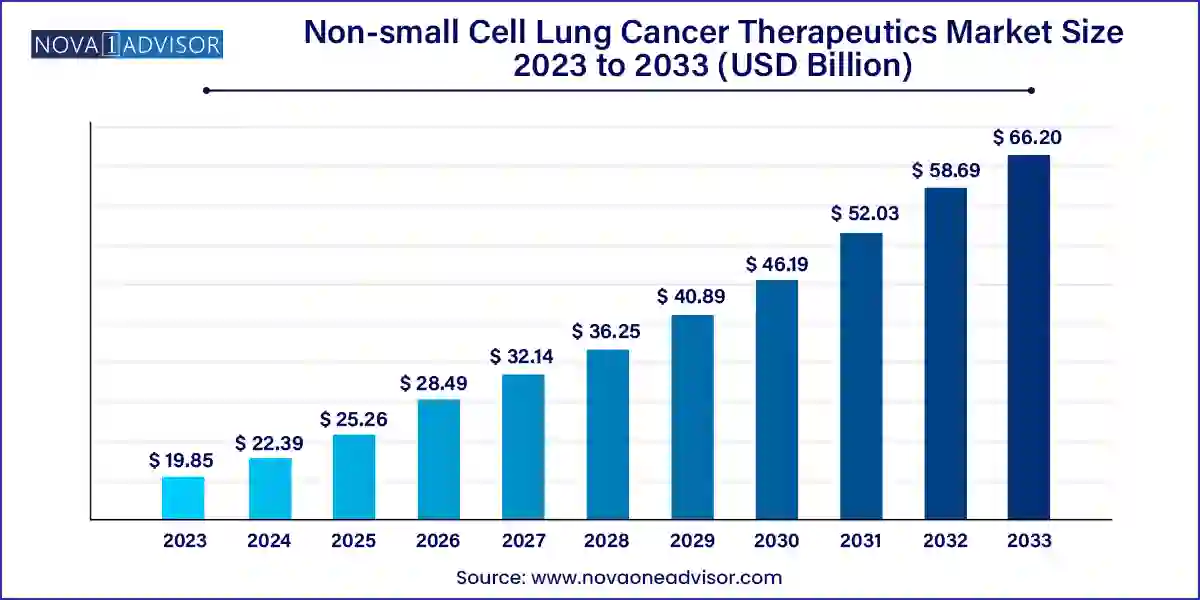

The global non-small cell lung cancer therapeutics market size was valued at USD 19.85 billion in 2023 and is anticipated to reach around USD 66.20 billion by 2033, growing at a CAGR of 12.8% from 2024 to 2033.

The market growth is attributed to the increasing rate of patients being diagnosed with lungs disorders. Increased consumption of tobacco products, deteriorating air quality due to air pollution, and unhealthy lifestyle have also contributed to the increase in lung cancer. Furthermore, increased investments by major medical institutes for research and development of medicines and treatments related to the non-small cell lung cancer (NSCLC) have resulted in the growth of this market.

The increase in the number of patients suffering from lung cancer due to excessive smoking and use of other tobacco products has resulted in the market expansion. Furthermore, air pollution, passive smoking, and consumption of unsafe water has also increased the number of lung cancer patients. Furthermore, increased awareness spread by government and NGOs about tobacco consumptions and health complications caused due to it has increased the number of patients seeking diagnosis and treatment of their respiratory health.

Increased investments by major companies in research and development of medicines and therapies in order to treat NSCLC and other disorders have attributed in the market growth of this industry. Companies are targeting to increase the number of medicines approved by the regulatory bodies for the treatment of lung disorders. Furthermore, the rising use and demand for precision medicine, primarily driven by the development of targeted therapies that effectively target cancer cells has also resulted in the growth of this market.

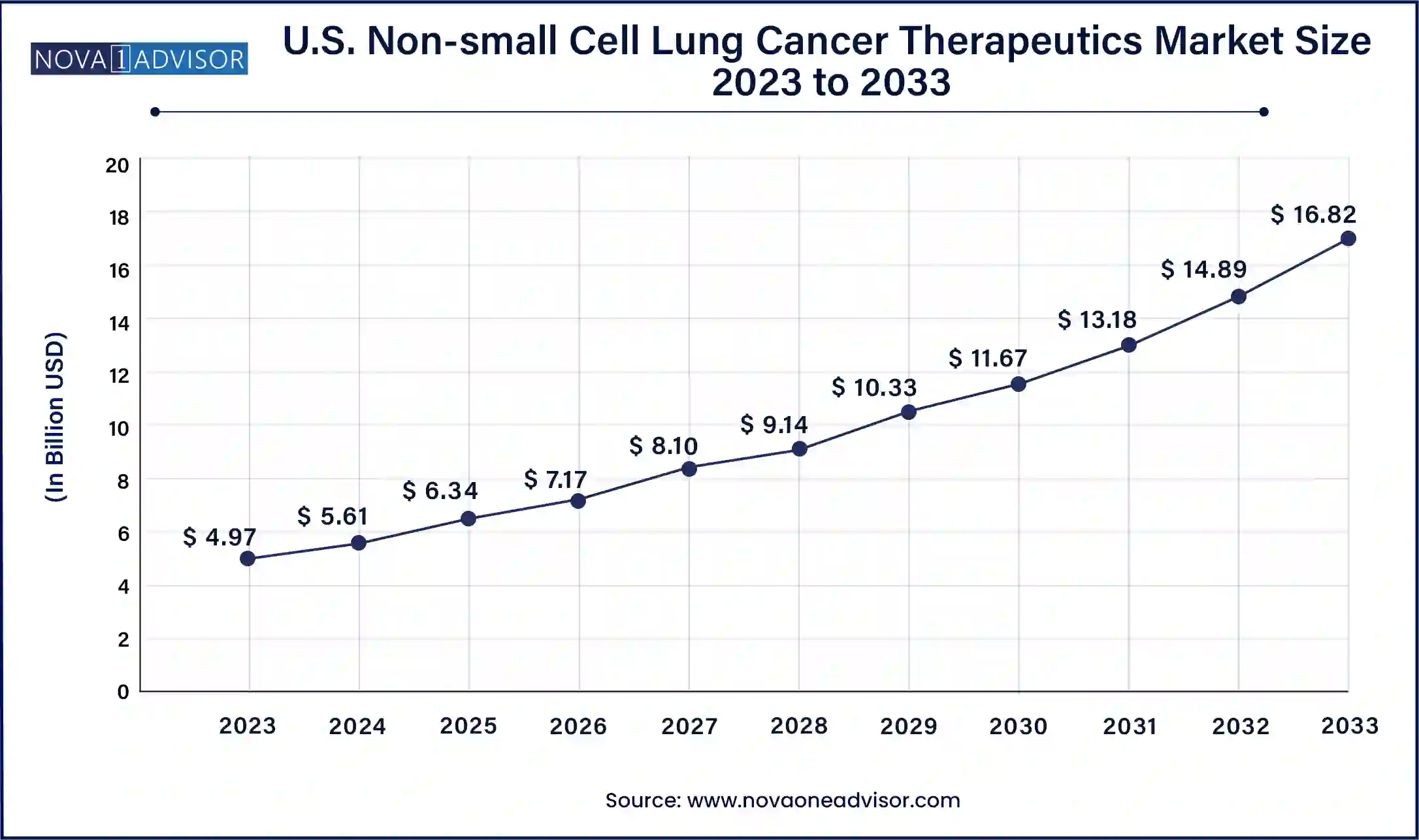

The U.S. non-small cell lung cancer therapeutics market size was valued at USD 4.97 billion in 2023 and is projected to surpass around USD 16.82 billion by 2033, registering a CAGR of 13.0% over the forecast period of 2024 to 2033.

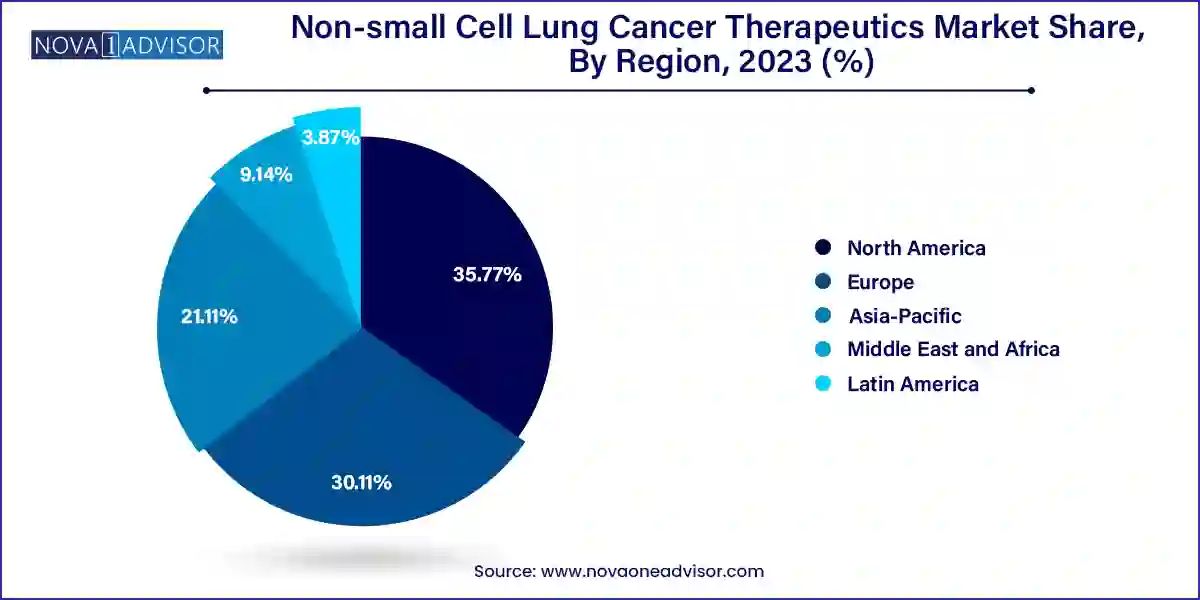

North America dominated the non-small cell lung cancer therapeutics market with a market share of 35.77% in 2023. This growth was attributed to the presence of developed healthcare facilities and increased awareness regarding cancer treatments. The market is also growing due to the presence of key market players who are targeting to deploy new and more effective medicines in order to treat NSCLC. Rise in the disposable income has increased the acceptance of costly treatments and drugs which further helps in the market growth of this region.

U.S. Non-small Cell Lung Cancer Therapeutics Market Trends

U.S. dominated themarket of North America in 2023 with a market share of 83.11% due to rise in the population with smoking addiction and air pollution. Presence of major medical institutes in the country helps in diagnosing the early stages of cancer. Major companies are investing heavily in the development of medicines and therapeutics, which is contributing to the market growth. Furthermore, growing awareness related to cancer treatment has increased the number of patients seeking diagnosis and treatment of their disorders.

Europe Non-small Cell Lung Cancer Therapeutics Market Trends

Europe non-small cell lung cancer therapeutics market was identified as a lucrative region in this industry as it had a market share of 30.11% in 2023 due to presence of major medical institutes and increase in the population with smoking addiction. Furthermore, increased awareness about cancer treatment by the government and various NGOs has increased the number of patients seeking for the treatment of NSCLC. Therefore, these factors are responsible for the positive market growth in this region.

UK non-small cell lung cancer therapeutics market is expected to grow rapidly due to the increasing prevalence of cancer diseases and introduction of new drugs and therapies for the treatment of NSCLC. Rising awareness and early detection efforts have increased the diagnosis rates of various cancer disorders. Furthermore, increase in the drugs approved by the regulatory bodies has also helped in the market growth of NSCLC therapeutics in this country.

Asia Pacific Non-small Cell Lung Cancer Therapeutics Market Trends

Asia Pacific had a significant market share in 2023 due to development in healthcare sector increasing population, and rising prevalence of NSCLC. Increase in the population with smoking addiction that are seeking medical help in order to diagnose and treat their lungs disorders has further resulted in the market growth in this region. Developing healthcare and deployment of new drugs in order to treat NSCLC has attributed in the increase in the diagnosis of patients with the disorders.

China non-small cell lung cancer therapeutics market held a substantial market share in non-small cell lung cancer therapeutics market due to increase in the adoption of therapies in order to treat NSCLC. With rise in the disposable income, adoption of costly therapies in order to treat NSCLC has increased. Furthermore, growing awareness of cancer treatments has resulted in the increase of patients seeking for treatments related to cancer.

| Report Attribute | Details |

| Market Size in 2024 | USD 22.39 Billion |

| Market Size by 2033 | USD 66.20 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, treatment, distribution channel, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd., Mylan N.V., Teva, Pharmaceutical Industries Ltd. , Sanofi , Pfizer Inc.,GSK plc , Novartis AG , Bayer AG , Eli Lilly and Company, Merck & Co., Inc. |

The adenocarcinoma segment dominated the market in 2023 with a share of 43.13% in 2023 due to increase in the population consuming tobacco and other products for smoking. Smoking addiction is one of the major reasons for patients diagnosed with adenocarcinoma. The segment is growing as the detection of adenocarcinoma is done at an early stage which allows for better treatment. Furthermore, increase in the targeted drugs used specifically to treat adenocarcinoma have further attributed to the market growth.

The squamous cell carcinoma (SCC) segment is anticipated to witness the fastest CAGR of 13.3% over the forecast period. This market growth is attributed to the rise in the patients exposed to UV radiation. SCC usually occurs in the neck and head region, including the nasal cavity, throat, lips and tongue regions. Furthermore, the awareness campaigns about SCC run by medical institutions and governments has led to more patients seeking treatment for the condition. Therefore, these factors are responsible for the market growth of this segment.

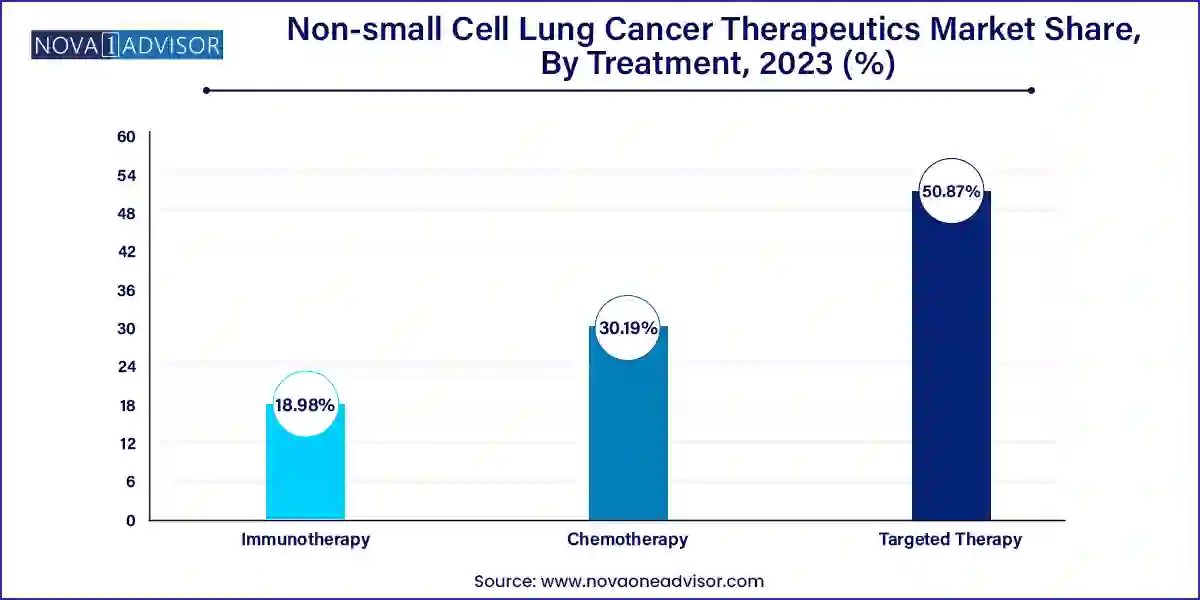

The targeted therapy segment dominated the market in 2023 with a share of 50.87% in 2023. The factors responsible for the market growth are the benefits of this therapy such as increased number of targeted therapeutics and low percentage of side effects during the treatment. Targeted therapies are specifically used to disrupt cancer cell growth signals. Targeted therapies can be customized according to the patient type which helps in minimization of the side effects. Hence, these reasons are responsible for the upward market growth of this segment.

The immunotherapy segment is expected to grow at a significant CAGR over the forecast period due to introduction of new products in the immunotherapy segment and increase in the preference of immunotherapy in order to treat cancer. Immunotherapy uses the immunity system in order to cure and control the cancer causing cells in the patient’s body. Furthermore, increased investments by key market players in order to develop better products to optimize the treatment has also helped in the market growth of this segment.

The hospital pharmacy segment dominated the market in 2023 with a share of 66.17% in 2023. This market growth was attributed to the increase in the number of hospitalized patients suffering from NSCLC. Increase in the number of medicines and treatments available for treating NSCLC has further attributed in the market growth of segment as key market players are targeting to deploy more regulatory approved medicines in order to treat these disorders. Therefore. These reasons are responsible for the market growth of hospital pharmacy segment.

The drug store and retail pharmacy segment is anticipated to witness a significant CAGR over the forecast period owing to the increased availability of regulatory approved drugs for consumption by patients seeking to cure NSCLC. Increased prevalence of lung cancer has resulted in the high demand for medications and treatments. Therefore, drug stores and retail pharmacies provides convenient access to medications. Furthermore, increased awareness about cancer treatment has resulted in the increase in number of patients seeking to consume medicines that helps in the treatment of lungs disorder. Therefore, these factors have resulted in the market growth of this segment.

Some of the major companies in the non-small cell lung cancer therapeutics market are F.Hoffmann-La Roche Ltd., Mylan N.V., Teva Pharmaceutical Industries Ltd., Sanofi, Pfizer Inc. Companies are focusing on deploying new drugs and therapies in order to deal with the rising demand for lung cancer patients.

The following are the leading companies in the non-small cell lung cancer therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Non-small Cell Lung Cancer Therapeutics market.

By Type

By Treatment

By Distribution Channel

By Region