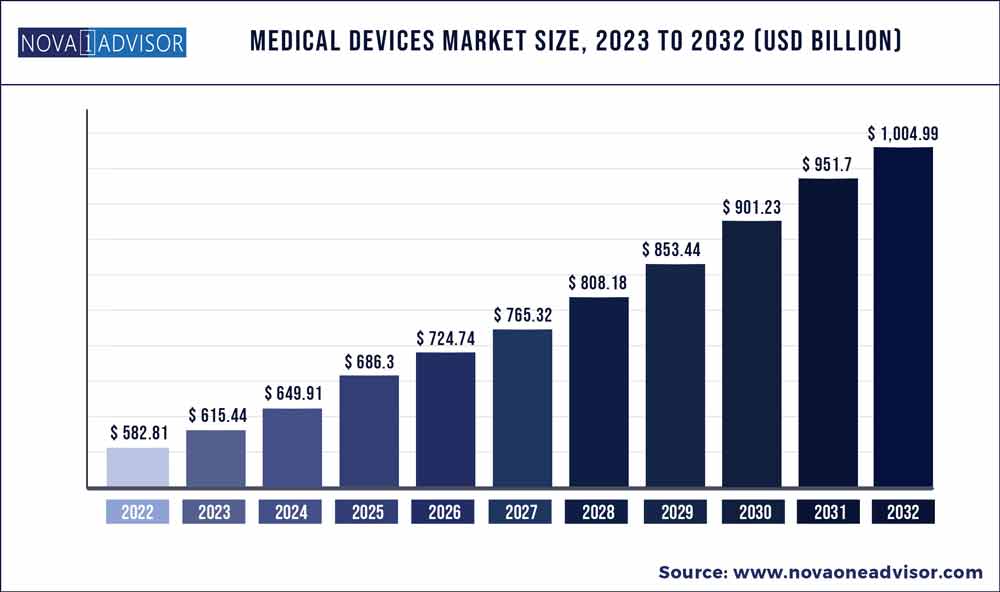

The global medical devices market size was exhibited at USD 582.81 billion in 2022 and is projected to hit around USD 1,004.99 billion by 2032, growing at a CAGR of 5.6% during the forecast period 2023 to 2032.

Key Pointers:

A medical device is an instrument, apparatus, implant, machine, tool, in vitro reagent, or similar used to diagnose, prevent, help alleviate, treat, or cure disease or other conditions. Unlike pharmaceuticals or biologics, medical devices achieve their goals through physical, structural, or mechanical action rather than chemical or metabolic action within or on the body. Simple, low-risk (Class-I) devices such as tongue depressors, medical thermometers, disposable gloves, and bedpans are examples, as are complex, high-risk (Class-II) devices that are implanted and prolong life.

Medical Devices Market Report Scope

|

Report Coverage |

Details |

|

Market Size in 2023 |

USD 615.44 Billion |

|

Market Size by 2032 |

USD 1,004.99 Billion |

|

Growth Rate From 2023 to 2032 |

CAGR of 5.6% |

|

Base Year |

2022 |

|

Forecast Period |

2023 to 2032 |

|

Segments Covered |

Product, Therapeutic Application, End User, |

|

Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

|

Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

|

Key Companies Profiled |

DePuy Synthes, Medtronics Plc, Fesenius Medical Care, GE Healthcare, Philips Healthcare, Ethicon LLC, Siemens Healthineers, Stryker, Cardinal Health, Baxter International Inc., BD |

Medical Devices Market COVID-19 Analysis:

The coronavirus outbreak is disrupting supply chains all around the world with the most aggravating effect on the medical devices market. The COVID-19 pandemic has impacted the production scenario globally, it has changed the business environment for numerous organizations across the globe. Most companies have extended their production capacity to meet the increasing demand for essential supplies. Covid-19 severely impacted the overall medical devices market around the world, which directly influenced hospital capacities and the ability for patients to seek care for a number of diseases. According to the World Health Organization (WHO), during COVID-19 over 28 million elective surgeries across the globe were cancelled, whilst 38% of global cancer surgeries were postponed. The coronavirus pandemic caused an unprecedented surge in the demand for medical products. The supply chain for COVID-19 relevant medical devices, such as personal protective equipment (PPE), ventilators, and testing supplies and equipment, was unprepared to satisfy higher demand.

Medical Devices Market Dynamics:

Drivers

The rising prevalence of chronic conditions and treatment of patients suffering from these diseases is exerting huge pressure on the healthcare systems of many countries. The overall costs of treating a patient in a hospital inpatient setting are significantly higher, and longer hospital stays are associated with a higher economic burden. Therefore, with the efforts taken by healthcare agencies to shift patients towards home care settings, also market players are actively investing in research and development of advanced and easy-to-use medical equipment such as specialized beds, person-lifting and transferring equipment, and toileting aids for the treatment of chronic diseases.

Restraints

The medical devices industry has witnessed noteworthy developments in the past decade regarding to the new technologies being implemented and new design modifications, among others. However, these devices' high cost, which includes a comparatively higher acquisition cost, and subsequent maintenance costs, leads to an overall increased device cost and ownership. Some of the advanced devices are associated with various other components such as chips, batteries, sensors, and some other accessories which require periodic replacement.

Opportunities

Increasing investment in research and development activity by medical technology companies due to the rising prevalence of chronic disease and easy approval process for those devices by the regulatory authorities are expected to propel the medical devices market growth over the upcoming years. According to the article published in Regulatory Affairs Professionals Society (RAPS), the US Food and Drug Administration’s (FDA) Center for Devices and Radiological Health (CDRH) approved or authorized 13 devices in the year 2022. Additionally, the increasing spending on R&D by the pharmaceutical, biopharmaceutical, and medical devices companies is further supplementing the growth of the medical devices industry during the forecast period.

Medical Devices Market Value Chain Analysis

In research and product development, the researchers work on improving product technology, advanced, and cost-effective designs for easy maneuvering. As there are various medical devices in the market, many companies have started adding innovative features and advanced technology such as IoT and artificial intelligence to their products to show better efficiency. The manufacturing process begins with the assembling of raw materials. Sourcing raw material is the initial phase in the manufacturing of the devices.

Distribution and sales are an essential part of value chain. The global medical devices market distribution network consists of value chain analysis, which further includes intermediaries, direct selling, and

Medical Devices Market Segment Overview:

By Device Type

Drug Delivery Devices:

Drug delivery devices, are pharmaceutical formulations or devices that help in achieving targeted delivery or Controlled Release (CR) of therapeutic agents in the body. The drug delivery systems are segmented into metered dose inhaler devices, infusion systems, and other Companies such as Bayer AG (Germany), Johnson & Johnson (US), and Baxter International, Inc. (US) among others are the key players offering drug delivery systems.

Diagnostic Devices:

Diagnostic devices are tools used to identify the nature or cause of a certain phenomenon, usually related to a medical condition. The diagnostic devices are segmented into laboratory based diagnostic devices, wearable diagnostic devices, and others. Laboratory based diagnostic devices are further segmented into X-ray, Computed Tomography (CT), and Positron Emission Tomography (PET). Wearable diagnostic devices are segmented into vital signs monitors, fetal and obstetric monitoring devices, and others.

Invasive Devices:

Any medical devices that are inserted into the body is considered an invasive device. The invasive devices are segmented into implants and stimulation devices, defibrillators, pacemakers, and others. In addition, a rise in the number of minimally invasive surgery devices due to its higher acceptance rate over traditional surgeries, increasing prevalence of chronic diseases such as cardiovascular diseases, and technological advancement in the invasive devices are anticipated to drive the growth of the invasive devices segment.

Respiratory Therapeutic Devices:

Respiratory therapeutic devices are mainly utilized to improve pulmonary functions by cleaning the airway, increasing lung oxygen intake capacity, and facilitating mucus evacuation from the bronchi. The respiratory therapeutic devices are segmented into ventilators, oxygen concentrators, resuscitators, and others. These respiratory therapeutic devices are also used to help in the treatment of a variety of chronic illnesses associated with respiratory problems such as Chronic Obstructive Pulmonary Disease (COPD), bronchitis, sleep disorders, asthma, and other chronic illnesses.

Electronic Medical Device:

Electronic medical devices include pacemakers, defibrillators, drug-releasing pumps, hearing aids, and diagnostic equipment for measuring, monitoring, and recording body functions such as heartbeat and brain waves. The electronic medical devices are segmented into monitoring devices, massage chairs, heating blankets, electronical hospital beds, and others. Monitoring devices are further segmented into sphygmomanometer, pulse oximeter, digital thermometers, brain wave meter, electrocardiogram meter, body fat meter, bone density meter, physiological monitoring system, and others that include blood gas & electrolyte analyzers.

Others:

Other medical devices include endoscopy devices, ophthalmology devices, and wound management medical devices among others. Endoscopy is a minimally invasive medical treatment that identifies, prevents, and treats visceral organ disorders such as Inflammatory Bowel Disease (IBD). These devices are implanted in the body either through natural cavities (such as the anus and mouth) or through incisions, particularly in arthroscopy.

By Application

Cardiovascular Diseases:

Rising prevalence of cardiovascular diseases such as heart failure, stroke, cardiomyopathy, and others are expected to drive the medical devices market growth. According to the World Health Organization (WHO), large population people died suffering from cardiovascular diseases in 2019 globally

Diagnostic Imaging:

The diagnostic imaging is the technique of creating visual illustrations of the inner body for clinical examination and medical interpolation, along with the visual representation of the function of certain organs or tissues. It includes ultrasound, X-Ray, Positron Emission Tomography (PET), Computed Tomography (CT), and Magnetic Resonance Imaging (MRI) scanners are used for spot diagnosis, monitoring disease progression, treatment planning, and evaluation of the efficacy of treatment for several chronic diseases such as cancer and others.

Orthopedics:

The rising prevalence of orthopedics diseases such as osteoarthritis, rheumatoid arthritis, and degenerative disc disease among others, and the growing aging population across the globe are expected to drive the market growth. For instance, as per the National Institutes of Health (US), the prevalence of degenerative disc disease is typically proportional to age, with large number of old age people having degenerative disc disease, rising to 80% among those aged 80 years or over.

Oncology:

Rising prevalence of cancer which is directly influence demand for medical devices such as Computed Tomography (CT), Positron Emission Tomography (PET), and Magnetic Resonance Imaging (MRI) among others are anticipated to drive the market growth. For instance, according to World Health Organization (WHO) figures, cancer is the primary or second leading cause of death as well as large number of populations suffering from cancer disease.

Ophthalmic:

Ophthalmic diseases consist of illness related to the eyes that includes glaucoma, cataract, and other vision-related issues. In addition, the rising prevalence of ophthalmic disease also raises the demand for medical devices. For instance,, according to the American Academy of Ophthalmology (AAO), in the US alone, in the year 2019, a major population aging population and above suffer from vision impairment, with about a million suffering from blindness.

General Surgery:

Increasing cases of anal & distal rectal cancer, esophageal cancer, gall bladder disorders, hernia repair, and other chronic diseases all over the globe are some of the key contributing factors to the growth of the segment. The various medical devices such as electrical cautery, dermatome, laser scalpel, and other medical & surgical equipment are used to perform various general surgeries.

Respiratory:

Medical devices related to respiratory system are used to mechanically support the impaired gas exchange function of the patients. A major share of the population is experiencing respiratory issues. As per the report presented by ResMed at the American Thoracic Society (ATS) 2018 International Conference, a large number of world population suffered from Obstructive Sleep Apnea (OSA) resulting in abnormal breathing patterns. Such illness requires respiratory support for normalizing breathing patterns

Similarly, as per the European Respiratory Journal in 2018, the major population suffering from OSA.

Dental:

Medical devices such as dental cone-beam computed tomography, dental lasers, dental implants, and others are used for diagnosis and treatment planning of dental problems and maintaining dental health. The rising prevalence of oral health disorders and growing demand for dental care facilities for efficient dental surgical procedures are the major factors propelling the growth of the market.

ENT:

ENT devices such as endoscopes, hearing screening devices, and hearing implants among others are used to treat various ENT disorders such as cholesteatoma, sinusitis, and others. The rising geriatric population, increasing prevalence of ENT-related disorders, and increasing penetration of minimally invasive ENT procedures are among the key trends stimulating market growth.

Neurology:

Neurological disorders include Alzheimer’s disease, vascular dementia, Parkinson’s disease, multiple sclerosis, neuropathies, epilepsy, and other disorders. The rising prevalence of these diseases is increasing the demand for neurodiagnostic, neuro-interventional, and neurostimulation devices among others for the diagnosis and treatment of neurological disorders. According to the Alzheimer's Association (US), Alzheimer’s dementia may affect 13.8 million Americans aged 65 and above.

Nephrology & Urology:

The increasing patient population suffering from diabetes, blood pressure, chronic kidney disease, fluid & electrolyte disorders, prostate cancer, and other nephrology & urologic diseases drives the market growth. For instance, according to the U.S. Department of Health & Human Services, in 2021, a major population in the US suffered from chronic kidney disease. As there is a rising prevalence of diabetes and high blood pressure among adults, there is a high risk of developing Chronic Kidney Disease (CKD) and urological disorder.

Others:

The other applications involve the use of medical devices for dermatology, gynecological diseases, and Infectious diseases among others. Dermatology diagnostic & treatment devices such as imaging devices, electrosurgery devices, and others help in diagnosing and treatment of skin disorders such as psoriasis, eczema, acne, rosacea, ichthyosis, vitiligo, etc.

By End User

Hospitals & Clinics:

Rising prevalence of cardiovascular diseases such as heart failure, stroke, cardiomyopathy, have augmented the utilization of the medical devices in hospitals & clinics across diverse geographies. According to the World Health Organization (WHO), in 2019 a large population across the globe died suffering from cardiovascular diseases.

Ambulatory Surgical Centers:

Ambulatory surgical centers are outpatient surgery centers that provide diagnostic and preventive services. The ambulatory surgical centers perform same-day surgeries such as cataract surgery, gall bladder removal, abdominal hernia repair, skin therapy, and others.

Homecare Settings:

The homecare settings segment is growing tremendously due to the availability of better treatment for the patient and external factors such as the COVID-19 pandemic, making it difficult for patients to visit hospitals & clinics. Some electronic medical devices enable people to manage their own homecare settings more conveniently and independently such as pulse oximeters, digital thermometers, massage chairs, heating blankets, and others.

Others:

The other segments include trauma centers, rehabilitation centers, and research centers among others where medical devices are used for diagnosis, treatment, monitoring, and management of diseases. Trauma centers provide care for patients suffering from major traumatic injuries.

Medical Devices Market Regional Analysis

North America accounted largest market share in Medical Devices Market. This is attributed to the increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, diabetes, Chronic Obstructive Pulmonary Disease (COPD), Alzheimer's, obesity, arthritis among others. Moreover, the presence of favourable reimbursement policies, well-developed healthcare infrastructure, and rapid adoption of advanced medical technologies in the region drive the regional market growth during the forecast period.

Asia-Pacific is considered as fastest growing medical devices market. This is due to the factors such as improving healthcare infrastructure, government initiatives, and the increasing patient population suffering from chronic diseases such as cancer, arthritis, osteoporosis, chronic kidney disease, and heart diseases.

Some of the prominent players in the Medical Devices Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Medical Devices market.

By Product

By Therapeutic Application

By End User

By Region