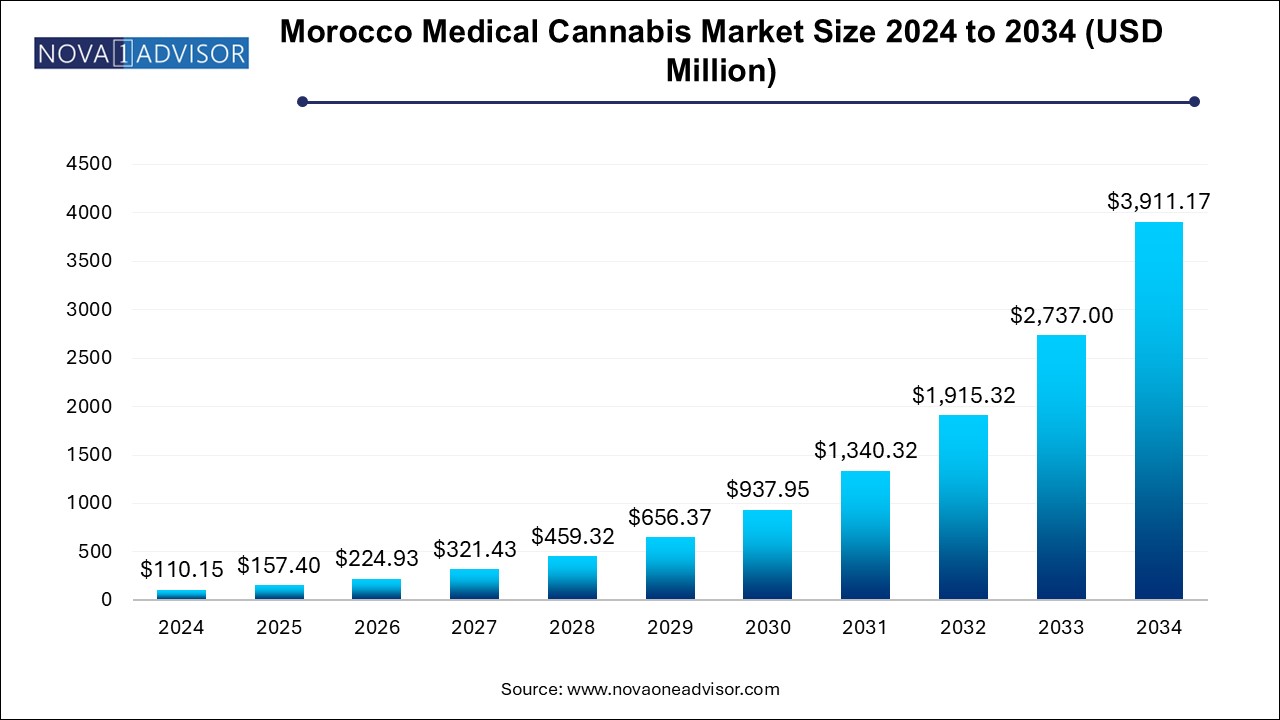

The Morocco medical cannabis market size was exhibited at USD 157.40 million in 2024 and is projected to hit around USD 3,911.17 million by 2034, growing at a CAGR of 42.9% during the forecast period 2024 to 2034.

The Morocco medical cannabis market is undergoing a transformative shift as the country positions itself at the intersection of public health innovation and agricultural reform. Historically known as one of the world’s largest producers of illicit cannabis, Morocco is now turning the page by formalizing a regulated medical cannabis industry aimed at harnessing the plant’s therapeutic potential. Following the Moroccan government’s landmark legislation in 2021 to legalize cannabis for medical, cosmetic, and industrial purposes, a regulated framework has emerged to develop this sector under strict licensing and export-oriented objectives.

This evolving market is driven by both domestic reform and international demand. With growing global acceptance of cannabis as a therapeutic agent—particularly for managing chronic pain, neurological disorders, and mental health conditions—Morocco has recognized the dual benefits of improving public health while stimulating rural development in its historically marginalized Rif region. The newly formed National Agency for the Regulation of Cannabis-Related Activities (ANRAC) has already begun granting cultivation and transformation licenses to cooperatives and industrial partners, primarily targeting export to Europe and beyond.

Although still in its early stages, the Moroccan medical cannabis market is benefiting from favorable agricultural conditions, international investment interest, and rising awareness among healthcare providers and patients. As regulatory frameworks continue to mature and infrastructure expands to support GMP-compliant cultivation and extraction, Morocco is poised to become a regional leader in the global medical cannabis economy. Furthermore, partnerships between the government, research institutions, and private companies are expected to unlock innovation in cannabinoid science, cultivation techniques, and pharmaceutical-grade cannabis formulations.

Formalization of cannabis cultivation under state regulation, particularly targeting regions like Al Hoceima, Chefchaouen, and Taounate.

Growing interest from European pharmaceutical companies in sourcing Moroccan medical cannabis for CBD extraction and formulation.

Emergence of local cooperatives receiving cultivation licenses, enabling legal and sustainable income for smallholder farmers.

Adoption of EU GMP standards in cultivation and processing facilities to ensure export-readiness.

Rise of cannabis-based therapies for chronic illnesses, including cancer, epilepsy, and multiple sclerosis, among Moroccan patients.

Expansion of cannabis research partnerships between Moroccan universities and global biotech firms.

Increased public and healthcare provider awareness regarding the benefits of medical cannabis, reducing stigma.

Investment in oil and tincture production technologies for sublingual, topical, and ingestible medical cannabis applications.

Strengthening of Morocco’s export ambitions, with discussions to establish trade agreements with European Union countries.

| Report Coverage | Details |

| Market Size in 2025 | USD 157.40 Million |

| Market Size by 2034 | USD 3,911.17 Million |

| Growth Rate From 2024 to 2034 | CAGR of 42.9% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Bio Cannat; PharmaCielo.com.; RIAD ZITOUN |

The most significant driver of the Moroccan medical cannabis market is the legalization of cannabis for medical and therapeutic use in 2021, followed by the establishment of a structured regulatory framework under Law 13-21. This legislation marked a historic shift in national drug policy, transitioning from prohibition to controlled usage, cultivation, and commercialization of cannabis-derived products for medical purposes. The government's proactive stance in setting up a licensing process, along with the creation of ANRAC (L’Agence Nationale de Réglementation des Activités liées au Cannabis), has laid the groundwork for a transparent and scalable industry.

This regulatory structure provides legal certainty for investors, cultivators, and pharmaceutical developers, creating a foundation for both domestic development and international trade. By prioritizing medical cannabis, Morocco has aligned its reform with public health goals and economic diversification efforts. The emphasis on exporting to high-demand European markets—where medical cannabis frameworks are already mature—adds further commercial viability to Morocco’s strategy. This government-backed legalization, paired with abundant agricultural resources and skilled labor, positions Morocco as a key emerging player in the global cannabis supply chain.

Despite regulatory advances, a key restraint in the Morocco medical cannabis market is the limited domestic infrastructure for cannabis-based healthcare. While legalization supports export and controlled domestic use, the availability of specialized doctors, pharmacists, and clinics equipped to prescribe and distribute medical cannabis remains minimal. There is a considerable gap in training and certification programs for healthcare professionals, leading to hesitation in prescribing cannabinoid-based therapies.

Moreover, public understanding of cannabis as a legitimate medical treatment is still evolving, and residual stigma may slow domestic market uptake. Additionally, the Moroccan pharmaceutical sector is still in the early stages of adapting to cannabis formulation and distribution protocols. Without strong integration into national healthcare systems, including prescription pathways, reimbursement schemes, and clinical research databases, the domestic market could remain underdeveloped in the near term, with most commercial activity focused on exports.

A powerful opportunity lies in establishing Morocco as a low-cost, high-quality global export hub for medical cannabis, particularly for Europe. Morocco offers a unique blend of factors—climate suitability, long-established cannabis cultivation know-how, proximity to European markets, and government support—that position it as a strategic supplier of pharmaceutical-grade cannabis flower, oil, and isolates.

Countries like Germany, Italy, and the Netherlands have legalized medical cannabis and rely heavily on imports due to limited domestic production. Morocco’s potential to offer EU GMP-compliant cannabis at competitive prices is attracting the attention of foreign investors and importers. With the right infrastructure and quality controls, Morocco can become a reliable sourcing partner for CBD oils, tinctures, and full-spectrum extracts. In addition to supplying raw materials, Morocco could grow into a center for cannabis research, extraction technology, and white-label manufacturing for international brands.

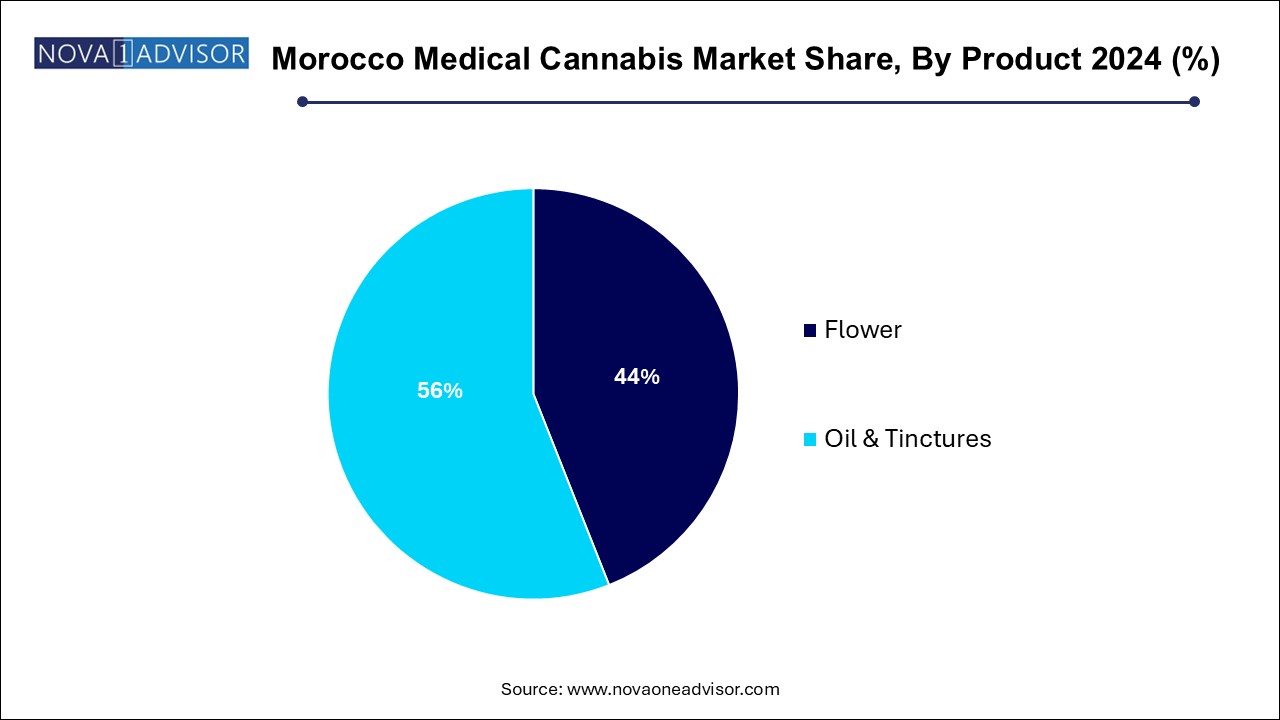

By product, the flower segment held the largest market share in 2024 and is expected to grow at the fastest CAGR of 44.0% over the forecast period. Moroccan cultivators, especially in the Rif mountains, have historically grown cannabis for resin (hashish) production, and the transition to regulated flower cultivation has been relatively seamless. As the initial regulatory licenses favor bulk cultivation and export of cannabis flower for processing abroad, this segment is expected to maintain a strong presence in the early years of the legal market.

Oil and tinctures are emerging as the fastest growing product segment, especially for medical use due to their standardized dosing, patient convenience, and versatility. Unlike raw flower, cannabis oils and tinctures are more suitable for sublingual and ingestible administration, allowing for precise control over cannabinoid delivery. These products are preferred for treating chronic conditions such as epilepsy, anxiety, and multiple sclerosis. As Morocco develops domestic processing capabilities and aligns with EU Good Manufacturing Practices (GMP), oil and tincture production is expected to grow substantially to serve both domestic prescriptions and export markets.

By application, the chronic pain held largest market share of 23.9% in 2024. Medical cannabis has shown consistent efficacy in alleviating chronic pain associated with conditions like arthritis, cancer, and back disorders, making it a preferred option where conventional analgesics or opioids are insufficient. This application is also the most likely to receive physician endorsement early in the adoption curve, as evidence from international clinical trials continues to accumulate.

The Tourette's syndrome segment is expected to grow at the fastest CAGR over the forecast period, driven by compelling success stories and growing acceptance of cannabinoid-based therapies for refractory epilepsy. Cannabidiol (CBD), in particular, has been approved in multiple countries for use in children with treatment-resistant epilepsy, such as Dravet syndrome and Lennox-Gastaut syndrome. Morocco's medical sector is gradually acknowledging these benefits, especially as foreign case studies and WHO recommendations influence domestic policy and prescribing behavior. Other neurodegenerative and mental health-related conditions like PTSD and multiple sclerosis are also contributing to accelerated growth.

February 2025 – ANRAC (National Cannabis Agency) announced the issuance of 20 new cultivation and processing licenses in the Chefchaouen and Taounate regions, expanding Morocco’s regulated cannabis farming footprint.

November 2024 – Phytocann Maroc, a joint venture between a Swiss pharmaceutical firm and a Moroccan cooperative, launched its first EU GMP-compliant extraction facility targeting CBD oil exports to Germany and Italy.

August 2024 – The Moroccan Ministry of Health partnered with Rabat Medical University to initiate the country’s first clinical trial assessing cannabis oil's efficacy in managing multiple sclerosis and neuropathic pain.

May 2024 – Cannabist International signed an MoU with the Moroccan government to develop a $10 million cannabis research and processing campus in Al Hoceima, with operations scheduled to begin in 2026.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the morocco medical cannabis market

By Product

By Application