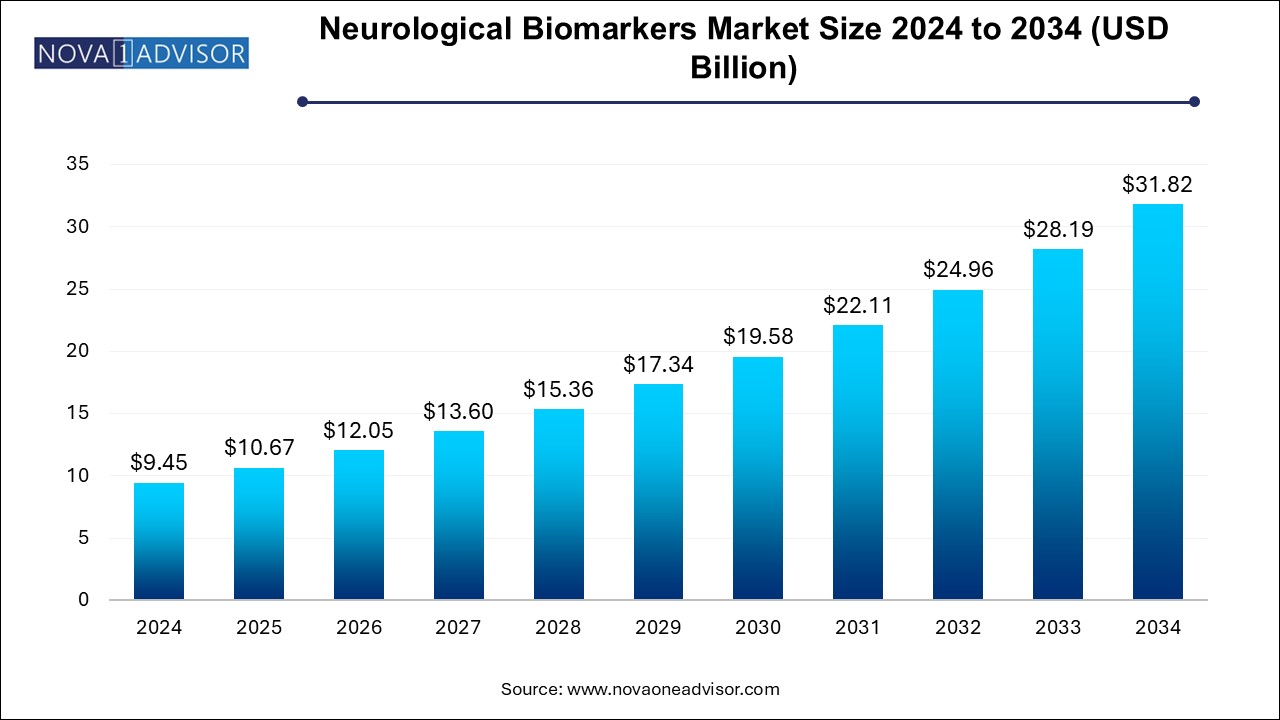

The neurological biomarkers market size was exhibited at USD 9.45 billion in 2024 and is projected to hit around USD 31.82 billion by 2034, growing at a CAGR of 12.91% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.67 Billion |

| Market Size by 2034 | USD 31.82 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.91% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Abbott; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Alseres Pharmaceuticals, Inc.; DiaGenic ASA; Banyan Biomarkers, Inc.; Rules-Based Medicine; Quanterix |

Technological advancements, a rising prevalence of neurological disorders such as Parkinson's disease, Alzheimer's Disease (AD), dementia, brain tumors, & epilepsy, and increased funding for R&D of neurological biomarkers are factors responsible for market growth over the forecast period.

The COVID-19 pandemic brought both opportunities and challenges in the market for neurological biomarkers. While there was a growing demand for biomarkers due to the virus's neurological implications, hurdles such as disruptions in research and development activities, delayed clinical trials, and economic constraints disrupted market expansion. These challenges can hinder market growth by impeding the timely introduction of new neurological biomarkers, affecting their overall adoption and market penetration.

An increasing prevalence of neurological disorders is anticipated to drive market advancement. As per WHO estimates, in the U.S., stroke is the third leading cause of death and Parkinson’s disease currently impacts around 1 million people in the country. Technological advancements in biomarkers have made it easier for physicians and researchers to track & manage brain health.

Recent advancements in detection and biomarker signatures have helped in making neurological diseases more treatable. With an advent of neurological biomarkers detected in blood over the past few years, diagnosing diseases such as Alzheimer’s, autism, chronic traumatic encephalopathy, major depressive disorder, and Parkinson’s disease is likely to become easier.

As per a WHO article published in February 2024, every year, nearly 5 million people globally are diagnosed with epilepsy. Rising cases of Alzheimer’s disease in older people is expected to fuel market growth. For instance, according to WHO, globally, over 55 million people have dementia and about 10 million new cases are reported every year. According to Alzheimer’s Association, approximately 13.8 million people aged 65 and above are expected to suffer from Alzheimer’s dementia by 2060.

The development and introduction of Blood Based Biomarkers (BBBMs) for diagnosing AD & mild traumatic brain injury, among other conditions, contribute to market growth. For instance, in March 2020, NIH-funded researchers developed a blood-based test for detecting phosphorylated-tau-181 (ptau181), which indicates the presence of AD. This approach is less costly and invasive than existing brain imaging & spinal fluid tests. In January 2021, Abbott introduced the first rapid blood test for traumatic brain injury, including concussion. The i-STAT TBI plasma test measures a specific protein found in blood after a TBI and can help avoid the need for CT scans in case of negative test results.

Furthermore, growing research and innovation activities to help diagnose Parkinson’s disease using antigen-antibody binding techniques is fueling market growth. For example, according to an article by NCBI, in 2022, diagnosis of Parkinson's disease by investigating the inhibitory effect of serum components on P450 inhibition assay requires immunoblotting analysis, and it demonstrates that P450 inhibition assay can discriminate between sera from healthy individuals and patients with Parkinson’s disease. Moreover, this technique is easier to perform and is faster than other assays, as it does not require any pretreatment.

Biomarker discovery has been increasing in this segment in recent years. For instance, in April 2021, two novel sleep biomarkers associated with neurodegenerative diseases, including Parkinson’s disease and dementia, were discovered by a group of NIH-funded institutions using the Sleep Profiler EEG Sleep Monitor by Advanced Brain Monitoring, Inc. This discovery is not only critical in deriving a correlation with neurological diseases but also to improve brain-related understanding. Such developments are likely to further propel research in this segment.

Proteomic biomarkers accounted for largest share of 30.49% of the neurological biomarkers market in 2024. Various powerful systems can detect and even measure low concentration of proteomic neurological biomarkers. For example, Merck’s SMCxPRO can quantify proteins in blood-plasma samples and support managing neurological conditions such as Alzheimer’s. This has aided in the early diagnosis of neurological conditions, fueling market growth. Also, recent improvements in sensitivity & reproducibility in instruments, such as LC-MS/MS, microarray technology, and development of immunoassay-based single-molecule quantification & multiplexing, are further boosting proteomics-based biomarker research.

Other types, which include digital biomarkers, are anticipated to witness significant revenue growth through 2034. Digital biomarkers offer various biopharmaceutical and pharmaceutical firms with supplemental and contextual data to conclude clinical trial decisions. For instance, in May 2022, NeuraLight received funding of USD 25 million to develop novel digital biomarkers for diagnosing neurological diseases. Thus, growing funding for digital biomarkers is expected to fuel segment growth.

Alzheimer’s disease accounted for the largest market share in 2024 and is expected to remain dominant during the forecast period due to rising disease prevalence and increasing awareness for its early diagnosis and timely treatment. According to Alzheimer’s Association, globally, approximately 55 million individuals are living with dementia, with this number anticipated to rise to 78 million by 2034 and around 139 million by 2050. Moreover, in the U.S., approximately 6.5 million individuals are estimated to live with AD in 2022.

The Parkinson’s disease segment is expected to expand at a substantial CAGR from 2025 to 2034. Increasing R&D activities in biomarkers can potentially offer new opportunities for Parkinson’s therapeutics. For instance, according to an article published in Pharmaceutical Technology, in October 2022, a research study identified a novel cerebrospinal fluid biomarker for Parkinson’s disease, strengthening the scope of possible drug targets. Thus, neurological biomarkers may open new avenues for treating Parkinson’s disease and are projected to drive market expansion during the forecast period.

Research organizations and other end-use areas accounted for a dominant market share 45.0% in 2024.Research institutes, such as the National Institute of Neurological Disorders and Stroke (NINDS), have been providing significant funding for biomarker discovery, validation, and qualification of various neurological disorders. In May 2022, Amprion Inc. received an additional research grant of around USD 730,000 from NINDS for continued validation of the SYNTap Biomarker Test to diagnose neurological diseases or disorders.

Hospital & hospital laboratories segment, meanwhile, is expected to grow at the fastest CAGR through 2034, owing to an increase in hospitalization rates. Diagnostic centers often function in collaboration with hospitals, enabling hospitals to have in-house diagnostic setups. Furthermore, ongoing development of healthcare infrastructure is anticipated to enhance existing hospital facilities. A majority of blood-based biomarker assays are purchased by hospitals and are used in significant volumes.

North America accounted for a significant revenue share in 2024 and is expected to witness strong growth from 2025 to 2034. This growth can be attributed to increased understanding of significant potential of biomarkers in drug development. A strong presence of regulatory bodies is also expected to fuel regional growth of biomarker-based drug development. For instance, in March 2022, H.U. Group Holdings Inc. and its subsidiary Fujirebio launched Lumipulse, a fully automated biomarker for Alzheimer’s. Increasing government funding for development of neurological biomarkers is expected to further fuel market growth.

Asia Pacific is meanwhile expected to advance at the highest CAGR through 2034. A noticeable increase in disposable income in developing countries, such as India & China, rising incidence of neurological disorders, and growing geriatric population that is highly susceptible to these diseases, along with a fast-growing prevalence of target diseases are further expected to propel regional market expansion.

Advancements in R&D by major companies are expected to positively impact regional market development.For instance, in June 2022, researchers from Hiroshima University and Kobe University developed a novel blood test for diagnosis of Parkinson’s disease. In addition, researchers had previously developed an inhibition assay P450 to identify changes in Parkinson’s disease.

Companies are adopting strategies that allow them to use their resources to aid in new product developments and enhance their supply chain.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the neurological biomarkers market

By Type

By Application

By End-use

By Regional

Chapter 1 Neurological Biomarkers Market: Methodology and Scope

1.1 Market Segmentation And Scope

1.1.1 Segment Definition

1.1.1.1 Application Segment

1.1.1.2 Type Segment

1.1.1.3 End Use Segment

1.2 Regional Scope

1.3 Estimates And Forecast Timeline

1.4 Objectives

1.4.1 Objective - 1

1.4.2 Objective - 2

1.4.3 Objective - 3

1.5 Research Methodology

1.6 Information Procurement

1.6.1 Purchased Database

1.6.2 Internal Database

1.6.3 Secondary Sources

1.6.4 Primary Research

1.7 Information Or Data Analysis

1.7.1 Data Analysis Models

1.8 Market Formulation & Validation

1.9 Model Details

1.9.1 Commodity Flow Analysis

1.10 List Of Secondary Sources

1.11 List Of Abbreviations

Chapter 2 Neurological Biomarkers Market: Executive Summary

2.1 Market Outlook

2.2 Application And Type Snapshot

2.3 End Use Snapshot

2.4 Competitive Landscape Snapshot

Chapter 3 Neurological Biomarkers Market: Variables, Trends, And Scope

3.1 Neurological Biomarkers Market Lineage Outlook

3.1.1 Parent Market Outlook

3.2 Penetration And Growth Prospect Mapping

3.3 Pipeline Analysis

3.3.1 Alzheimer’s Disease

3.3.2 Parkinson’s Disease

3.3.3 Multiple Sclerosis

3.3.4 Autism Spectrum Disorder

3.4 Market Dynamics

3.4.1 Market Driver Analysis

3.4.1.1 Increasing Prevalence Of Neurological Diseases

3.4.1.2 Technological Advancements

3.4.1.3 Increased Funding For R&d In Biomarkers

3.4.2 Market Restraint Analysis

3.4.2.1 Lack Of Consumer Awareness

3.4.2.2 Reimbursement Policies

3.5 Neurological Biomarkers: Market Analysis Tools

3.5.1 Industry Analysis - Porter’s Five Forces

3.5.2 Pestle Analysis

Chapter 4 Neurological Biomarkers Market: Segment Analysis, By Type, 2021 - 2033

4.1 Neurological Biomarkers Market: Type Movement Analysis

4.1.1 Genomic

4.1.1.1 Genomic Neurological Biomarkers Market, 2021 - 2033

4.1.2 Proteomic

4.1.2.1 Proteomic Neurological Biomarkers Market, 2021 - 2033

4.1.3 Metabolomic

4.1.3.1 Metabolomic Neurological Biomarkers Market, 2021 - 2033

4.1.5 Imaging

4.1.5.1 Imaging Neurological Biomarkers Market, 2021 - 2033

4.1.6 Others

4.1.6.1 Other Neurological Biomarkers Market, 2021 - 2033

Chapter 5 Neurological Biomarkers Market: Segment Analysis, By Application, 2021 - 2033

5.1 Neurological Biomarkers Market: Application Movement Analysis

5.1.1 Alzheimer’s Disease

5.1.1.1 Alzheimer’s Disease Market, 2021 - 2033

5.1.2 Parkinson’s Disease

5.1.2.1 Parkinson’s Disease Market, 2021 - 2033

5.1.3 Multiple Sclerosis

5.1.3.1 Multiple Sclerosis Market, 2021 - 2033

5.1.4 Autism Spectrum Disorder

5.1.4.1 Autism Spectrum Disorder Market, 2021 - 2033

5.1.5 Others

5.1.5.1 Others Market, 2021 - 2033

Chapter 6 Neurological Biomarkers Market: Segment Analysis, By End-use, 2021 - 2033

6.1 Neurological Biomarkers Market: End-use Movement Analysis

6.1.1 Hospital & Hospital Laboratories

6.1.1.1 Hospitals & Hospital Laboratories Market, 2021 - 2033

6.1.2 Independent Clinical Diagnostic Centers

6.1.2.1 Independent Clinical Diagnostic Centers Market, 2021 - 2033

6.1.3 Research Organizations And Others

6.1.3.1 Research Organizations And Others Market, 2021 - 2033

Chapter 7 Neurological Biomarkers Market: Segment Analysis, By Region, 2021 - 2033

7.1 Regional Market Snapshot

7.2 North America

7.2.1 North America Neurological Biomarkers Market, 2021 - 2033

7.2.2 U.S.

7.2.2.1 U.S. Neurological Biomarkers Market, 2021 - 2033

7.2.2.2 Key Country Dynamics

7.2.2.3 Regulatory Framework

7.2.2.4 Reimbursement Scenario

7.2.3 Canada

7.2.3.1 Canada Neurological Biomarkers Market, 2021 - 2033

7.2.3.2 Key Country Dynamics

7.2.3.3 Regulatory Framework

7.2.3.4 Reimbursement Scenario

7.3 Europe

7.3.1 Europe Neurological Biomarkers Market, 2021 - 2033

7.3.2 UK

7.3.2.1 UK Neurological Biomarkers Market, 2021 - 2033

7.3.2.2 Key Country Dynamics

7.3.2.3 Regulatory Framework

7.3.2.4 Reimbursement Scenario

7.3.3 Germany

7.3.3.1 Germany Neurological Biomarkers Market, 2021 - 2033

7.3.3.2 Key Country Dynamics

7.3.3.3 Regulatory Framework

7.3.3.4 Reimbursement Scenario

7.3.4 Spain

7.3.4.1 Spain Neurological Biomarkers Market, 2021 - 2033

7.3.4.2 Key Country Dynamics

7.3.4.3 Regulatory Framework

7.3.4.4 Reimbursement Scenario

7.3.5 France

7.3.5.1 France Neurological Biomarkers Market, 2021 - 2033

7.3.5.2 Key Country Dynamics

7.3.5.3 Regulatory Framework

7.3.5.4 Reimbursement Scenario

7.3.6 Italy

7.3.6.1 Italy Neurological Biomarkers Market, 2021 - 2033

7.3.6.2 Key Country Dynamics

7.3.6.3 Regulatory Framework

7.3.6.4 Reimbursement Scenario

7.3.7 Denmark

7.3.7.1 Denmark Neurological Biomarkers Market, 2021 - 2033

7.3.7.2 Key Country Dynamics

7.3.7.3 Regulatory Framework

7.3.7.4 Reimbursement Scenario

7.3.8 Sweden

7.3.8.1 Sweden Neurological Biomarkers Market, 2021 - 2033

7.3.8.2 Key Country Dynamics

7.3.8.3 Regulatory Framework

7.3.8.4 Reimbursement Scenario

7.3.9 Norway

7.3.9.1 Norway Neurological Biomarkers Market, 2021 - 2033

7.3.9.2 Key Country Dynamics

7.3.9.3 Regulatory Framework

7.3.9.4 Reimbursement Scenario

7.4 Asia Pacific

7.4.1 Asia-pacific Neurological Biomarkers Market, 2021 - 2033

7.4.2 Japan

7.4.2.1 Japan Neurological Biomarkers Market, 2021 - 2033

7.4.2.2 Key Country Dynamics

7.4.2.3 Regulatory Framework

7.4.2.4 Reimbursement Scenario

7.4.3 China

7.4.3.1 China Neurological Biomarkers Market, 2021 - 2033

7.4.3.2 Key Country Dynamics

7.4.3.3 Regulatory Framework

7.4.3.4 Reimbursement Scenario

7.4.4 India

7.4.4.1 India Neurological Biomarkers Market, 2021 - 2033

7.4.4.2 Key Country Dynamics

7.4.4.3 Regulatory Framework

7.4.4.4 Reimbursement Scenario

7.4.5 South Korea

7.4.5.1 South Korea Neurological Biomarkers Market, 2021 - 2033

7.4.5.2 Key Country Dynamics

7.4.5.3 Regulatory Framework

7.4.5.4 Reimbursement Scenario

7.4.6 Thailand

7.4.6.1 Thailand Neurological Biomarkers Market, 2021 - 2033

7.4.6.2 Key Country Dynamics

7.4.6.3 Regulatory Framework

7.4.6.4 Reimbursement Scenario

7.4.7 Australia

7.4.7.1 Australia Neurological Biomarkers Market, 2021 - 2033

7.4.7.2 Key Country Dynamics

7.4.7.3 Regulatory Framework

7.4.7.4 Reimbursement Scenario

7.5 Latin America

7.5.1 Latin America Neurological Biomarkers Market, 2021 - 2033

7.5.2 Brazil

7.5.2.1 Brazil Neurological Biomarkers Market, 2021 - 2033

7.5.2.2 Key Country Dynamics

7.5.2.3 Regulatory Framework

7.5.2.4 Reimbursement Scenario

7.5.3 Mexico

7.5.3.1 Mexico Neurological Biomarkers Market, 2021 - 2033

7.5.3.2 Key Country Dynamics

7.5.3.3 Regulatory Framework

7.5.2.4 Reimbursement Scenario

7.5.4 Argentina

7.5.4.1 Argentina Neurological Biomarkers Market, 2021 - 2033

7.5.4.2 Key Country Dynamics

7.5.4.3 Regulatory Framework

7.5.4.4 Reimbursement Scenario

7.6 MEA

7.6.1 MEA Neurological Biomarkers Market, 2021 - 2033

7.6.2 South Africa

7.6.2.1 South Africa Neurological Biomarkers Market, 2021 - 2033

7.6.2.2 Key Country Dynamics

7.6.2.3 Regulatory Framework

7.6.2.4 Reimbursement Scenario

7.6.3 Saudi Arabia

7.6.3.1 Saudi Arabia Neurological Biomarkers Market, 2021 - 2033

7.6.3.2 Key Country Dynamics

7.6.3.3 Regulatory Framework

7.6.3.4 Reimbursement Scenario

7.6.4 UAE

7.6.4.1 UAE Neurological Biomarkers Market, 2021 - 2033

7.6.4.2 Key Country Dynamics

7.6.4.3 Regulatory Framework

7.6.2.4 Reimbursement Scenario

7.6.5 Kuwait

7.6.5.1 Kuwait Neurological Biomarkers Market, 2021 - 2033

7.6.5.2 Key Country Dynamics

7.6.5.3 Regulatory Framework

7.6.5.4 Reimbursement Scenario

Chapter 8 Neurological Biomarkers Market: Competitive Analysis

8.1 Company Categorization

8.2 Strategy Mapping

8.2.1 New Product Launches

8.2.2 Partnerships

8.2.3 Acquisitions

8.2.4 Collaborations

8.2.5 Funding

8.3 Company Market Share Analysis, 2022

8.4 Company Profiles

8.4.1 Abbott

8.4.1.1 Company Overview

8.4.1.2 Financial Performance

8.4.1.3 Product Benchmarking

8.4.1.4 Strategic Initiatives

8.4.2 Johnson & Johnson Services, Inc.

8.4.2.1 Company Overview

8.4.2.2 Financial Performance

8.4.2.3 Product Benchmarking

8.4.2.4 Strategic Initiatives

8.4.3 Bio-rad Laboratories, Inc.

8.4.3.1 Company Overview

8.4.3.2 Financial Performance

8.4.3.3 Product Benchmarking

8.4.3.4 Strategic Initiatives

8.4.4 Alseres Pharmaceuticals, Inc.

8.4.4.1 Company Overview

8.4.4.2 Product Benchmarking

8.4.5 Banyan Biomarkers, Inc.

8.4.5.1 Company Overview

8.4.5.2 Product Benchmarking

8.4.5.3 Strategic Initiatives

8.4.6 Rules-based Medicine

8.4.6.1 Company Overview

8.4.6.2 Financial Performance

8.4.6.3 Product Benchmarking

8.4.6.4 Strategic Initiatives

8.4.7 Thermo Fisher Scientific, Inc.

8.4.7.1 Company Overview

8.4.7.2 Financial Performance

8.4.7.3 Product Benchmarking

8.4.7.4 Strategic Initiatives

8.4.8 Diagenic Asa

8.4.8.1 Company Overview

8.4.8.2 Product Benchmarking

8.4.9 Merck & Co., Inc.

8.4.9.1 Company Overview

8.4.9.2 Financial Performance

8.4.9.3 Product Benchmarking

8.4.9.4 Strategic Initiatives

8.4.10 Quanterix

8.4.10.1 Company Overview

8.4.10.2 Product Benchmarking

8.4.10.3 Strategic Initiatives