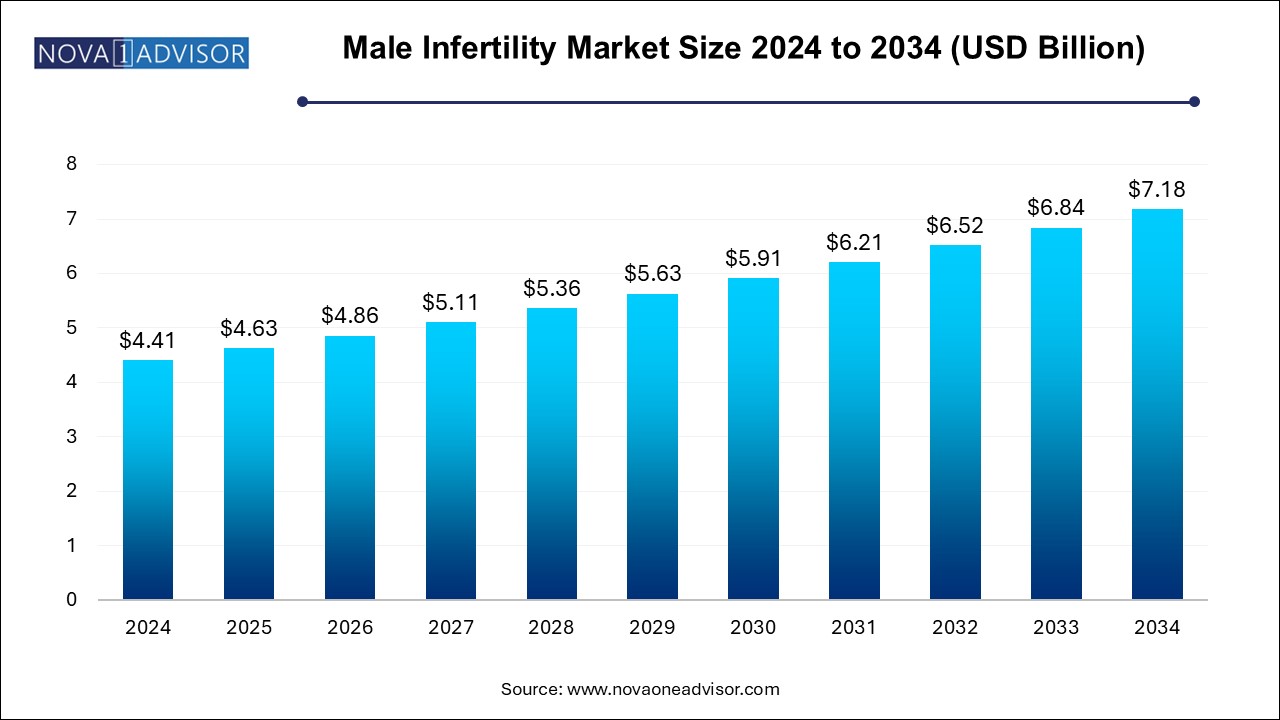

The male infertility market size was exhibited at USD 4.41 billion in 2024 and is projected to hit around USD 7.18 billion by 2034, growing at a CAGR of 5.0% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.63 Billion |

| Market Size by 2034 | USD 7.18 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.0% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Test, Treatment, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Bayer Healthcare; Andrology solutions; Aytu BioScience, Inc.; Cadila Healthcare Ltd.; Halotech DNA SL; EMD Sereno, Inc.; SCSA Diagnostics, Inc.; Intas Pharmaceuticals Ltd. |

Increasing infertility rates across the globe and the adoption of assisted reproductive technologies (ARTs) are expected to drive the market for male infertility in the forthcoming years. ARTs cover a wide spectrum of infertility treatments and offer solutions for males facing problems, such as low sperm count, abnormal sperm quality, and poor motility. Moreover, ARTs offer a high success rate as compared to medications. The market for male infertility is expected to witness significant growth in the future owing to technological advancements in the field of assisted reproductive technologies.

With the general acceptability and diagnostic techniques' ability to give an accurate analysis of sperm DNA integrity, DNA fragmentation technology is projected to grow steadily in the future. DNA fragmentation in sperm is one of the main reasons for male infertility. For diagnostic reasons, this technique is performed to diagnose male infertility. COVID-19 affected healthcare services severely. Only emergency medical procedures were allowed during the initial phase of the pandemic. The diagnostics, personal protection equipment, and critical medical supplies have seen increasing demand, while medical procedures have dropped by 50% to 60%, depending on the market.

The clinical disease generated by the SARS-CoV-2 virus, COVID-19, has been linked to a huge cytokine storm and organ system destruction. Despite the lack of evidence for SARS-CoV-2 virus detection in the testis, testicular injury and dysregulation of gonadotropins linked to inflammation have been documented in some studies. Furthermore, as a result of the pandemic's fast evolution, constantly updated medical therapies and governmental regulations that cause delays in care might affect fertility.

An increase in the global prevalence of infertility is a significant clinical problem. Around 48 million couples suffer from infertility worldwide. Of all cases, about 20% to 30% of cases are due to male factor infertility. This may be due to one or a combination of factors, such as abnormal morphology, lower sperm concentration, and poor sperm motility. Hence, increasing male infertility and growing awareness regarding the same have further prompted the use of drugs, hormonal therapy, and ART. Alcohol intake, smoking, obesity, stress, and lifestyle changes are some of the major factors that can be attributed to infertility in males. According to the National Center for Health Statistics, the fertility rate in males below 30 years has decreased globally by 15% from 2006 to 2010.

Continuous efforts in R&D are carried out for a better understanding of the idiopathic world of infertility. Hence, companies are investing in the development of devices for identifying the root cause and targeted treatment. Furthermore, the development and commercialization of hormonal therapy are likely to drive the market for male infertility during the forecast period. Governments of various countries have taken initiatives to improve the reimbursement scenario for infertility-related treatments. In addition, improved safety of patient data due to standardization of regulations is expected to increase patient preference for infertility treatments.

The DNA fragmentation segment accounted for the largest revenue share of 21.77% in 2024 owing to the ability of the diagnostic techniques to provide a reliable analysis of sperm DNA integrity. Adoption of this technique is increasing in the market as sperm DNA fragmentation is a leading cause of infertility in males. Based on test, the market is segmented into DNA fragmentation technique, oxidative stress analysis, microscopic examination, sperm agglutination, computer assisted semen analysis, sperm penetration assay, and others.

Computer-assisted semen analysis is expected to witness significant growth in the coming years due to technological advancements. Semen analysis is the most preferred test for the diagnosis and it can be performed through microscopic examination techniques. For instance, in April 2018, Sandstone Diagnostics received the U.S. FDA approval to launch Trak Volume Cup, a device that allows males to measure semen volume and diagnose hypospermia at home.

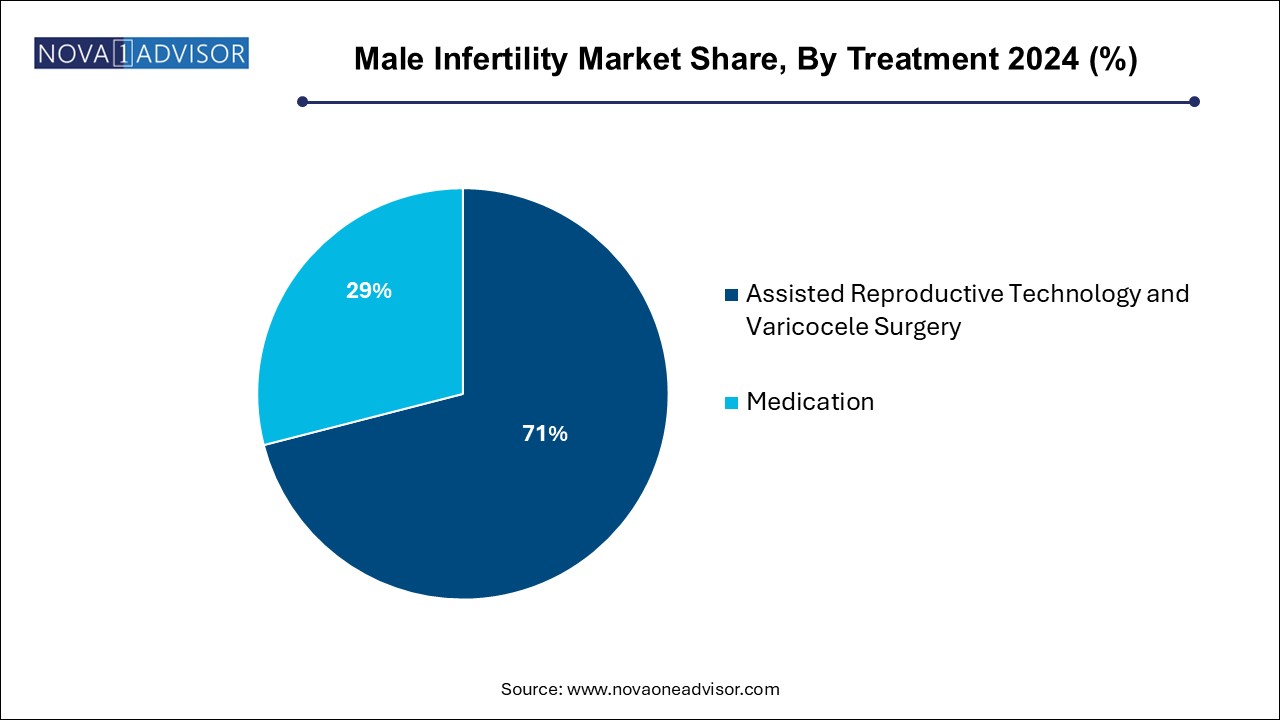

The ART and varicocele surgery segment dominated the market with a revenue share of 71.0% in 2024. The most preferred technique for the treatment of male infertility is enhancing spermatogenesis with the help of hormonal therapy for a natural pregnancy, especially among males with a low sperm count. Based on treatment, the market for male fertility is segmented into ART and varicocele surgery and medication.

ARTs are used to treat major factors responsible for male infertility, such as sperm autoantibodies, viral orchitis, epididymal dysfunction, accessory gland infection, chemotherapy, heat, trauma, and other idiopathic factors. The high cost of treatment and the requirement of several other therapy cycles are some of the major factors contributing to the segment growth. Increasing healthcare expenditure in developing countries, growing awareness about male infertility, and rising adoption in middle- and low-income countries are the key factors anticipated to drive the ART segment over the forecast period.

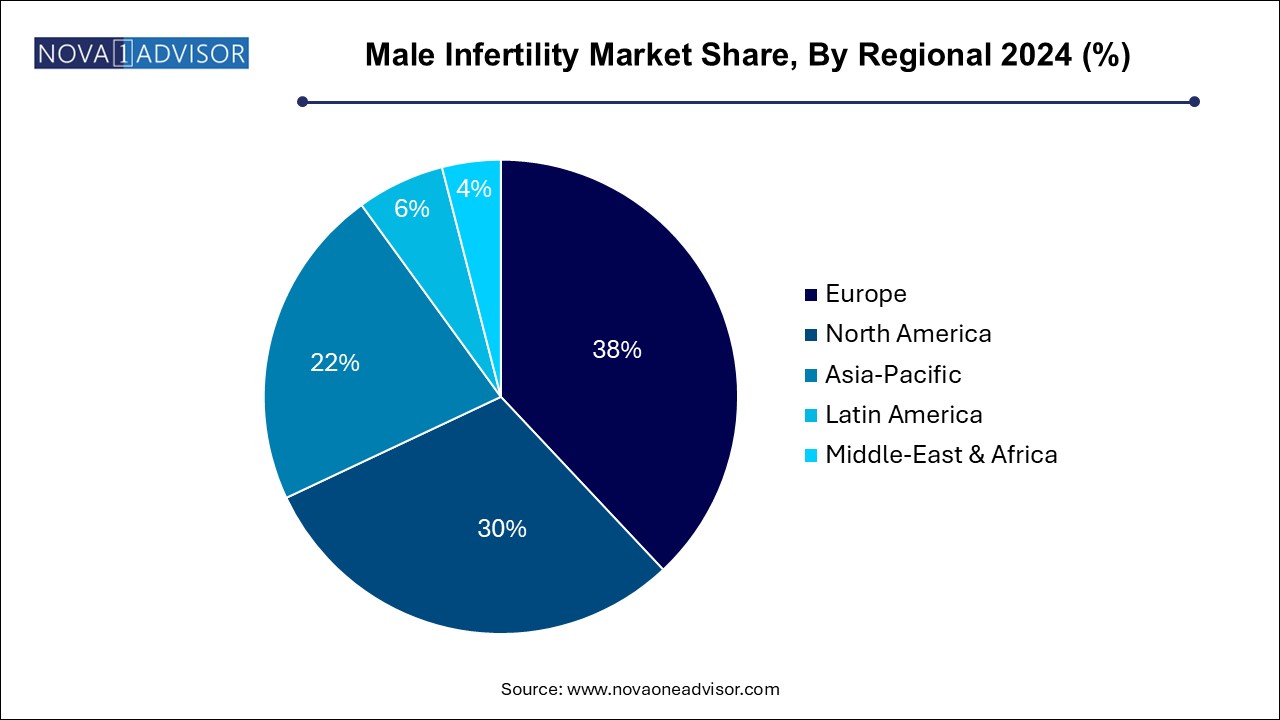

In 2024, Europe dominated the market with a revenue share of 38.0%. This is attributed to the availability of well-equipped and advanced fertility clinics, higher adoption of costlier treatment, better coverage for diagnosis and treatment, and high awareness level. Furthermore, healthcare spending and the availability of well-established healthcare infrastructure are contributing significantly to the regional market growth.

Asia Pacific is expected to witness the fastest growth with a CAGR of 5.60% over the forecast period. Emerging countries in the region, including India, China, and Singapore, have been witnessing strong economic growth. The Asian market is being driven by advancements in medical diagnostics as well as rising male infertility. The growing geriatric population, along with a rise in lifestyle-associated diseases, has resulted in an increase in the incidence rate of male infertility.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the male infertility market

By Test

By Treatment

By Regional

Chapter 1 Methodology and Scope

1.1 Market Segmentation & Scope

1.1.1 Test

1.1.2 Treatment

1.1.3 Regional Scope

1.1.4 Estimates and Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary research

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity flow analysis (Model 1)

1.6.2 Volume price analysis (model 2)

1.7 List of Secondary Sources

1.8 Objectives

1.8.1 Objective - 1

1.8.2 Objective - 2

Chapter 2 Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.2.1 Test

2.2.2 Treatment

2.2.3 Region

2.3 Competitive Insights

2.4 Male Infertility Market Outlook, 2021

Chapter 3 Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.2 Market Segmentation

3.3 Penetration & Growth Prospect Mapping

3.3.1 Penetration Analysis

3.3.2 Market driver analysis

3.3.2.1 High Adoption of Assisted Reproductive Technology (ART)

3.3.2.2 Increasing incidence of infertility

3.3.2.3 Acquisitions, mergers, and partnerships in the market

3.3.2.4 Technological advancements

3.3.3 Market restraint analysis

3.3.3.1 High cost of treatment

3.4 Male Infertility Market: Business Environment Analysis Tools

3.4.1 Porter’s Five Forces Analysis

3.4.2 PESTEL Analysis

3.5 Clinical Trial Analysis

Chapter 4 Male Infertility Market: Test Analysis

4.1 Male Infertility Test Market Share Analysis, 2021 & 2034

4.2 Male Infertility Test Market: Segment Dashboard:

4.3 Market Size & Forecasts and Trend Analyses, 2021 - 2034 for the Test Segment

4.3.1 DNA Fragmentation Technique

4.3.1.1 DNA fragmentation technique market, 2021 - 2034 (USD Million)

4.3.2 Oxidative Stress Analysis

4.3.2.1 Oxidative stress analysis market, 2021 - 2034 (USD Million)

4.3.3 Microscopic Examination

4.3.3.1 Microscopic Examination market, 2021 - 2034 (USD Million)

4.3.4 Sperm Agglutination

4.3.4.1 Sperm agglutination market, 2021 - 2034 (USD Million)

4.3.5 Computer Assisted Semen Analysis

4.3.5.1 Computer-assisted semen analysis market, 2021 - 2034 (USD Million)

4.3.6 Sperm Penetration Assay

4.3.6.1 Sperm penetration assay market, 2021 - 2034 (USD Million)

4.3.7 Others

4.3.7.1 Others market, 2021 - 2034 (USD Million)

Chapter 5 Male Infertility Market: Treatment Analysis

5.1 Male Infertility Treatment Market Share Analysis, 2021 & 2034

5.2 Male Infertility Treatment Market: Segment Dashboard:

5.3 Market Size & Forecasts and Trend Analyses, 2021 - 2034 for the Treatment Segment

5.3.1 ART & Varicocele Surgery

5.3.1.1 ART & varicocele surgery market, 2021 - 2034 (USD Million)

5.3.2 Medication

5.3.2.1 Medication market, 2021 - 2034 (USD Million)

Chapter 6 Male Infertility Market: Regional Analysis

6.1 Male Infertility Regional Market Share Analysis, 2021 & 2034

6.2 Male Infertility Regional Market: Segment Dashboard

6.3 Regional Market Snapshot (Market Size, CAGR, Top Verticals, Key Players, Top Trends)

6.4 SWOT Analysis, by Region

6.4.1 North America

6.4.2 Europe

6.4.3 Asia Pacific

6.4.4 Latin America

6.4.5 MEA

6.5 Market Size, & Forecasts, and Trend Analysis, 2021 - 2034

6.5.1 North America

6.5.1.1 North America male infertility market, 2021 - 2034 (USD Million)

6.5.1.1.1 U.S.

6.5.1.1.1.1 Regulatory & reimbursement scenario

6.5.1.1.1.2 U.S. male infertility market, 2021 - 2034 (USD Million)

6.5.1.1.2 Canada

6.5.1.1.2.1 Regulatory & reimbursement scenario

6.5.1.1.2.2 Canada male infertility market, 2021 - 2034 (USD Million)

6.5.2 Europe

6.5.2.1 Europe male infertility market, 2021 - 2034 (USD Million)

6.5.2.1.1 U.K.

6.5.2.1.1.1 Regulatory & reimbursement scenario

6.5.2.1.1.2 U.K. male infertility market, 2021 - 2034 (USD Million)

6.5.2.1.2 Germany

6.5.2.1.2.1 Regulatory & reimbursement scenario

6.5.2.1.2.2 Germany male infertility market, 2021 - 2034 (USD Million)

6.5.2.1.3 France

6.5.2.1.3.1 Regulatory & reimbursement scenario

6.5.2.1.3.2 France male infertility market, 2021 - 2034 (USD Million)

6.5.2.1.4 Italy

6.5.2.1.4.1 Regulatory & reimbursement scenario

6.5.2.1.4.2 Italy male infertility market, 2021 - 2034 (USD Million)

6.5.2.1.5 Spain

6.5.2.1.5.1 Regulatory & reimbursement scenario

6.5.2.1.5.2 Spain male infertility market, 2021 - 2034 (USD Million)

6.5.3 Asia Pacific

6.5.3.1 Asia Pacific male infertility market, 2021 - 2034 (USD Million)

6.5.3.1.1 Japan

6.5.3.1.1.1 Regulatory & reimbursement scenario

6.5.3.1.1.2 Japan male infertility market, 2021 - 2034 (USD Million)

6.5.3.1.2 China

6.5.3.1.2.1 Regulatory & reimbursement scenario

6.5.3.1.2.2 China male infertility market, 2021 - 2034 (USD Million)

6.5.3.1.3 India

6.5.3.1.3.1 Regulatory & reimbursement scenario

6.5.3.1.3.2 India male infertility market, 2021 - 2034 (USD Million)

6.5.3.1.4 Australia

6.5.3.1.4.1 Regulatory & reimbursement scenario

6.5.3.1.4.2 Australia male infertility market, 2021 - 2034 (USD Million)

6.5.3.1.5 South Korea

6.5.3.1.5.1 Regulatory & reimbursement scenario

6.5.3.1.5.2 South Korea male infertility market, 2021 - 2034 (USD Million)

6.5.4 Latin America

6.5.4.1 Latin America male infertility market, 2021 - 2034 (USD Million)

6.5.4.1.1 Brazil

6.5.4.1.1.1 Regulatory & reimbursement scenario

6.5.4.1.1.2 Brazil male infertility market, 2021 - 2034 (USD Million)

6.5.4.1.2 Mexico

6.5.4.1.2.1 Regulatory & reimbursement scenario

6.5.4.1.2.2 Mexico male infertility market, 2021 - 2034 (USD Million)

6.5.4.1.3 Argentina

6.5.4.1.3.1 Regulatory & reimbursement scenario

6.5.4.1.3.2 Argentina male infertility market, 2021 - 2034 (USD Million)

6.5.5 Middle East and Africa (MEA)

6.5.5.1 MEA male infertility market, 2021 - 2034 (USD Million)

6.5.5.1.1 South Africa

6.5.5.1.1.1 Regulatory & reimbursement scenario

6.5.5.1.1.2 South Africa male infertility market, 2021 - 2034 (USD Million)

6.5.5.1.2 Saudi Arabia

6.5.5.1.2.1 Regulatory & reimbursement scenario

6.5.5.1.2.2 Saudi Arabia male infertility market, 2021 - 2034 (USD Million)

6.5.5.1.3 UAE

6.5.5.1.3.1 Regulatory & reimbursement scenario

6.5.5.1.3.2 UAE male infertility market, 2021 - 2034 (USD Million)

Chapter 7 Competitive Analysis

7.1 Strategic Framework/ Competition Categorization (Key innovators, Market leaders, emerging players

7.2 Vendor Landscape

7.2.1 Strategy Mapping

7.2.2 Launch of New Products

7.2.3 Merger and Acquisition

7.2.4 Product Approvals

7.3 Company Market Position Analysis (Geographic Presence, Product Portfolio, Strategic Initiatives)

7.4 Company Profiles

7.4.1 EMD Serono, Inc.

7.4.1.1 Company overview

7.4.1.2 Financial performance

7.4.1.3 Product benchmarking

7.4.1.4 Strategic initiatives

7.4.2 Endo International plc

7.4.2.1 Company overview

7.4.2.2 Financial performance

7.4.2.3 Product benchmarking

7.4.2.4 Strategic initiatives

7.4.2.5 SWOT analysis

7.4.3 Sanofi

7.4.3.1 Company overview

7.4.3.2 Financial performance

7.4.3.3 Product benchmarking

7.4.3.4 Strategic initiatives

7.4.3.5 SWOT Analysis

7.4.4 Bayer Group

7.4.4.1 Company overview

7.4.4.2 Financial performance

7.4.4.3 Product benchmarking

7.4.4.4 Strategic initiatives

7.4.4.5 SWOT analysis

7.4.5 SCSA Diagnostics

7.4.5.1 Company overview

7.4.5.2 Product benchmarking

7.4.6 Andrology Solutions

7.4.6.1 Company overview

7.4.6.2 Product benchmarking

7.4.7 Halotech DNA SL

7.4.7.1 Company overview

7.4.7.2 Product benchmarking

7.4.7.3 Strategic initiatives

7.4.8 Intas Pharmaceuticals Ltd.

7.4.8.1 Company overview

7.4.8.2 Financial performance

7.4.8.3 Product benchmarking

7.4.8.4 Strategic initiatives

7.4.8.5 SWOT analysis

7.4.9 Aytu BioScience, Inc.

7.4.9.1 Company overview

7.4.9.2 Financial performance

7.4.9.3 Product Benchmarking

7.4.9.4 Strategic initiatives

7.4.9.5 SWOT Analysis

7.4.10 Cadila Pharmaceuticals

7.4.10.1 Company overview

7.4.10.2 Product benchmarking

7.4.10.3 Strategic initiatives

7.4.11 Vitrolife

7.4.11.1 Company overview

7.4.11.2 Financial performance

7.4.11.3 Product benchmarking

7.4.11.4 Strategic initiatives

7.4.11.5 SWOT Analysis

Chapter 8 Recommendations