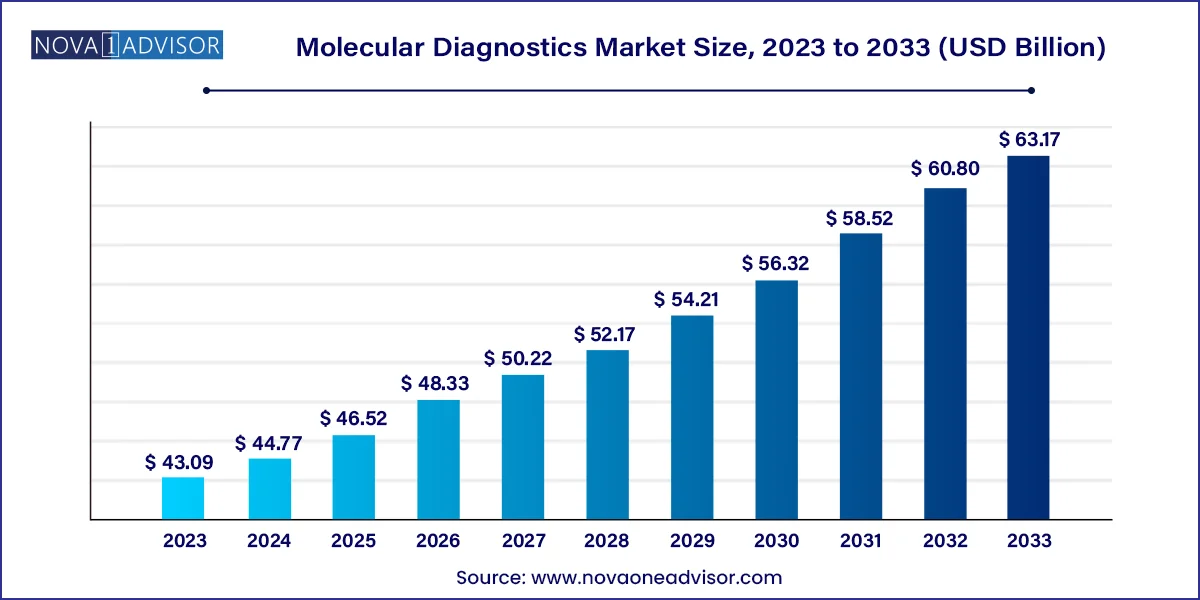

The global molecular diagnostics market size was USD 43.09 billion in 2023, calculated at USD 44.77 billion in 2024 and is expected to reach around USD 63.17 billion by 2033, expanding at a CAGR of 3.9% from 2024 to 2033.

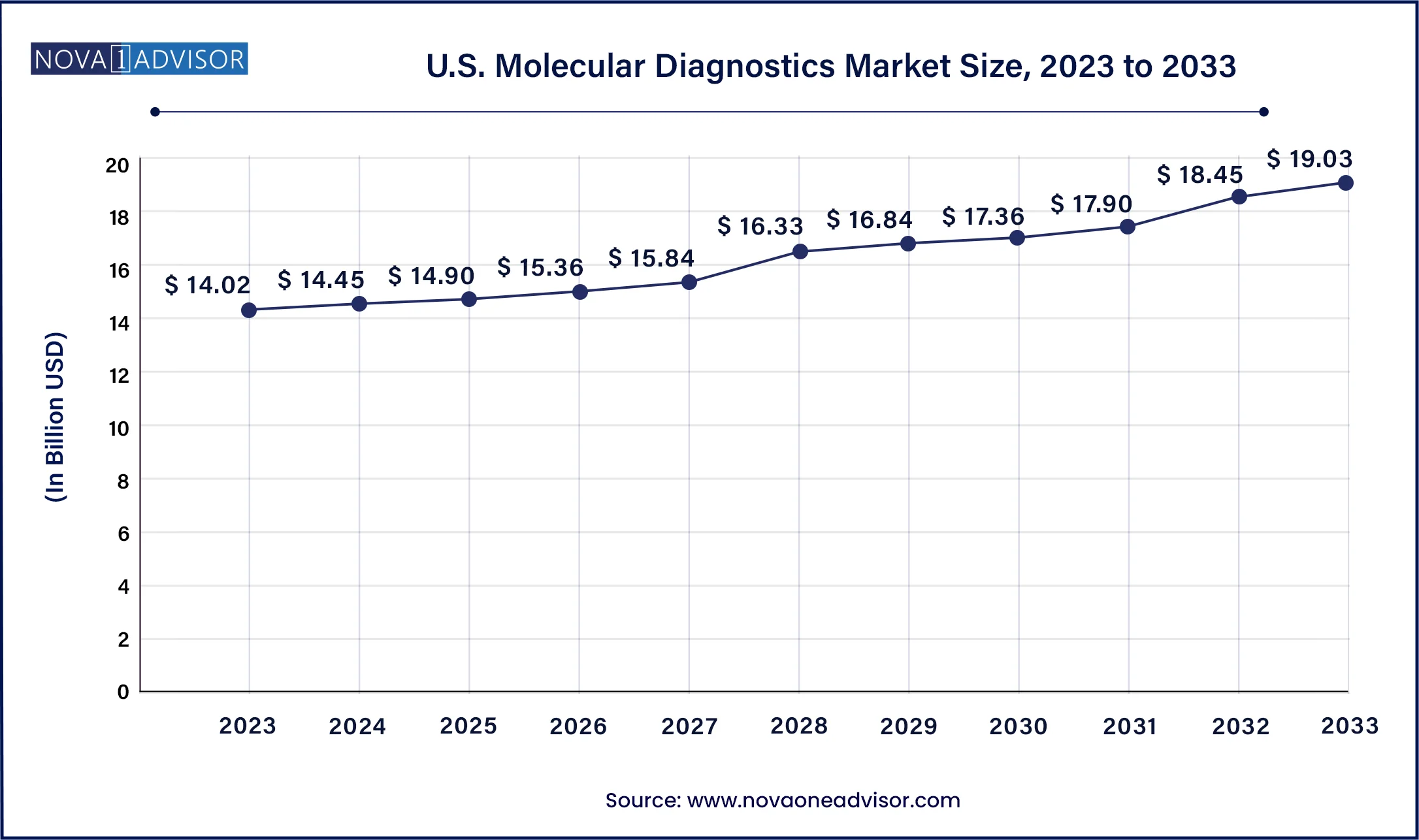

The U.S. molecular diagnostics market size was valued at USD 14.02 billion in 2023 and is anticipated to reach around USD 19.03 billion by 2033, growing at a CAGR of 3.1% from 2024 to 2033.

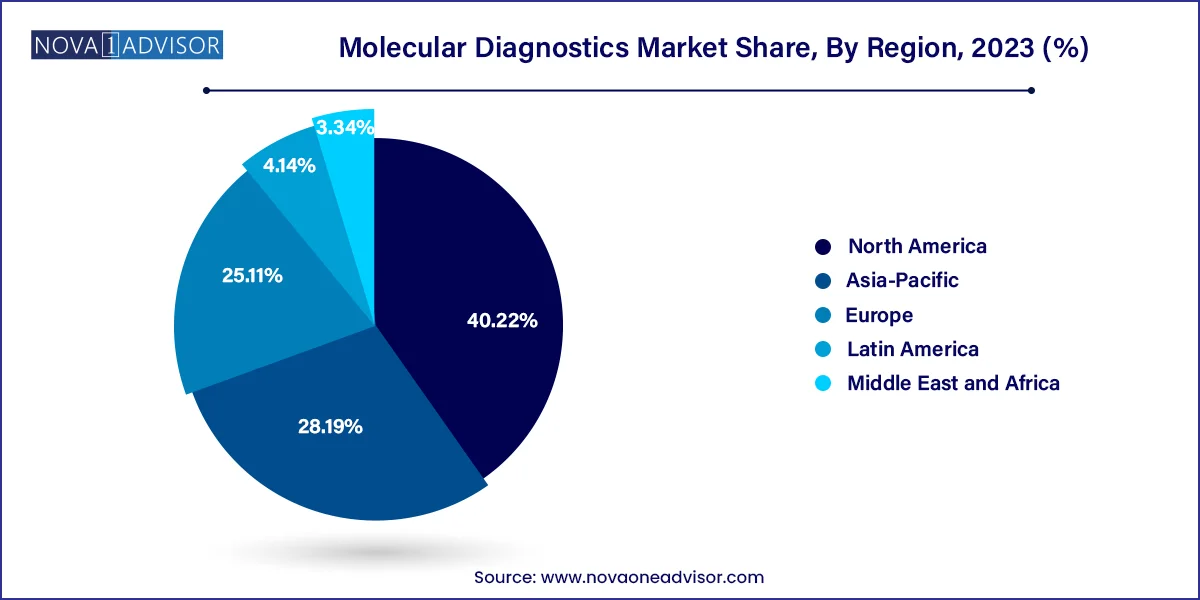

North America dominated the market and accounted for a 40% share in 2023. This is attributed to the rising epidemiology of infectious as well as chronic diseases, thus, encouraging companies to introduce novel molecular diagnostic tests, thereby boosting market growth. For instance, in August 2023, QIAGEN received the U.S. FDA approval for therascreen PDGFRA RGQ PCR kit, this aids physicians in identifying patients with gastrointestinal stromal tumors (GIST). Moreover, in January 2023, the U.S. FDA approved EUA for the VIASURE Monkeypox Virus Real-Time PCR Reagents developed by BD and CerTest Biotec for Mpox virus detection. Moreover, high standards of living and consumer awareness about early diagnosis, as well as well-established healthcare system, act as key drivers for growth.

Asia Pacific is anticipated to exhibit significant growth from 2024 to 2033 owing to increased market penetration, initiatives of local market players to increase the adoption of novel diagnostic technologies, and high unmet market needs. For instance, in August 2023, Indian companies CrisprBits and MolBio Diagnostics entered into a strategic collaboration to revolutionize POC diagnostics by integrating CRISPR technology into POC tests to detect pathogens and genetic markers. Moreover, regional market growth can be attributed to several factors, such as the increasing adoption of NGS, rise in testing of life-threatening diseases, such as cancer, COVID-19, tuberculosis, and STDs, growing demand for personalized medicine, and increasing use of artificial intelligence (AI) & machine learning (ML).

The Factors, such as technological advancements, an increasing geriatric population, and increasing demand for accurate & effective genetic testing are boosting market growth. Moreover, rising demand for point-of-care testing can be attributed to increasing demand for self-testing diagnostics and rising patient awareness about faster diagnostics, which is encouraging industry players to develop novel testing products. For instance, in February 2023, Huwel Lifesciences designed a portable RT-PCR machine to test different types of viruses.

The company claimed that the test takes around 30 minutes and can be used to conduct the test for respiratory and other infections using blood and gastrointestinal samples. The rising geriatric population globally is at a higher risk of developing numerous diseases, including cancer, cardiovascular diseases, obesity, neurological disorders, and diabetes. According to the World Bank Group data, in 2022, there were about 779 million people aged 65 years & above globally. In addition, the number of individuals aged 80 years and above is projected to double by 2050, to surpass more than 1.5 billion. Thus, growing geriatric population is expected to be a high-impact rendering driver of the market. In addition, the growing incidence of infectious diseases is expected to propel market growth.

Rising target population due to high incidence of STIs, such as HIV and HPV, is expected to drive industry growth. According to the WHO, the prevalence and incidence of HIV were approximately 39 million and 1.3 million, respectively, in 2022 across the globe. Furthermore, people suffering from HIV are highly susceptible to other infections, such as tuberculosis, which is the leading cause of death among HIV-affected people. Rising number of initiatives by key players to improve access to cost-effective resources is anticipated to drive market growth. Molecular diagnostics render accurate & effective results and have indispensable applications in disease diagnostics. For instance, in December 2023, Co-Diagnostics, Inc. submitted documents for review of the Co-Dx PCR COVID-19 test with Co-Dx PCR Pro instrument to the U.S. FDA for emergency use authorization.

These tests and instruments are designed for use at POC and at-home settings. Increasing introduction of novel molecular diagnostic products and favorable initiatives undertaken by government and non-government bodies further support the market expansion. For instance, in November 2023, F. Hoffmann-La Roche Ltd launched LightCycler PRO System to raise the usability of molecular PCR testing in translational research and in vitro diagnostic applications. Similarly, BARDA’s 2022-2026 Strategic Plan supports development and authorization of advance pathogen-specific diagnostics. Moreover, BARDA supports T2 Biosystems’s T2Biothreat Panel, a blood molecular diagnostic test, which can detect six pathogens in a single sample.

| Report Attribute | Details |

| Market Size in 2024 | USD 44.77 Billion |

| Market Size by 2033 | USD 63.17 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Test Location, Technology, Application, End User, and Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Siemens Healthineers AG (Germany), Quidel Corporation (US), F. Hoffmann-La Roche Ltd. (Switzerland), Hologic, Inc. (US), Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Illumina, Inc. (US), Becton, Dickinson and Company (US), Grifols, S.A. (Spain), PerkinElmer, Inc. (US), Abbott Laboratories (US), bioMérieux SA (France), QIAGEN N.V. (Netherlands), Myriad Genetics, Inc. (US), Agilent Technologies, Inc. (US), geneOmbio Technologies Pvt. Ltd. (India) |

Market Drivers

Rising requirement for cancer diagnostics

According to the National Institutes of Health's projection, there will be approximately 1,958,310 cancer cases in the United States in 2023. This number of rising cases of cancer brings demand for early diagnosis of cancer across the globe. Molecular diagnostics plays a crucial role in the early detection of cancer. Molecular diagnostics identify cancer-related biomarkers at an early stage, healthcare providers can diagnose cancer before symptoms arise, leading to earlier treatment initiation. Cancer continues to be a leading cause of morbidity and mortality across the globe, as the cancer cases increase, the demand for accurate and precise diagnostic method also grows. This element is observed to pose a driver for the market.

Development of precision medicine

Precision medicine focuses on tailoring medical treatments and interventions to individual patients based on their unique genetic makeup, lifestyle, and environmental factors. Molecular diagnostics play a crucial role in this approach by enabling the identification of specific biomarkers, genetic mutations, and gene expression patterns that can guide treatment decisions for each patient. Molecular diagnostics have become an essential component of the drug development process. Companion diagnostics are tests used to identify patients who are most likely to respond positively to a particular treatment. By identifying suitable candidates for specific therapies, companion diagnostics help pharmaceutical companies improve the success rates of clinical trials and streamline the drug development process. Thereby, drives the growth of the market.

Market Restraints

Presence of alternative diagnostic methods

Alternative diagnostic methods, such as traditional laboratory tests or imaging techniques, may already be established and widely accepted in the medical community. When molecular diagnostics compete with these existing methods, it can be challenging to gain market share and acceptance, especially if the alternatives are perceived as more cost-effective or easier to implement. Molecular diagnostics often involve sophisticated technologies and specialized equipment, making them more expensive than some conventional diagnostic methods. This cost factor can hinder their adoption, especially in resource-limited settings where healthcare facilities may not have the financial means to invest in expensive molecular diagnostic infrastructure. Thus, the presence of alternative testing methods in the market creates a restraint for the market.

Stringent regulatory policies

Stringent regulatory requirements act as barriers to entry for new entrants in the molecular diagnostics market. As a consequence, established companies with already approved products may have a competitive advantage, making it difficult for newcomers to gain a foothold. Regulatory agencies often work closely with healthcare payers to determine the coverage and reimbursement of molecular diagnostic tests. Uncertain or restrictive reimbursement policies can create financial uncertainties for companies, affecting their willingness to invest in research and development, market expansion, or product improvement. Such policies or guidelines are observed to hamper the market’s expansion.

Market Opportunity

Rising focus on less-invasive testing methods

Less invasive testing methods can enable earlier detection and continuous monitoring of diseases, leading to better treatment outcomes and overall patient management. Patients often prefer non-invasive or minimally invasive procedures as they are less painful, have shorter recovery times, and reduce the risk of complications. The aging population is more prone to chronic diseases that require frequent monitoring, making less invasive testing methods particularly beneficial for this demographic. Molecular diagnostics has enabled the development of blood tests that can detect specific genetic, or protein markers associated with various diseases. These tests can provide valuable information without the need for invasive procedures, making them more appealing to both patients and healthcare providers. Thus, the rising demand for less invasive testing methods creates significant opportunities for the molecular diagnostics market.

Market Challenge

Data safety challenges

Molecular diagnostics heavily rely on the analysis and sharing of sensitive genomic information, data privacy and security becomes critical issues. The rise in cyberattack and data breaches to personal health information could deter patients and healthcare providers from embracing molecular diagnostics technologies. Concerns about how companies handle, or store genetic data might also deter users, patients or consumers from adopting such services. All these factors associated with data safety concerns create a significant challenge for the market.

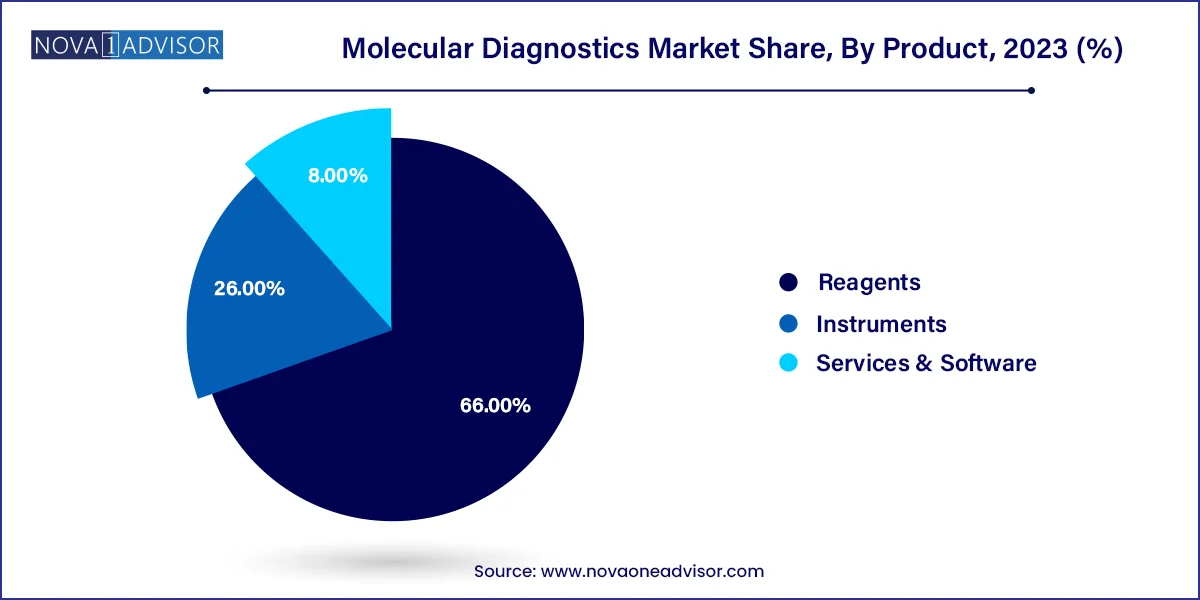

The reagents segment dominated the market and accounted for a share of 66% of the global revenue in 2023. It is expected to maintain its dominance throughout the forecast years owing to its wide application scope in research & clinical settings and increasing adoption of novel tests. For instance, in April 2023, Cepheid, a subsidiary of Danaher, announced a plan to introduce novel tests for a range of infectious diseases, including respiratory diseases and tuberculosis. The company has collaborated with researchers at Rutgers University to develop this novel technology that allow to detect 10 independent targets in one reaction. Moreover, standardized results, improved efficiency, and cost-effectiveness are anticipated to support market growth.

The instruments segment held the second-largest revenue share in 2023 due to the extensive use of instruments in different healthcare facilities to diagnose life-threatening diseases. Moreover, introduction of technologically advanced instruments is further supporting the segment growth. For instance, in February 2023, Thermo Fisher Scientific, Inc. announced the release of QuantStudio, Applied Biosystems, Absolute Q AutoRun dPCR Suite, a new digital PCR research tool. Moreover, in May 2023, Sansure Biotech presented its comprehensive range of IVD products, including the iPonatic III portable molecular workstation, at EuroMedLab Rome 2023.

Global Molecular Diagnostics Market Revenue, By Product, 2023-2033 (US$ Million)

| Product | 2023 | 2024 | 2030 | 2033 |

| Instruments | 11,037.71 | 11,348.83 | 13,945.20 | 15,809.40 |

| Reagents | 28,001.71 | 29,042.24 | 36,271.22 | 41,548.31 |

| Others | 3,217.30 | 3,284.70 | 3,680.22 | 3,930.76 |

The polymerase chain reaction technology segment accounted for the largest revenue share in 2023. This is attributed to its use in detecting COVID-19 and other infectious diseases. The increasing use of high-throughput PCR technology to detect infectious diseases and genetic or inherited conditions is expected to drive market growth. For instance, in April 2023,Molbio Diagnostics launched Truenat H3N2/H1N1, the initial PoC Real-Time Polymerase Chain Reaction (PCR) test that assists in the proven identification of influenza infections. The sequencing technology segment is expected to grow at the fastest CAGR from 2024 to 2033.

The segment growth can be attributed to the rising penetration of technology in diagnostic applications, introduction of novel NGS tests, and favorable initiatives by key players. For instance, in April 2023, Alercell launched the LENA Molecular Dx Leukemia Platform, which comprises 12 molecular diagnostic tests based on next-gen DNA sequencing technology. Moreover, in January 2023, QIAGEN and Helix established an exclusive agreement to improve next-gen sequencing companion testing in genetic illnesses. DNA sequencing technologies are integrally linked to drug discovery, novel drug development, and personalized medicine. Companies are launching new NGS-based tests for early disease diagnosis.

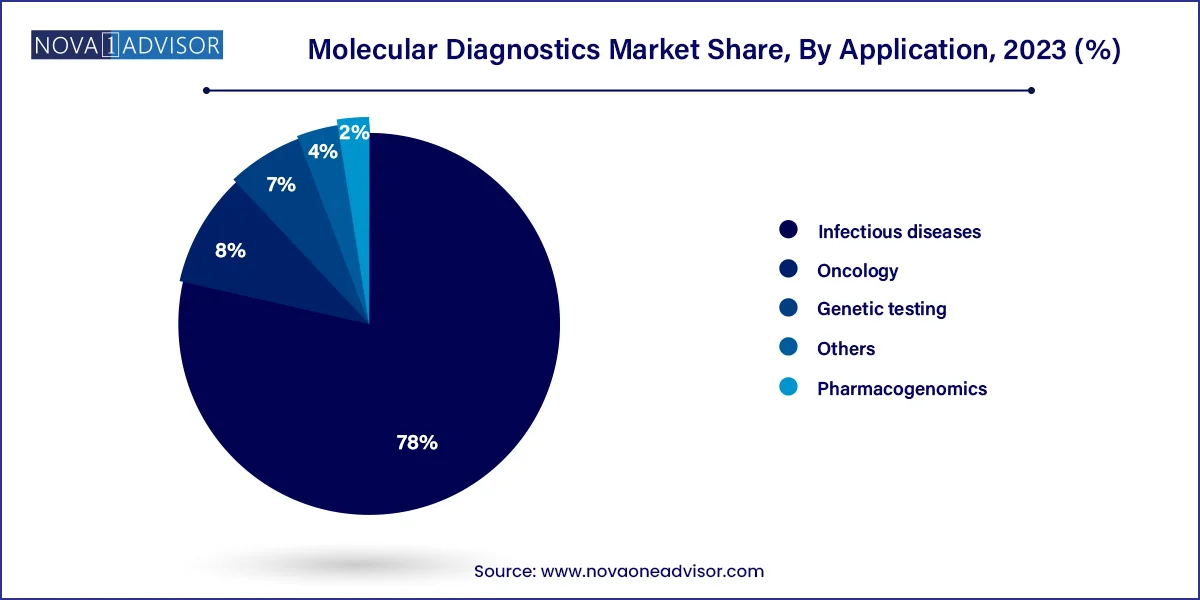

The infectious diseases segment accounted for the largest revenue share of 78% in 2023. The increased usage of molecular, particularly PCR tests, for diagnosing COVID-19 has increased the segment share significantly. Moreover, the increasing prevalence of infectious diseases across the globe is further increasing the demand for novel molecular diagnostic tests. For instance, in May 2023, the U.S. FDA approved 510(k) clearance for Hologic's Panther Fusion SARS-CoV-2/Flu A/B/RSV assay. This assay is a molecular diagnostic test that discriminates between the four utmost common respiratory viruses. Moreover, in April 2023, Oxford Nanopore and bioMérieux formed a strategic partnership involving nanopore technology to develop novel treatments for infectious diseases.

The oncology segment is expected to grow at a high CAGR from 2024 to 2033. According to the American Cancer Society estimates, in 2023, about 288,300 new cases of prostate cancer and around 59,610 new cases of leukemia were estimated to be diagnosed in the U.S. Moreover, increasing collaboration activities between research institutes and market players to develop new diagnostic solutions for cancer is supporting the segment growth. For instance, in October 2023, QIAGEN and Myriad Genetics collaborated to develop companion diagnostic tests based on PCR, dPCR, and NGS technology for cancer.

Global Molecular Diagnostics Market Revenue, By Application, 2023-2033 (US$ Million)

| Application | 2023 | 2024 | 2030 | 2033 |

| Oncology | 3,503.51 | 3,830.52 | 6,728.34 | 8,705.32 |

| Pharmacogenomics | 860.97 | 922.82 | 1,454.02 | 1,819.46 |

| Infectious Diseases | 33,087.01 | 33,757.00 | 37,435.45 | 40,347.07 |

| Genetic Testing | 2,989.71 | 3,250.97 | 5,560.32 | 7,137.94 |

| Others | 1,815.52 | 1,914.47 | 2,718.51 | 3,278.69 |

The central laboratories segment dominated the industry in 2023 owing to high procedure volumes for COVID testing and other healthcare indications in central laboratories. In April 2023, ELI TechGroup announced its plans to introduce a high throughput sample-to-result molecular diagnostics equipment to help laboratories worldwide. Moreover, a rise in the number of initiatives undertaken by governments to provide various services, such as reimbursement for diagnostic tests, is another major factor anticipated to drive market growth.

There is an increasing interest in the development of molecular diagnostic platforms that can also be used as OTC or in at-home settings. Therefore, various companies are designing assays & molecular diagnostic platforms that patients can use without the help of healthcare professionals. For instance, in March 2023, Lucira Health launched the first and only at-home COVID-19 and flu tests in the U.S. The U.S. FDA gave the COVID-19 & Flu Home Test the first and only Emergency Use Authorization (EUA) for OTC usage at home and other non-laboratory locations.

Global Molecular Diagnostics Market Revenue, By Location, 2023-2033 (US$ Million)

| Location | 2023 | 2024 | 2030 | 2033 |

| POC | 5,580.12 | 5,886.10 | 8,207.03 | 9,887.79 |

| Self testing/OTC | 2,021.63 | 2,213.58 | 3,861.16 | 5,157.90 |

| Central Labs | 34,654.97 | 35,576.08 | 41,828.46 | 46,242.79 |

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Molecular Diagnostics market.

By Product

By Technology

By Application

By Test Location

By End User

By Region