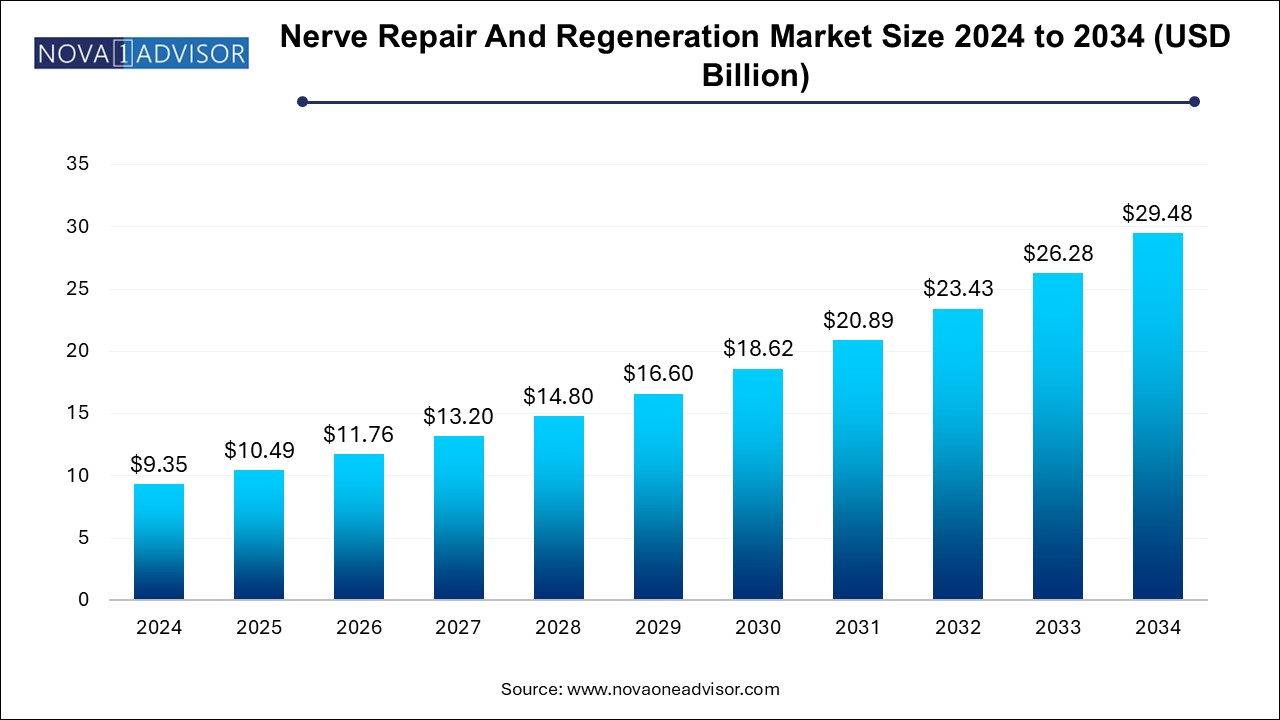

The nerve repair and regeneration market size was exhibited at USD 9.35 billion in 2024 and is projected to hit around USD 29.48 billion by 2034, growing at a CAGR of 12.17% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.49 Billion |

| Market Size by 2034 | USD 29.48 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 12.17% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Surgery, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | AxoGen, Inc.; Stryker Corporation; St. Jude Medical, Inc.; Baxter International, Inc.; Polyganics B.V.; Boston Scientific, Inc.; Integra Lifesciences Corporation; Cyberonics, Inc.; Medtronic plc. |

Rising cases of neurological disorders and a strong product pipeline by the major companies are the key factors driving the market. Improved treatment efficiency for neurological disorders due to several technological advancements is also likely to contribute to the market growth. During the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) pandemic, various government containment measures led outpatient clinics' neurological activities to be disrupted. Vulnerable patients such as those with Parkinson's disease (PD) or dystonic patients with deep brain stimulation (DBS) were at a higher risk of chronic stress because of social restriction measures, and their motor and psychiatric symptoms were reported to deteriorate.

Furthermore, the availability of multiple therapies for treating various Central Nervous System (CNS) disorders, such as Parkinson’s disease and Alzheimer’s, and the increasing scope of applications are further expected to boost the market growth over the forecast period. According to the Alzheimer’s Association, in 2024, 6.5 million people aged 65 or more in America were suffering from Alzheimer's disease.

Increasing awareness, environmental influence, lifestyle, genetics, nutrition, and physical injuries are some of the factors that can cause such disorders. In 2015, a report presented at the annual meeting of the American Society for Surgery of the Hand (ASSH) stated that the processed nerve allograft used in the treatment of patients with upper extremity nerve impairments may lead to the restoration of motor and sensory nerve functions. Patients treated with a PNA allograft (Avance Nerve Graft, AxoGen) exhibited recovery of motor function and sensory nerve function in 75% and 85% of the patients, respectively.

The neurostimulation and neuromodulation devices segment emerged as the largest segment with a revenue share of over 66.9% in 2024. The segment is further sub-segmented into Deep Brain Stimulation (DBS), Spinal Cord Stimulation (SCS), Vagus Nerve Stimulation (VNS), Sacral Nerve Stimulation (SNS), and Gastric Electric Stimulation (GES) Devices. The spinal cord stimulation devices segment was the largest sub-segment in 2024 with a revenue share of over 40.0%. Many commercially available spinal cord products and a wide range of applications were the factors responsible for the growth of the segment. Based on product, the market has been classified into biomaterials and neurostimulation & neuromodulation devices.

Investments by key companies to develop more effective devices are likely to propel market growth in the coming years. For instance, in January 2023, Axogen Corporation launched an independent publication of a retrospective & comprehensive clinical review of recovery rates between autograft, conduits, and allograft using meta-analysis. The biomaterials segment is anticipated to expand at the fastest CAGR from 2024 to 2034 due to technological advancements, a wide range of applications, government funding for innovations, and biocompatibility. Advanced products such as biodegradable polymers are expected to enhance spinal stabilization and healing of fractures and reduce hospitalization.

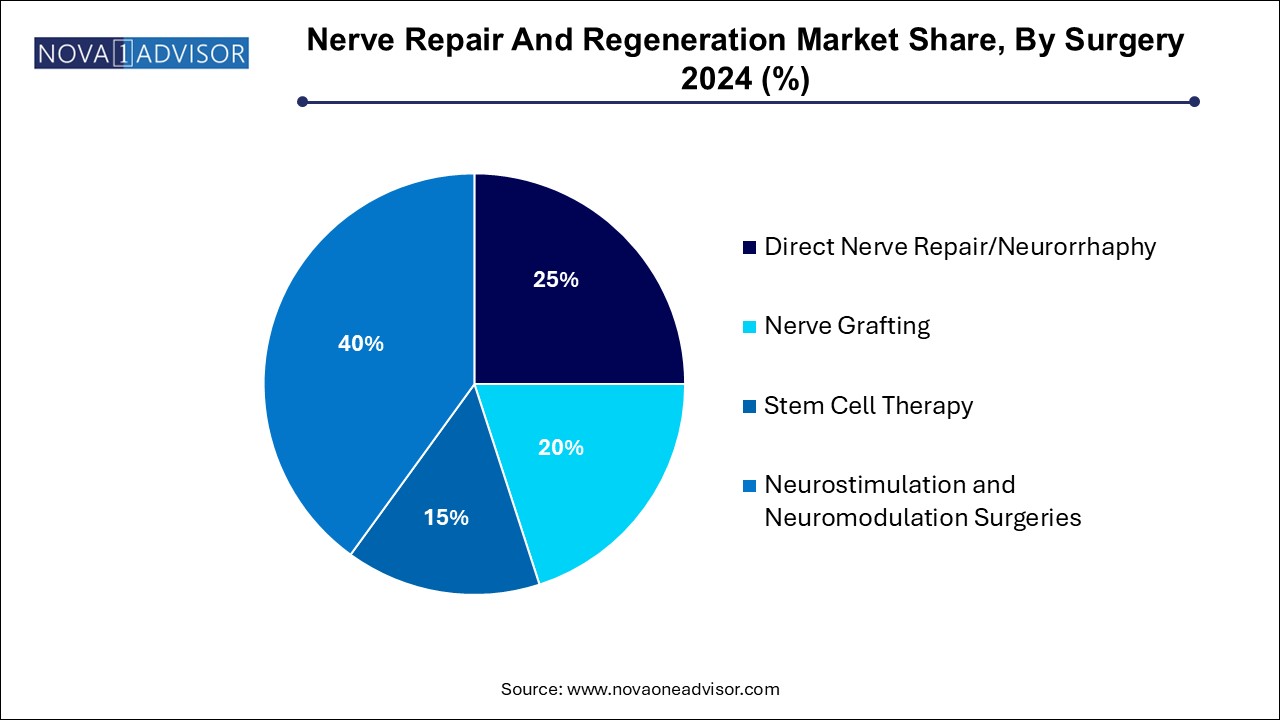

Neurostimulation and neuromodulation surgeries held the largest revenue share of over 40.0% in 2024. Stem cell therapy is expected to register the fastest CAGR over the forecast years. Various government initiatives and approvals to conduct clinical trials of biomaterials are anticipated to boost the market growth. There are approximately 570 clinics in the U.S. providing stem cell therapies and the number is expected to rise, thereby augmenting segment growth. Based on surgery, the market is divided into direct nerve repair or neurorrhaphy, nerve grafting, stem cell therapy, and neurostimulation and neuromodulation surgery.

Expected commercialization of the products in the coming years due to investments by companies and research institutes is also anticipated to boost the market growth. Neurostimulation and neuromodulation surgeries are expected to maintain their lead over the forecast period due to the availability of several products and technological advancements to reduce chronic pain. For instance, in April 2016, St. Jude launched Axium Neurostimulator System in the U.S. and approved the implants for Dorsal Root Ganglion (DRG). The system reduces the chronic pain for complex regional pain syndrome I and II patients, which could not be achieved through the traditional SCS system.

In 2024, North America dominated the market with over 30.8% share owing to the increased incidence of neural disorders and supportive health insurance coverage scenario in the region. The availability of technologically advanced devices owing to the presence of major market players is also a major factor fueling the growth of this region. For instance, in February 2016, Medtronic plc launched Reclaim DBS therapy for the treatment of obsessive-compulsive disorder (OCD). Furthermore, Boston Scientific’s Precision Montage MRI-safe SCS, which is used for chronic pain, received FDA approval in May 2016.

The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period due to the increasing target population base, rising awareness among patients, supportive government initiatives, the presence of unmet medical needs, and the advent of innovative technologies. China, India, Japan, Australia, and Singapore are the major countries contributing to the regional growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the nerve repair and regeneration market

By Product

By Surgery

By Regional

Chapter 1 Nerve Repair And Regeneration Market: Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.4 Information or Data Analysis

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.2 Volume Price Analysis (model 2)

1.7 List of Secondary Sources

1.8 List of Abbreviations

1.9 Objectives

1.9.1 Objective - 1

1.9.2 Objective - 2

Chapter 2 Nerve Repair And Regeneration Market: Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Landscape Outlook

Chapter 3 Nerve Repair And Regeneration Market: Variables, Trends & Scope

3.1 Market Lineage outlook

3.1.1 Parent Market Outlook

3.2 Market Segmentation

3.3 Penetration & Growth Prospect Mapping

3.3.1 Penetration & Growth Prospect Mapping

3.4 Regulatory Framework & Reimbursement Scenario

3.5 Market Dynamics

3.5.1 Market Driver Analysis

3.5.1.1 Increasing government fundings and reimbursements

3.5.1.2 Increasing incidences of the neurological disorders

3.5.1.3 Rising medical tourism

3.5.2 Market Restraint Analysis

3.5.2.1 Lack of awareness in the patients for treatment of nerve repair and regeneration

3.5.2.2 High cost of the treatment and unavailability of trained medical personnel

3.6 Business Environment Analysis Tools

3.6.1 Porter’s Five Forces Analysis

3.6.1.1 Bargaining power of buyers: Moderate

3.6.1.2 Bargaining power of suppliers: Low

3.6.1.3 Competitive rivalry: High

3.6.1.4 Threat of new entrants: Moderate

3.6.1.5 Threat of substitutes: Moderate

3.6.2 PESTEL Analysis

3.6.2.1 Political & legal landscape

3.6.2.2 Economic landscape

3.6.2.3 Social landscape

3.6.2.4 Technological landscape

3.6.2.5 Environmental landscape

3.7 Major Deals & Strategic Alliances Analysis

3.7.1 Mergers & Acquisitions

3.7.2 Licensing & Partnership

Chapter 4 Nerve Repair And Regeneration Market: Product Analysis

4.1 Nerve Repair And Regeneration Product Market Share Analysis, 2022

4.2 Nerve Repair And Regeneration Product Market: Segment Dashboard:

4.3 Market Size & Forecasts And Trend Analyses, 2018 To 2030 For The Product Segment

4.3.1 Biosimilars

4.3.1.1 Biosimilars market, 2018 - 2030 (USD Million)

4.3.2 Neurostimulation & Neuromodulation Devices

4.3.2.1 Spinal cord stimulation devices market, 2018 - 2030 (USD Million)

4.3.2.2. Deep brain stimulation devices market, 2018 - 2030 (USD Million)

4.3.2.3 Sacral nerve stimulation devices market, 2018 - 2030 (USD Million)

4.3.2.4 Vagus nerve stimulation devices market, 2018 - 2030 (USD Million)

4.3.2.5 Gastric electric stimulation devices market, 2018 - 2030 (USD Million)

Chapter 5 Nerve Repair And Regeneration Market: Surgery Analysis

5.1 Nerve Repair And Regeneration Surgery Market Share Analysis, 2022

5.2 Nerve Repair And Regeneration Surgery Market: Segment Dashboard

5.3 Market Size & Forecasts And Trend Analyses, 2018 - 2030 For The Surgery

5.3.1 Direct Nerve Repair/Neurorrhaphy

5.3.1.1 Direct nerve repair/Neurorrhaphy market, 2018 - 2030 (USD Million)

5.3.2 Nerve Grafting

5.3.2.1 Nerve grafting market, 2018 - 2030 (USD Million)

5.3.3 Stem Cell Therapy

5.3.3.1 Stem cell therapy market, 2018 - 2030 (USD Million)

5.3.4 Neurostimulation & Neuromodulation Surgeries

5.3.4.1 Neurostimulation & neuromodulation surgeries market, 2018 - 2030 (USD Million)

Chapter 6 Nerve Repair And Regeneration Market: Regional Analysis

6.1. Regional market share analysis, 2024 & 2034

6.2. Regional Marketplace: Key Takeaways

6.3. North America

6.3.1. SWOT Analysis

6.3.2. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.3.3. U.S.

6.3.3.1. Country Dynamics

6.3.3.2. Country Variables

6.3.3.3. Competitive Landscape

6.3.3.4. Regulatory/Reimbursement Framework

6.3.3.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.3.4. Canada

6.3.4.1. Country Dynamics

6.3.4.2. Country Variables

6.3.4.3. Competitive Landscape

6.3.4.4. Regulatory/Reimbursement Framework

6.3.4.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4. Europe

6.4.1. SWOT Analysis

6.4.2. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.3. UK

6.4.3.1. Country Dynamics

6.4.3.2. Country Variables

6.4.3.3. Competitive Landscape

6.4.3.4. Regulatory/Reimbursement Framework

6.4.3.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.4. Germany

6.4.4.1. Country Dynamics

6.4.4.2. Country Variables

6.4.4.3. Competitive Landscape

6.4.4.4. Regulatory/Reimbursement Framework

6.4.4.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.5. France

6.4.5.1. Country Dynamics

6.4.5.2. Country Variables

6.4.5.3. Competitive Landscape

6.4.5.4. Regulatory/Reimbursement Framework

6.4.5.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.6. Italy

6.4.6.1. Country Dynamics

6.4.6.2. Country Variables

6.4.6.3. Competitive Landscape

6.4.6.4. Regulatory/Reimbursement Framework

6.4.6.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.7. Spain

6.4.7.1. Country Dynamics

6.4.7.2. Country Variables

6.4.7.3. Competitive Landscape

6.4.7.4. Regulatory/Reimbursement Framework

6.4.7.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.8. Denmark

6.4.8.1. Country Dynamics

6.4.8.2. Country Variables

6.4.8.3. Competitive Landscape

6.4.8.4. Regulatory/Reimbursement Framework

6.4.8.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.9. Sweden

6.4.9.1. Country Dynamics

6.4.9.2. Country Variables

6.4.9.3. Competitive Landscape

6.4.9.4. Regulatory/Reimbursement Framework

6.4.9.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.4.10. Norway

6.4.10.1. Country Dynamics

6.4.10.2. Country Variables

6.4.10.3. Competitive Landscape

6.4.10.4. Regulatory/Reimbursement Framework

6.4.10.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5. Asia Pacific

6.5.1. SWOT Analysis

6.5.2. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5.3. Japan

6.5.3.1. Country Dynamics

6.5.3.2. Country Variables

6.5.3.3. Competitive Landscape

6.5.3.4. Regulatory/Reimbursement Framework

6.5.3.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5.4. China

6.5.4.1. Country Dynamics

6.5.4.2. Country Variables

6.5.4.3. Competitive Landscape

6.5.4.4. Regulatory/Reimbursement Framework

6.5.4.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5.5. India

6.5.5.1. Country Dynamics

6.5.5.2. Country Variables

6.5.5.3. Competitive Landscape

6.5.5.4. Regulatory/Reimbursement Framework

6.5.5.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5.6. Australia

6.5.6.1. Country Dynamics

6.5.6.2. Country Variables

6.5.6.3. Competitive Landscape

6.5.6.4. Regulatory/Reimbursement Framework

6.5.6.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5.7. Thailand

6.5.7.1. Country Dynamics

6.5.7.2. Country Variables

6.5.7.3. Competitive Landscape

6.5.7.4. Regulatory/Reimbursement Framework

6.5.7.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.5.8. South Korea

6.5.8.1. Country Dynamics

6.5.8.2. Country Variables

6.5.8.3. Competitive Landscape

6.5.8.4. Regulatory/Reimbursement Framework

6.5.8.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.6. Latin America

6.6.1. SWOT Analysis

6.6.2. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.6.3. Brazil

6.6.3.1. Country Dynamics

6.6.3.2. Country Variables

6.6.3.3. Competitive Landscape

6.6.3.4. Regulatory/Reimbursement Framework

6.6.3.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.6.4. Mexico

6.6.4.1. Country Dynamics

6.6.4.2. Country Variables

6.6.4.3. Competitive Landscape

6.6.4.4. Regulatory/Reimbursement Framework

6.6.4.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.6.5. Argentina

6.6.5.1. Country Dynamics

6.6.5.2. Country Variables

6.6.5.3. Competitive Landscape

6.6.5.4. Regulatory/Reimbursement Framework

6.6.5.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.7. MEA

6.7.1. SWOT Analysis

6.7.2. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.7.3. South Africa

6.7.3.1. Country Dynamics

6.7.3.2. Country Variables

6.7.3.3. Competitive Landscape

6.7.3.4. Regulatory/Reimbursement Framework

6.7.3.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.7.4. Saudi Arabia

6.7.4.1. Country Dynamics

6.7.4.2. Country Variables

6.7.4.3. Competitive Landscape

6.7.4.4. Regulatory/Reimbursement Framework

6.7.4.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.7.5. UAE

6.7.5.1. Country Dynamics

6.7.5.2. Country Variables

6.7.5.3. Competitive Landscape

6.7.5.4. Regulatory/Reimbursement Framework

6.7.5.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

6.7.6. Kuwait

6.7.6.1. Country Dynamics

6.7.6.2. Country Variables

6.7.6.3. Competitive Landscape

6.7.6.4. Regulatory/Reimbursement Framework

6.7.6.5. Market estimates and forecast, 2021 - 2034 (Revenue, USD Million)

Chapter 7 Competitive Analysis

7.1 Recent Developments & Impact Analysis, By Key Market Participants

7.2 Strategic Framework/ Competition Categorization (Key Innovators, Market Leaders, Emerging Players

7.3 Vendor Landscape

7.4 Public Companies

7.4.1 Company Market Position Analysis (Revenue, Geographic Presence, Product Portfolio, Strategic Initiatives, Employee Strength)

7.5 Private Companies

7.5.1 Company Market Position Analysis (Geographic Presence, Product Portfolio, Key Alliance, Industry Experience)

7.6 Company Profiles

7.6.1 CYBERONICS, INC

7.6.1.1 Company overview

7.6.1.2 Financial performance

7.6.1.3 Product benchmarking

7.6.1.4 Strategic initiatives

7.6.1.5 SWOT Analysis

7.6.2 MEDTRONIC

7.6.2.1 Company overview

7.6.2.2 Financial performance

7.6.2.3 Product benchmarking

7.6.2.4 Strategic initiatives

7.6.2.5 SWOT Analysis

7.6.3 STRYKER

7.6.3.1 Company overview

7.6.3.2 Financial performance

7.6.3.3 Product benchmarking

7.6.3.4 Strategic initiatives

7.6.3.5 SWOT Analysis

7.6.4 AXOGEN CORPORATION

7.6.4.1 Company overview

7.6.4.2 Financial performance

7.6.4.3 Product benchmarking

7.6.4.4 Strategic initiatives

7.6.4.5 SWOT Analysis

7.6.5 ST. JUDE MEDICAL

7.6.5.1 Company overview

7.6.5.2 Financial performance

7.6.5.3 Product benchmarking

7.6.5.4 Strategic initiatives

7.6.5.5 SWOT Analysis

7.6.6 BAXTER

7.6.6.1 Company overview

7.6.6.2 Financial performance

7.6.6.3 Product benchmarking

7.6.6.4 Strategic initiatives

7.6.6.5 SWOT Analysis

7.6.7 BOSTON SCIENTIFIC CORPORATION

7.6.7.1 Company overview

7.6.7.2 Financial performance

7.6.7.3 Product benchmarking

7.6.7.4 Strategic initiatives

7.6.7.5 SWOT Analysis

7.6.8 POLYGANICS

7.6.8.1 Company overview

7.6.8.2 Financial performance

7.6.8.3 Product benchmarking

7.6.8.4 Strategic initiatives

7.6.9 INTEGRA LIFESCIENCES

7.6.9.1 Company overview

7.6.9.2 Financial performance

7.6.9.3 Product benchmarking

7.6.9.4 Strategic initiatives

7.6.9.5 SWOT Analysis