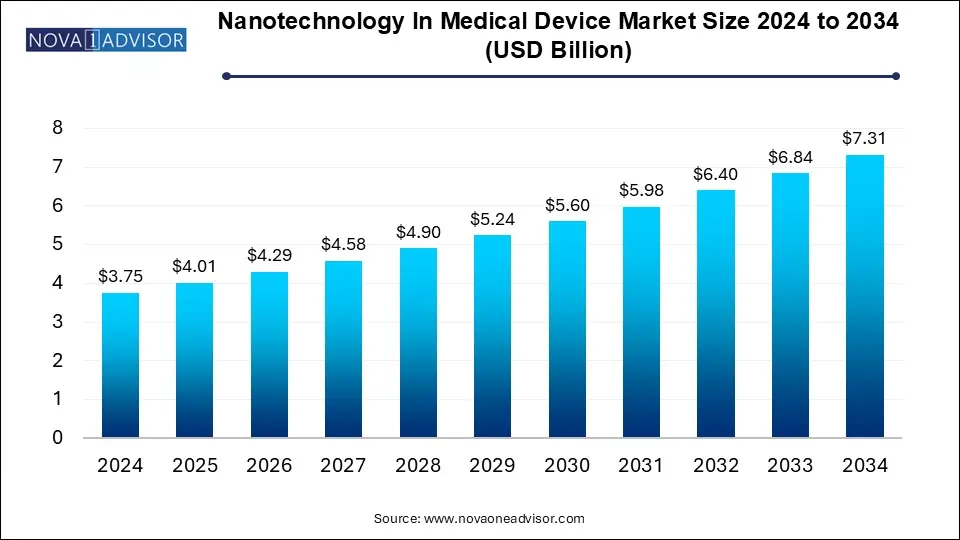

The nanotechnology in medical devices market size was exhibited at USD 3.75 billion in 2024 and is projected to hit around USD 7.31 billion by 2034, growing at a CAGR of 6.9% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.01 Billion |

| Market Size by 2034 | USD 7.31 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Smith & Nephew PLC; Abbott Laboratories; 3M; Zimmer Biomet; Stryker; Starkey; Dentsply Sirona; Boston Scientific Corporation; LivaNova PLC; Cochlear Ltd |

This growth is propelled by several pivotal factors. Nanotechnology facilitates the creation of highly precise and targeted medical treatments. Engineered at the nanoscale, materials can interact with biological systems at the molecular level, enabling exact drug delivery and improving therapeutic outcomes significantly.

This precision is particularly critical in addressing intricate diseases such as cancer, where targeted delivery minimizes systemic side effects, enhances treatment efficacy, and potentially improves patient outcomes. As nanotechnology continues to evolve, its applications promise to revolutionize the landscape of medical treatment by providing tailored therapies that offer greater effectiveness and reduced adverse effects, marking a transformative shift in healthcare delivery and patient care standards.

Nanomaterials like quantum dots and nanosensors offer high-resolution imaging of biological structures and processes, providing detailed and precise visualization. This enhanced imaging capability is crucial for the early detection of diseases, allowing for timely and accurate diagnosis. Similarly, it facilitates personalized treatment planning by providing comprehensive insights into individual patient conditions. As a result, the use of nanotechnology in diagnostics contributes to better patient outcomes, as early detection and personalized treatment plans lead to more effective interventions and improved overall healthcare management.

Moreover, nanotechnology promotes the development of smart medical devices that can actively monitor physiological parameters and deliver therapies in real-time. Nanosensors embedded in devices can detect biomarkers indicative of disease progression or treatment response, allowing for timely intervention and personalized medicine approaches. In January 2022, Pfizer Inc. and Acuitas Therapeutics, a company specializing in lipid nanoparticle delivery systems for mRNA-based therapeutics, announced a Development and Option agreement. This agreement grants Pfizer the non-exclusive option to license Acuitas' LNP technology for therapeutic development.

Furthermore, the scalability and cost-effectiveness of nanotechnology are driving its adoption in medical device manufacturing. Advances in nanofabrication techniques have lowered production costs while improving device performance and reliability. This scalability makes nanotechnology accessible to a broader range of healthcare providers and patients, fostering market expansion.

The implantable devices segment held the largest share of 53.8% in 2024, due to advancements in technology and research. For instance, a January 2024 report by MDPI highlights how nanomedicine is offering groundbreaking solutions for cardiovascular diseases in both adults and children. This innovative approach has the potential to revolutionize cardiac care, enhancing treatments for myocardial ischemia, improving imaging techniques, and addressing congenital heart conditions. The integration of nanotechnology in cardiac rhythm management devices is poised to transform the field, providing more precise and effective therapies. As research progresses, these advancements are expected to drive further market growth, offering new hope and improved outcomes for patients with cardiovascular diseases.

The other segment is projected to grow at the fastest CAGR from 2025 to 2034. This segment benefits from advancements in diagnostic tools, regenerative medicine, and targeted drug delivery systems. Innovations such as nanoscale biosensors, nanorobots for precision surgery, and nanoparticle-based therapies are driving this expansion. As research and development in these fields continue to progress, this segment is poised for substantial market growth, offering novel solutions and enhancing the overall effectiveness of medical treatments. This trend underscores the broadening scope and impact of nanotechnology in healthcare.

The orthopedics segments held the largest share of 28.0% in 2024, driven by the rising prevalence of orthopedic diseases. Nanotechnology is enhancing the development of orthopedic implants, making them more durable, biocompatible, and effective in promoting bone healing. According to a WHO report from July 2022, significant contributors to the global burden of musculoskeletal conditions include fractures, affecting 440 million peopleworldwide Conditions like osteoarthritis and fractures are becoming more common, increasing the demand for advanced orthopedic solutions. As research progresses, nanotechnology's role in improving implant performance and patient outcomes is expanding, contributing significantly to market growth in this segment.

The dentistry segment is expected to grow at a significant CAGR from 2025 to 2034. Nanotechnology enhances dental treatments through improved dental filling materials, advanced diagnostic tools, and superior drug delivery systems for oral health. These innovations offer better durability, biocompatibility, and effectiveness in treating dental conditions. As the prevalence of dental diseases rises and the demand for advanced dental care increases, the adoption of nanotechnology in dentistry continues to expand, driving market growth and improving patient outcomes.

The hospitals segment held the largest share of 51.0% in 2024, driven by increasing investments from hospitals in advanced medical technologies. Hospitals are recognizing the potential of nanotechnology to enhance diagnostic accuracy, improve treatment efficacy, and reduce recovery times. This has led to a surge in the adoption of nanotechnology-based medical devices, such as nanoscale imaging tools and targeted drug delivery systems. As hospitals continue to invest in cutting-edge technologies to offer better patient care and outcomes, the market for nanotechnology in medical devices is set to expand, reflecting a growing trend in healthcare innovation.

The clinics segment is growing at the fastest CAGR of 7.0% over the forecast period. This is driven by advancements in precision medicine and targeted therapies. Nanotechnology enables the development of highly sensitive diagnostic tools and therapeutic devices that can detect diseases at earlier stages and deliver treatments with greater precision. However, the adoption of nanotechnology in medical devices often entails higher development and manufacturing costs due to the complexity of nanoscale materials and processes. Funding for research and development in this field is substantial, with investments from government grants, private investors, and collaborations with academic institutions driving innovation. These investments are crucial for overcoming cost barriers and expanding the clinical applications of nanotechnology in medical settings.

North America nanotechnology in medical devices market dominated the overall global market and accounted for the 34.6% revenue share in 2024. This isdriven by technological advancements and regulatory approvals. Innovations in nanotechnology are enhancing the precision and effectiveness of medical devices, leading to improved patient outcomes. Regulatory bodies like the FDA have been actively approving nanotechnology-based medical devices, further propelling market expansion.

For instance, in October 2020, Orthofix Medical Inc. announced that the U.S. FDA granted 510(k) clearance for the nanotechnology feature of its FIREBIRD Fusion System. This product has launched earlier that year whichis the first 3D-printed titanium bone screw incorporating nanotechnology. This is specifically engineered to compress and stabilize the sacroiliac joint during fusion. This supportive regulatory environment and ongoing technological progress are key factors boosting the market's development.

U.S. Nanotechnology in Medical Devices Market Trends

The U.S. nanotechnology in medical devices marketheld a significant share of North America market in 2024, due to substantial investments and funding. Increased capital influx from both government initiatives and private sector investments is driving innovation and development in this field, enhancing the capabilities of medical devices and promoting advanced healthcare solutions.

Europe Nanotechnology In Medical Devices Market Trends

The Europe nanotechnology in medical devices market is experiencing significant growth due to extensive research and development efforts and a strong focus on innovation. Significant investments in R&D are driving the creation of advanced nanotechnology-based medical devices, enhancing diagnostic and therapeutic capabilities. This commitment to innovation is fostering the growth and competitiveness of the European market in this sector.

Asia Pacific Nanotechnology In Medical Devices Market Trends

The Asia Pacific nanotechnology in medical devices market is experiencing the fastest growth, driven by extensive research initiatives and government-supported nanomaterial programs. Increased awareness of the benefits of nanotechnology in healthcare is fostering adoption. For instance, in June 2024, the Japan-Taiwan Workshop on Nanomaterial and Biomedicine was held at NIMS. Organized by the Research Center for Macromolecules and Biomaterials at NIMS (Japan) and co-organized by the Center of Applied Nanomedicine at National Cheng Kung University (Taiwan), the event took place at the WPI-MANA Auditorium on the NIMS Namiki site. These efforts are enhancing diagnostic and therapeutic capabilities, contributing to market expansion, and positioning the region as a leader in medical device innovation.

Latin America Nanotechnology In Medical Devices Market Trends

The Latin America nanotechnology in medical devices market is experiencing significant growth, with increased funding and investment in advanced technology. This financial support is driving the development of innovative nanotechnology-based medical devices, enhancing diagnostic and therapeutic capabilities across the region and fostering technological advancement in healthcare.

Middel East And Africa Nanotechnology In Medical Devices Market Trends

The MEA nanotechnology in medical devices market is expanding with key players investing in regional expansion. These companies are focusing on introducing advanced nanotechnology-based medical devices to enhance healthcare delivery and meet the growing demand for innovative medical solutions in the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the nanotechnology in medical devices market

By Type

By Application

By End Use

By Regional