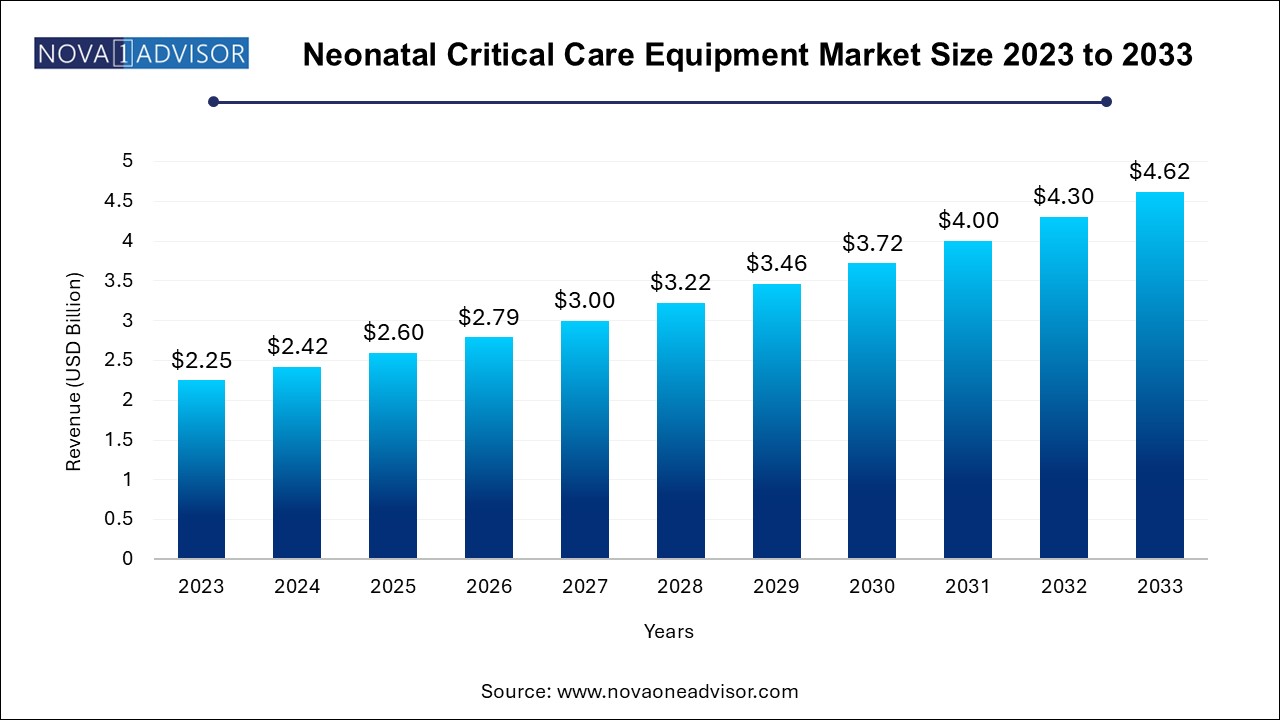

The global neonatal critical care equipment market size was exhibited at USD 2.25 billion in 2023 and is projected to hit around USD 4.62 billion by 2033, growing at a CAGR of 7.45% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.42 Billion |

| Market Size by 2033 | USD 4.62 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.45% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | Drägerwerk AG & Co. KGaA; Cardinal Health; Koninklijke Philips N.V.; Medtronic; Vyaire; BD; GE Healthcare; Ambu A/S; Utah Medical Products, Inc.; Natus Medical Incorporated; Inspiration Healthcare Group plc; Atom Medical Corp.; Fisher & Paykel Healthcare Limited; Masimo; Phoenix Medical Systems (P) Ltd. |

The increasing research for product innovation and the rising number of preterm and low-weight births are expected to drive the growth of the market over the forecast period. The prevalence of LBW and the number of preterm births is constantly rising, which is increasing the demand for care devices. According to WHO, an estimated 15 million newborn children are born preterm, and 20 million or more are born with LBW yearly. These infants are at higher risk of developing congenital disabilities, including retinopathy of prematurity and cerebral palsy. To counter this issue, there is a growing demand for neonatal monitoring and care equipment.

Universities and manufacturers are researching to help resolve product-specific challenges that healthcare professionals face. More noninvasive methods are being adopted, including ultrasound equipment for automatic fetal measurements assisting in labor and tele-ultrasound that is designed to provide at-home ultrasound scans. Considering the high number of neonatal deaths in developing economies, startups are focusing on product innovations. For instance, in August 2021, Resus Right, an Australian startup, received USD 800,000 for its neonatal resuscitation devices for respiratory issues in neonates.

Currently, available monitors in NICUs have modes to incorporate the respiratory rate and airflow, ECG recordings, oxygen saturation over time, temperature, and invasive arterial blood pressure. Advancements in conventional monitoring and imaging devices and equipment for neonates have gained popularity in the past few years and reported increased demand from NICUs. For instance, in May 2023, Sibel Health received the U.S. FDA 510 (k) clearance for its Anne One neonatal and infant monitoring platform. It is a wireless, clinical-grade, and continuous monitoring solution developed specifically for adults, infants, and neonates.

The COVID-19 pandemic negatively impacted the market in 2020. Initially, the lockdown imposed due to the COVID-19 pandemic stretched medical services, disrupting maternity care across the world. The pandemic resulted in a considerable decrease in NICU admissions and newborn resuscitations, which, in turn, negatively impacted the sales of neonatal infant care devices. On the other hand, a high preference for home healthcare is expected to continue post-pandemic, creating new opportunities in the coming years.

The thermoregulation equipment segment held a significant revenue share of 33.0% in 2023 in the neonatal critical care equipment market. With the increasing prevalence of neonatal hypothermia and growing awareness about related high mortality & morbidity, the demand for thermoregulation equipment is expected to increase over the forecast period. According to a research article published in the National Library of Medicine in September 2020, around 32% to 85% of neonates born in hospitals and around 11% to 92% born at home suffer from hypothermia globally, with a higher prevalence in developing economies.

Based on equipment type, the market is divided into thermoregulation equipment, phototherapy equipment, neonatal monitoring devices, respiratory devices, and others. The phototherapy equipment segment is expected to witness the fastest growth over the forecast period due to innovations focusing on their portability and power dependency. Moreover, with the high risk of jaundice in preterm babies, the demand for phototherapy equipment is rising globally. Severe Neonatal Jaundice (SNJ) is among the top 5 to 10 causes of neonatal deaths globally, per the Global Burden of Disease. According to an article published in MDPI in March 2023, the prevalence of SNJ varies from region to region, ranging from 0.73% to 3.34%, with the highest prevalence reported in African & Southeast Asian regions.

The hospitals segment dominated the market with a revenue share of 57.9% in 2023. The segment is further expected to witness the fastest growth over the forecast period. Hospitals that provide neonatal critical care are expanding their treatment capabilities by launching new centers and partnering with other organizations. For instance, in April 2023, the Motherhood Hospitals chain launched virtual Neonatal Intensive Care Units (NICUs) at five locations in India. Expansion of service portfolio by including innovative treatments assists hospitals in strengthening their market position.

Based on end-use, the market is segmented into hospitals, clinics, and others. The clinics segment is expected to witness significant growth over the forecast period. Clinics for neonatal critical care are evolving with patient requirements. Initially, neonatal follow-up was associated with patients discharged from the NICU. However, Neonatal Follow-up Clinics (NFUCs) focus on early intervention and continued monitoring of high-risk infants. Moreover, organizations are providing financial assistance to parents for NICU expenses.

The Asia Pacific region dominated the market with the largest share of 54.35% in 2023. Technological advancements in neonatal critical care equipment and the increasing number of preterm births are anticipated to promote market growth. According to a UNICEF dataset, the overall mortality rate of neonates in South Asia was 22.992 per 1,000 live births in 2021, contributing to 801,694 neonatal deaths in this region in 2021. Hence, the availability of a large patient pool, increasing awareness regarding neonatal care, and the growing presence of global players are likely to drive growth during the forecast period.

The Middle East & Africa region is expected to witness the fastest growth over the forecast period, due to the increasing prevalence of preterm births in Africa. Preterm newborns are found to be prone to infections and diseases. According to an article published in the JAMA Network, most preterm births (around 60%) occur in Africa and South Asia. Hence, these newborns need to be monitored using fetal incubators and fetal monitors. These factors are expected to increase the demand for monitoring devices and equipment, driving technological advancements.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global neonatal critical care equipment market

Type

End-use

Regional