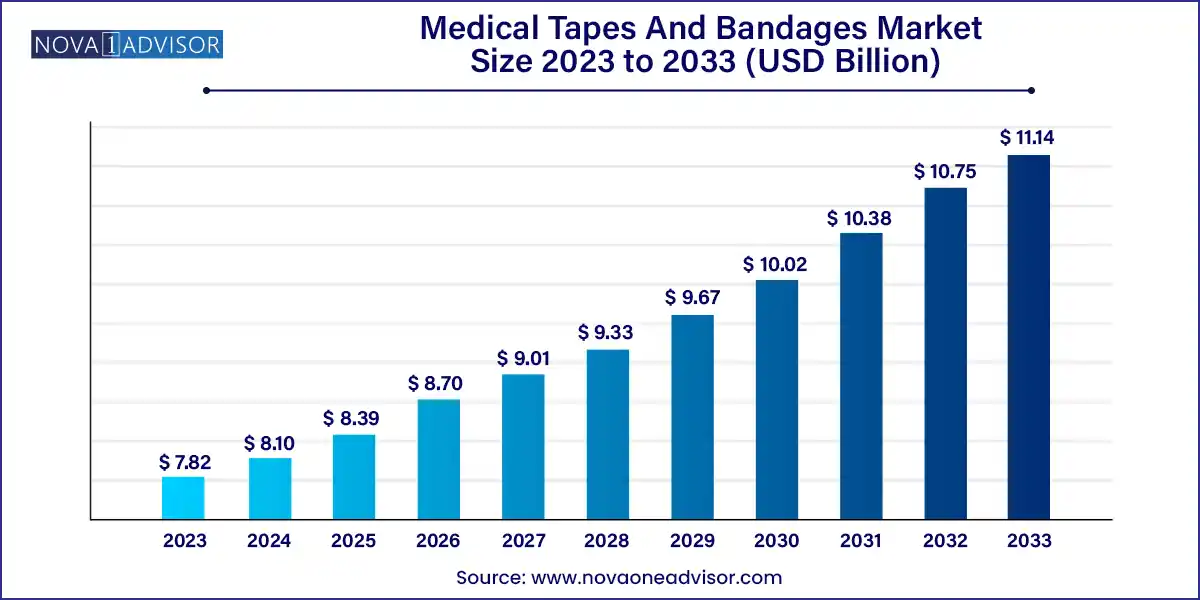

The global medical tapes and bandages market size was exhibited at USD 7.82 billion in 2023 and is projected to hit around USD 11.14 billion by 2033, growing at a CAGR of 3.6% during the forecast period of 2024 to 2033.

The medical tapes and bandages market is an essential segment of the global healthcare industry, acting as a foundational element in wound care management. Medical tapes and bandages are utilized extensively across clinical, surgical, and home-care settings for a variety of applications including dressing wounds, securing IV lines, and managing orthopedic injuries. These products are indispensable tools in treating everything from routine cuts to post-operative surgical sites and chronic ulcers.

With an aging population, the prevalence of diabetes, rising surgical interventions, and increased awareness of wound care, the market has experienced significant growth. Medical tapes, available in various materials such as paper, fabric, and plastic, offer versatility in handling sensitive skin and prolonged usage. Bandages ranging from elastic to orthopedic variants serve multiple applications in trauma care, burns, and sports medicine.

The COVID-19 pandemic accelerated the demand for medical supplies, including tapes and bandages, particularly due to the need for secure dressings during hospital stays, the management of pressure ulcers due to long ICU stays, and increased emphasis on infection control. Furthermore, innovation in adhesive technologies and breathable fabrics has led to a new wave of advanced medical tapes and bandages catering to both high-performance clinical use and at-home care.

Development of Skin-friendly and Hypoallergenic Products: New tapes with non-irritant adhesives are in demand for pediatric, geriatric, and long-term care patients.

Shift Toward Advanced Wound Care Bandages: Integration of antimicrobial agents, hydrogel layers, and moisture-control features into traditional bandage formats.

Increased Use in Sports and Fitness Industries: Rising athletic injuries and preventive wrapping have expanded the market outside hospital settings.

Growing Popularity of Transparent and Breathable Tapes: Enhanced patient comfort and improved visibility during wound monitoring drive this trend.

Rise in Home Healthcare Demand: Patients managing chronic wounds or post-operative recovery at home are increasingly relying on over-the-counter tapes and bandages.

Eco-friendly and Biodegradable Materials: Manufacturers are exploring sustainable tape and bandage products to reduce medical waste.

Digital Integration in Bandages: Smart bandages with embedded sensors are being trialed for real-time wound monitoring in research settings.

Contract Manufacturing and Private Label Growth: Retail chains are increasingly launching private-label wound care products, boosting demand for outsourced production.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.10 Billion |

| Market Size by 2033 | USD 11.14 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Smith & Nephew PLC; Mölnlycke Health Care AB; 3M; Ethicon Inc. (JOHNSON & JOHNSON); McKesson Corporation; B. Braun SE; Paul Hartmann AG; Coloplast; Integra Lifesciences; Medline Industries. |

A primary driver for the medical tapes and bandages market is the surging number of surgical procedures worldwide. As surgical volumes rise due to aging populations, expanding access to healthcare, and increasing incidence of chronic diseases the demand for high-quality wound closure and management products grows correspondingly.

For example, in the U.S. alone, more than 15 million surgeries are performed annually. Each of these procedures necessitates multiple rounds of dressing, requiring both tapes and bandages at various stages of care. From securing catheters to supporting sutures, medical tapes play a critical role in surgical wound management, while bandages are essential in post-operative protection and healing.

Despite technological advancements, a significant restraint in the market is the risk of skin irritation and allergic reactions associated with certain adhesives or synthetic materials. Many patients particularly the elderly, neonates, or those with chronic illnesses have sensitive skin prone to breakdown or dermatitis upon repeated application.

Additionally, improper use or poor-quality tapes can lead to skin stripping, rashes, and even infections, undermining the healing process. These risks can result in litigation and product recalls, making regulatory compliance and quality assurance critical. The need to strike a balance between adhesion strength and skin tolerance remains a challenge for manufacturers.

As global healthcare systems emphasize outpatient and home care, a significant opportunity arises in the expansion of retail wound care products, especially for chronic conditions and elderly care. The increase in patient-managed care for minor surgeries, diabetic ulcers, or pressure sores drives the demand for easy-to-use, durable, and affordable wound dressings.

Retail pharmacies and e-commerce platforms have become key distribution channels for branded and generic medical tapes and bandages. Companies are developing consumer-friendly packaging, clear usage instructions, and even bundled dressing kits tailored to home use. This trend is especially prominent in developed markets with aging populations and strong home-care infrastructure.

Medical bandages dominate the product landscape, primarily because of their versatility and wider application in both clinical and non-clinical settings. Muslin and elastic bandage rolls are staples in emergency care, sports injury management, and orthopedic support. Orthopedic bandages, in particular, hold significant value in post-fracture rehabilitation and surgeries. Elastic plaster bandages, which offer both support and compression, are vital in vascular care and trauma treatment. Their low cost, reusability in some forms, and availability in multiple sizes contribute to their dominant market share.

Medical tapes are the fastest-growing segment, driven by rising demand for wound dressing adhesion in both hospital and outpatient settings. Among these, fabric tapes especially those made from cotton and silk are preferred for their breathability and durability. Paper tapes, known for being gentle on the skin, are used in neonatal and geriatric care. Additionally, advancements in transparent plastic tapes, made from propylene, allow for easy wound monitoring. This segment’s growth is also bolstered by innovation in adhesive materials and waterproof variants catering to active and long-term care patients.

Surgical wounds account for the majority of application usage, with tapes and bandages being essential components before, during, and after operations. They are used to secure surgical dressings, prevent bleeding, protect incisions from infection, and provide pressure to control swelling. Due to increasing volumes of minor and major surgeries worldwide, hospitals stock extensive varieties of tapes and bandages suited for different procedures and healing phases.

Sports injuries are the fastest-growing application, reflecting the global popularity of physical fitness and organized sports. Elastic and compression bandages are extensively used for sprains, strains, and joint support. Athletic tapes, often with enhanced stretch and grip, are applied for injury prevention and performance enhancement. The expansion of sports medicine facilities and growing participation in amateur sports across demographics has led to increased consumption of these products in non-hospital settings.

Hospitals remain the largest end-use segment, utilizing medical tapes and bandages across various departments including emergency rooms, surgical suites, ICUs, and outpatient clinics. Infection control protocols and patient turnover require frequent dressing changes, making these products indispensable. Additionally, hospitals purchase in bulk and require sterile, high-quality products from trusted medical suppliers, contributing to consistent demand.

Retail and homecare sectors are the fastest-growing, as more consumers purchase wound care products for minor cuts, abrasions, and post-surgical recovery at home. Pharmacies, supermarkets, and online platforms now offer a range of bandages and tapes tailored for self-application. Products marketed for convenience, comfort, and value are especially popular among caregivers for elderly or chronically ill patients. The COVID-19 pandemic also highlighted the importance of self-reliance in medical care, accelerating the growth of this segment.

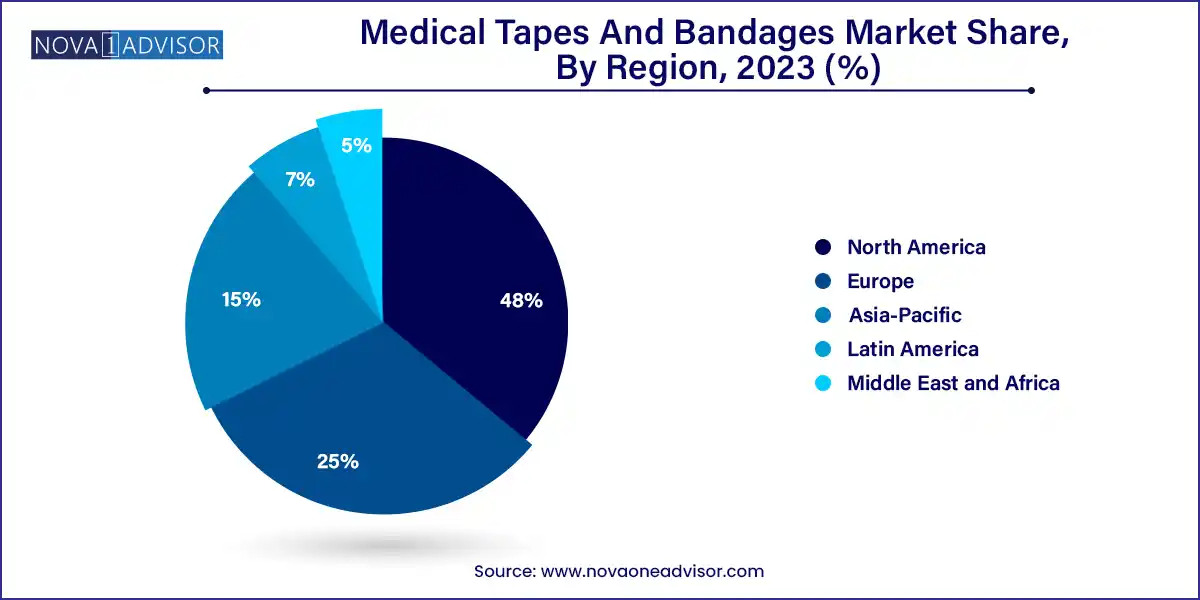

North America dominates the medical tapes and bandages market, owing to its advanced healthcare system, high surgical volumes, and strong distribution networks. The U.S. accounts for a significant share, backed by an aging population, rising prevalence of chronic diseases like diabetes, and a well-established wound care industry. Major players like 3M and Johnson & Johnson operate extensive product portfolios and invest in continual innovation tailored to local clinical needs.

Hospitals and surgical centers across North America follow strict protocols for wound management, which translates into recurring demand for sterile and high-performance bandages and tapes. Furthermore, insurance reimbursements for wound care support product accessibility, while private-label brands flourish in retail chains such as CVS and Walgreens.

Asia-Pacific is witnessing the fastest growth, spurred by healthcare infrastructure improvements, increasing patient populations, and rising awareness of infection control. Countries like India, China, and Japan are experiencing rising hospital admissions, government healthcare investments, and higher surgical rates. The expanding middle class and growing geriatric population further increase the demand for affordable wound care solutions.

In addition to public hospital systems, a growing number of private clinics, sports academies, and rehabilitation centers are creating demand for diverse tape and bandage products. Additionally, the proliferation of online retail platforms in the region enables consumers to purchase quality medical supplies directly, boosting market penetration.

March 2025: Smith & Nephew introduced a new hypoallergenic silicone-based surgical tape aimed at reducing skin trauma in elderly patients.

February 2025: 3M launched a line of eco-conscious fabric tapes manufactured from renewable cotton and biodegradable adhesives.

January 2025: Johnson & Johnson expanded its Band-Aid product line in Asia with specialized bandages for humid climates featuring sweat-resistant properties.

December 2024: Mölnlycke Health Care opened a new wound care manufacturing facility in Malaysia to serve the Asia-Pacific market with locally produced tapes and bandages.

November 2024: Cardinal Health partnered with a leading athletic brand to co-develop high-performance kinesiology tapes for sports medicine applications.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical tapes and bandages market.

Product

Application

End-use

By Region