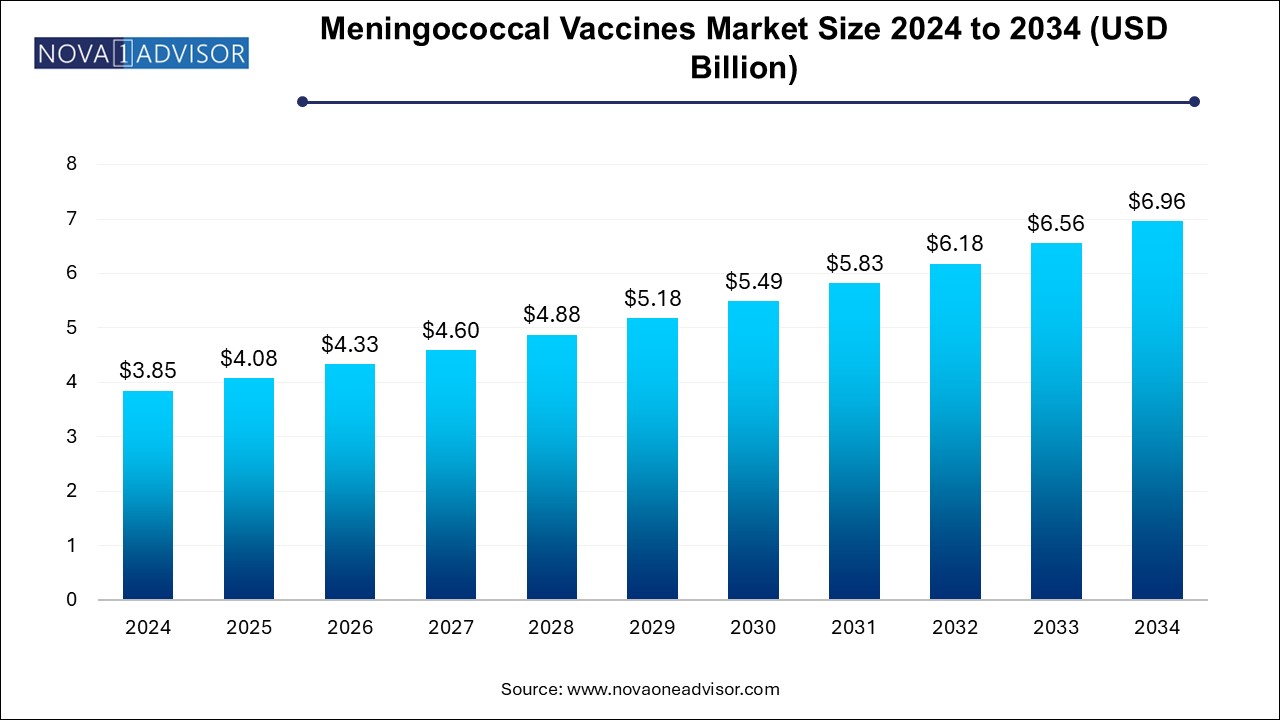

The meningococcal vaccines market size was exhibited at USD 3.85 billion in 2024 and is projected to hit around USD 6.96 billion by 2034, growing at a CAGR of 6.1% during the forecast period 2024 to 2034.

The meningococcal vaccines market plays a vital role in global public health by offering protection against invasive meningococcal disease (IMD), a potentially fatal bacterial infection caused by Neisseria meningitidis. The disease can lead to meningitis and septicemia, and if left untreated, has a high fatality rate within hours of symptom onset. Globally, several serogroups of N. meningitidis primarily A, B, C, W-135, and Y are responsible for disease outbreaks, necessitating multivalent vaccine formulations.

Meningococcal vaccines are typically administered during infancy, adolescence, or when traveling to endemic regions. Immunization programs, travel vaccination mandates, and outbreak containment initiatives have created sustained demand across both developed and developing nations. Countries such as the United States, United Kingdom, and members of the African Meningitis Belt have incorporated meningococcal vaccines into their national immunization schedules, demonstrating the vaccine’s role as a public health priority.

The market is composed of several vaccine types bivalent, quadrivalent, and monovalent formulations as well as recombinant vaccines targeted specifically at serogroup B. Products like Menactra, Menveo, Bexsero, Trumenba, and Nimenrix are well-known commercial brands. Advances in vaccine development, such as conjugate and protein-based technologies, have improved immunogenicity and duration of protection.

Despite declining incidence in some regions due to effective vaccination campaigns, meningococcal disease continues to cause periodic epidemics, especially in low-resource settings. Growing awareness, international collaborations (such as GAVI support in Africa), and technological innovation in vaccine platforms are contributing to market growth. As governments push toward universal immunization coverage, the meningococcal vaccines market is expected to expand steadily over the next decade.

Shift Toward Quadrivalent Conjugate Vaccines: These provide broader coverage and are preferred by national immunization programs due to protection against serogroups A, C, W-135, and Y.

Increased Demand for Serogroup B Vaccines: Recombinant vaccines like Bexsero and Trumenba have gained prominence in high-income countries due to the rising burden of MenB-related cases.

Integration Into Routine Immunization Schedules: Many countries have made meningococcal vaccination a mandatory part of childhood or adolescent immunization programs.

Growth in Travel and Military Vaccinations: Travelers and military personnel are increasingly vaccinated due to high-risk exposure in endemic areas or crowded living conditions.

Public-Private Partnerships in Low-Income Countries: GAVI and WHO collaborations are enabling access to affordable vaccines in Africa and Asia, especially in the meningitis belt.

Improved Storage and Stability Profiles: Innovations in vaccine thermostability are allowing wider distribution in remote and resource-constrained areas.

Focus on Infant and Neonatal Immunization: New vaccine formulations and schedules are targeting younger age groups for early protection.

R&D in Multivalent Protein-Based Vaccines: Next-gen candidates are being developed to provide universal or cross-serogroup protection using modular protein antigens.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.08 Billion |

| Market Size by 2034 | USD 6.96 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.1% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Brand, Serotype, Age group, Sales Channels, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Pfizer Inc.; Sanofi; Serum Institute of India Ltd.; GSK plc; Merck & Co., Inc.; Walvax Biotechnology Co., Ltd. |

A key driver for the meningococcal vaccines market is the strong support from government health authorities and global vaccination alliances. Meningococcal disease, although relatively rare in some countries, is considered a public health emergency due to its rapid progression, high fatality rate, and potential for outbreaks.

Governments have responded by integrating meningococcal vaccines into national immunization programs (NIPs). For instance, the CDC recommends routine vaccination of adolescents in the U.S., and similar guidelines are followed in the UK, Australia, and several EU countries. Travel-related mandates such as Saudi Arabia’s requirement for pilgrims during Hajj to receive a quadrivalent meningococcal vaccine also add to recurring demand.

The World Health Organization (WHO) and GAVI have made meningococcal vaccine distribution a priority in the African meningitis belt, where cyclical epidemics are common. The success of MenAfriVac a low-cost vaccine targeting serogroup A in countries like Burkina Faso and Chad illustrates how global partnerships can drive vaccine access and market growth. As new serogroups emerge and surveillance improves, these public health policies continue to fuel market expansion globally.

While global demand for meningococcal vaccines is rising, a significant restraint lies in affordability and distribution challenges, especially in low- and middle-income countries (LMICs). Meningococcal vaccines, particularly conjugate and recombinant types, are among the costlier vaccines in the immunization landscape. This limits widespread availability in regions with constrained healthcare budgets.

The costs associated with cold chain logistics, multi-dose immunization regimens, and limited healthcare infrastructure further hamper penetration in rural or underserved areas. Although global initiatives like GAVI provide subsidies, these programs are not universally implemented, and coverage gaps remain.

Moreover, adult and adolescent vaccination often receives less policy focus compared to infant immunization, limiting uptake in certain age groups. Vaccine hesitancy, misinformation, and lack of awareness about meningococcal disease severity also pose non-financial barriers in some markets.

A major opportunity in the meningococcal vaccines market is the development of multivalent and recombinant vaccine platforms that can offer broader, longer-lasting, and more flexible protection. Existing quadrivalent and bivalent vaccines focus on key serogroups, but emerging vaccine technologies are targeting cross-serogroup immunity and broader age coverage.

For example, vaccines like Bexsero (GSK) and Trumenba (Pfizer) represent significant milestones in the fight against serogroup B, which had previously proven difficult to address through conventional polysaccharide conjugate technologies. These protein-based vaccines have opened up new avenues for universal meningococcal vaccines that may eliminate the need for multiple formulations.

Additionally, next-gen candidates are being developed using nanoparticle platforms, reverse vaccinology, and mRNA-based technologies, which offer the potential for single-dose, highly immunogenic vaccines with fewer storage constraints. The R&D momentum in this space, supported by both public health needs and commercial incentives, positions the market for long-term innovation-driven growth.

Quadrivalent vaccines dominate the meningococcal vaccine type segment, as they offer broad protection against serogroups A, C, W-135, and Y. These vaccines are widely used in national immunization programs due to their effectiveness in adolescents, travelers, and outbreak responses. MenACWY vaccines are often administered in a single or two-dose schedule and are available through both public and private distribution channels.

Bivalent vaccines are growing quickly, especially in response to regional disease patterns. Some countries opt for bivalent vaccines targeting serogroups C and Y or A and C, particularly when local epidemiology doesn’t necessitate broader coverage. However, quadrivalent vaccines are gradually replacing bivalent options due to improved protection breadth and rising affordability through public procurement programs.

Menactra has traditionally dominated the market, particularly in North America and parts of Europe. Manufactured by Sanofi, it’s a quadrivalent conjugate vaccine approved for use in children and adolescents. Its long-standing availability and robust safety profile have made it a top choice among pediatricians and school-based vaccination programs.

Bexsero is among the fastest-growing brands, especially in Europe and North America. Developed by GlaxoSmithKline, Bexsero targets serogroup B and is the first recombinant protein-based MenB vaccine to be widely adopted. It is increasingly used in response to local MenB outbreaks and has been incorporated into routine infant immunization schedules in the UK and Italy, boosting demand.

Serotype B commands strong market growth, due to its unique epidemiological behavior and the difficulty of targeting it through traditional polysaccharide vaccines. The success of Trumenba and Bexsero highlights rising awareness and demand for serogroup B vaccines, particularly in countries with advanced surveillance systems.

Serotype A has seen significant demand in Africa, largely through MenAfriVac campaigns. However, with serogroup A nearly eliminated in many regions, the focus is shifting to C, W-135, and Y, all of which are covered by quadrivalent formulations, thereby consolidating demand in the ACWY segment.

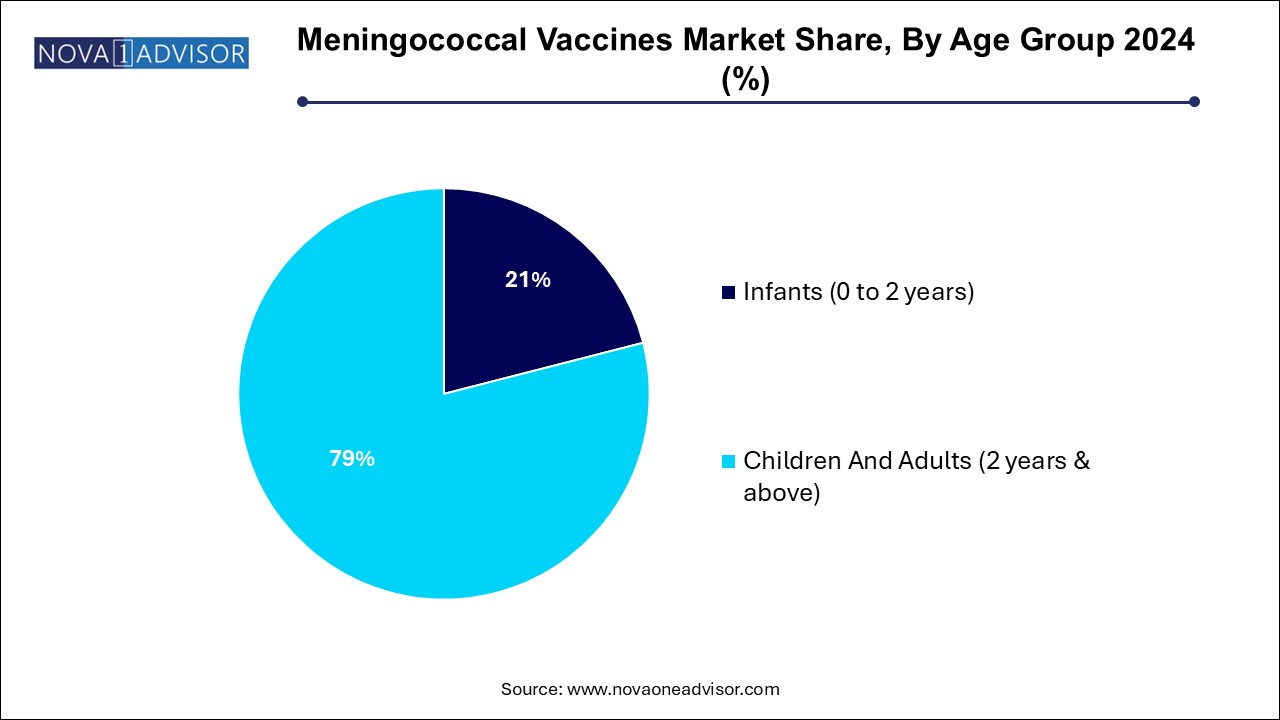

Children and adults (2 years & above) represent the largest market share, driven by routine adolescent vaccination, catch-up immunizations, and travel requirements. This age group is commonly targeted with quadrivalent vaccines, and the higher frequency of school and travel-related vaccinations ensures steady demand.

Infants (0 to 2 years) are the fastest-growing group, particularly with the introduction of MenB vaccines suitable for early life immunization. Countries like the UK and Ireland have added Bexsero to infant immunization schedules, and other countries are evaluating similar decisions. Rising incidence of infant meningitis and high mortality in this age group are compelling factors driving this trend.

Based on sales channel, the public sales channel segment held the largest market share of 69.4% in 2024 and is anticipated to maintain its dominance throughout the forecast period. A large share of the segment can be attributed to the inclusion of major meningococcal vaccine brands, such as Trumenba, Bexsero, Menactra, Nimenrix, Menveo, and others in immunization programs in a major market for vaccination against meningococcal infections. For instance, in July 2020, the government of New South Wales changed the immunization schedule, and the government is funding Bexsero for Aboriginal children & some at-risk people and Nimenrix for people at high risk of infection.

The private sales channel is mainly driven by increasing demand for meningococcal vaccines in developing countries. Moreover, increasing disposable income, increasing outbound traveling from work, study, pilgrims for Mecca and Umrah, and increasing awareness is driving the demand for vaccination against meningococcal vaccines through private sales channels.

North America holds the largest share in the meningococcal vaccines market, driven by high awareness, advanced healthcare infrastructure, and strong immunization mandates. The U.S. CDC recommends routine MenACWY vaccination at 11–12 years and a booster at 16, ensuring recurring demand. Both MenACWY and MenB vaccines are widely available, with strong insurance coverage and healthcare provider networks ensuring high compliance.

The presence of leading manufacturers such as Pfizer and Sanofi, along with frequent adoption of new vaccine technologies, further supports market growth. School-entry requirements, college campus vaccination policies, and military mandates reinforce vaccine uptake. With increasing travel and rising MenB awareness, demand in the U.S. is expected to grow steadily.

Asia-Pacific is the fastest-growing region, led by increasing vaccine access, government immunization efforts, and international health collaborations. Countries such as India, China, and Indonesia are seeing heightened awareness about meningitis, especially in densely populated or rural areas. Though incidence varies by country, improved diagnostics and surveillance are helping detect cases more effectively.

In addition, regional epidemic preparedness initiatives and partnerships with GAVI and WHO have facilitated broader distribution of affordable vaccines. Japan, Australia, and South Korea are expanding their use of MenACWY and MenB vaccines in response to local outbreaks and travel requirements. As healthcare systems modernize and disposable incomes rise, demand for both public and private meningococcal vaccination is poised for rapid growth.

March 2025: GlaxoSmithKline announced the initiation of Phase III trials for a next-generation MenABCWY pentavalent vaccine designed to cover all five major serogroups with one dose.

January 2025: Pfizer reported expanded availability of Trumenba in Canada for adolescent and young adult MenB protection, supported by a national awareness campaign.

November 2024: The WHO prequalified a new quadrivalent MenACWY vaccine from a Chinese manufacturer, marking the first time a low-cost, regionally produced option will be accessible in sub-Saharan Africa.

September 2024: Sanofi launched a thermostable version of Menactra in Latin America, designed for easier storage in remote and tropical regions.

June 2024: GAVI expanded its meningitis response portfolio, committing $150 million to introduce MenACWY vaccines in 10 additional African nations through 2027.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the meningococcal vaccines market

Type

Brand

Age Group

Serotype

Sales Channel

Regional