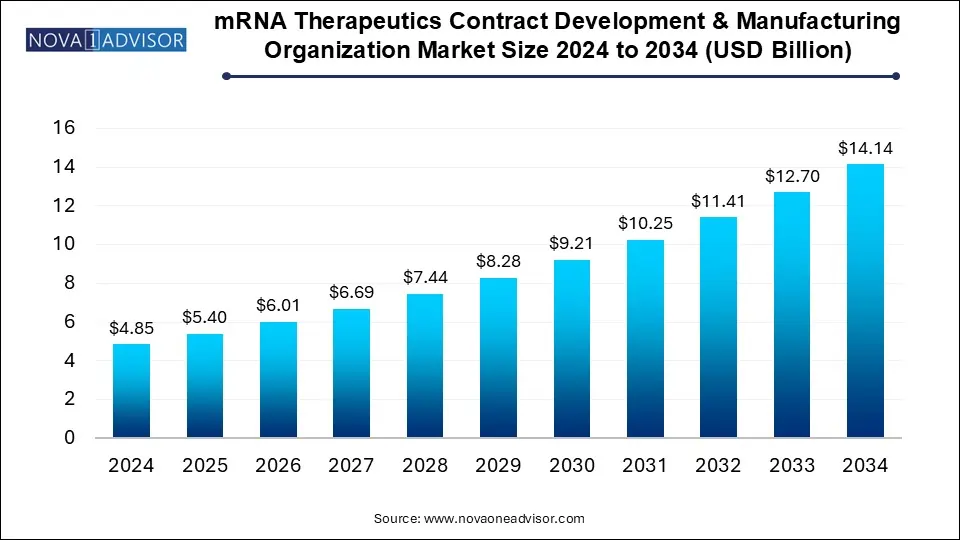

The mRNA therapeutics contract development & manufacturing organization market size was exhibited at USD 4.85 billion in 2024 and is projected to hit around USD 14.14 billion by 2034, growing at a CAGR of 11.29% during the forecast period 2025 to 2034.

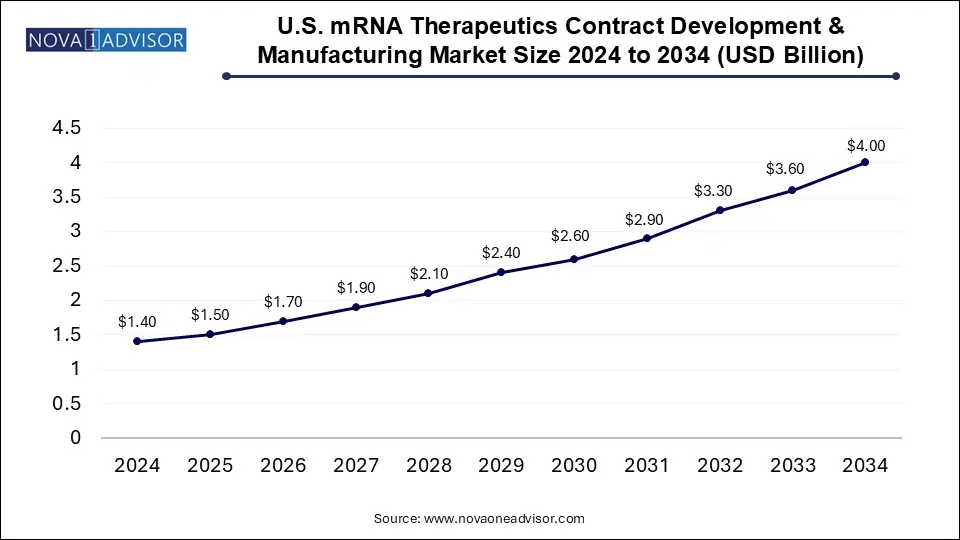

The U.S. mRNA therapeutics contract development & manufacturing organization market size reached USD 1.4 billion in 2024 and is anticipated to be worth around USD 4.0 billion by 2034, poised to grow at a CAGR of 10.01% from 2025 to 2034.

North America leads the global CDMO market for mRNA therapeutics due to its mature biotechnology infrastructure, robust regulatory framework, and significant investment activity. The region boasts a concentration of mRNA pioneers, experienced contract manufacturers, and integrated supply chain networks. In addition, federal initiatives encouraging vaccine stockpiling, health security, and next-gen therapies continue to drive CDMO demand.

Particularly in the U.S., large-scale CDMOs are expanding their facilities with flexible, multi-product capabilities designed to accommodate the evolving needs of mRNA innovators.

Asia Pacific – The Fastest Growing Region

Asia Pacific is rapidly becoming the world’s fastest-growing hub for mRNA CDMO activity. This surge is propelled by national biotech missions, foreign investment, and the emergence of regional pharmaceutical giants seeking self-sufficiency. Countries such as China, South Korea, India, and Singapore are investing heavily in biomanufacturing infrastructure to reduce dependency on Western supply chains.

In addition to local startups, global CDMOs are entering joint ventures or setting up facilities in Asia to tap into skilled talent pools, cost advantages, and favorable regulatory landscapes. This expansion makes the region a rising force in the global CDMO hierarchy.

The mRNA therapeutics CDMO market has emerged as a cornerstone of next-generation biotechnology, catalyzed by the paradigm shift in drug development and global health preparedness. While the initial momentum was largely driven by the urgent need for rapid-response vaccines during global health crises, the broader potential of messenger RNA (mRNA) technology has extended well beyond infectious diseases. From targeted cancer treatments and protein replacement therapies to metabolic and cardiovascular disease interventions, mRNA therapeutics represent a flexible, scalable, and customizable treatment modality.

As the biotechnology and pharmaceutical sectors race to bring mRNA-based therapies into clinical and commercial reality, Contract Development and Manufacturing Organizations (CDMOs) have taken on a central role. These entities provide a combination of specialized services including nucleic acid synthesis, lipid nanoparticle formulation, aseptic fill-finish, analytical testing, and regulatory support. Their infrastructure, experience, and agility make them critical partners in translating laboratory innovations into safe, effective, and commercially viable therapies.

The U.S., Europe, and Asia Pacific have established themselves as hubs for mRNA therapeutic research and production. However, as geopolitical stability, intellectual property policies, and logistics gain importance, CDMOs are being compelled to expand across emerging regions to establish localized manufacturing footprints. The demand for flexible, small-batch capabilities alongside large-scale manufacturing has further increased the complexity and opportunity within this sector.

Diversification of mRNA Applications Beyond Vaccines

There is a strong pivot toward developing mRNA-based therapeutics for oncology, rare genetic conditions, and regenerative medicine.

Surge in Personalized Medicine and mRNA Customization

Increasing demand for individualized cancer immunotherapies and patient-specific treatments is accelerating adoption of bespoke mRNA synthesis services.

Miniaturization and Modular CDMO Facilities

CDMOs are investing in smaller, modular production units that allow faster batch switching and localized production capabilities.

Advancement in Lipid Nanoparticle (LNP) Delivery Systems

Continuous innovation in LNP technology is helping improve delivery efficiency and stability of mRNA drugs.

Hybrid Models of CDMO Engagement

Strategic alliances and long-term co-development agreements are replacing traditional outsourcing models to reduce development time and cost.

Academic and Government Partnerships on the Rise

Increased involvement of public health institutions and academic labs in mRNA research has led to public-private CDMO partnerships.

Digitalization and Real-Time Quality Control

Integration of AI, digital twins, and real-time analytics is streamlining quality assurance and accelerating compliance workflows.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.40 Billion |

| Market Size by 2034 | USD 14.14 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 11.29% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Application, Indication, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Danaher (Aldevron); Biomay AG; Bio-Synthesis, Inc.; eTheRNA; Kaneka Eurogentec S.A.; TriLink BioTechnologies; ApexBio Technology; BioNTech SE; BioCina; Lonza; Recipharm AB; Novo Holdings (Catalent, Inc.); Samsung Biologics |

One of the strongest driving forces in the mRNA CDMO market is the ongoing wave of innovation in therapeutic modalities. mRNA therapeutics have disrupted the traditional pharmaceutical pipeline by eliminating the need to directly produce proteins or antigens. Instead, mRNA acts as an instruction set for the body to manufacture its own therapeutic response, drastically simplifying the development model and reducing time to clinic.

This has opened the door for agile and adaptive development across a spectrum of conditions, ranging from infectious diseases and rare genetic disorders to oncology and neurodegeneration. The intrinsic programmability of mRNA enables researchers to quickly develop and test a new sequence, bypassing complex and lengthy protein engineering. CDMOs benefit from this agility by offering scalable, adaptable manufacturing services to both established biopharma players and emerging biotech innovators, fueling the growth of this market.

Despite the remarkable flexibility of mRNA technology, the actual manufacturing process is highly complex, posing a significant challenge for both developers and CDMOs. Each step from nucleic acid synthesis and purification to encapsulation in lipid nanoparticles and fill-finish processes must meet strict sterility and safety standards. Moreover, maintaining RNA integrity throughout the process is a technical hurdle, due to its inherent instability.

Regulatory expectations for mRNA therapies are still evolving. While fast-tracked approvals during public health emergencies helped the technology gain visibility, non-vaccine mRNA therapeutics now face higher regulatory scrutiny. CDMOs must stay abreast of evolving global and country-specific compliance mandates, further complicating timelines and resource allocation. Companies that cannot align with these technical and quality requirements may face significant setbacks, creating bottlenecks in the market.

As mRNA gains ground as a flexible platform, one of the most promising opportunities lies in its application to genetic and metabolic diseases. Traditionally, conditions like cystic fibrosis, phenylketonuria, and Gaucher disease have had limited or no effective treatments due to their complexity and genetic underpinnings. With mRNA, it is now possible to program cells to produce the missing or defective proteins directly, offering a therapeutic pathway without altering the DNA itself.

This ability to intervene without permanent genetic modification holds vast clinical and ethical appeal. As research moves from preclinical to early-phase trials, biotech companies are increasingly collaborating with CDMOs to ensure early-stage scalability, quality assurance, and regulatory alignment. Companies that invest in platform capabilities for rare and metabolic disease therapeutics stand to gain early-mover advantage in a high-value, underserved market.

Viral Vaccines Continue to Dominate the Application Segment

Following the widespread deployment of mRNA vaccines in global immunization efforts, this application remains the largest in the CDMO market. The ability to rapidly generate vaccine candidates using synthetic processes has established mRNA as a preferred choice in pandemic preparedness. Moreover, researchers are now exploring seasonal mRNA vaccines for influenza and other respiratory illnesses.

The viral vaccine application benefits from high-volume demand, stable regulatory frameworks, and a well-established cold-chain infrastructure. CDMOs that invested early in mRNA vaccine production facilities continue to receive major contracts for formulation, fill-finish, and distribution support.

Cancer Immunotherapies Are the Fastest Growing Application Segment

The application of mRNA in oncology, especially in personalized cancer vaccines, is experiencing explosive growth. These therapies are customized to encode tumor-specific neoantigens, allowing for the training of a patient’s immune system to recognize and destroy malignant cells. Unlike traditional cancer therapies, mRNA immunotherapies can be created relatively quickly and with reduced toxicity.

CDMOs supporting this segment are often required to deliver flexible batch sizes, rapid sequence turnaround, and high-quality lipid nanoparticle delivery systems. As clinical evidence grows, demand for CDMO partners in this space will intensify, particularly among mid-sized biotech innovators looking for modular, agile production support.

Infectious Diseases Dominate the Indication Segment

The ability of mRNA to address rapidly evolving infectious threats has been proven beyond doubt. The need for globally distributed, fast-response mRNA platforms has encouraged major CDMO investment into high-throughput production lines specifically designed for infectious disease applications.

From endemic diseases to bioterrorism preparedness, CDMOs are seen as strategic national assets capable of providing scalable response capabilities. The maturity of this indication — both commercially and in public awareness — ensures that infectious diseases will continue to dominate the CDMO market for the foreseeable future.

Metabolic and Genetic Diseases are the Fastest Growing Indication Segment

Advances in molecular diagnostics have enabled precise identification of mutations responsible for hundreds of rare genetic diseases. mRNA therapeutics offer the potential to bypass faulty genes and temporarily restore function by expressing corrective proteins. This transient, non-integrative approach holds promise for diseases with limited or no therapeutic options.

CDMOs serving this niche must support highly individualized pipelines, rapid production of novel sequences, and stringent purification standards. As clinical trials gain traction, these CDMOs are positioning themselves at the frontier of a high-growth, high-impact therapeutic area.

Biotech Companies Dominate the End-use Segment

The majority of innovation in mRNA therapeutics is being driven by small to mid-sized biotech firms. These companies typically operate lean R&D teams and rely on CDMO partners for everything from synthesis to GMP-scale production. With venture funding and grant support, these biotechs represent a constant source of demand for development services.

CDMOs that can offer consultative partnerships advising on formulation, process optimization, and regulatory strategy are often the preferred choice among biotech clients looking to maximize speed and efficiency.

Government and Academic Institutes are the Fastest Growing End-Users

Universities, public research centers, and national health organizations are increasingly entering the mRNA space, developing preclinical pipelines for public health priorities and neglected diseases. These institutions seek partnerships with CDMOs to translate academic work into scalable clinical assets.

Public-sector CDMO contracts also provide funding stability and reputational value for private companies, making this a rapidly growing market segment.

January 2025 – GenPath Biologics broke ground on a $400M facility in Texas dedicated to mRNA therapeutic manufacturing, featuring modular cleanrooms and AI-driven quality control systems.

November 2024 – BioVerse CDMO announced a partnership with a Canadian cancer research institute to co-develop and manufacture personalized mRNA cancer vaccines targeting glioblastoma.

October 2024 – BioSmart Korea expanded its GMP-compliant plant in Incheon to include lipid nanoparticle production suites aimed at enabling smaller biotech clients across Southeast Asia.

August 2024 – EpiScribe Therapeutics and MedBridge announced a long-term co-manufacturing deal to supply mRNA therapies for rare lysosomal storage diseases, with production based in Ireland.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the mRNA therapeutics contract development & manufacturing organization market

By Application

By Indication

By End-use

By Regional