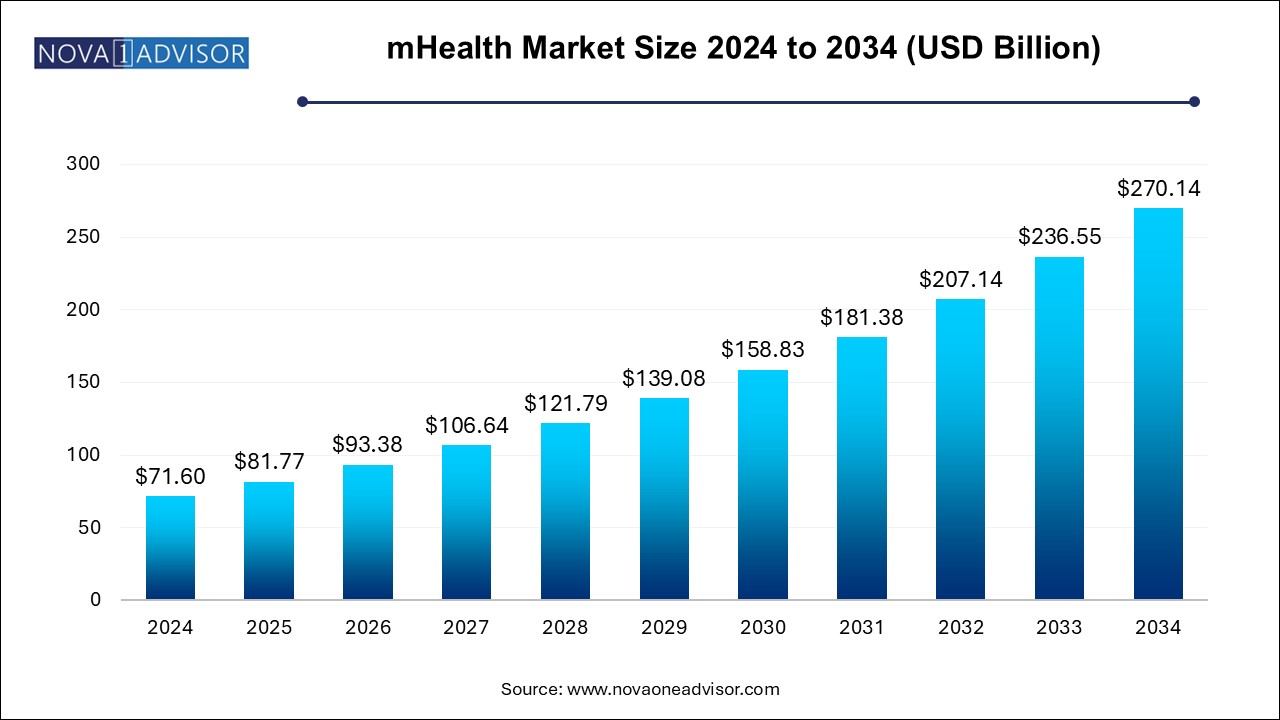

The mHealth market size was exhibited at USD 71.6 billion in 2024 and is projected to hit around USD 270.14 billion by 2034, growing at a CAGR of 14.2% during the forecast period 2025 to 2034.

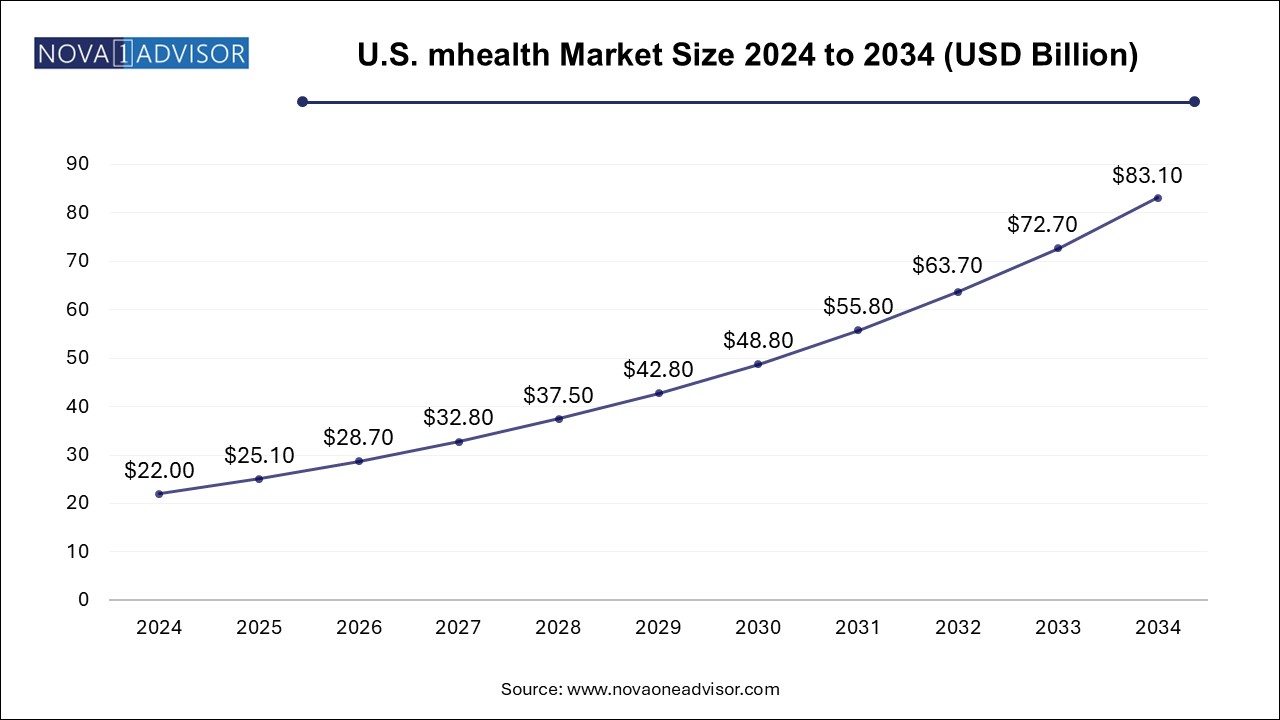

The U.S. mHealth market size is evaluated at USD 22.0 billion in 2024 and is projected to be worth around USD 83.1 billion by 2034, growing at a CAGR of 12.84% from 2025 to 2034.

North America dominated the global mHealth market and accounted for the largest revenue share of nearly 40% in 2024. Factors such as rapid growth in the use of smartphones, advancements in coverage networks, prevalence of chronic diseases, and in geriatric population are expected to drive mHealth technology & solutions in North America. As per data by the United Health Foundation in 2022, the population of adults aged 65 years & above in the U.S. was nearly 58 million, equivalent to 17.3% of the total population. By 2040, this percentage is expected to rise to 22%.

U.S. mHealth Market Trends

The U.S. dominated North America’s mHealth market with a market share of above 85% owing to the presence of a large number of players operating in various areas, such as mobile & network operations, healthcare management, and software development. Market players are involved in introducing innovative healthcare apps, building network infrastructure, and increasing adoption of various mHealth services in the U.S. As per a Demandsage report, in 2024, around 82.2% of the U.S. population owned smartphones, which can be used to access mHealth apps; these devices accounted for 70% of digital media time in the country. The U.S. is a leading market for mHealth applications across the globe.

Europe mHealth Market Trends

The Europe mHealth market is expected to witness significant growth over the forecast period. An increasing number of mHealth apps and services are being launched in Europe, focusing mainly on monitoring patients with chronic diseases and aiding independent aging solutions. According to Eurostat, in January 2024, the estimated population of the EU was 448.8 million, with 21.3% of it aged 65 years and above. The aging population is expected to drive the demand for mHealth services in chronic care management, diagnostic solutions, and post-acute care management.

Germany mHealth market is one of the largest in Europe, with a significant expenditure on health. According to World Bank statistics, its total healthcare expenditure accounted for 12.8% of GDP in 2021. Furthermore, rising geriatric population and increasing incidence of chronic diseases are expected to drive the market growth in Germany. According to an AARP International report, Germany’s population aged 65 years and above is expected to reach 24 million by 2050, accounting for almost one-third of the total population.

Asia Pacific mHealth Market Trends

Asia Pacific mHealth market is expected to witness the fastest CAGR of 15.2% over the forecast period, owing to the increasing penetration of smartphones & smart wearables and increasing adoption of mHealth services. According to The Mobile Economy 2024 by GSMA, unique mobile subscriptions in Asia Pacific reached 1.73 billion by the end of 2022, estimated to reach 2.11 billion by 2024.

The mHealth market in China is expected to witness significant growth from 2025 to 2034, owing to the rising patient population and increasing internet penetration. According to the data from the China Internet Network Information Center (CNNIC), as of December 2022, China has 1.067 billion internet users, an increase of 35.49 million since December 2021. The internet penetration rate has also increased by 2.6 percentage points, reaching 75.6%.

mHealth Market By Middle East & Africa mHealth Market Trends

The mHealth market in the Middle East and Africa (MEA) is expected to witness significant growth in the coming years. The mHealth solutions are transforming healthcare in MEA, driven by the expanding internet connectivity and government initiatives. Telemedicine, mHealth apps, wearable devices, and Artificial Intelligence (AI) are the major trends revolutionizing healthcare accessibility, costs, and outcomes in MEA.

Saudi Arabia mHealth market is undergoing substantial growth. The adoption of mHealth technologies in Saudi Arabia is in its nascent stage. Increasing smartphone penetration and improving internet connectivity are some of the major drivers boosting the adoption. According to Ubuy estimates, approximately 92% of the Saudi population either has access to or owns a smartphone. The number of smartphone users was 33.55 million individuals in 2024.

| Report Coverage | Details |

| Market Size in 2025 | USD 81.77 Billion |

| Market Size by 2034 | USD 270.14 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 14.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Component, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Apple, Inc.; AT&T Intellectual Property; AirStrip Technologies, Inc.; Veradigm LLC (formerly, Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; Vodafone Group PLC; Google, LLC; Telefonica S.A.; SoftServe, Inc.; Samsung Electronics Co., Ltd.; Orange; SeekMed |

The mHealth apps segment accounted for the largest revenue share of over 50% in 2024. The segment is also projected to witness the fastest CAGR during the forecast period. The growing reach of the internet & smartphones, coupled with the increasing adoption of mobile health applications among medical practitioners & patients, contributes significantly to the substantial market valuation of this segment. Moreover, the expanding recognition of mobile health apps for purposes such as remote patient monitoring, medication management, disease tracking, fitness & wellbeing, women's health, and personal health record management, among others, is also driving growth.

The mHealth services segment is expected to witness the second-fastest CAGR from 2025 to 2034. mHealth services utilize the widespread use of mobile devices to improve healthcare accessibility, delivery, and management. These services include health monitoring apps, wearable devices that track vital signs, and telemedicine platforms enabling remote consultations with healthcare professionals. mHealth technology is crucial in preventive care, chronic disease management, and health education. It encourages proactive engagement in personal well-being, making healthcare more efficient and patient centric.

The patient segment held the largest share in 2024 and is expected to witness the fastest CAGR of 15.2% from 2025 to 2034, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Patients are increasingly drawn to mHealth due to their convenience and accessibility. With the rise in smartphone usage globally, patients can easily access healthcare services from the comfort of their homes, reducing the need for physical visits to healthcare facilities. For instance, there were 6.8 billion smartphone users worldwide as of 2024, and this number is projected to grow to 7.34 billion by 2025.

The providers segment held a significant market share in 2024 and is expected to maintain this share over the forecast period. This can be attributed to the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the mHealth market

By Component

By End-use

By Regional

Chapter 1 mHealth Market: Research Methodology & Scope

1.1 Market Segmentation and Scope

1.2 Market Definition

1.3 Research Methodology

1.3.1 Information Procurement

1.3.1.1 Purchased database

1.3.1.2 internal database

1.3.2 Primary Research

1.4 Research Scope and Assumptions

1.5 List of Data Sources

Chapter 2 mHealth Market: Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Insights

2.4 Global mHealth Snapshot

Chapter 3 mHealth Market: Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Related/Ancillary Market

3.2 Penetration and Growth Prospect Mapping

3.3 Market Dynamics

3.3.1 Market Driver Analysis

3.3.2 Market Restraint Analysis

3.3.3 Industry Challenges

3.4 Global mHealth Market Analysis Tools

3.4.1 Industry Analysis - Porter’s

3.4.1.1 Bargaining power of the suppliers

3.4.1.2 Bargaining power of the buyers

3.4.1.3 Threats of substitution

3.4.1.4 Threats from new entrants

3.4.1.5 Competitive rivalry

3.4.2 PESTEL Analysis

3.4.2.1 Political landscape

3.4.2.2 Economic and Social landscape

3.4.2.3 Technology landscape

3.4.2.4 Legal landscape

3.4.2.5 Technology landscape

3.4.3 Major Deals & Strategic Alliances Analysis

3.5 COVID-19 Impact on the market

Chapter 4. mHealth Market Segment Analysis, By Component, 2018 - 2030 (USD Million)

4.1. Definition and Scope

4.2. Component Segment Dashboard

4.3. Global mHealth Market, by Component, 2021 to 2034

4.4. Wearables & Connected Medical Devices

4.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2. Vital Sign Monitoring Devices

4.4.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.2. Heart Rate Monitors

4.4.2.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.3. Activity Monitors

4.4.2.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.4. Electrocardiographs

4.4.2.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.5. Pulse Oximeters

4.4.2.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.6. Spirometers

4.4.2.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.7. Blood Pressure Monitors

4.4.2.7.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.2.8. Others

4.4.2.8.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.3. Sleep Monitoring Devices

4.4.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.3.2. Sleep trackers.

4.4.3.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.3.3. Wrist Actigraphs

4.4.3.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.3.4. Polysomnographs

4.4.3.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.3.5. Others

4.4.3.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.4. Electrocardiographs Fetal and Obstetric Devices

4.4.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.5. Neuromonitoring Devices

4.4.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.5.2. Electroencephalographs

4.4.5.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.5.3. Electromyographs

4.4.5.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.4.5.4. Others

4.4.5.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5. mHealth Apps

4.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2. Medical Apps

4.5.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2. Women's Health

4.5.2.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2.2. Fitness and Nutrition

4.5.2.2.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2.3. Menstrual Health

4.5.2.2.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2.4. Pregnancy Tracking & Postpartum Care

4.5.2.2.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2.5. Menopause

4.5.2.2.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2.6. Disease Management

4.5.2.2.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.2.7. Others

4.5.2.2.7.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3. Chronic Disease Management Apps

4.5.2.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3.2. Diabetes Management Apps

4.5.2.3.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3.3. Blood Pressure and ECG Monitoring Apps

4.5.2.3.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3.4. Mental Health Management Apps

4.5.2.3.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3.5. Cancer Management Apps

4.5.2.3.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3.6. Obesity Management Apps

4.5.2.3.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.3.7. Other Chronic Disease Management Apps

4.5.2.3.7.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.4. Personal Health Record Apps

4.5.2.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.5. Medication Management Apps

4.5.2.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.6. Diagnostic Apps

4.5.2.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.7. Remote Monitoring Apps

4.5.2.7.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.2.8. Others (Medical Reference, Professional Networking, Healthcare Education)

4.5.2.8.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.5.3. Fitness Apps

4.5.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6. Services

4.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6.2. Monitoring Services

4.6.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6.2.2. Independent Aging Solutions

4.6.2.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6.2.3. Chronic Disease Management & Post-Acute Care Services

4.6.2.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6.3. Diagnosis Services

4.6.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6.4. Healthcare Systems Strengthening Services

4.6.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.6.5. Others

4.6.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.7. MHealth Systems

4.7.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.7.2. EHR

4.7.2.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.7.3. E-prescribing Systems

4.7.3.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

4.8. Healthcare Analytics

4.8.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 5. mHealth Market: Segment Analysis, by End-use, 2021- 2034 (USD Million)

5.1. Definition and Scope

5.2. End-use Segment Dashboard

5.3. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.4. Patients

5.4.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.5. Providers

5.5.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.6. Payers

5.6.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

5.7. Others

5.7.1. Market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 6. mHealth Market: Segment Analysis, by Region, by Component, by End-use, 2021- 2034 (USD Million)

6.1. Definition & Scope

6.2. Regional Market Share Analysis, 2023 & 2030

6.3. Regional Market Dashboard

6.4. Market Size, & Forecasts Trend Analysis, 2021 to 2034:

6.5. SWOT Analysis

6.6. North America

6.6.1. U.S.

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework

6.6.1.3. Competitive scenario

6.6.1.4. U.S. market estimates and forecasts, 2021 to 2034 (USD Million)

6.6.2. Canada

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework

6.6.2.3. Competitive scenario

6.6.2.4. Canada market estimates and forecasts, 2021 to 2034 (USD Million)

6.7. Europe

6.7.1. UK

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework

6.7.1.3. Competitive scenario

6.7.1.4. UK market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.2. Germany

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework

6.7.2.3. Competitive scenario

6.7.2.4. Germany market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.3. France

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework

6.7.3.3. Competitive scenario

6.7.3.4. France market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.4. Italy

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework

6.7.4.3. Competitive scenario

6.7.4.4. Italy market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.5. Spain

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework

6.7.5.3. Competitive scenario

6.7.5.4. Spain market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.6. Norway

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework

6.7.6.3. Competitive scenario

6.7.6.4. Norway market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.7. Sweden

6.7.7.1. Key country dynamics

6.7.7.2. Regulatory framework

6.7.7.3. Competitive scenario

6.7.7.4. Sweden market estimates and forecasts, 2021 to 2034 (USD Million)

6.7.8. Denmark

6.7.8.1. Key country dynamics

6.7.8.2. Regulatory framework

6.7.8.3. Competitive scenario

6.7.8.4. Denmark market estimates and forecasts, 2021 to 2034 (USD Million)

6.8. Asia Pacific

6.8.1. Japan

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework

6.8.1.3. Competitive scenario

6.8.1.4. Japan market estimates and forecasts, 2021 to 2034 (USD Million)

6.8.2. China

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework

6.8.2.3. Competitive scenario

6.8.2.4. China market estimates and forecasts, 2021 to 2034 (USD Million)

6.8.3. India

6.8.3.1. Key country dynamics

6.8.3.2. Regulatory framework

6.8.3.3. Competitive scenario

6.8.3.4. India market estimates and forecasts, 2021 to 2034 (USD Million)

6.8.4. Australia

6.8.4.1. Key country dynamics

6.8.4.2. Regulatory framework

6.8.4.3. Competitive scenario

6.8.4.4. Australia market estimates and forecasts, 2021 to 2034 (USD Million)

6.8.5. South Korea

6.8.5.1. Key country dynamics

6.8.5.2. Regulatory framework

6.8.5.3. Competitive scenario

6.8.5.4. South Korea market estimates and forecasts, 2021 to 2034 (USD Million)

6.8.6. Singapore

6.8.6.1. Key country dynamics

6.8.6.2. Regulatory framework

6.8.6.3. Competitive scenario

6.8.6.4. Singapore market estimates and forecasts, 2021 to 2034 (USD Million)

6.9. Latin America

6.9.1. Brazil

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework

6.9.1.3. Competitive scenario

6.9.1.4. Brazil market estimates and forecasts, 2021 to 2034 (USD Million)

6.9.2. Mexico

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework

6.9.2.3. Competitive scenario

6.9.2.4. Mexico market estimates and forecasts, 2021 to 2034 (USD Million)

6.9.3. Argentina

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework

6.9.3.3. Competitive scenario

6.9.3.4. Argentina market estimates and forecasts, 2021 to 2034 (USD Million)

6.10. MEA

6.10.1. South Africa

6.10.1.1. Key country dynamics

6.10.1.2. Regulatory framework

6.10.1.3. Competitive scenario

6.10.1.4. South Africa market estimates and forecasts, 2021 to 2034 (USD Million)

6.10.2. Saudi Arabia

6.10.2.1. Key country dynamics

6.10.2.2. Regulatory framework

6.10.2.3. Competitive scenario

6.10.2.4. Saudi Arabia market estimates and forecasts 2021 to 2034, (USD Million)

6.10.3. UAE

6.10.3.1. Key country dynamics

6.10.3.2. Regulatory framework

6.10.3.3. Competitive scenario

6.10.3.4. UAE market estimates and forecasts, 2021 to 2034 (USD Million)

6.10.4. Kuwait

6.10.4.1. Key country dynamics

6.10.4.2. Regulatory framework

6.10.4.3. Competitive scenario

6.10.4.4. Kuwait market estimates and forecasts, 2021 to 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. List of Key Companies

7.3.1. Google, Inc.

7.3.1.1. Company overview

7.3.1.2. Financial performance

7.3.1.3. Product benchmarking

7.3.1.4. Strategic initiatives

7.3.2. Allscripts (Veradigm LLC)

7.3.2.1. Company overview

7.3.2.2. Financial performance

7.3.2.3. Product benchmarking

7.3.2.4. Strategic initiatives

7.3.3. Apple, Inc.

7.3.3.1. Company overview

7.3.3.2. Financial performance

7.3.3.3. Product benchmarking

7.3.3.4. Strategic initiatives

7.3.4. AT&T Intellectual Property

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. Veradigm LLC (formerly, Allscripts Healthcare Solutions)

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Qualcomm Technologies, Inc.

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Telefonica S.A.

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. Vodafone Group

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. SoftServe, Inc

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. Samsung Electronics Co., Ltd.

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. SeekMed

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives

7.3.12. Orange

7.3.12.1. Company overview

7.3.12.2. Financial performance

7.3.12.3. Product benchmarking

7.3.12.4. Strategic initiatives