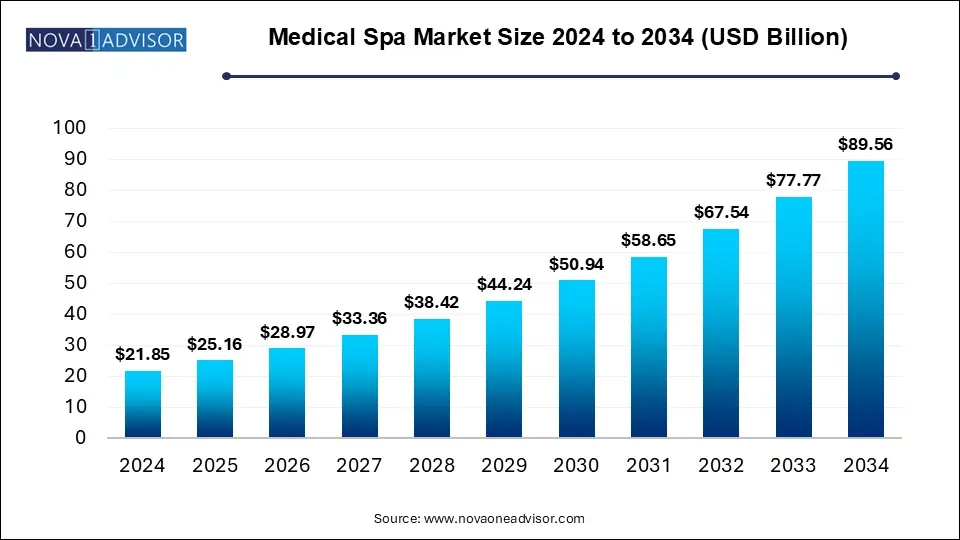

The medical spa market size was estimated at USD 21.85 billion in 2024 and is projected to hit around USD 89.56 billion by 2034, expanding at a CAGR of 15.15% during the forecast period from 2025 to 2034. The rising influence of medical tourism and rapid innovation in non-invasive treatments is expected to boost the expansion of the medical spa market during the forecast period.

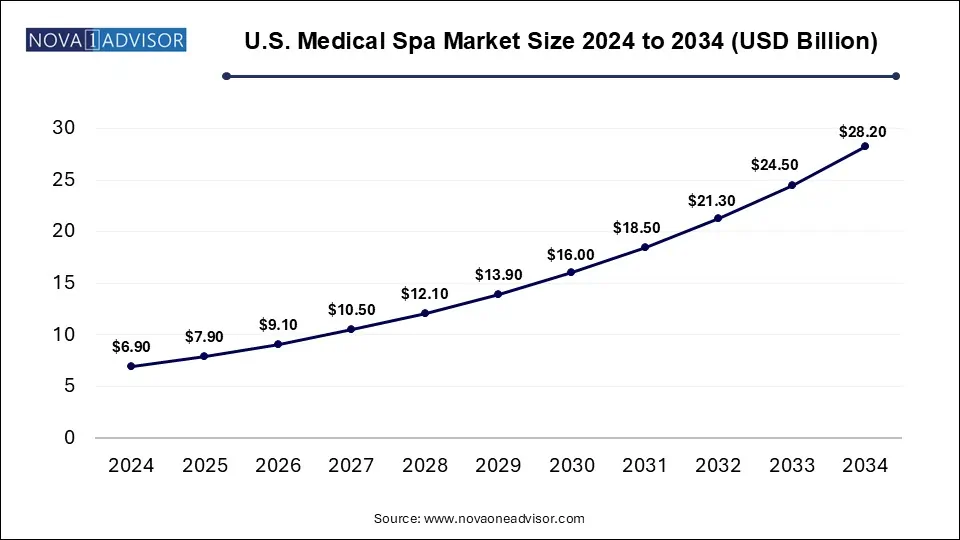

The U.S. Medical Spa Market size was valued at USD 6.9 billion in 2024 and is expected to hit around USD 28.2 billion by 2034, growing at a CAGR of 13.65% from 2025 to 2034.

North America held the dominating share in 2024, owing to rising disposable income, higher prevalence of obesity, and increasing preference for non-surgical aesthetics. The North American region benefits from a sophisticated healthcare infrastructure and a supportive regulatory framework that ensures safety standards and consumer trust in medical spa services. The region has higher expenditure on wellness tourism (domestic and international traffic) than other regions. The easy availability of different services and products for various aesthetic procedures in the U.S. and Canada is expected to further boost market growth.

Some of the key players operating in the region are increasingly adopting marketing strategies such as partnership/collaboration and acquisition to strengthen their presence. For instance, in March 2025, XWELL, Inc., a company specializing in wellness, announced its plan to acquire several medical spas by the end of 2025. The expansion is backed by a USD 4 million private placement and targets the intersection of wellness and beauty, a sector experiencing significant growth.

Asia Pacific is anticipated to register the highest CAGR over the forecast period due to the increasing popularity and growth of the wellness tourism sector and rising wellness tourism expenditure. Other factors such as the increasing popularity of non-invasive and minimally invasive procedures, the rising obesity population, increasing disposable income, and increasing focus on wellness and improving standard of living. Such factors are anticipated to promote the growth of the market in the Asia Pacific.

As wellness and aesthetic care are gaining increasing popularity in the millions of lives, the medical spas market continues to grow around the world, particularly in developed and developing countries. Medical spas are also known as medi-spas or med spas. Medical spas generally provide nonsurgical cosmetic medical services. Medical spas offer a wide range of treatments, including Coolsculpting, Microneedling, Botox, and others. Med spas are typically supervised by a licensed physician, but some specific procedures are usually done by an aesthetic nurse practitioner. The surging demand for non-invasive cosmetic procedures, driven by the rising focus on personal appearance and health consciousness, significantly fuels the market growth in the coming years.

According to the Medical Spa State of the Industry Report 2024 released by American Med Spa Association (AmSpa), the medical aesthetics industry continues the steady growth it has experienced in the past 15 years, growing from 8,899 locations in 2022 to 10,488 in 2023.

| Report Coverage | Details |

| Market Size in 2025 | USD 25.16 Billion |

| Market Size by 2034 | USD 89.56 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 15.15% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service, Gender, Age Group, Service Provider, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Chic La Vie Med Spa; Clinique La Prairie; Kurotel-Longevity Medical Center and Spa; Lanserhof; The Orchard Wellness Resort; Biovital Medspa LLC; Allure Medspa; Longevity Wellness Worldwide; Serenity Medspa; Vichy Celestins Spa Hotel; Brenners Park-Hotel & Spa; SHA Wellness Clinic; Cocoona Centre Of Aesthetic Transformation; Mezzatorre Hotel and Thermal SPA; Aesthetics Medispa; Lily’s Medical Spa; Lisse; The DRx Clinic; Westchase Medspa; Chiva Som; Mandarin Oriental Hotel Group Limited |

Opportunity

Rising popularity of non-invasive and minimally invasive procedures

The increasing demand for non-invasive and minimally invasive procedures is projected to offer lucrative growth opportunities to the medical spas market. Med spa facilities provide traditional spa treatments with advanced medical technology Medical Spas offer a wide variety of non-invasive and minimally invasive procedures which most commonly include botox injections: facial fillers, double chin reduction, laser skin treatment, laser hair removal, skin tightening, coolsculpting, stretch mark reduction: spider vein removal, facials, chemical peels, microdermabrasion: medical weight loss, microneedling, breast boost, lash extension, and others. These treatments are performed to address various cosmetic issues such as acne, deep wrinkles, weight loss, scarring, loose skin, body firming, and others. As compared to surgical interventions, these methods offer patients faster recovery times, lower risk, and less expensive options. Thus, increasing adoption of non-invasive and minimally invasive procedures to enhance the aesthetic appeal is expected to accelerate the market expansion in the coming years.

Restraint

High cost

The high cost associated with nonsurgical treatments is anticipated to projected to hinder the market's growth. The high treatment cost and regulatory complexities, implemented by numerous government organizations, are some of the key factors that are likely to hamper the market's expansion. In addition, the market has observed a lack of awareness and limited availability of various treatment options, particularly in underdeveloped countries may restrict the expansion of the global medical spa market.

The adult segment accounted for the dominating share in 2024. The majority of the medspas have their customers in their mid-30s, 40s, and 50s due to the increasing focus of adults on body contouring and anti-aging treatments. Nearly 26.0% of all the female customers in the U.S. belonged to the age group of 35-54 as per the 2022 AmSpa Medical Spa State of the Industry Report. The high spending capacity of people aged 35 to 50 and increasing demand for dermal fillers among this age group are propelling the segment's growth.

The high influence of social media is increasing the demand for facial treatments among adolescents. Teenagers are increasingly incorporating anti-aging products and treatments into their beauty regimens. Moreover, they want scarless skin permanently and are opting for nonsurgical scar revisions.

The geriatric segment is estimated to witness substantial growth during the forecast period. As per WHO, the share of people aged above 60 will increase to 1.4 billion by 2030. The desire to look young and attractive even in old age is favoring the growth of the geriatric segment. People aged above 60 are more interested in maintaining a healthy lifestyle, which leads to an increase in the number of medspa visits.

The female segment accounted for the largest revenue share in 2024. Women being the primary customers, various women-oriented services are being increasingly designed, which is positively impacting segment growth. The rising adoption of various aesthetic treatments by females is boosting segment growth. Women use spa services to boost physical happiness and self-esteem as well as gain self-confidence. Many women want to enhance their facial appearance, which has resulted in an increased number of visits for Botox and dermal injections. According to the AmSpa 2022 Medical Spa State of the Industry Report, in the U.S., around 88.0% of medspa goers were females.

The male segment is expected to witness lucrative growth during the forecast period. The adoption of medical spa services among men has increased as they have realized that these treatments are healthy and relaxing. As a result, the industry is developing skin care products and services focused on men. An increasing number of male customers and the development of targeted market strategies for males are likely to boost segment growth.

The single ownership segment registered its dominance over the global medical spa market in 2024. According to the American Med Spa Association report 2024, estimates, in 2023, single-location medical spas generated $92167 in monthly revenue. The industry is dominated by single-owned, small-sized, and single-location medical spa facilities equipped with the latest technology. In addition, rising burnout rates and decreasing reimbursement rates are driving more physicians to either become medical spa directors or the sole owners or co-owners of the facility. According to the American Med Spa Association (AmSpa) report 2024, 81% of medical spas are single-location.

Medical practice-associated spas are offering an integrated, holistic healthcare and wellness approach coupled with the involvement of highly-skilled and experienced practitioners. These facilities align their wellness therapies and treatments with other specialties of the hospital, offering integrated care. Hence, such facilities are witnessing high demand in recent years.

The facial treatment segment dominated the market with a higher revenue share in 2024. The dominant share of the segment is mainly attributed to the increasing demand for anti-aging treatment options such as Botox and dermal fillers. According to the ISAPS report 2023, botulinum toxins are among the top non-surgical aesthetic procedures for both men and women and across all age groups, with 8.8 million procedures performed by plastic surgeons worldwide. In second place, hyaluronic acid procedures increased by 29% to 5.5 million.

The body shaping and contouring segment is anticipated to witness the fastest growth during the forecast period, owing to the rising demand for noninvasive fat reduction procedures. Advancements in energy-based minimally invasive devices perfectly fit within the medspa model and are anticipated to open new opportunities for aesthetic enhancement.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Medical Spa Market

By Service

By Age Group

By Gender

By Service Provider

By Regional