressively investing in NGS-based diagnostics. As demand for personalized medicine grows and infrastructure improves, Asia-Pacific is set to become a major growth engine for the global liquid biopsy market.

The following are the leading companies in the lung cancer liquid biopsy market. These companies collectively hold the largest market share and dictate industry trends.

February 2024 – Guardant Health announced FDA approval of Guardant360 TissueNext, complementing its liquid biopsy test to enable integrated tissue and blood testing for lung cancer profiling.

January 2024 – Illumina launched a new NGS platform tailored for liquid biopsy applications, with reduced sequencing costs and improved ctDNA detection sensitivity.

November 2023 – Grail received CE mark approval for its Galleri multi-cancer early detection blood test, expanding its availability across the EU, including for high-risk lung cancer patients.

October 2023 – Roche Diagnostics partnered with Flatiron Health to integrate liquid biopsy data into real-world clinical evidence platforms for lung cancer treatment optimization.

September 2023 – Burning Rock Biotech released new clinical data demonstrating high accuracy of its LungPlasma test in detecting EGFR mutations in early-stage NSCLC patients in China.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Lung Cancer Liquid Biopsy market.

By Sample Type

By Biomarker

By Technology

By End-use

By Clinical Application

By Product

By Region