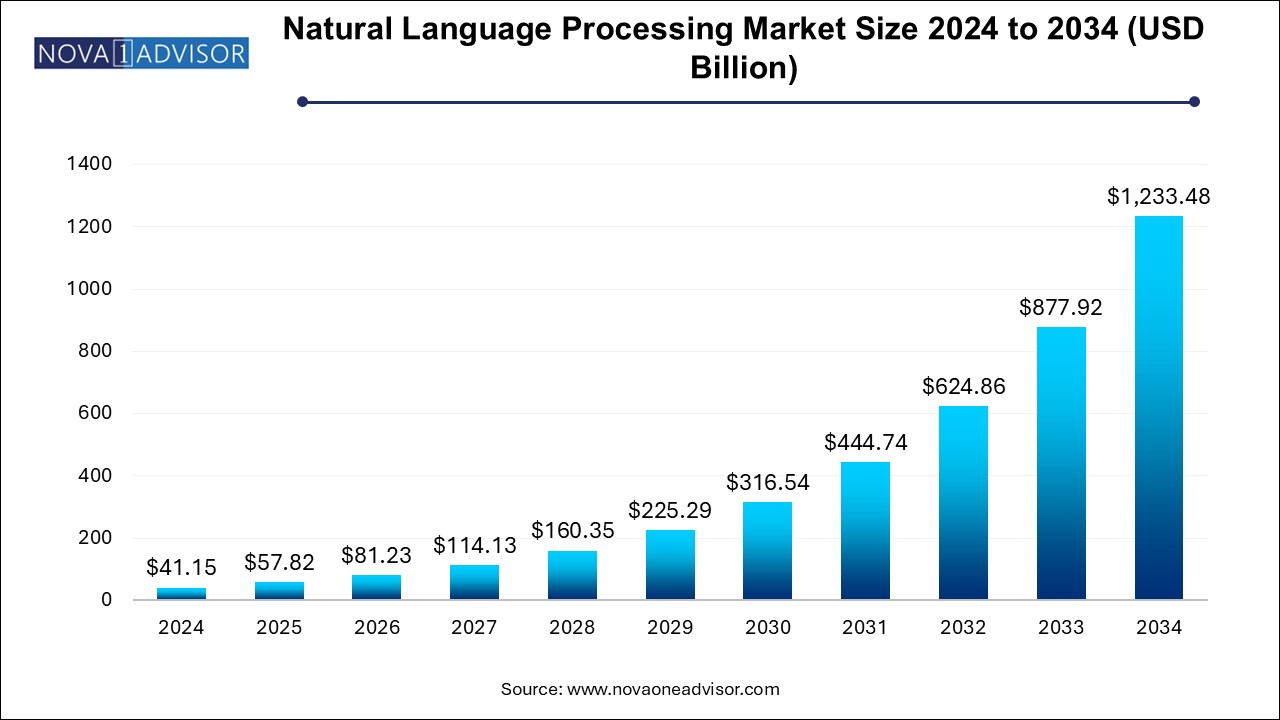

The natural language processing market size was exhibited at USD 41.15 billion in 2024 and is projected to hit around USD 1233.48 billion by 2034, growing at a CAGR of 40.5% during the forecast period 2024 to 2034.

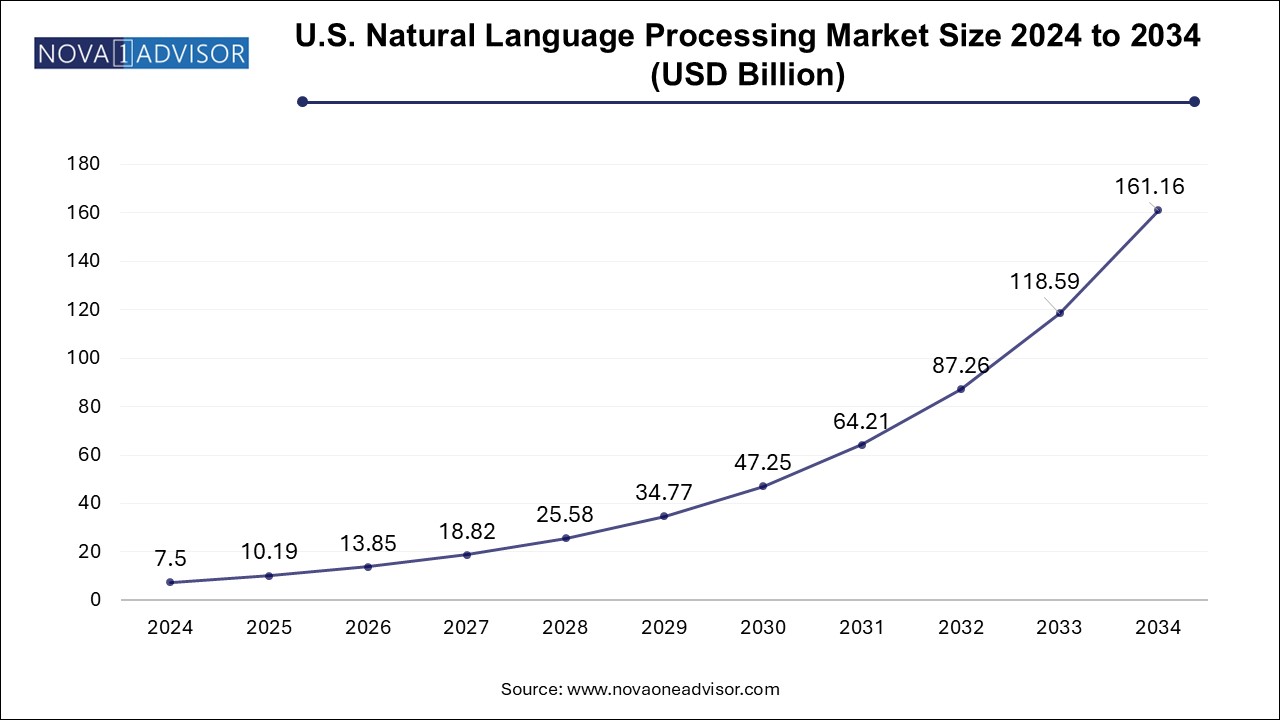

The U.S. natural language processing market size is evaluated at USD 7.5 billion in 2024 and is projected to be worth around USD 161.16 billion by 2034, growing at a CAGR of 35.9% from 2024 to 2034.

North America is estimated to hold the largest revenue share of 31.0% in 2024. primarily due to the presence of leading technology firms, a mature AI ecosystem, and high investment in R&D. The U.S. is home to major players like Microsoft, Google, IBM, and AWS, all of which are heavily investing in AI and NLP innovations. The region's early adoption of AI technologies, strong digital infrastructure, and high cloud penetration support NLP integration across various industries. Moreover, enterprises in North America are ahead in deploying AI-driven customer support, fraud detection, and compliance solutions, driving further NLP adoption.

Asia Pacific is the fastest-growing region, attributed to rapid digital transformation, increasing smartphone and internet penetration, and growing investment in AI startups. Countries like China, India, and South Korea are witnessing a surge in demand for intelligent automation in customer service, e-commerce, and education. In India, for instance, the government’s push for vernacular content and regional language services is propelling the demand for multilingual NLP. Additionally, the booming BPO sector is integrating NLP to enhance service delivery.

Natural Language Processing (NLP) has evolved from a theoretical concept in linguistics and computer science into a pivotal technology in artificial intelligence, reshaping the way machines interact with human language. As a subfield of AI, NLP bridges the gap between human communication and machine understanding. With applications ranging from voice assistants like Amazon’s Alexa and Apple’s Siri to business intelligence systems and healthcare automation, NLP is transforming workflows, customer service, data analysis, and accessibility.

The global NLP market has witnessed exponential growth driven by rising investments in AI technologies, increasing demand for real-time data analysis, and the explosion of digital content. NLP is enabling organizations to extract actionable insights from unstructured data sources such as emails, social media, documents, and call transcripts. This transformation allows companies to make more informed decisions, improve customer experience, and automate repetitive tasks.

NLP solutions are also playing a vital role in sectors such as healthcare—enhancing diagnostics and patient care—and in the legal and financial sectors, where document classification and sentiment analysis are critical. Furthermore, multilingual NLP capabilities are helping businesses scale globally by localizing content and communications effectively.

Rise of Transformer-Based Models: The advent of transformer-based architectures like BERT and GPT has significantly improved contextual understanding, driving better accuracy in NLP applications.

Integration with Conversational AI: NLP is becoming core to the functionality of chatbots and virtual assistants, enhancing user experiences across e-commerce, banking, and tech support.

Multilingual NLP and Cross-Lingual Training: Increasing demand for language processing across multiple languages is spurring innovations in cross-lingual and multilingual NLP tools.

Domain-Specific NLP Solutions: Custom NLP solutions tailored for industries like legal, healthcare, and retail are gaining traction, offering better performance than generic models.

Expansion of Sentiment Analysis Tools: With rising social media usage, businesses are leveraging sentiment analysis to gauge public opinion, monitor brand perception, and inform marketing strategies.

NLP in Healthcare: Use of NLP to analyze EHR (Electronic Health Records), automate transcription, and assist in clinical decision-making is expanding rapidly.

Voice Technology Integration: NLP is playing a crucial role in speech-to-text applications, virtual agents, and voice-based searches, driving accessibility and convenience.

Ethical and Responsible AI: There's growing emphasis on fairness, bias mitigation, and explainability in NLP models, especially in sensitive sectors like hiring, finance, and law enforcement.

| Report Coverage | Details |

| Market Size in 2025 | USD 57.82 Billion |

| Market Size by 2034 | USD 1233.48 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 40.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Component, Deployment, Enterprise Size, Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | 3M; Apple; AWS; Baidu; Google LLC; IBM Corporation; Meta; Microsoft; Oracle Inc.; Inbenta; IQVIA |

A key driver fueling the NLP market is the rising emphasis on improving customer experience through automated interactions and personalized engagement. Businesses across sectors are leveraging NLP-powered chatbots and voice assistants to streamline communication and resolve customer queries efficiently. NLP tools enable real-time sentiment analysis, enabling businesses to understand customer emotions, intent, and preferences at scale.

For instance, in the telecom industry, companies deploy NLP algorithms to analyze support calls, chat logs, and social media interactions. This insight not only identifies recurring issues but also helps proactively address customer dissatisfaction. Similarly, in the retail sector, NLP aids in analyzing customer reviews to guide product improvements and targeted marketing. The integration of NLP into CRM systems allows for enhanced personalization, significantly boosting customer satisfaction and retention rates.

Despite rapid growth, the NLP market faces challenges related to data privacy and security. NLP systems often require access to vast amounts of user data, including sensitive personal information, emails, voice recordings, and financial records. This raises significant concerns around data protection, consent, and compliance with stringent regulations like GDPR, HIPAA, and CCPA.

For example, voice assistants processing user queries may inadvertently collect private data, which, if mismanaged or breached, can lead to legal and reputational risks. Moreover, biases in training data can perpetuate discrimination or misinformation, leading to ethical concerns. The complexity of anonymizing unstructured text data adds to the difficulty in ensuring complete privacy. These concerns are slowing down the adoption of NLP solutions in highly regulated industries and call for robust encryption, transparency, and ethical AI practices.

An emerging opportunity within the NLP landscape lies in developing robust multilingual and cross-lingual models. With globalization, enterprises seek solutions that transcend linguistic boundaries to better serve diverse customer bases across regions. Multilingual NLP enables real-time translation, content localization, and support for multiple languages—essential for industries such as e-commerce, tourism, and international education.

For instance, global e-commerce platforms are adopting NLP to translate product descriptions, user reviews, and customer service responses into various languages, ensuring consistency and engagement. Healthcare companies are exploring NLP tools to deliver information and services across multilingual demographics. This trend presents a significant growth avenue for vendors who can offer scalable, accurate, and culturally aware NLP solutions.

The solution segment accounted for the dominant revenue share of 72.6% in 2024. owing to the high adoption of NLP software tools for tasks like text classification, sentiment analysis, and document summarization. Businesses across industries are increasingly deploying NLP software to automate processes, reduce manual workload, and extract valuable insights from unstructured data. These solutions are integrated into CRM, ERP, and business intelligence tools, offering flexibility, scalability, and accuracy. Vendors are also embedding advanced AI models into NLP platforms, making them more intuitive and capable of handling complex tasks like contextual question answering and conversational analytics.

However, the services segment is anticipated to grow at the fastest rate, driven by the need for implementation support, training, and customization. Organizations often lack the in-house expertise to integrate NLP systems effectively and rely on professional services for smooth deployment. Additionally, as NLP tools become more specialized, demand for domain-specific consulting and managed services is on the rise. Service providers are playing a pivotal role in enabling SMEs and enterprises alike to adopt NLP with minimal operational disruption.

The on-premise segment is estimated to account for the leading share of 59.8% in 2024. However, its growth is relatively slower as cloud-native tools become more secure and widely accepted. Hybrid deployment models are emerging as a middle ground, allowing sensitive data to stay on-premise while leveraging cloud capabilities for processing at scale..

The advances in cloud computing have created a transformation by enabling the creation of cloud-based NLP applications. Cloud platforms allow for seamless integration of NLP models with existing data pipelines and analytics dashboards. They offer rapid updates, real-time processing capabilities, and lower upfront costs, making them especially appealing to small and mid-sized firms. Major cloud providers like AWS, Microsoft Azure, and Google Cloud offer NLP toolkits that enable rapid development and deployment of applications like chatbots, translation engines, and knowledge management systems.

The large enterprise's segment held the leading revenue share of 61.9% in 2024, They utilize NLP for comprehensive applications—from customer sentiment tracking to regulatory compliance automation. Large firms in banking, telecom, and healthcare sectors integrate NLP into core systems for predictive analytics, fraud detection, and documentation workflows. The high volume of unstructured data they manage further amplifies the need for sophisticated NLP tools.

Small & Medium Enterprises (SMEs) are rapidly catching up, fueled by access to cloud-based NLP tools and SaaS models. SMEs are adopting NLP to enhance customer support, generate insights from customer reviews, and streamline back-office operations. With growing digital footprints and increasing competition, SMEs are realizing the ROI of NLP investments and are embracing lightweight, cost-effective solutions customized for their scale.

The statistical NLP segment held the largest revenue share of 39.3% in 2024. leveraging probabilistic models and machine learning techniques for parsing and understanding language. These models are data-driven, adaptable, and capable of handling ambiguity in real-world language, making them ideal for applications like predictive text, translation, and topic modeling. Advances in deep learning have further enhanced statistical NLP capabilities, enabling context-aware analysis and improving model performance with more data.

The hybrid NLP segment is forecasted to grow most rapidly, combining rule-based precision with statistical model flexibility. Hybrid approaches are especially effective in domains requiring high accuracy and explainability, such as legal document analysis or clinical data interpretation. The balance between deterministic and probabilistic methods ensures greater reliability, making hybrid NLP increasingly popular in regulated sectors.

Sentiment analysis dominated NLP applications, driven by its extensive use in marketing, brand monitoring, and customer feedback management. It empowers businesses to understand customer emotions and preferences, influencing product development and strategy. Social media analytics, for instance, heavily relies on sentiment analysis to track public opinion in real time.

Risk and threat detection is emerging as the fastest-growing application, particularly in sectors like finance, cybersecurity, and defense. NLP is used to monitor communications, detect anomalies, and flag potential security threats from textual sources. Integration with AI-driven threat intelligence platforms is enhancing proactive security responses.

The healthcare segment is expected to account for a leading share of 23.0% in 2024. with applications ranging from clinical documentation automation to patient sentiment tracking and diagnostic assistance. NLP is used to extract meaningful information from EHRs, improve physician workflows, and support telemedicine platforms. With increasing digitalization of health records and growing emphasis on patient-centric care, the demand for NLP in healthcare is expected to surge.

The IT & telecommunication segment is projected to witness the highest growth rate during the forecast period. Tleveraging the technology for chatbots, ticket classification, call log analysis, and network optimization. NLP is integral to helpdesks, customer engagement tools, and automated knowledge base creation. Telecom operators are also using NLP to gain insights from user behavior and service feedback.

January 2025: Google introduced its Gemini Pro NLP model, aimed at improving language comprehension across multilingual contexts, with applications in customer service and education.

February 2025: Microsoft Azure integrated OpenAI’s GPT-4 Turbo into its Cognitive Services suite, enabling more nuanced NLP applications in enterprise cloud environments.

March 2025: IBM announced a collaboration with the Mayo Clinic to develop domain-specific NLP tools for clinical document summarization and medical coding.

April 2025: SAP acquired a language technology startup focused on NLP-driven document processing to enhance its enterprise workflow automation capabilities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the natural language processing market

By Component

By Deployment

By Enterprise Size

By Type

By Application

By End-use

By Regional