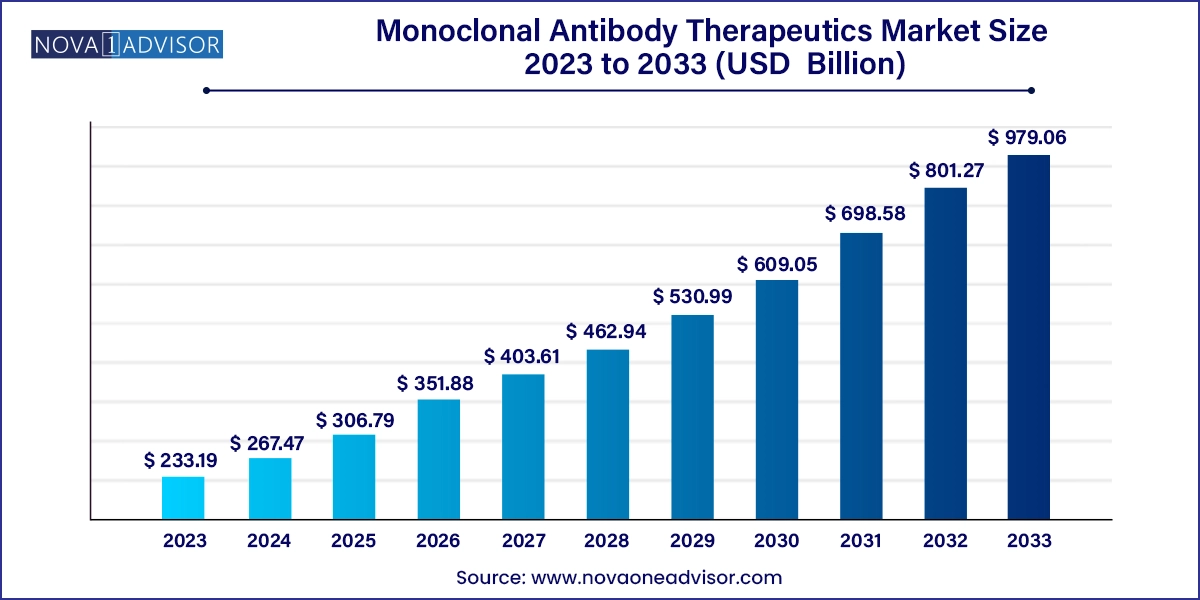

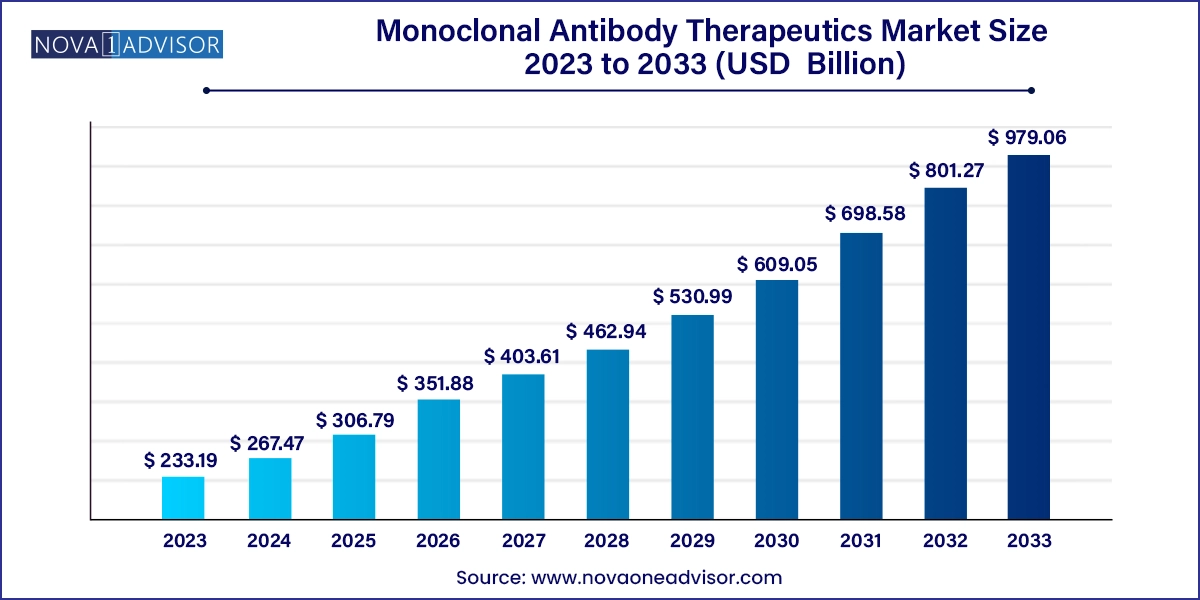

Monoclonal Antibody Therapeutics Market Size and Growth

The global monoclonal antibody therapeutics market size was valued at USD 233.19 billion in 2023 and is anticipated to reach around USD 919.06 billion by 2033, growing at a CAGR of 14.7% from 2024 to 2033.

Monoclonal Antibody Therapeutics Market Key Takeaways

- North America accounted for the largest share of the monoclonal antibody therapeutics industry in 2023

- In-Vitro segment held a dominant share in production method segment in the monoclonal antibody therapeutics industry

- Human segment held a dominant share in source segment in the monoclonal antibody therapeutics industry

- Oncology is likely to grow at significant CAGR in the monoclonal antibody therapeutics industry

- The hospitals segment of the monoclonal antibody therapeutics industry is expected to register fastest growth during the forecast period.

Market Overview

The global monoclonal antibody (mAb) therapeutics market represents one of the most dynamic segments in modern medicine, revolutionizing the management of chronic diseases, autoimmune disorders, and particularly cancer. Monoclonal antibodies, which are laboratory-produced molecules designed to mimic the immune system’s ability to fight off harmful pathogens, have reshaped drug discovery and delivery paradigms due to their specificity, efficacy, and safety profiles.

The application of monoclonal antibodies spans a wide range of therapeutic areas including oncology, hematology, immunology, and ophthalmology, among others. Their capacity to precisely target antigens on diseased cells or tissues while minimizing off-target effects has positioned them as front-line therapies in conditions like rheumatoid arthritis, multiple sclerosis, breast cancer, non-Hodgkin's lymphoma, and age-related macular degeneration.

From blockbuster drugs like Adalimumab (Humira) and Trastuzumab (Herceptin) to next-generation immune checkpoint inhibitors like Nivolumab (Opdivo) and Pembrolizumab (Keytruda), monoclonal antibody therapeutics have emerged as critical tools in both chronic and rare disease management. The emergence of bispecific antibodies and antibody-drug conjugates (ADCs) further underscores the potential of this class of biologics.

With global health systems increasingly favoring targeted therapies that deliver superior outcomes with lower systemic toxicity, monoclonal antibody therapies are positioned to maintain robust demand in the years ahead. Furthermore, advances in recombinant DNA technology, bioprocessing, and regulatory frameworks are accelerating their development and commercial rollout.

Major Trends in the Market

-

Growth of biosimilar monoclonal antibodies: Patent expirations of blockbuster biologics are fostering a surge in biosimilar development, improving affordability and access.

-

Rising focus on oncology and immunotherapy: Cancer remains the largest and fastest-growing therapy area, particularly with checkpoint inhibitors and personalized mAb regimens.

-

Emergence of subcutaneous and self-administration formats: Convenience and patient compliance are driving innovations in mAb delivery routes.

-

Expanding pipeline of bispecific and trispecific antibodies: Multi-targeted mAbs are evolving rapidly, offering greater efficacy in complex diseases.

-

Increased adoption of in-vitro production platforms: Scalable, cell-based production systems are preferred for better control, efficiency, and lower contamination risk.

-

Collaborations between biotech and pharma giants: Licensing agreements and co-development initiatives are fueling faster innovation and broader distribution.

-

Use of AI and bioinformatics in antibody discovery: Computational platforms are reducing time-to-market by predicting structures and antigen affinity.

-

Government and private funding in rare disease treatments: Financial incentives and orphan drug designations are fostering innovation in niche therapeutic areas.

Monoclonal Antibody Therapeutics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 267.47 Billion |

| Market Size by 2033 |

USD 919.06 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.7% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Production Method, By Sources, By Route of Administration, By Therapy Area, By End User , By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd (Switzerland), Abbvie Inc. (US), Johnson & Johnson Services, Inc. (US), Merck & Co., Inc. (US), Bristol Myers Squibb Company (US), AstraZeneca (UK), Sanofi (France), Novartis AG (Switzerland), Amgen Inc. (US), Takeda Pharmaceutical Company Limited (Japan), GSK plc. (UK), Eli Lilly and Company (US), Regeneron Pharmaceuticals Inc. (US), Biogen (US), UCB S.A. (Belgium), Boehringer Ingelheim International GmbH (Germany), Y-mAbs Therapeutics Inc. (US), Teva Pharmaceutical Industries Ltd. (Israel) and among others. |

Market Driver: Rising Prevalence of Chronic and Autoimmune Diseases

One of the strongest drivers of the monoclonal antibody therapeutics market is the escalating global prevalence of chronic and autoimmune diseases. Conditions like Crohn’s disease, rheumatoid arthritis, psoriasis, multiple sclerosis, and lupus affect millions worldwide, often requiring long-term, targeted treatment. Unlike traditional immunosuppressants, monoclonal antibodies offer disease-modifying action with reduced side effects, making them the therapy of choice in many clinical guidelines.

In the U.S. alone, it’s estimated that over 24 million people live with autoimmune conditions. Drugs like Adalimumab (anti-TNF) and Tocilizumab (IL-6 receptor blocker) have revolutionized disease management in these populations. Their ability to directly inhibit inflammatory pathways has translated into improved patient outcomes, reduced hospitalization rates, and better quality of life. As diagnostic capabilities improve and healthcare systems adopt value-based care models, mAbs are poised to gain even more traction.

Market Restraint: High Cost and Accessibility Issues

Despite their efficacy, monoclonal antibody therapeutics come with a significant cost burden, both for healthcare systems and patients. The complex and resource-intensive nature of biologics manufacturing—requiring specialized cell lines, bioreactors, and strict quality controls—contributes to high prices. Moreover, logistical challenges in cold chain distribution and administration (often intravenous) further add to the cost.

In regions with underdeveloped healthcare infrastructure or limited insurance coverage, access to monoclonal antibody therapies remains restricted. This issue is exacerbated in low- and middle-income countries, where even generic medications struggle to reach populations consistently. Even in developed economies, insurers may limit access or require extensive prior authorization for high-cost mAb therapies. This economic disparity continues to pose a significant barrier to widespread adoption.

Market Opportunity: Rapid Expansion of Oncology mAb Applications

A transformative opportunity for the monoclonal antibody therapeutics market lies in the oncology segment. Monoclonal antibodies have changed the landscape of cancer treatment by providing precision-targeted therapies that attack tumors while sparing healthy tissues. From HER2-positive breast cancer to advanced lung, kidney, and skin cancers, mAbs are integrated into treatment regimens as monotherapy or in combination with chemotherapy and radiation.

Checkpoint inhibitors like Keytruda (Pembrolizumab) and Opdivo (Nivolumab) have shown unprecedented results in metastatic melanoma and non-small cell lung cancer. Their success is prompting further research into combining mAbs with cell therapies, vaccines, and small-molecule inhibitors. With the global oncology burden projected to exceed 29 million cases by 2040, the scope for monoclonal antibody innovation in this space is immense. The rise of biomarkers and companion diagnostics will further personalize mAb treatment strategies, unlocking a new wave of opportunities.

Segmental Analysis

By Production Method

In-vitro production methods dominate the monoclonal antibody therapeutics market, owing to their scalability, safety, and compatibility with regulatory standards. These methods, primarily based on recombinant DNA technology and cell culture systems (e.g., CHO cells), allow precise control over antibody characteristics like glycosylation patterns and affinity. Leading manufacturers prefer in-vitro systems to produce large volumes of high-purity mAbs needed for chronic treatments. Their usage is also safer, eliminating animal welfare concerns associated with in-vivo methods. Moreover, in-vitro platforms support faster turnaround for clinical trials and commercial scale-ups, making them indispensable to pipeline efficiency.

In-vivo production, while largely phased out from mainstream manufacturing, still holds relevance in research environments and for developing niche or orphan biologics. Some animal-derived antibody production methods remain in use for rare diseases or for producing polyclonal antibodies, which may be used in diagnostics or emergency therapeutics. Despite being slower and less controlled, in-vivo methods are sometimes seen in early-stage research, especially where cost or infrastructure limits access to bioreactors.

By Sources

Humanized monoclonal antibodies continue to dominate the market due to their balance between efficacy and reduced immunogenicity. Developed through genetic engineering techniques that graft non-human antigen-binding regions onto human antibody frameworks, these mAbs significantly reduce the risk of adverse immune responses. Medications like Trastuzumab and Bevacizumab have set the benchmark in cancer and ophthalmology respectively, showcasing the therapeutic utility of humanized antibodies.

Fully human monoclonal antibodies are the fastest-growing source segment, supported by advancements in transgenic animal models and phage display technologies. Drugs like Adalimumab (Humira), the world's best-selling drug for years, exemplify this class. Their lack of foreign protein segments minimizes allergic reactions and anti-drug antibody (ADA) formation, which is especially valuable in chronic treatments. With evolving regulatory support and robust clinical pipelines, the transition toward fully human mAbs is accelerating.

By Route of Administration

Intravenous (IV) administration dominates the monoclonal antibody therapeutics market, especially in hospital-based settings and for acute care patients. IV delivery ensures rapid bioavailability and precise dosing, making it the preferred method in oncology, hematology, and intensive care units. Many first-generation mAbs were formulated for IV use due to stability constraints and because healthcare professionals could monitor for immediate allergic reactions.

Subcutaneous (SC) delivery is the fastest-growing route of administration due to increasing patient preference for home-based therapy and convenience. SC formulations reduce clinic visits, lower infusion times, and improve patient compliance—especially important in autoimmune diseases. Products like Dupilumab for atopic dermatitis and Benralizumab for asthma are leading the shift toward SC injections. Drug-device combinations, such as prefilled syringes and auto-injectors, are being adopted rapidly, particularly in Western markets.

By Therapy Area

Oncology remains the dominant therapeutic area, accounting for the largest revenue share in the monoclonal antibody therapeutics market. mAbs are used extensively in the treatment of breast, lung, colorectal, and hematologic malignancies. Drugs like Rituximab (CD20-targeted) and Trastuzumab (HER2-targeted) are widely used, while newer agents like Atezolizumab and Durvalumab expand treatment options via immune checkpoint pathways. As personalized oncology expands through biomarker-guided treatment protocols, the demand for novel mAbs will continue to climb.

Ophthalmology is emerging as the fastest-growing therapy area, largely driven by aging populations and increasing cases of macular degeneration and diabetic retinopathy. Anti-VEGF monoclonal antibodies like Ranibizumab (Lucentis) and Bevacizumab (used off-label) have redefined standard-of-care treatment in retinal diseases. Newer, longer-acting formulations are being developed to reduce injection frequency and improve patient adherence.

By End User

Hospitals dominate the end-user segment as mAb therapies often require clinical supervision during administration, especially for IV infusions. Hospital settings offer the infrastructure needed for cold storage, controlled infusion rates, and immediate management of hypersensitivity reactions. Oncology departments, transplant centers, and rheumatology clinics within hospitals are key usage points for monoclonal antibodies.

Long-term care facilities, while smaller in market share, are seeing a steady rise in monoclonal antibody administration due to aging populations and increased prevalence of chronic conditions like Alzheimer’s and arthritis. SC mAbs suitable for at-home or community-based care are enabling this shift. These facilities also benefit from mAbs that prevent hospital readmissions by maintaining disease control in elderly patients with multiple comorbidities.

Regional Analysis

North America Dominates the Global Market

North America particularly the United States dominates the monoclonal antibody therapeutics market, accounting for the largest share in terms of revenue and clinical activity. The region benefits from a strong pharmaceutical infrastructure, leading biotech firms, robust regulatory frameworks, and a high incidence of chronic and oncologic diseases. The U.S. FDA has been at the forefront of fast-tracking mAb approvals under initiatives like Breakthrough Therapy Designation. Companies like Amgen, AbbVie, and Bristol-Myers Squibb lead the way in developing blockbuster biologics. Additionally, widespread insurance coverage and a culture of early biologics adoption contribute to market dominance.

Asia-Pacific is the Fastest Growing Region

Asia-Pacific is emerging as the fastest-growing region due to rising healthcare investments, improving access to biologics, and increasing prevalence of cancer and autoimmune diseases. Countries like China, Japan, and India are actively expanding their biopharma manufacturing capacity and regulatory pathways to accommodate monoclonal antibody production. China's local mAb innovation is supported by companies like Innovent Biologics and Junshi Biosciences, which are gaining global attention for oncology and COVID-19 antibody therapies. As healthcare infrastructure improves and biologic approvals increase, the region is poised to be a critical growth engine for global mAb sales.

Monoclonal Antibody Therapeutics Market Top Key Companies:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbvie Inc. (US)

- Johnson & Johnson Services, Inc. (US)

- Merck & Co., Inc. (US)

- Bristol Myers Squibb Company (US)

- AstraZeneca (UK)

- Sanofi (France)

- Novartis AG (Switzerland)

- Amgen Inc. (US)

- Takeda Pharmaceutical Company Limited (Japan)

- GSK plc. (UK)

- Eli Lilly and Company (US)

- Regeneron Pharmaceuticals Inc. (US)

- Biogen (US)

- UCB S.A. (Belgium)

- Boehringer Ingelheim International GmbH (Germany)

- Y-mAbs Therapeutics Inc. (US)

- Teva Pharmaceutical Industries Ltd. (Israel) and among others.

Monoclonal Antibody Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Monoclonal Antibody Therapeutics market.

By Production Method

By Sources

- Human

- Humanized

- Chimeric

- Other Sources

By Route of Administration

- Intravenous

- Subcutaneous

- Other Route of Administration

By Therapy Area

- Autoimmune & Inflammatory Disorders

- Oncology

- Hematology

- Ophthalmology

- Other Therapy Areas

By End User

- Hospitals

- Long-term Care Facilities

- Other End Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)