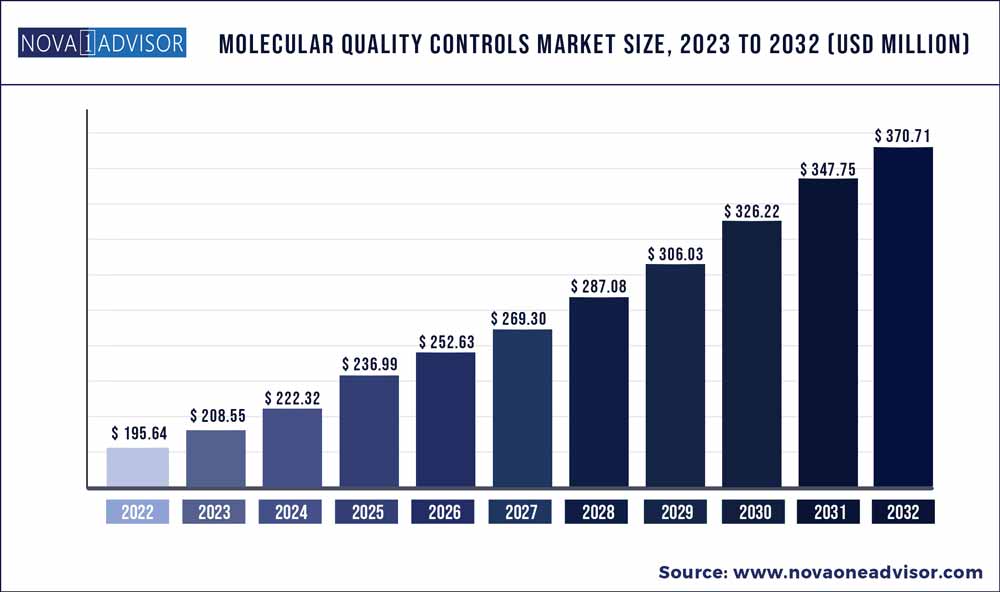

The global molecular quality controls market size was exhibited at USD 195.64 million in 2022 and is projected to hit around USD 370.71 million by 2032, growing at a CAGR of 6.6% during the forecast period 2023 to 2032.

Key Takeaways:

Molecular Quality Controls Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 195.64 Million |

| Market Size by 2032 | USD 370.71 Million |

| Growth Rate From 2023 to 2032 | CAGR of 6.6% |

| Base Year | 2022 |

| Forecast Period | 2023-2032 |

| Segments Covered | By Product, By Analyte Type, By Application, By End User, By Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), Anchor Molecular (US), Thermo Fisher Scientific, Inc. (US), Randox Laboratories Ltd. (UK), LGC Limited (UK), Abbott Laboratories (US), Fortress Diagnostics (UK), SERO AS (Norway), Anchor Molecular (US), Vircell S.L. (Spain), Ortho Clinical Diagnostics, Inc. (US), QuidelOrthoCorporation (US), Sun Diagnostics, LLC (US), Seegene Inc. (South Korea), ZeptoMetrix, LLC (US), Qnostics (UK), Bio-Techne Corporation (US), Microbiologics, Inc. (US), Steck LLC (US), Helena Laboratories Corporation (US), Microbix Biosystems Inc. (Canada), Molbio Diagnostics Pvt. Ltd. (India), SpeeDx Pty. Ltd. (Australia), Maine Molecular Quality Controls, Inc. (US), and Grifols, S.A. (Spain). |

The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of this market is primarily driven by the increasing number of accredited clinical laboratories, growing adoption of third-party quality controls, and increasing government funding for genomic projects. Rising demand for multi-analyte controls and growth opportunities in emerging countries are expected to offer opportunities for market players during the forecast period.

On the other hand, the additional costs involved in the quality control process and budget constraints in hospitals and laboratories, are expected to restrain the market growth to some extent in the coming years.

Molecular Quality Controls Market Dynamics

Driver: Growing preference for personalized medicines

Genomics has played a key role in the emergence of personalized medicine. Personalized medicine provides tailored treatments and prevention procedures to suit each individual’s condition for optimal results. This field of medicine offers the most promising approach to tackle diseases that have not been well-known for responding effectively to the existing treatments or cures. As per the Personalized Medicine report published in the PMC (Personalized Medicine Coalition):

The cost of genome sequencing has dropped dramatically in the last six years, approximately a million-fold. The Human Genome Project was completed by thousands of researchers in 13 years and cost USD 2.7 billion (Source: WIRED, September 2022). According to a blog published in Sequencing in 2022, due to the growing interest in DNA sequencing numerous bioinformatics companies are focused on creating new technologies, sequencers, and consumables aiming to offer genetic testing at affordable costs.

Restraint: Budgetary constraints in clinical laboratories

Setting up a QC process in a clinical laboratory requires significant investments. Laboratories also need to maintain dedicated personnel to manage the QC system. Moreover, QC procedures incur similar costs, regardless of the volume of tests performed. Hence, the cost of adopting QC procedures is very high for clinical laboratories working with low volumes of diagnostic tests. This, coupled with budgetary constraints in many hospitals and laboratories in developed and developing economies, is expected to result in the lower adoption of QC practices.

Opportunity: Rising demand for multi-analyte controls

Technological advancements have led to the development of a new range of multi-analyte and multi-instrument controls. These innovative controls consolidate multiple instrument-specific controls into a single control, thereby enabling clinical laboratories to cut down costs. In addition, these controls save the time involved in separate QC procedures for each individual analyte. A number of multi-analyte controls are available in the market, such as the Amplicheck Series (BD Company), AcroMetrix Series (Thermo Fisher Scientific), Seraseq Controls (SeraCare), and Introl Series (Maine Molecular Quality Controls). These controls help laboratories to perform quality control for multiple parameters, including cardiac and tumor markers and DNA/RNA of multiple infectious disease-causing agents in a single run.

Challenge: Stringent regulatory requirements for IVD products

Regulatory and legal requirements applied to IVD (including molecular diagnostics) in the US and European countries are becoming more stringent. In the US, IVD products are defined under 21 CFR 809 and regulated under guidelines like medical devices. The FDA released new FDA guidance documents. Under US federal regulations, device manufacturers must submit a 510 (k) application for any further modifications to a device. New applications may require software updates or new software installation in an existing device or any other changes made to these devices. In the past few years, the FDA requirements, particularly with regard to 510(k) notifications, have increased, requiring more data and details than earlier. This change, resulting in unpredictable premarket submission requirements, is extremely unfavorable for IVD manufacturers that require 510(k) clearance.

The independent controls segment of the Molecular Quality Controls Industry has accounted for the highest market share during the forecast period

On the basis of product, the molecular quality controls market is segmented into instrument specific controls and independent controls. The independent controls segment accounted for the highest share of the global market in 2022. The large share of this segment is attributed to the longer shelf-life and reduced cost of operation.

The single-analyte controls has accounted for the highest share of the Molecular Quality Controls Industry during the forecast period.

Based on analyte type, the molecular quality controls market is segmented into multi-analyte controls and single-analyte controls. Single-analyte controls accounted for the highest share of the market in 2022. The large share of this segment can be attributed to the low risk of cross-reactivity and the significant use of singleplex assays in hospitals.

The infectious disease diagnostic segment accounted for the highest share of the Molecular Quality Controls Industry in 2022

On the basis of application, the molecular quality controls market is segmented into genetic testing, oncology testing, infectious disease diagnostics, and other applications (including microbiology, tissue typing, DNA fingerprinting, cardiovascular disease testing and neurology disease testing). The infectious disease diagnostics segment accounted for the highest share of the global market in 2022. The large share of this segment is attributed to the development of advanced assays for different infectious diseases.

The diagnostic laboratories segment accounted for the largest share of the Molecular Quality Controls Industry in 2022

Based on end users, the molecular quality controls market is segmented into diagnostic laboratories, hospitals, IVD manufacturers & CROs, academic & research institutes, and other end users (blood banks, local public health laboratories, home health agencies, and nursing homes). The diagnostic laboratories segment accounted for the largest share of the market in 2022. This can be attributed to the increasing number of accredited diagnostic laboratories worldwide and the growing number of laboratory tests performed in diagnostic laboratories.

North America accounted for the largest share of the Molecular Quality Controls Industry in 2022

Based on region, the molecular quality controls market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2022. The large share of this regional segment is mainly due to the developed healthcare system in the US and Canada and the presence of many leading molecular quality control product manufacturers.

Recent Developments of Molecular Quality Controls Industry

Some of the prominent players in the Molecular quality controls Market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Molecular quality controls market.

By Product

By Analyte Type

By Application

By End User

By Region