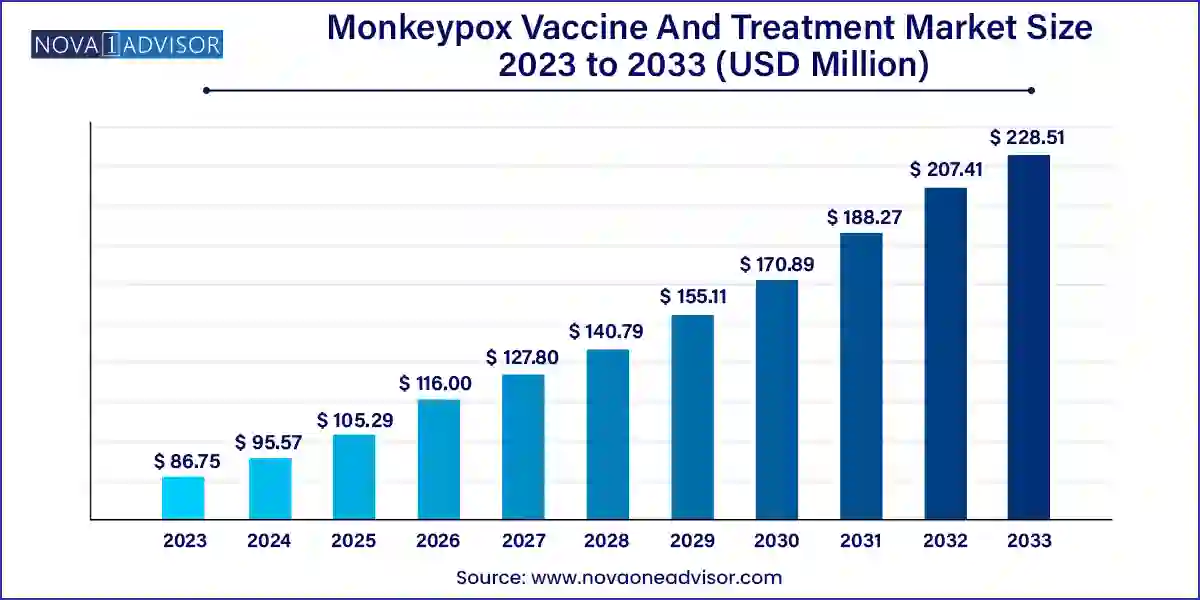

The monkeypox vaccine and treatment market size was exhibited at USD 86.75 million in 2023 and is projected to hit around USD 228.51 million by 2033, growing at a CAGR of 10.17% during the forecast period 2024 to 2033.

The Monkeypox Vaccine and Treatment Market has emerged as a critical domain within the broader spectrum of infectious disease control, particularly after the global monkeypox outbreak in 2022–2023, which acted as a catalyst for public health mobilization. Originally endemic to parts of Central and West Africa, monkeypox a zoonotic disease caused by the monkeypox virus has seen increased global prevalence due to human-to-human transmission and cross-border movement. The growing recognition of monkeypox as a potential global health threat has prompted urgent research and investments in developing dedicated vaccines, antiviral treatments, and immune therapies.

The World Health Organization (WHO) and national regulatory bodies swiftly classified monkeypox as a Public Health Emergency of International Concern (PHEIC), leading to a surge in demand for vaccines such as JYNNEOS (also marketed as Imvanex in Europe) and treatments like tecovirimat. Though monkeypox shares similarities with smallpox, existing smallpox vaccines have only partial efficacy. Therefore, developing specific monkeypox-targeted therapeutics has become a priority.

Pharmaceutical giants, biotechnology startups, and government institutions have collaborated on rapid vaccine approvals, global distribution networks, and therapeutic trials. The expansion of funding, regulatory fast-tracking, and pandemic preparedness programs have further propelled the market. With the global health ecosystem now more vigilant, the monkeypox vaccine and treatment market is anticipated to experience sustained growth, especially as health authorities aim to build long-term immunity and prevention capabilities against future outbreaks.

Increasing Stockpiling Initiatives by Governments: Governments in the U.S., EU, and APAC regions are increasingly stockpiling vaccines like JYNNEOS and antiviral treatments as part of pandemic preparedness frameworks.

Rising Investment in Research and Development (R&D): Continuous R&D by biotech firms and research institutions is leading to next-generation monkeypox-specific vaccines and therapies with enhanced efficacy and reduced side effects.

Widening Immunization Campaigns: Public health agencies are expanding vaccination programs to include high-risk populations such as healthcare workers, immunocompromised individuals, and communities with higher transmission rates.

Regulatory Fast-Tracking of Therapeutics: The FDA, EMA, and other agencies have implemented emergency use authorizations and accelerated approval pathways for monkeypox-related products.

Increased Use of Tecovirimat (TPOXX): Originally developed for smallpox, tecovirimat has gained traction as a front-line treatment option for monkeypox, with increasing clinical data supporting its efficacy.

Globalization of Vaccine Manufacturing: Manufacturers are diversifying production sites to ensure rapid supply to low- and middle-income countries during outbreaks.

Integration of AI in Drug Discovery: AI and machine learning tools are being increasingly used to identify potential antiviral compounds against orthopoxviruses, including monkeypox.

Public-Private Collaborations: Governments are partnering with biotech firms for supply agreements and R&D funding, ensuring faster product development and wider distribution.

| Report Coverage | Details |

| Market Size in 2024 | USD 95.57 Million |

| Market Size by 2033 | USD 228.51 Million |

| Growth Rate From 2024 to 2033 | CAGR of 10.17% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Gender, Route of Administration, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled | Bavarian Noric; SIGA Technologies; Chimerix; EMERGENT; Gilead Sciences, Inc. |

One of the key drivers for the monkeypox vaccine and treatment market is the rising global prevalence and the re-emergence of monkeypox cases in non-endemic countries. The 2022 outbreak, which saw significant case counts in the U.S., UK, and European nations, highlighted the vulnerability of global populations to zoonotic diseases. Increased urbanization, climate change, and international travel have enabled faster virus transmission, raising alarms among public health officials. This has led to an urgent need for specific countermeasures such as dedicated vaccines, antivirals, and immunotherapies. The heightened awareness and subsequent mobilization of resources have significantly accelerated market growth, attracting new stakeholders and boosting innovation.

Despite the growing urgency, the market faces a significant restraint limited access to vaccines and treatments in low-income countries. While nations in North America and Europe have been able to stockpile and rapidly distribute JYNNEOS and tecovirimat, many African countries still lack access to these life-saving interventions. Supply chain constraints, lack of infrastructure, and prioritization of local populations by manufacturers have compounded the disparity. Furthermore, intellectual property rights and high costs pose additional barriers for equitable distribution. These access inequalities threaten the global containment of the disease and highlight the need for international collaboration and funding mechanisms to ensure equitable health solutions.

The market offers a substantial opportunity through the expansion of clinical trials and a burgeoning therapeutic pipeline. With multiple pharmaceutical companies and academic institutions entering the space, there is significant momentum toward developing more specialized and effective treatments. Beyond JYNNEOS and tecovirimat, newer antivirals and vaccine platforms (such as mRNA-based solutions) are in early-stage and mid-stage trials. Companies like SIGA Technologies and Tonix Pharmaceuticals are exploring diverse approaches, ranging from immune modulators to next-gen smallpox-based platforms. The growing interest in orthopoxvirus immunology offers ample scope for market growth, with emerging players receiving government grants and venture capital investments to explore novel molecules and delivery mechanisms.

Vaccines dominated the product segment in 2024, with JYNNEOS/Imvanex being the leading sub-category due to its safety profile and approval for monkeypox in both the U.S. and Europe. Unlike older smallpox vaccines, JYNNEOS is a non-replicating live vaccine, making it safer for immunocompromised individuals and those with skin conditions. It was the primary choice for ring vaccination strategies during the 2022 outbreak. Smallpox vaccines like ACAM2000 are also utilized, but their side effects limit widespread application. The “Others” category, encompassing next-generation platforms, is gradually expanding as biotech firms push alternative vaccine candidates through clinical pipelines.

Drugs represent the fastest-growing product category, particularly tecovirimat (TPOXX), which has been widely prescribed off-label for monkeypox treatment. Approved by the FDA for smallpox but recommended by the CDC for monkeypox in emergency situations, tecovirimat has shown strong efficacy in reducing symptoms and hospitalization durations. Brincidofovir and cidofovir are also used, although their toxicity profiles are concerning. The "Others" segment includes novel antivirals undergoing Phase II/III clinical evaluations. The rapid adoption of these treatments in developed countries is propelling their growth trajectory, especially as combination therapy approaches are being investigated.

The male segment held the dominant share of the monkeypox vaccine and treatment market. This can be attributed to the higher incidence rates of monkeypox among men during recent outbreaks, particularly among men who have sex with men (MSM), who were identified as a high-risk group in many countries. Public health efforts focused primarily on vaccinating males in urban clusters with elevated transmission risks. As a result, vaccine coverage and antiviral usage were initially skewed toward male populations, influencing the gender-based market share.

The 'Others' gender category is the fastest growing, driven by a growing emphasis on inclusive healthcare practices. Transgender and non-binary individuals, particularly within MSM networks, are now recognized in public health policies and immunization strategies. This inclusion ensures equitable access to vaccines and treatments and reflects a more nuanced understanding of transmission dynamics. As surveillance systems improve and health agencies push for gender-sensitive programming, this segment is expected to register significant year-on-year growth.

Hospitals remain the dominant end-use segment, owing to their role as primary centers for diagnosing, isolating, and treating monkeypox cases. Hospitals house specialized equipment and trained personnel needed for severe or complicated infections, including cases requiring VIG administration. They also act as vaccination hubs during outbreak surges, managing both emergency response and post-exposure prophylaxis. Institutional purchases by hospitals form a significant part of government contracts with manufacturers.

Specialty clinics are the fastest-growing segment, particularly in urban centers with high transmission rates. These clinics have become focal points for targeted vaccination campaigns and outpatient antiviral administration. With quicker turnaround times, decentralized locations, and community outreach capabilities, specialty clinics bridge the gap between hospitals and public health units. Their role in ongoing surveillance and follow-up treatment ensures continued relevance in endemic and non-endemic regions alike.

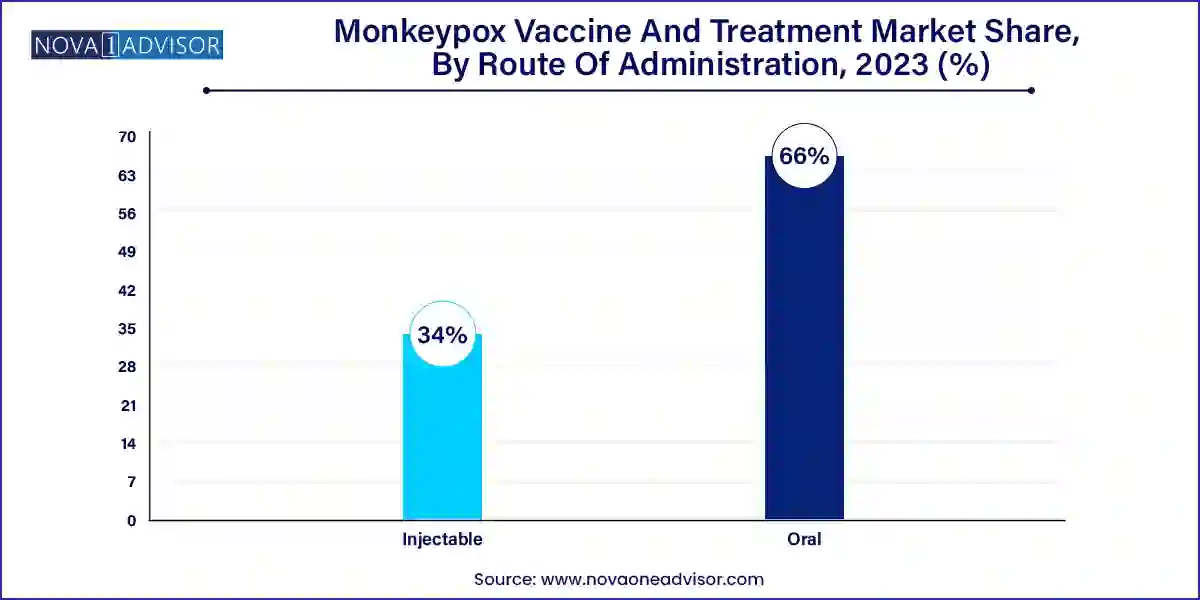

Injectable routes dominate the market, primarily because all currently approved monkeypox vaccines and treatments including JYNNEOS, ACAM2000, tecovirimat, and VIG are administered via intramuscular or subcutaneous injections. These methods offer high bioavailability, precise dosing, and are compatible with the healthcare infrastructure of most countries. Healthcare providers prefer injectables due to their rapid onset of action and controlled pharmacokinetics, particularly in acute infection management and post-exposure prophylaxis scenarios.

Oral administration is gaining traction as the fastest-growing route, especially with the use of oral tecovirimat. The convenience of oral medications reduces the burden on healthcare facilities and allows for outpatient management, which is critical during widespread outbreaks. Moreover, research is underway to develop oral formulations of newer antivirals with improved tolerability and fewer gastrointestinal side effects. Oral drugs are expected to improve compliance rates, particularly in resource-constrained or remote areas.

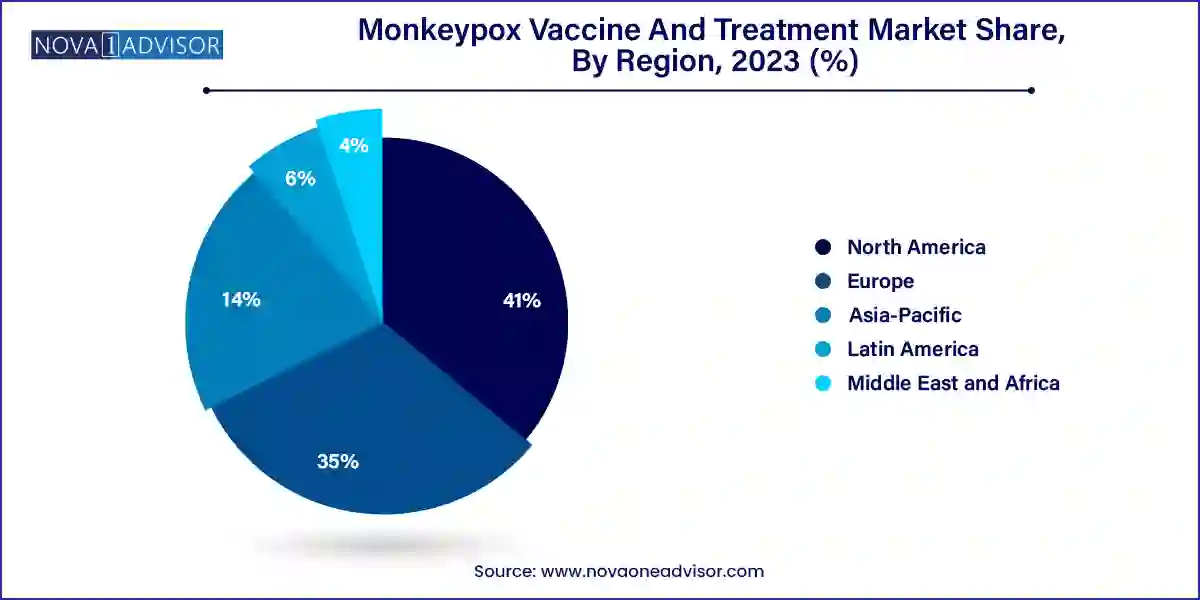

North America currently dominates the monkeypox vaccine and treatment market, led by the United States. The U.S. Department of Health and Human Services (HHS) has played a proactive role in managing outbreaks through strategic stockpiling and partnerships with manufacturers like Bavarian Nordic and SIGA Technologies. The U.S. led the rapid deployment of JYNNEOS during the 2022 outbreak, with over a million doses distributed within months. Strong public health infrastructure, advanced R&D capabilities, and high public awareness have enabled North America to lead in both vaccine adoption and therapeutic deployment. Moreover, continuous funding for biodefense preparedness under programs like Project BioShield bolsters market stability.

Asia-Pacific is the fastest-growing regional market, driven by heightened surveillance, increasing awareness, and rising government investments in disease control infrastructure. Countries like Japan, South Korea, and India have initiated clinical trials and procurement programs, ensuring timely access to monkeypox countermeasures. Australia became one of the early adopters of JYNNEOS in the region, rolling out pre-emptive vaccination strategies in vulnerable communities. Additionally, emerging biotech sectors in India and China are exploring partnerships and localized manufacturing of monkeypox therapeutics. The region's demographic size, combined with growing health expenditure and increasing disease vigilance, makes it a promising frontier for market expansion.

January 2025: Bavarian Nordic announced a new contract with the European Commission to supply an additional 3 million doses of JYNNEOS/Imvanex over the next 12 months for strategic stockpiling and outbreak response.

November 2024: SIGA Technologies received a $60 million procurement order from the U.S. government under the Strategic National Stockpile program for additional tecovirimat (TPOXX) units.

August 2024: Tonix Pharmaceuticals initiated Phase 2 clinical trials for its proprietary TNX-801 vaccine candidate, an attenuated orthopoxvirus vaccine designed to provide broader protection against monkeypox.

May 2024: Emergent BioSolutions entered into a collaborative R&D agreement with the Biomedical Advanced Research and Development Authority (BARDA) to explore next-gen VIG formulations for immunocompromised patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the monkeypox vaccine and treatment market

Product

Gender

Route of Administration

End-use

Regional