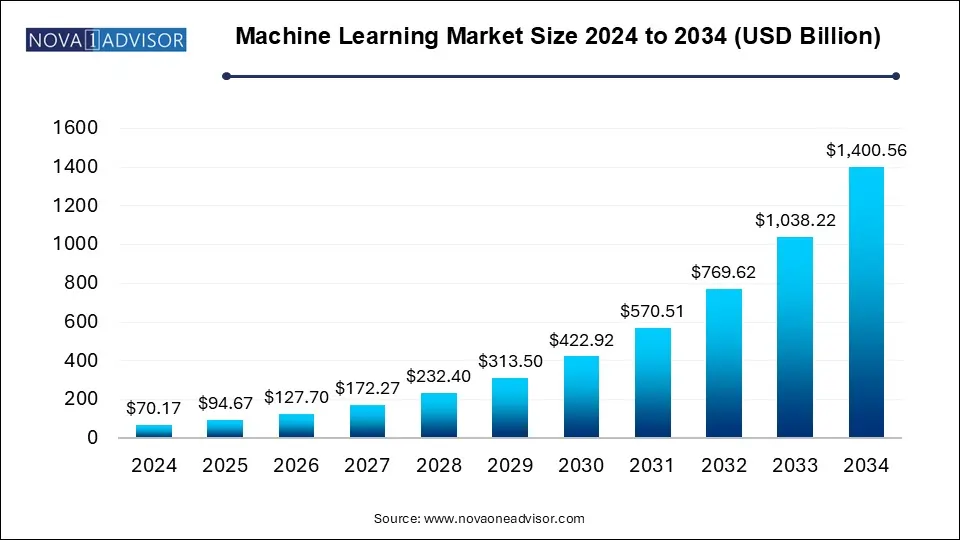

The machine learning market size was exhibited at USD 70.17 billion in 2024 and is projected to hit around USD 1400.56 billion by 2034, growing at a CAGR of 34.9% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 94.67 Billion |

| Market Size by 2034 | USD 1400.56 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 34.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Component, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Amazon Web Services, Inc.; Baidu Inc.; Google Inc.; H2o.AI; Hewlett Packard Enterprise Development LP; Intel Corporation; International Business Machines Corporation; Microsoft Corporation; SAS Institute Inc.; SAP SE |

Artificial Intelligence (AI) is an emerging technology transforming how businesses and people operate. Through the development of several digital services and products, as well as supply chain optimization, these technologies have revolutionized the consumer experience. While some startups concentrate on solutions for specialized domains, numerous technology firms invest in this area to create AI platforms. Machine Learning (ML), one of the AI approaches, is getting a lot of momentum in the industry due to its quick progress.

Automation is a key trend in machine learning, intending to reduce manual labor to construct and deploy models. Platforms for automated machine learning (AutoML) are becoming increasingly common, allowing non-experts to take advantage of machine learning capabilities and quicken model building. Moreover, Deep learning, a machine learning that uses multiple-layer neural networks, is also improving. This tendency, the availability of enormous datasets, and the creation of more effective algorithms are all driven by advancements in processing capacity. Deep learning provides innovations in speech recognition, natural language processing, and computer vision.

Technology has paved the way across various applications. This technology is used in advertising to forecast consumer behavior and enhance advertising efforts. Different models are used in AI-driven marketing to automate, augment, and enhance the data into actions. Machine learning is used in banking and finance to complete loan approval and asset management tasks. This technology is used in other applications, such as document management, security, and publishing, propelling the industry's growth.

Machine learning is transforming healthcare by aiding in medical diagnostics. For instance, Google's DeepMind division created an algorithm that can recognize retinal pictures of eye conditions like diabetic retinopathy. Early detection, prompt treatment, and a reduction in the workload for medical staff are all made possible by this technology. In addition, personalized medicine, disease outbreak prediction, and medication development also involve machine learning.

The service segment dominated the market in 2024 with a revenue share of 51.6%. Based on component, the market is divided into hardware, software, and service. Over the projection period, the hardware segment is anticipated to expand at the greatest CAGR. It can be related to the rising use of machine learning-optimized hardware. Creating specialized silicon processors with AI and ML capabilities is fueling hardware adoption. It is projected that the industry will continue to grow due to firms like SambaNova Systems developing processing devices with greater power.

The software segment is likely to account for a modest market share. Due to improved cloud infrastructure and hosting characteristics, the usage of cloud-based applications is projected to increase. Adoption is accelerated by cloud-based software since it enables users to switch from machine learning to deep learning. In recent years, there has been an increase in demand for machine learning services. Customers may manage their ML tools and cope with a variety of dependency stacks with the use of managed services.

The large enterprises segment dominated the market in 2024 with a revenue share of 66.0%. Based on enterprise size, the machine learning market is categorized into Small and Medium Enterprises (SMEs) and large enterprises.Large businesses are utilizing cloud-based machine learning platforms and services more and more. Cloud platforms' scalable and economic infrastructure makes machine learning model training and deployment possible. Large enterprises can use machine learning without making significant infrastructure investments thanks to services like Amazon Web Services (AWS), Google Cloud AI Platform, and Microsoft Azure Machine Learning which offer pre-built models, distributed training capabilities, and infrastructure management.

The adoption of machine learning is rapidly increasing among small and medium-sized enterprises. Due to their sometimes-constrained resources, SMEs may require additional skills to analyze significant data. Machine learning platforms and technologies may automate data analysis procedures, enabling SMEs to gain insightful knowledge from their data without putting in much human work. SMEs may better understand consumer behavior, enhance inventory management, optimize marketing efforts, and make data-driven choices using automated data analysis.

The advertising & media segment dominated the market in 2024 with a revenue share of 20.0%. Hyper-personalization is one of the key trends in which machine learning algorithms analyze enormous volumes of user data to produce highly personalized and pertinent adverts that boost engagement and conversion rates. Another trend is cross-channel optimization, in which machine learning algorithms plan budgets and modify bidding schemes to optimize advertising campaigns across several channels. Additionally, a growing emphasis is on ad fraud detection using machine learning. Advertisers are leveraging machine learning algorithms to identify and prevent fraudulent activities such as click and impression fraud, ensuring that ad campaigns are effective, and budgets are protected.

The law segment is expected to register the highest CAGR over the forecast period. In the law segment, machine learning is transforming how legal professionals handle tasks, process information, and make decisions. Several key trends are shaping the use of machine learning in the legal industry. Predictive analytics is gaining prominence, where machine learning algorithms analyze vast amounts of legal data to predict case outcomes, assess risks, and support legal strategies. This trend enables lawyers to make data-driven decisions and improve efficiency in case management which is driving the growth of the segment.

The North America segment dominated the market in 2024 with a revenue share of 30.0%. With the increasing impact of machine learning on society, there is a growing emphasis on ethical AI and responsible AI practices in North America. Organizations prioritize fairness, transparency, and accountability in machine learning models and algorithms. Efforts are being made to mitigate biases, ensure privacy protection, and address ethical considerations related to AI applications. Regulatory frameworks, guidelines, and industry standards are being developed to govern the region's responsible use of machine learning.

Machine learning and AI technologies are being quickly adopted in Asia Pacific nations, including China, India, and South Korea. Emerging economies use AI to boost productivity, promote economic growth, and tackle societal issues. The region's machine-learning industry is expanding due to government efforts, investments in R&D, and robust technological ecosystems. For instance, In January 2023, Baidu Inc. intended to introduce a chatbot service using artificial intelligence similar to OpenAl's ChatGPT. In March, the biggest search engine in China plans to release a ChatGPT-like app, first incorporating it within its core search functions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the machine learning market

By Component

By Enterprise Size

By End-use

By Regional