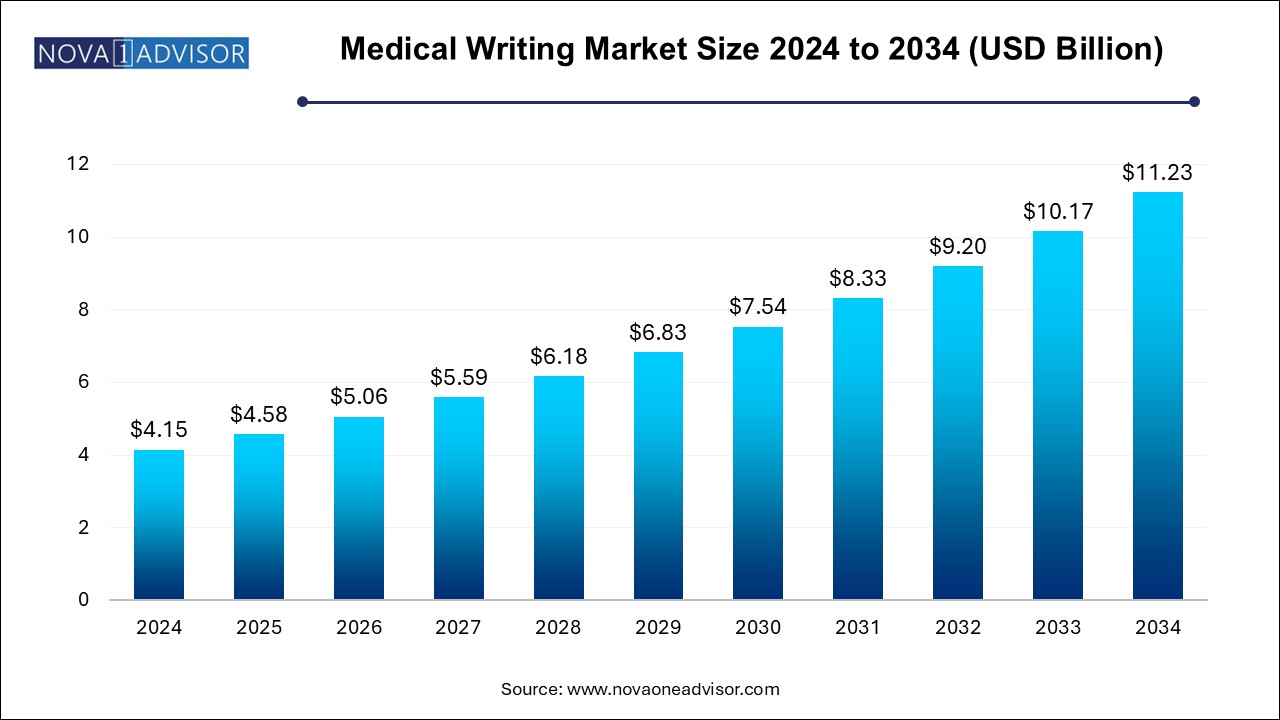

The medical writing market size was exhibited at USD 4.15 billion in 2024 and is projected to hit around USD 11.23 billion by 2034, growing at a CAGR of 10.47% during the forecast period 2024 to 2034.

Report Scope of Medical Writing Market

| Report Coverage | Details |

| Market Size in 2025 | USD 4.58 Billion |

| Market Size by 2034 | USD 11.23 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 10.47% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Parexel International Corporation; Trilogy Writing & Consulting GmBH; Freyr; Cactus Communications; Labcorp Drug Development; IQVIA Holdings Inc.; Omics International; Synchrogenix; Siro Clinpharm Private Limited; Quanticate; Inclin, Inc. |

The high demand for medical writers can be attributed to a rise in CRO outsourcing, increased R&D investments by market players, a favorable environment for clinical study in developing countries, and new medical device regulations. According to a study conducted in 2018, around 80% of internet users in the U.S. searched online for health-related information. In addition, nearly 60% of social media users rely on health information posted on social media platforms. Doctors can expand their reach for better patient care by engaging with patients on these platforms. Hence, the demand for online medical writing is increasing. However, the information posted on such forums should be by medical writing guidelines.

In recent years, pharmaceutical companies have adapted their advertising strategies to improve patient outreach. In addition, the growing influence of social media on customers’ decisions has compelled pharmaceutical and biotechnology companies to reconsider their marketing strategies. Hence, the robust growth of health and wellness-related blogs is expected to boost the demand for scientific writing.

Regulatory authorities want a thorough methodology for all phases of product development, which complicates the approval process boosting the market growth in the coming years. Additionally, insurance companies want drug information in order to establish reimbursement policies. As a result, pharmaceutical companies are finding it difficult to adhere to industry standards.

The pharmaceutical industry spends thrice the amount spent on R&D in other high-tech industries such as computer & software services. As per the Congressional Budget Office (CBO) report, R&D spending on pharmaceuticals reached USD 83 billion in the U.S. in 2019. Around 30 top pharmaceutical companies have collaborations with at least one CRO to maintain their product portfolios.

R&D activities provide market players with a competitive edge in the market. There were a total of 62,092 recruiting studies as of March 24, 2021, according to data given by ClinicalTrails.gov. Top pharmaceutical, medical devices, and biotechnology companies spend a significant share of their revenues on R&D activities to maintain their position in the market by introducing innovative products.

There is a new trend in the market of multiple strategic relationships, wherein each CRO provides a single function and multiple service providers are maintained. Clinical trials are increasing in number as a result of increased R&D investments. However, the number of clinical writers is not increasing at the same rate, resulting in the shortage of skilled writers in the field of medicine, which is expected to increase the scope for new writers in the field of medicine.

Based on type, the clinical writing segment dominated the global medical writing market with a share of 38.1% in 2024. The segment is estimated to dominate the market throughout the forecast period. Clinical writing is used by health professionals on a regular basis and a clinical writer must have a thorough knowledge of the clinical language as well as culture. An understanding of the target reader and the purpose is required for effective clinical writing.

It is used in protocols, consent documents, and clinical study reports for all the phases of clinical trials in product development. It mainly focuses on professionals with a sound comprehension of drug/product development processes and analysis of scientific data.

Regulatory writing is expected to be the fastest-growing segment with a CAGR of 11.30% during the forecast period. It is used throughout the process of product development for clinical documentation. It is required for describing and reporting data from clinical trials for the purpose of regulatory submissions and approvals. When the product or drug receives approval, post-approval regulatory documentation is required. Thus, stringent regulations are resulting in increasing documentation which is boosting the segment growth.

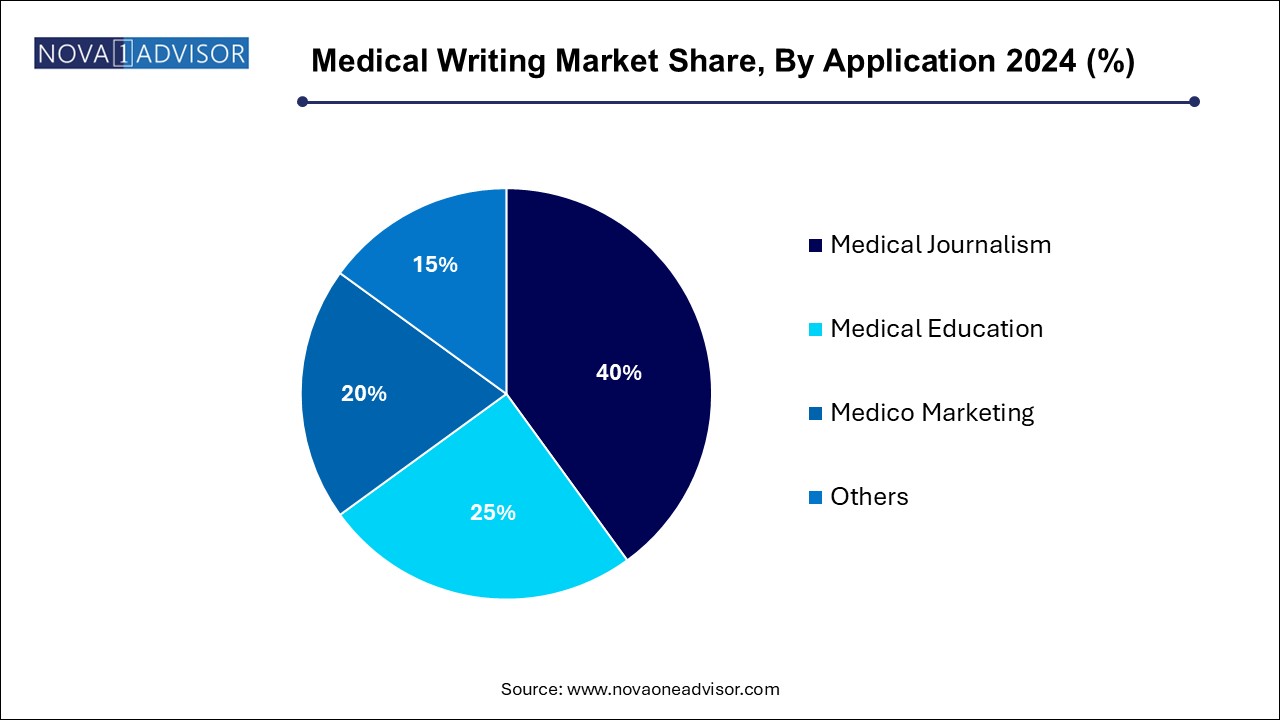

The medical journalism segment accounted for the maximum share of the market with 40.0% in 2024. The segment is mainly concerned with investigating, reporting, and communicating health issues to a wide audience. This type of journalism targets nonprofessional/non-expert audiences, along with healthcare professionals. Based on application, the global medical writing market is segmented into medical journalism, medical education, medico marketing, and others.

Health-related issues are of common interest to most people, as they have an impact on the behavior of people. Rapid advancements in the field of medicine and the growing importance of health information have increased the need for writers who are capable of comprehending and communicating health-related information through their writing.

On the other hand, the medico marketing segment is expected to witness the highest CAGR during the forecast period. Medico-marketing involves designing marketing content for drugs and other products. The ever-changing product mix in the pharmaceutical & biotechnology industry acts as a driving factor for improved marketing practices.

Based on end-use, the CROs & other segments dominated the market in 2024 due to rising R&D costs. The segment includes medical device/pharmaceutical & biotechnology companies, and CROs & others. Drug manufacturers are under pressure to replace revenue loss specifically due to the introduction of generics post-patent expiration.

CROs conduct clinical trials to introduce new products in the market in given timelines. They have the required expertise and infrastructure that give the benefit of cost, time, and efficiency at the same time. CROs have a separate service section for medical writing. Emerging economies such as Japan, India, and China are preferred countries for outsourcing these activities. Many of these countries have given better offers to the experts in Western countries.

On the other hand, medical device, pharmaceutical & biotechnology companies hire writers or journalists frequently. Established pharmaceutical companies have a separate team of medical writers. In addition, various companies outsource writers.

North America dominated the market with a share of 35.4% in 2024. Clinical writing in the U.S. for FDA approval requires an in-depth understanding of the requirements laid down by the regulatory authority. The documents for FDA submission must be succinct and accurate.

North America's growth is attributed to the existence of numerous pharmaceutical companies and considerable drug development operations in the US. However, numerous US pharmaceutical corporations use low-cost offshore countries for contract research organization (CRO) activities resulting in discrepancies between consumption and production.

On the other hand, Asia Pacific is likely to witness a lucrative growth rate over the forecast period from 2023 to 2034. The need for quality writing is increasing in the Asia Pacific as it is being recognized as an emerging profession. China and India are likely to dominate the regional market owing to inexpensive labor, quick turnaround times, an abundance of English writers, and easy availability of resources.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the medical writing market

Type

Application

End-use

Regional