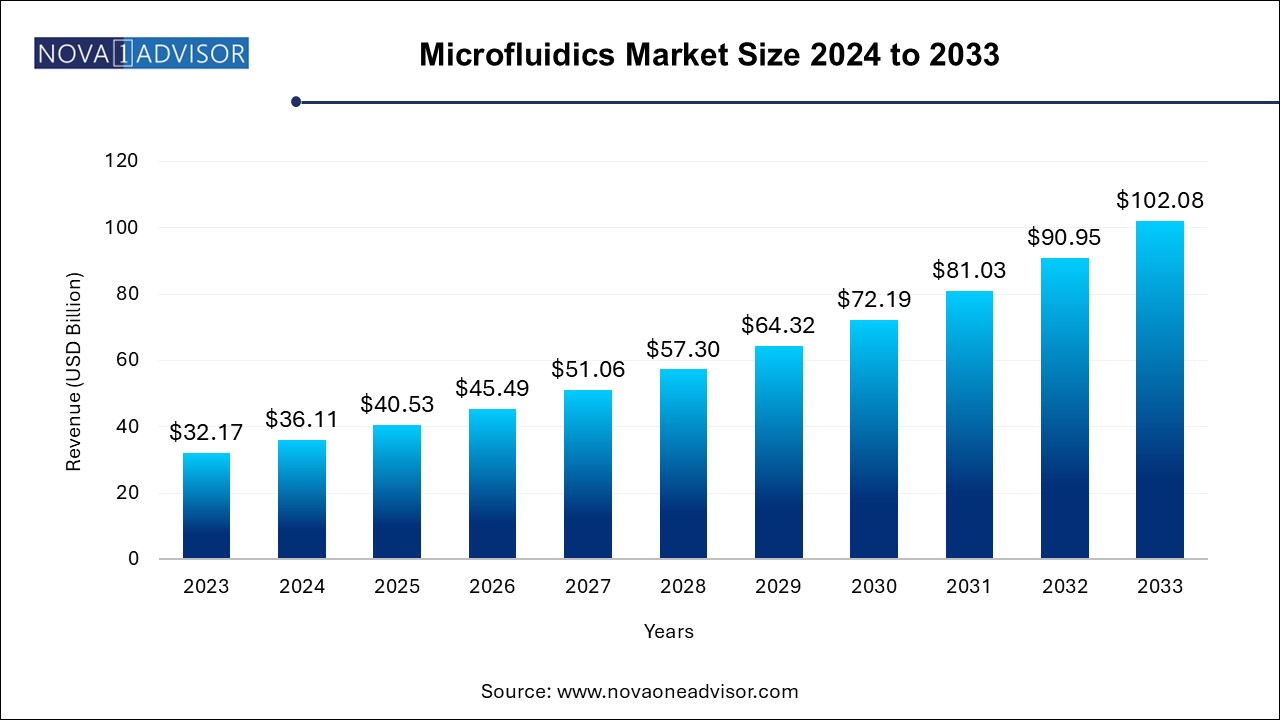

The global microfluidics market size was exhibited at USD 32.17 billion in 2023 and is projected to hit around USD 102.08 billion by 2033, growing at a CAGR of 12.24% during the forecast period of 2024 to 2033.

The microfluidics market is a cornerstone of innovation in both biomedical and non-biomedical sciences, offering transformative potential across diagnostics, drug delivery, environmental testing, and material synthesis. Microfluidics refers to the science and technology of systems that process or manipulate tiny (10⁻⁹ to 10⁻¹⁸ liters) amounts of fluids using microchannels. The precision, speed, and integration capabilities of these platforms have positioned them at the intersection of biology, chemistry, engineering, and information technology.

In healthcare, microfluidics is reshaping how diagnostic tests are conducted ushering in a new era of lab-on-a-chip devices that require less sample volume, offer faster results, and can be deployed at the point-of-care (PoC). The COVID-19 pandemic brought microfluidic PCR and RT-PCR platforms into the global spotlight, showcasing their ability to deliver rapid, portable, and accurate diagnostics at scale. Beyond medical diagnostics, applications in drug discovery, wearable biosensors, genomics, and cell culture-based testing (e.g., organs-on-chips) are driving sustained market momentum.

Outside the biomedical sphere, microfluidic systems are used in areas such as inkjet printing, cosmetics formulation, food safety, and environmental monitoring. As interdisciplinary research flourishes, commercial adoption is being supported by scalable manufacturing processes, biocompatible materials, and favorable regulatory pathways. With academic institutions, startups, and multinational corporations contributing to an ever-diversifying pipeline of microfluidic solutions, the market is poised for expansive and long-term growth.

Rise of Point-of-Care Diagnostics: Portable, low-cost microfluidic devices are enabling rapid testing in decentralized settings such as clinics, rural areas, and even homes.

Miniaturization and Integration in Lab-on-a-Chip Systems: High-throughput screening and multiplex diagnostics are increasingly embedded on microchips, accelerating research and clinical workflows.

Growth in Organs-on-Chips for Drug Development: Simulating organ-level physiology in vitro is gaining traction for reducing animal testing and improving preclinical predictability.

Adoption of Polymer and Flexible Substrates: Cost-effective and scalable materials such as PDMS and thermoplastics are becoming standard in device fabrication.

Advancements in Continuous Flow Microfluidics: These systems support stable, automated fluid processing for applications in chemical synthesis and diagnostics.

Hybrid Microfluidics and AI Integration: Smart devices with built-in data analytics, sensors, and connectivity are enhancing real-time decision-making.

Sustainability and Green Chemistry Applications: Eco-friendly solvents and sustainable materials are emerging to align microfluidics with green lab initiatives.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.17 Billion |

| Market Size by 2033 | USD 102.08 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.24% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Material, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Illumina, Inc.; F. Hoffmann-La Roche Ltd; PerkinElmer, Inc; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Abbott; Standard BioTools. |

The key driver of the microfluidics market is the growing global demand for rapid, accurate, and portable point-of-care (PoC) diagnostic solutions. Traditional centralized laboratory testing is often time-consuming, requires trained personnel, and is not always accessible in resource-limited settings. Microfluidics addresses these limitations by enabling the development of compact, user-friendly diagnostic platforms that integrate sample processing, reaction, and detection into a single device.

During the COVID-19 pandemic, microfluidic-based PoC tests enabled mass-scale testing with faster turnaround times. Even beyond infectious diseases, PoC testing for diabetes (glucose monitoring), cardiovascular diseases (troponin levels), and cancer biomarkers (e.g., PSA, CA-125) is increasing. The appeal lies in their minimal reagent use, faster results, and integration with smartphones or cloud-based analytics, which support remote healthcare delivery.

Despite significant advancements, a primary restraint in the microfluidics market is the complexity of manufacturing and regulatory compliance. Microfluidic devices often require multi-material integration, precision microfabrication, and rigorous quality control, particularly when used in medical or pharmaceutical applications. Achieving consistency across batches, especially for commercial-scale production, can be technically challenging and cost-intensive.

Moreover, as many microfluidic devices are combination products involving diagnostics, drug delivery, or software components, they must adhere to complex regulatory frameworks. Approvals from authorities such as the U.S. FDA or EMA can be time-consuming and may require extensive clinical validation, especially for PoC devices with direct patient impact. These challenges often act as a barrier for startups or research labs attempting to transition from prototype to product.

An emerging opportunity lies in the growth of organ-on-a-chip (OoC) technologies, which replicate the microarchitecture and physiological response of human organs using microfluidic platforms. These miniature systems mimic key aspects of lung, liver, kidney, and even brain function, offering researchers a viable alternative to animal testing and conventional 2D cell cultures.

Major pharmaceutical companies and regulators are now supporting OoC integration into preclinical studies to better predict drug toxicity, metabolism, and efficacy. For example, Emulate Inc. has developed human liver chips used by companies like Johnson & Johnson to evaluate drug safety. The expansion of 3D cell culture, stem cell technologies, and CRISPR-based gene editing is further enhancing the relevance of OoCs. As regulatory frameworks evolve to recognize these models, demand for customizable, scalable microfluidic systems that support tissue engineering is expected to grow exponentially.

Medical/Healthcare applications dominate the market, driven by the proliferation of microfluidic-based diagnostic platforms and therapeutic delivery systems. Within medical applications, PCR and RT-PCR-based systems gained unprecedented visibility during the COVID-19 crisis. Their ability to miniaturize laboratory-grade testing into portable cartridges reshaped the diagnostic landscape, reducing turnaround time from days to minutes. These systems are now being repurposed for other pathogens, including influenza, tuberculosis, and even antimicrobial resistance profiling.

ELISA and microarray-based applications are emerging as the fastest-growing segments, driven by rising demand for multiplexed, high-sensitivity platforms for chronic disease diagnostics and biomarker discovery. Microfluidic ELISA platforms use far less reagent and offer faster assay kinetics, making them suitable for use in PoC settings. Similarly, microarray-on-a-chip platforms are being developed to simultaneously test for genetic mutations, drug resistance, and allergy profiles, particularly in personalized medicine and oncology.

Polymer-based materials dominate this segment, largely due to their cost-effectiveness, ease of mass production, and compatibility with rapid prototyping. Polymers such as polymethyl methacrylate (PMMA), cyclic olefin copolymer (COC), and polystyrene are widely used in diagnostic chips, biosensors, and PoC devices. Polymer substrates are amenable to soft lithography, injection molding, and roll-to-roll printing, allowing for scalable and repeatable device fabrication.

PDMS (Polydimethylsiloxane) is the fastest-growing material, especially in academic and early-stage commercial research. Its biocompatibility, optical transparency, and flexibility make it ideal for prototyping organs-on-chips, cell-based assays, and dynamic fluidic simulations. PDMS allows for real-time visualization of cellular behavior and is often combined with other materials for hybrid applications. Though traditionally less suitable for long-term storage and industrial use, innovations in PDMS curing and bonding are expanding its applicability to commercial and clinical microfluidic devices.

Lab-on-a-chip technology dominates the market, encompassing a broad range of applications in diagnostics, genomics, and drug screening. These platforms condense multiple lab processes—including sample preparation, amplification, and detection—into a single microfluidic chip. Widely used in PoC diagnostics and personalized medicine, lab-on-a-chip solutions offer portability, speed, and reduced sample consumption. Devices like Abbott’s ID NOW and Cepheid’s GeneXpert have brought this technology to global prominence.

Organs-on-chips represent the fastest-growing segment, as pharmaceutical and biomedical research shifts toward more accurate and ethical models for drug testing and disease modeling. Companies such as Emulate, MIMETAS, and TissUse are commercializing multi-organ systems that replicate vascular flow, cellular heterogeneity, and real-time responses to therapeutic agents. The convergence of 3D bioprinting, stem cell biology, and microfluidics is expected to accelerate adoption across toxicology, pharmacokinetics, and regenerative medicine.

North America leads the global microfluidics market, owing to its mature healthcare infrastructure, strong R&D ecosystem, and high adoption of advanced diagnostic tools. The United States, in particular, houses numerous key players such as Thermo Fisher Scientific, Danaher (Cepheid), and Illumina, alongside a thriving startup ecosystem. Public funding from the National Institutes of Health (NIH) and DARPA supports microfluidic research in both diagnostics and drug development. Additionally, the presence of regulatory clarity from the FDA accelerates the time-to-market for microfluidic medical devices.

Asia-Pacific is the fastest-growing region, fueled by increasing healthcare expenditure, rising chronic disease prevalence, and expanding biotech hubs. Countries like China, Japan, South Korea, and India are investing in home-grown diagnostic capabilities, including microfluidics-based PoC testing. China's “Made in China 2025” initiative and India’s push for domestic diagnostic manufacturing have created favorable environments for microfluidics startups and CDMOs. Furthermore, the region’s cost advantages in manufacturing and its large patient population make it a strategic market for both innovation and scale.

Emulate Inc. (March 2025): Partnered with the FDA to further validate its liver-on-a-chip model for preclinical drug safety assessment, supporting regulatory innovation in microfluidics-based systems.

Fluigent (February 2025): Announced the launch of a smart microfluidic pressure controller with AI-assisted flow optimization for lab-on-chip research.

Dolomite Microfluidics (January 2025): Released a modular microfluidic chip set targeting nanoparticle synthesis and encapsulation for mRNA-based drug delivery systems.

Illumina Inc. (December 2024): Expanded its microfluidics R&D team to enhance single-cell sequencing workflows through integrated microfluidic platforms.

Micronit (November 2024): Opened a new facility in the Netherlands focused on scalable production of microfluidic devices for diagnostics and life sciences.

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global microfluidics market.

Application

Material

Technology

By Region