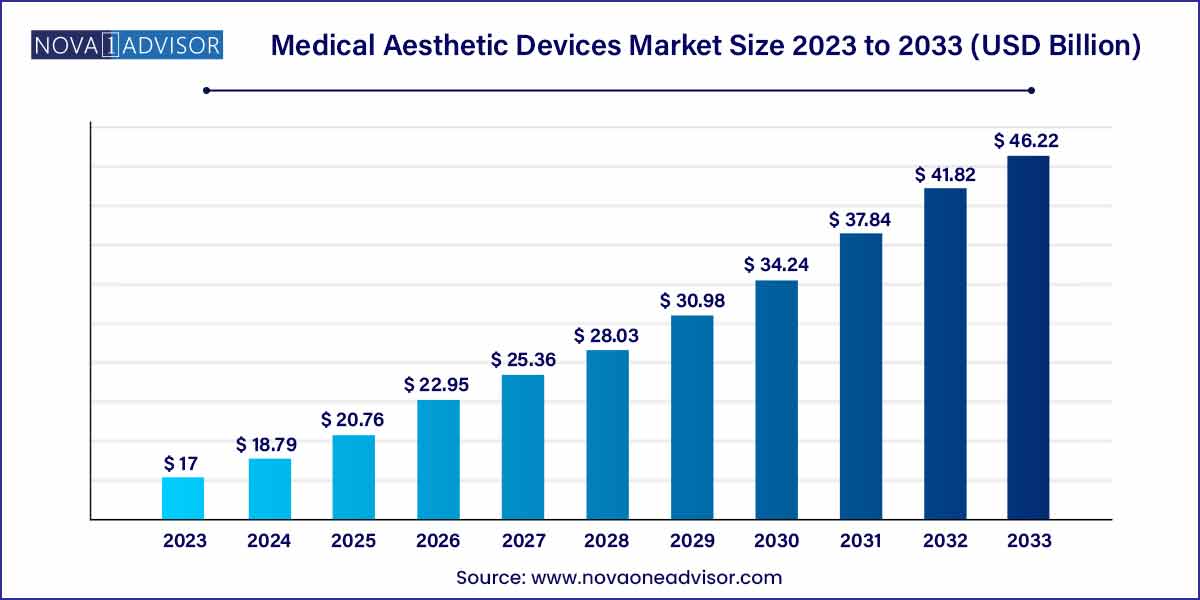

The global medical aesthetic devices market size was exhibited at USD 5.30 billion in 2023 and is projected to hit around USD 19.48 billion by 2033, growing at a CAGR of 13.9% during the forecast period 2024 to 2033.

The Medical Aesthetic Devices Market is experiencing remarkable growth, propelled by evolving beauty standards, technological advancements, and rising demand for minimally invasive and non-invasive cosmetic procedures. These devices encompass a broad spectrum of tools and implants designed to enhance physical appearance through surgical and non-surgical means. They are extensively used in procedures such as facial rejuvenation, body contouring, wrinkle reduction, hair removal, skin tightening, and breast or facial augmentation.

A growing segment of the global population is seeking aesthetic enhancements, not solely for vanity but to improve confidence and correct perceived defects whether age-related, congenital, or accidental. The increasing acceptance of cosmetic treatments across both genders and diverse age groups is breaking traditional barriers, leading to a democratization of aesthetic procedures. For instance, millennials are emerging as a significant consumer group, opting for preventive treatments like botulinum toxin injections and dermal fillers in their twenties and thirties to delay visible signs of aging.

This market has also witnessed a surge in demand from emerging economies, where rising disposable incomes and greater awareness of advanced aesthetic treatments have resulted in increased procedure volumes. Furthermore, the COVID-19 pandemic catalyzed the shift toward aesthetic self-care, with a noticeable rise in the so-called “Zoom boom” phenomenon, where increased video conferencing led individuals to focus more on their facial appearance and seek aesthetic improvements.

Globally, healthcare providers and medical spas are incorporating innovative technologies to enhance results while minimizing downtime and complications. From portable laser systems to AI-enabled diagnostic tools for customized skin treatments, the aesthetic device ecosystem is becoming more sophisticated, personalized, and accessible.

Shift Toward Minimally and Non-Invasive Procedures: Consumers prefer treatments with less pain, fewer complications, and faster recovery times.

Technology Integration: Use of AI, robotics, and 3D imaging for enhanced diagnosis, treatment planning, and outcome prediction.

Male Aesthetics on the Rise: A growing number of men are undergoing aesthetic treatments, especially body contouring and hair restoration.

Expansion of Medical Spas: The proliferation of certified beauty centers offering medical-grade treatments in non-hospital settings.

Increased Popularity of Combination Therapies: Clinics are offering bundled treatments combining injectables, lasers, and skin-tightening techniques for holistic results.

Youthful Aging Movement: Young consumers are proactively undergoing treatments to prevent signs of aging rather than reverse them.

Home-Use Devices Gaining Traction: Portable devices for light therapy, skin toning, and hair removal are attracting DIY beauty consumers.

Customized and Personalized Aesthetic Solutions: Tailored treatments using data-driven skin and facial analysis tools.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.30 Billion |

| Market Size by 2033 | USD 19.48 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End User, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Allergan plc, Dentsply Sirona Inc., Johnson & Johnson, LUMENIS LTD, MERZ PHARMA GMBH & CO. KGAA, Hologic, Inc., Sientra Inc, SYNERON MEDICAL LTD, VALEANT PHARMACEUTICAL INTERNATIONAL, INC, Zimmer Biomet Holdings, Inc. |

The rising demand for minimally invasive and non-invasive cosmetic treatments stands as a core driver in the medical aesthetic devices market. Unlike traditional surgical approaches, these procedures require little to no downtime, pose fewer risks, and offer fast, noticeable results. Treatments such as botulinum toxin injections, laser resurfacing, RF-based skin tightening, and cryolipolysis are increasingly preferred for their convenience and efficacy.

According to data from the American Society of Plastic Surgeons, minimally invasive cosmetic procedures increased significantly over the past decade, overtaking traditional surgical methods. Technologies like Intense Pulsed Light (IPL) and fractional CO2 lasers are revolutionizing skin rejuvenation, offering patients a smoother experience with long-lasting results. This consumer shift is being embraced by both established clinics and newer medical spas, boosting device sales and expanding the market's footprint.

Despite its growing popularity, one major restraint affecting the medical aesthetic devices market is the high cost associated with advanced treatments and equipment. Cutting-edge devices utilizing laser, ultrasound, or radiofrequency technology require substantial investment by clinics. These costs are often passed onto consumers, making procedures unaffordable for a significant portion of the population, particularly in developing regions.

Moreover, many aesthetic procedures are not covered under standard health insurance, as they are categorized as elective. This further limits access for middle-income and low-income groups. The financial burden also impacts small and medium-sized clinics, which may be unable to invest in the latest devices or expand their service offerings. Cost-sensitive consumers and providers may resort to substandard or non-regulated devices, raising concerns around safety and efficacy.

Emerging economies represent a fertile growth opportunity for the medical aesthetic devices market. As urbanization accelerates and middle-class populations grow in regions such as Latin America, Southeast Asia, and the Middle East, aesthetic treatments are gaining popularity beyond high-income countries. Rising income levels, increasing focus on appearance in competitive job markets, and expanding healthcare infrastructure are contributing factors.

Moreover, aesthetic tourism is flourishing in countries like Thailand, Turkey, Brazil, and India, where patients from developed nations travel to access affordable treatments. Governments in these regions are also supporting the growth of aesthetic and wellness sectors through tourism initiatives and business incentives. Manufacturers who can offer cost-effective yet advanced devices tailored to these markets stand to gain significantly in the years ahead.

Energy-based Aesthetic Devices Dominate the Market owing to their widespread use in various applications such as skin tightening, hair removal, tattoo removal, and body contouring. Laser-based devices, in particular, are favored for their precision and multi-functionality. Clinics extensively use technologies like fractional lasers, IPL, and diode lasers for facial rejuvenation and pigmentation correction. These devices offer high efficacy with minimal invasiveness, aligning with modern consumer preferences.

On the other hand, Ultrasound-based Devices are the Fastest-Growing Segment due to their increased adoption in non-invasive skin lifting and body sculpting treatments. Devices such as Ultherapy use focused ultrasound energy to stimulate collagen production and tighten skin without any surgical intervention. The growing demand for alternatives to surgical facelifts is propelling this segment. Additionally, advancements in high-intensity focused ultrasound (HIFU) are opening doors to more versatile treatment offerings.

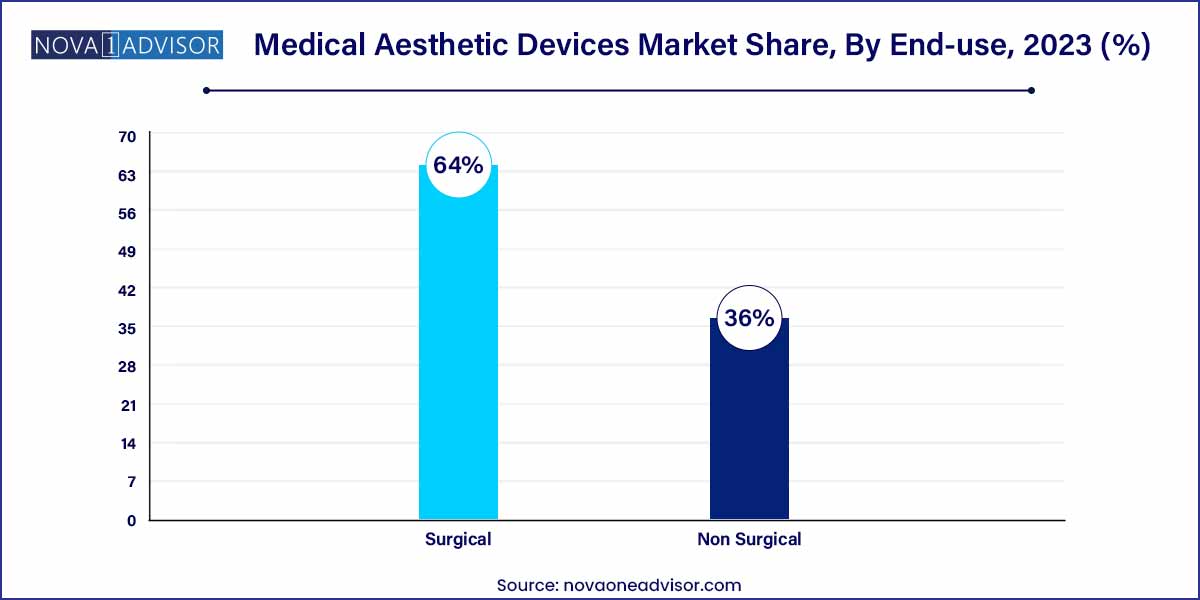

Non-Surgical Applications Hold the Largest Share in the market, driven by consumer preference for treatments with lower downtime, fewer side effects, and minimal risk. Non-surgical procedures such as botulinum toxin injections, dermal fillers, chemical peels, and energy-based skin treatments are routinely offered in both clinical and spa settings. The convenience and affordability of such procedures contribute to their rising popularity across all age groups.

Meanwhile, Surgical Applications are Experiencing Notable Growth, especially in facial and breast aesthetics. Surgical aesthetic implants such as rhinoplasty and breast augmentation remain popular for patients seeking long-term, dramatic improvements. With improved safety protocols, refined surgical techniques, and better implant materials, the surgical segment continues to grow, particularly in established markets like the U.S. and parts of Europe.

North America, led by the United States, remains the largest market for medical aesthetic devices. The region benefits from high disposable income, an aging population interested in youthful appearance, and a strong presence of global aesthetic device manufacturers. According to the American Society for Aesthetic Plastic Surgery, the U.S. performs millions of cosmetic procedures annually, with Botox, laser treatments, and breast augmentation leading the list.

The market here is further supported by favorable regulatory frameworks, growing male participation in cosmetic treatments, and strong technological infrastructure. Leading companies like Allergan (AbbVie), Cynosure, and Bausch Health have their headquarters or major operations based in the region, contributing to continued innovation and market dominance.

Asia-Pacific is the most dynamic and fastest-growing market, driven by factors such as rising middle-class incomes, changing beauty standards, and an increasing inclination toward aesthetic enhancement. Countries like South Korea and Japan are global hubs for cosmetic innovation, with South Korea in particular gaining fame for its aesthetic expertise and medical tourism. Korean companies like Classys and Lutronic are expanding their global presence by developing advanced and affordable devices.

India and China are also rapidly expanding their aesthetic markets. A younger population, greater openness to cosmetic treatments, and growing influence from social media and entertainment industries are fueling demand. Regional governments are also investing in healthcare infrastructure and supporting startups in the medtech and aesthetic domains, creating fertile ground for market expansion.

March 2025 – Allergan Aesthetics (AbbVie) launched a new AI-driven treatment planning system for dermal filler procedures, enhancing customization and safety outcomes.

January 2025 – Cynosure introduced a compact, multi-platform energy-based device aimed at medical spas and smaller clinics seeking high-performance tools in limited spaces.

October 2024 – Lumenis received FDA clearance for its updated laser-based hair removal system, which features improved skin cooling technology for pain-free treatment.

August 2024 – Merz Aesthetics expanded its presence in Latin America by launching its flagship facial injectable products in Brazil and Colombia.

June 2024 – Bausch Health Companies Inc. announced a strategic partnership with a digital skin imaging startup to integrate smart diagnostics with their energy-based devices.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global Medical aesthetic devices market.

By Type

By Application

By End User

By Region