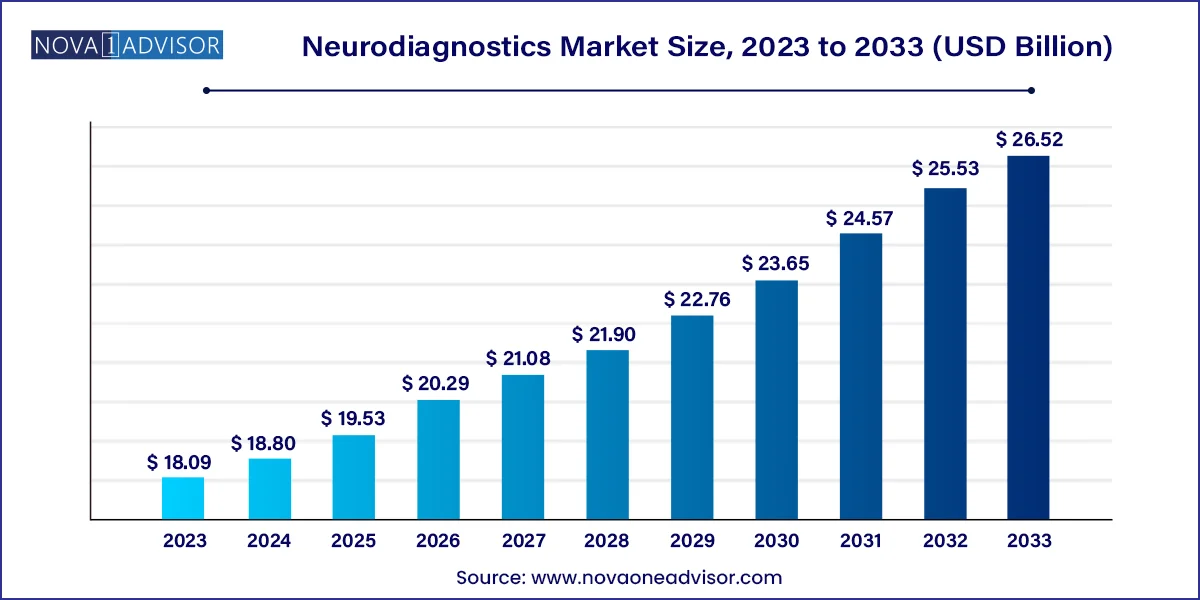

The global neurodiagnostics market size was valued at USD 18.09 billion in 2023 and is anticipated to reach around USD 26.52 billion by 2033, growing at a CAGR of 3.9% from 2024 to 2033.

The neurodiagnostics market has evolved significantly over the past decade, becoming a vital component of neurological healthcare across the globe. Neurodiagnostics refers to a specialized branch of medical science dedicated to the assessment and interpretation of brain, spinal cord, and nerve activity using advanced diagnostic tools. These tools assist in identifying, monitoring, and managing neurological disorders such as epilepsy, Parkinson’s disease, Alzheimer’s, traumatic brain injury (TBI), stroke, multiple sclerosis, and brain tumors.

The growing incidence of neurological disorders—especially among aging populations—has significantly propelled demand for effective diagnostic solutions. As the global burden of dementia and neurodegenerative diseases rises, early detection becomes paramount for timely intervention and management. According to recent WHO estimates, over 55 million people live with dementia worldwide, with nearly 10 million new cases annually. This surge has directly influenced investments in neurodiagnostic technologies, aimed at providing insights into structural and functional abnormalities within the central and peripheral nervous systems.

A notable aspect of the neurodiagnostics market is its intersection with multiple technologies—ranging from neuroimaging (MRI, CT, PET, SPECT) to electrophysiology (EEG, MEG), and from molecular diagnostics to computational tools like neuroinformatics. This multidisciplinary nature has fostered rapid innovation and expanded the clinical utility of neurodiagnostic platforms beyond neurology departments—into intensive care units, research laboratories, sports medicine, and even military healthcare systems.

While historically centralized in tertiary hospitals, neurodiagnostic services are now accessible through diagnostic laboratories, outpatient imaging centers, and mobile health units. This decentralization, coupled with digitization and AI integration, is accelerating adoption across developed and emerging healthcare markets.

Rising Adoption of AI-Powered Imaging Platforms: Artificial intelligence is being integrated into neuroimaging tools for enhanced anomaly detection, image reconstruction, and predictive analytics.

Miniaturization of EEG & MEG Devices: Portable and wearable EEG/MEG devices are being increasingly used for home-based monitoring and long-term ambulatory diagnostics.

Shift Toward Preventive Neurology: Growing awareness about early neurological screening is driving proactive use of neurodiagnostic tools in at-risk populations.

Neuroinformatics Integration: The use of big data, machine learning, and bioinformatics to interpret complex brain data is redefining diagnosis workflows and outcomes.

Multimodal Imaging Synergies: There is a growing preference for combining MRI, PET, and MEG data to gain comprehensive anatomical and functional insights.

Point-of-Care Diagnostics Expansion: Point-of-care (POC) neurodiagnostic kits are seeing rapid development, especially for emergency stroke evaluation.

Rise in Pediatric Neurology Testing: Increasing cases of autism spectrum disorder (ASD), epilepsy, and developmental delays have pushed demand for child-friendly diagnostic tools.

Brain-Computer Interfaces (BCIs): Diagnostic capabilities are now influencing therapeutic domains, especially in rehabilitation using brain-computer interface technologies.

| Report Attribute | Details |

| Market Size in 2024 | USD 18.80 Billion |

| Market Size by 2033 | USD 26.52 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, End Use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Canon Medical Systems Corporation; Siemens Healthineers AG; Koninklijke Philips N.V.; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Natus Medical Incorporated (Natus); Lifelines Neuro; Advanced Brain Monitoring, Inc.; NIHON KOHDEN CORPORATION.; F. Hoffmann-La Roche Ltd; GE HealthCare.; Mitsar Co. LTD. |

The Rising Global Burden of Neurological Disorders

The most significant driver influencing the neurodiagnostics market is the increasing prevalence of neurological disorders. Age-related cognitive decline, the rise in lifestyle-related cerebrovascular diseases, and the growing cases of traumatic brain injury (TBI) due to road accidents or sports injuries are creating a strong demand for timely neurological assessment. For instance, Alzheimer's disease affects nearly 6.7 million Americans, with numbers expected to double by 2050.

These statistics emphasize the necessity for accurate, accessible, and early neurodiagnostic interventions. Disorders like epilepsy, which require electroencephalographic (EEG) monitoring, and multiple sclerosis, where MRI is a primary diagnostic modality, are becoming increasingly common in both developed and developing regions. Additionally, post-COVID-19 neurological syndromes have further highlighted the need for sophisticated diagnostic tools in the early detection and monitoring of neuroinflammation and related complications.

High Cost and Limited Accessibility of Advanced Diagnostic Modalities

Despite technological advances, one of the major restraints limiting neurodiagnostic market expansion is the high cost of equipment and procedures. Devices like MRI, MEG, and PET scanners require significant capital investment, specialized personnel, and infrastructural support, making them accessible primarily to large hospitals or academic institutions. Furthermore, many of these devices require regular calibration and maintenance, adding to operational expenditures.

In low- and middle-income countries (LMICs), the availability of comprehensive neurodiagnostic setups remains sparse, creating disparities in neurological care. Insurance coverage for neurodiagnostic procedures also varies widely across geographies, adding to out-of-pocket patient burdens. This economic barrier inhibits broader adoption, especially in rural and under-resourced regions.

Integration of Tele-neurodiagnostics and Remote Monitoring

The rapid expansion of telemedicine offers an exciting opportunity for neurodiagnostics to reach underserved and remote populations. Tele-neurodiagnostics—enabled by wearable EEG devices, cloud-based image sharing, and remote analysis platforms—has the potential to overcome geographic and infrastructural limitations.

For instance, stroke patients in rural areas can now receive real-time diagnostic evaluations through teleradiology-supported CT/MRI scans, ensuring swift treatment decisions. Moreover, chronic neurological conditions like epilepsy or Parkinson’s disease can be monitored through ambulatory EEG systems, whose data is analyzed and reviewed remotely by specialists. This democratization of care, driven by digital technologies, can significantly expand the market's reach.

Neuroimaging technologies have consistently held the dominant share in the neurodiagnostics market. MRI and CT scans are considered gold standards for structural brain imaging, offering high-resolution views of anatomical changes associated with tumors, hemorrhage, atrophy, and ischemic strokes. PET and SPECT imaging provide crucial insights into cerebral metabolism and perfusion patterns—vital for understanding dementia, seizure focus localization, and movement disorders. These modalities are well-integrated into clinical practice across hospitals and imaging centers, owing to their diagnostic precision and established reimbursement pathways.

On the other hand, Neuroinformatics is poised to be the fastest-growing segment, fueled by the explosion of brain-related data and the growing complexity of diagnostic needs. Neuroinformatics platforms use machine learning algorithms and bioinformatic tools to analyze multimodal brain imaging data, electrophysiology records, and genetic markers. These platforms are crucial in research-driven environments, enabling deeper insights into brain networks and disease progression models. Their utility in guiding precision medicine strategies is expected to elevate their role in both clinical and research settings.

Hospitals and clinics accounted for the largest end-use segment, given their comprehensive infrastructure and skilled workforce capable of operating complex neurodiagnostic equipment. These facilities typically house high-end MRI/PET/EEG units and have access to multidisciplinary teams for patient assessment and treatment. They are also the primary choice for acute neurological cases such as stroke, traumatic brain injury, or tumor management, where timely and integrated diagnostics are crucial.

Meanwhile, diagnostic laboratories are emerging as the fastest-growing end-user segment due to increased outsourcing of neurodiagnostic procedures and the rising demand for cost-effective outpatient services. Standalone imaging and electrophysiological labs offer specialized services like ambulatory EEG, evoked potential tests, and neuroimaging on a referral basis. These centers often provide quicker appointments, focused expertise, and lower costs, making them appealing to both patients and insurers. As healthcare systems move toward decentralization, the role of diagnostic labs in neurodiagnostics is set to expand significantly.

North America has established itself as the dominant region in the global neurodiagnostics market, driven by a highly advanced healthcare infrastructure, extensive insurance coverage, and a high prevalence of neurological conditions. The U.S. in particular, hosts a large number of academic medical centers, specialized neurology clinics, and well-equipped hospitals that utilize cutting-edge diagnostic platforms. Public initiatives like the BRAIN Initiative, and the presence of key industry players, have fostered substantial investments in research, device development, and AI integration into diagnostic workflows.

Furthermore, rising awareness campaigns, routine screening programs for cognitive decline, and strong telehealth networks contribute to North America's market leadership. The availability of skilled professionals and government support for neurodegenerative disease management also underpin the robust market ecosystem.

Asia-Pacific is witnessing the fastest growth in the neurodiagnostics market due to a combination of rising disease burden, improving healthcare access, and growing investments in diagnostic infrastructure. Countries like China and India are experiencing an increase in stroke incidence and age-related neurological conditions, prompting health systems to scale up diagnostic capacities. Government-backed insurance schemes and public-private partnerships are helping bridge the infrastructure gap.

Moreover, regional adoption of telemedicine and mobile diagnostic units is helping extend services to rural areas. Japan and South Korea, known for their advanced technology sectors, are actively incorporating neuroinformatics and AI into healthcare, while Southeast Asian nations are improving their tertiary care capacities. The region's large patient pool and under-penetrated diagnostic market make it an attractive area for expansion by global players.

In March 2024, GE HealthCare announced the FDA clearance of its new AI-assisted MRI platform tailored for early detection of neurodegenerative diseases such as Parkinson’s and Alzheimer’s.

In January 2024, Philips Healthcare launched a new line of portable MEG and EEG systems designed for pediatric neurological testing and ambulatory care settings.

In October 2023, Canon Medical Systems expanded its neuroimaging product line with advanced PET/MRI hybrid systems in Europe and Asia-Pacific, aimed at research hospitals and neuroscience centers.

In July 2023, NeuroSky Inc. partnered with a U.S.-based telehealth provider to integrate its wearable EEG technology into remote neurological monitoring for epilepsy patients.

In May 2023, Siemens Healthineers entered a strategic alliance with a leading neuroinformatics software firm to integrate real-time brain imaging analytics into clinical workflows.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Neurodiagnostics market.

By Technology

By End Use

By Region