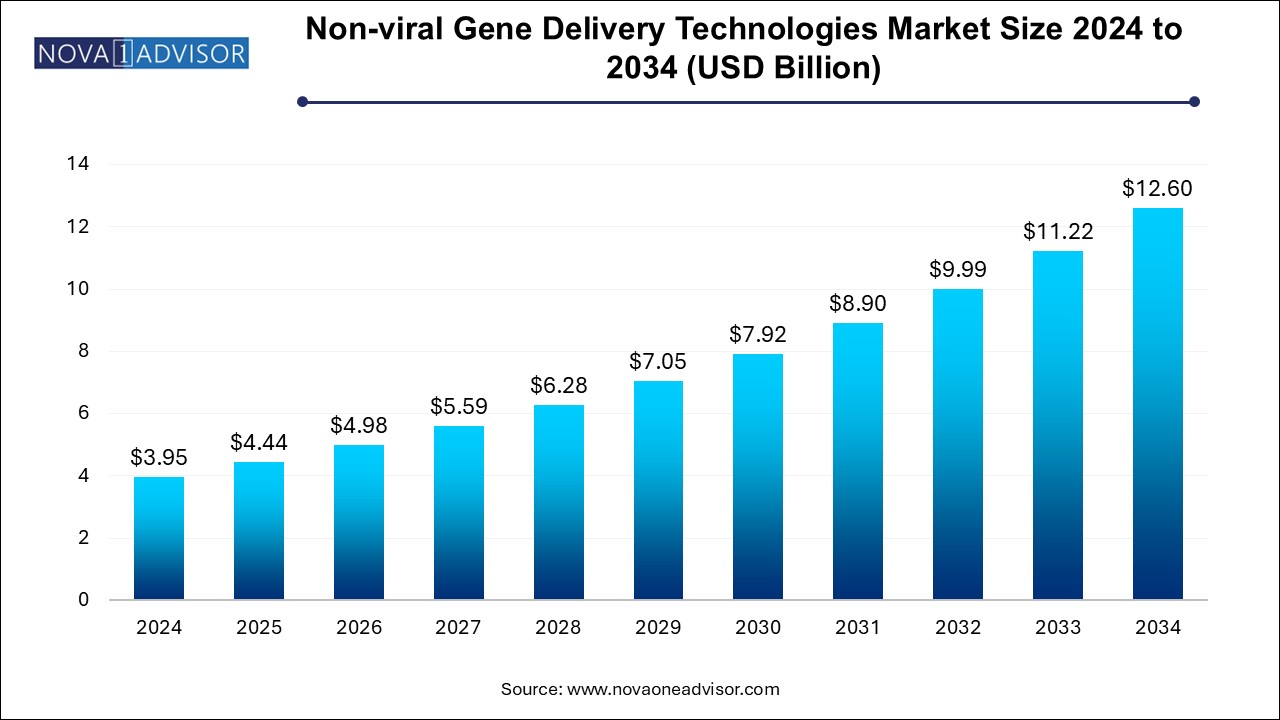

The non-viral gene delivery technologies market size was exhibited at USD 3.95 billion in 2024 and is projected to hit around USD 12.6 billion by 2034, growing at a CAGR of 12.3% during the forecast period 2025 to 2034.

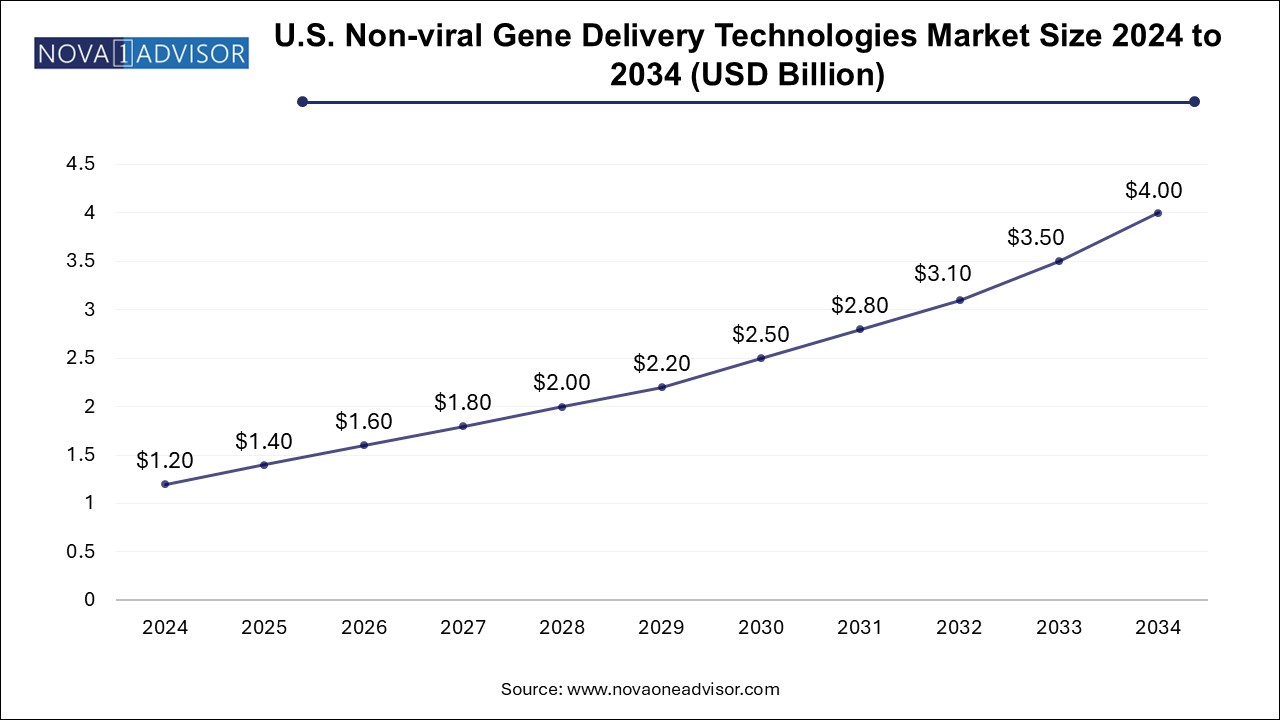

The U.S. non-viral gene delivery technologies market size is evaluated at USD 1.2 billion in 2024 and is projected to be worth around USD 4.0 billion by 2034, growing at a CAGR of 11.56% from 2025 to 2034.

North America non-viral gene delivery technologies market dominated globally with a share of 42.0% in 2024. Factors behind this growth include the strong research infrastructure, well-established pharmaceuticals and biotechnological sectors, and heavy investments in gene therapy and genetic medicine.

U.S. Non-viral Gene Delivery Technologies Market Trends

The U.S. non-viral gene delivery technologies market is primarily driven by the increasing demand for gene therapies and biotech innovations across various therapeutic areas such as oncology, genetic disorders, and chronic diseases. The U.S. benefits from a robust biopharmaceutical industry, strong R&D funding, and a supportive regulatory framework by agencies like the FDA, which have fast-tracked gene therapy approvals. Furthermore, the successful adoption of non-viral systems in mRNA vaccines during the COVID-19 pandemic has accelerated the use of non-viral gene delivery technologies, pushing for their wider adoption in gene therapy trials and research applications.

Europe Non-viral Gene Delivery Technologies Market Trends

The Europe non-viral gene delivery technologies market is driven by a combination of innovative research and the region's expanding focus on personalized medicine and genetic-based therapies. European governments and institutions are increasingly investing in the biotech sector, particularly in the UK, Germany, and France, where non-viral delivery technologies are integrated into research programs targeting diseases like cancer, cardiovascular disorders, and rare genetic conditions. Regulatory support from the European Medicines Agency (EMA) has enabled the commercialization of gene therapies, while the region’s collaboration between academia, research institutes, and the pharmaceutical industry accelerates the development and adoption of non-viral delivery systems.

The UK non-viral gene delivery technologies market is experiencing rapid growth driven by government investments in genomic research and a focus on biotech innovation. The UK is a hub for CRISPR research and gene editing, where non-viral delivery technologies are increasingly used for preclinical and clinical trials. In addition, the UK's growing healthcare ecosystem and its push toward adopting personalized medicine are key drivers of demand for efficient and scalable gene delivery systems. The regulatory support from UK authorities also fosters the development of non-viral gene therapies, enhancing their application in research and therapeutics.

France non-viral gene delivery technologies market growth is largely fueled by the country’s emphasis on biotechnology and genomics. France has become a leading player in genetic research, with institutes focusing on rare diseases, cancer, and neurological disorders. Non-viral gene delivery systems, such as lipid nanoparticles and polymeric carriers, are gaining traction as efficient, scalable alternatives to viral vectors. Furthermore, government-backed research programs and a strong pharmaceutical sector contribute to the growing adoption of non-viral delivery methods in both academic research and clinical applications.

Germany non-viral gene delivery technologies market is at the forefront in Europe, driven by its well-established biotechnology industry, robust research funding, and advanced manufacturing capabilities. The country’s focus on personalized medicine and genetic-based therapeutics has led to increased investments in non-viral delivery technologies. As Germany’s pharmaceutical and academic sectors continue to explore novel gene therapies for complex diseases such as cancer, diabetes, and genetic disorders, the demand for safe and efficient delivery systems is rising. The regulatory framework in Germany, supported by the European Medicines Agency, also enables the development of non-viral gene therapies.

Asia Pacific Non-viral Gene Delivery Technologies Market Trends

Asia Pacific non-viral gene delivery technologies market growth is driven by the adoption of the expanding biotech infrastructure, increasing investments in genetic therapies, and the demand for advanced gene-editing technologies like CRISPR/Cas9. Countries like Japan, China, and India are seeing rapid growth in the biotech sector, with a focus on genetic disorders, cancer research, and mRNA-based therapeutics. The affordability, scalability, and reduced immunogenicity of non-viral gene delivery technologies make them attractive options in these markets. Government policies supporting biotech research and clinical trials further boost market adoption.

The non-viral gene delivery technologies market in China is expanding rapidly due to the country’s focus on advancing genetic engineering and gene therapies. Government investments in biotech and life sciences, coupled with China's large patient population, drive the demand for non-viral delivery systems, particularly for cancer therapies and rare diseases. China's regulatory support for innovative gene therapies and its increasing participation in global clinical trials have accelerated the adoption of non-viral gene delivery technologies. The country's advancements in CRISPR technology also contribute to the growing utilization of non-viral vectors.

The non-viral gene delivery technologies market in Japan is leading the way in the Asia-Pacific region, with strong government support for biotech research and genetic therapies. Japan's established reputation in pharmaceuticals and healthcare innovation, alongside increasing investments in gene-editing technologies and mRNA-based therapies, propels the adoption of non-viral gene delivery systems. These systems are particularly important for targeted therapies in oncology, genetic disorders, and neurological conditions. Japan’s stringent regulatory framework ensures high standards for the development of non-viral gene therapies, further encouraging market growth.

The non-viral gene delivery technologies market in India is growing due to increased investments in biotechnology and a strong focus on affordable healthcare solutions. India’s large patient population, especially in areas of genetic diseases and cancer, drives the demand for more effective and scalable gene delivery systems. The rise of biotech startups and increasing collaboration between academia and the pharmaceutical industry further contribute to the adoption of non-viral delivery technologies in gene therapies. India's expanding clinical trial infrastructure is also providing more opportunities for the application of these technologies in therapeutic settings.

Middle East & Africa Non-viral Gene Delivery Technologies Market Trends

The Middle East & Africa non-viral gene delivery technologies market is witnessing growth due to increased investments in biotechnology and healthcare infrastructure development. Countries like the United Arab Emirates and Qatar are making substantial efforts to diversify their economies, with a focus on biotech and genetic medicine. The growing need for advanced gene therapies in areas such as oncology and genetic diseases is driving the demand for non-viral delivery methods. In addition, the Middle East’s collaboration with global biotech companies fosters the adoption of innovative gene delivery technologies in research and therapeutic applications.

The market for non-viral gene delivery technologies in Saudi Arabia is expanding due to the country’s emphasis on healthcare modernization and biotech innovation. The Saudi government’s efforts to diversify its economy through the Vision 2030 initiative have led to increased investments in the biotech sector, with a focus on genomic research and precision medicine. As the country seeks to address growing healthcare challenges, particularly in the areas of genetic disorders and cancer, non-viral gene delivery systems are seen as promising tools for safe and scalable gene therapies.

The market for non-viral gene delivery technologies in Kuwait is supported by the adoption of the country’s increasing focus on genomic research and biotechnology development. Kuwait is investing heavily in healthcare infrastructure and personalized medicine. The rising demand for gene therapies and the focus on rare diseases and cancer have led to the use of non-viral delivery methods in research and therapeutic applications. As the region continues to modernize its healthcare systems and collaborate with global biotech companies, the adoption of non-viral gene delivery systems is expected to grow.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.44 Billion |

| Market Size by 2034 | USD 12.6 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.3% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Mode, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc., GenScript, Danaher, Merck KGaA, Bio-Rad Laboratories, Altogen Biosystems, Lonza, Sonidel, SIRION BIOTECH GmbH, Innovative Cell Technologies, Inc. |

Based on mode, chemical accounted for the largest revenue share in 2024 and is projected to witness the fastest CAGR over the forecast period. The chemical mode of non-viral gene delivery technologies is driven by the increasing demand for efficient, safe, and scalable gene delivery systems. Chemical methods, such as lipid nanoparticles (LNPs), polymeric carriers, and lipoplexes, offer several advantages, including the ability to carry larger genetic payloads, reduced immunogenicity, and ease of production.

The growing interest in mRNA-based therapies and CRISPR/Cas9 gene editing has further accelerated the use of chemical delivery systems, as they provide a versatile platform for targeting specific cells and tissues. In addition, the scalability and cost-effectiveness of chemical-based delivery methods are crucial for advancing gene therapies for chronic diseases, cancer, and genetic disorders, driving their adoption across the biotechnology and pharmaceutical sectors.

Based on application, the research segment held the largest revenue share in 2024. The market is driven by the growing need for versatile, efficient, and cost-effective tools to study gene function, expression, and regulation. Non-viral delivery methods, such as lipid nanoparticles, polymeric vectors, and electroporation, offer researchers enhanced control over gene transfer, enabling precise manipulation of cells and tissues without the risks associated with viral vectors. These technologies are crucial for advancing research in gene editing, cancer therapy, and genetic diseases, as they facilitate the delivery of large genetic payloads and facilitate CRISPR-based genome editing. In addition, the shift towards more reproducible and scalable delivery systems supports the growing demand for non-viral methods in academic and commercial research laboratories, further accelerating their adoption in genetic studies.

The therapeutics segment is expected to witness the fastest CAGR over the forecast period. Non-viral delivery systems, including lipid nanoparticles, polymer-based carriers, and RNA-based technologies, are essential for delivering gene-based therapies for chronic diseases, genetic disorders, and cancer. Their ability to reduce immunogenicity, provide repeat administration, and carry large genetic payloads makes them ideal for therapeutic interventions. The success of non-viral technologies in mRNA vaccines, such as the COVID-19 vaccines by Moderna and Pfizer, has highlighted their potential in large-scale therapeutic applications. In addition, their adaptability to targeted delivery systems is fueling their adoption in precision medicine, particularly for diseases that require highly specific gene modifications or therapies.

Based on end use, the research and academic institutes segment held the largest revenue share of 49.0% in 2024 and is projected to witness the fastest CAGR over the forecast period. The market for research and academic institutes is driven by the increasing need for reliable, efficient, and cost-effective methods to explore gene function, expression, and modification.

Non-viral systems offer researchers a versatile platform to deliver genes or gene-editing tools like CRISPR/Cas9 without the complexities and risks associated with viral methods. These technologies enable precise control over genetic material delivery, facilitating studies in gene therapy, genetic diseases, cancer, and functional genomics. Furthermore, their ability to support large-scale experiments and reproducible results makes non-viral delivery methods increasingly popular in academic research, accelerating the development of new therapies and advancing basic scientific understanding.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the non-viral gene delivery technologies market

By Mode

By Application

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.1.1. Mode Segment

1.1.2. Application Segment

1.1.3. End Use Segment

1.2. Regional Scope

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. Internal Database

1.5.3. Primary Research

1.6. Information or Data Analysis:

1.6.1. Data Analysis Models

1.7. Market Formulation & Validation

1.8. Model Details

1.8.1. Commodity Flow Analysis

1.9. List of Secondary Sources

1.10. List of Abbreviations

1.11. Objective

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Rising Adoption in Therapeutics and Research

3.2.1.2. Technological Advancements and Innovation

3.2.2. Market Restraint Analysis

3.2.2.1. Limited Delivery Efficiency for Complex Targets

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. Mode Business Analysis

4.1. Mode Segment Dashboard

4.2. Non-viral gene delivery technologies market: Mode Movement Analysis

4.3. Non-viral gene delivery technologies market Size & Trend Analysis, by Mode, 2018 to 2030 (USD Million)

4.4. Chemical

4.4.1. Chemical market estimates and forecasts, 2021 - 2034 (USD Million)

4.4.2. LNPs

4.4.2.1. LNPs market estimates and forecasts, 2021 - 2034 (USD Million)

4.4.3. Polymers

4.4.3.1. Polymers market estimates and forecasts, 2021 - 2034 (USD Million)

4.4.4. Others

4.4.4.1. Others market estimates and forecasts, 2021 - 2034 (USD Million)

4.5. Physical

4.5.1. Physical market estimates and forecasts, 2021 - 2034 (USD Million)

4.5.2. Electroporation

4.5.2.1. Electroporation market estimates and forecasts, 2021 - 2034 (USD Million)

4.5.3. Microinjection

4.5.3.1. Microinjection market estimates and forecasts, 2021 - 2034 (USD Million)

4.5.4. Others

4.5.4.1. Others market estimates and forecasts, 2021 - 2034 (USD Million)

Chapter 5. Application Business Analysis

5.1. Application Segment Dashboard

5.2. Non-viral gene delivery technologies market Application Movement Analysis

5.3. Non-viral gene delivery technologies market Size & Trend Analysis, by mode, 2018 to 2030 (USD Million)

5.4. Research

5.4.1. Research market estimates and forecasts, 2021 - 2034 (USD Million)

5.5. Therapeutics

5.5.1. Therapeutics market estimates and forecasts, 2021 - 2034 (USD Million)

5.5.2. Gene Therapy

5.5.2.1. Gene Therapy market estimates and forecasts, 2021 - 2034 (USD Million)

5.5.3. Cell Therapy

5.5.3.1. Cell Therapy market estimates and forecasts, 2021 - 2034 (USD Million)

5.5.4. Vaccines

5.5.4.1. Vaccines market estimates and forecasts, 2021 - 2034 (USD Million)

Chapter 6. End Use Business Analysis

6.1. End Use Segment Dashboard

6.2. Non-viral gene delivery technologies market End Use Movement Analysis

6.3. Non-viral gene delivery technologies market Size & Trend Analysis, by End Use, 2018 to 2030 (USD Million)

6.4. Biotechnology and Biopharmaceutical Companies

6.4.1. Biotechnology and biopharmaceutical companies market estimates and forecasts, 2021 - 2034 (USD Million)

6.5. Research and academic institutes

6.5.1. Research and academic institutes market estimates and forecasts, 2021 - 2034 (USD Million)

6.6. Others

6.6.1. Others market estimates and forecasts, 2021 - 2034 (USD Million)

Chapter 7. Regional Business Analysis by mode, application, end use

7.1. Regional Dashboard

7.2. Market Size & Forecast and Trend Analysis, 2024 & 2034

7.3. North America

7.3.1. North America Non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.3.2. U.S.

7.3.2.1. Key Country Dynamics

7.3.2.2. Competitive Scenario

7.3.2.3. Regulatory Framework

7.3.2.4. U.S. non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.3.3. Canada

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Regulatory Framework

7.3.3.4. Canada non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.3.4. Mexico

7.3.4.1. Key Country Dynamics

7.3.4.2. Competitive Scenario

7.3.4.3. Regulatory Framework

7.3.4.4. Mexico non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4. Europe

7.4.1. Europe non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.2. UK

7.4.2.1. Key Country Dynamics

7.4.2.2. Competitive Scenario

7.4.2.3. Regulatory Framework

7.4.2.4. UK non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.3. Germany

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Regulatory Framework

7.4.3.4. Germany non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.4. France

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Regulatory Framework

7.4.4.4. France non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.5. Italy

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Regulatory Framework

7.4.5.4. Italy non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.6. Spain

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Regulatory Framework

7.4.6.4. Spain non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.7. Denmark

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Regulatory Framework

7.4.7.4. Denmark non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.8. Sweden

7.4.8.1. Key Country Dynamics

7.4.8.2. Competitive Scenario

7.4.8.3. Regulatory Framework

7.4.8.4. Sweden non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.4.9. Norway

7.4.9.1. Key Country Dynamics

7.4.9.2. Competitive Scenario

7.4.9.3. Regulatory Framework

7.4.9.4. Norway non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5. Asia Pacific

7.5.1. Asia Pacific Non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5.2. Japan

7.5.2.1. Key Country Dynamics

7.5.2.2. Competitive Scenario

7.5.2.3. Regulatory Framework

7.5.2.4. Japan non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5.3. China

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Framework

7.5.3.4. China non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5.4. India

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Framework

7.5.4.4. India non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5.5. Australia

7.5.5.1. Key Country Dynamics

7.5.5.2. Competitive Scenario

7.5.5.3. Regulatory Framework

7.5.5.4. Australia non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5.6. Thailand

7.5.6.1. Key Country Dynamics

7.5.6.2. Competitive Scenario

7.5.6.3. Regulatory Framework

7.5.6.4. Thailand non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.5.7. South Korea

7.5.7.1. Key Country Dynamics

7.5.7.2. Competitive Scenario

7.5.7.3. Regulatory Framework

7.5.7.4. South Korea Non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.6. Latin America

7.6.1. Latin America Non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.6.2. Brazil

7.6.2.1. Key Country Dynamics

7.6.2.2. Competitive Scenario

7.6.2.3. Regulatory Framework

7.6.2.4. Brazil non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.6.3. Argentina

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Framework

7.6.3.4. Argentina non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.7. MEA

7.7.1. MEA non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.7.2. South Africa

7.7.2.1. Key Country Dynamics

7.7.2.2. Competitive Scenario

7.7.2.3. Regulatory Framework

7.7.2.4. South Africa non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.7.3. Saudi Arabia

7.7.3.1. Key Country Dynamics

7.7.3.2. Competitive Scenario

7.7.3.3. Regulatory Framework

7.7.3.4. Saudi Arabia Non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.7.4. UAE

7.7.4.1. Key Country Dynamics

7.7.4.2. Competitive Scenario

7.7.4.3. Regulatory Framework

7.7.4.4. UAE non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

7.7.5. Kuwait

7.7.5.1. Key Country Dynamics

7.7.5.2. Competitive Scenario

7.7.5.3. Regulatory Framework

7.7.5.4. Kuwait non-viral gene delivery technologies market, 2021 - 2034 (USD Million)

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Strategy Mapping

8.3. Company Market Position Analysis, 2024

8.4. Company Profiles/Listing

8.4.1. Thermo Fisher Scientific Inc.

8.4.1.1. Overview

8.4.1.2. Financial Performance

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. GenScript

8.4.2.1. Overview

8.4.2.2. Financial Performance

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Danaher

8.4.3.1. Overview

8.4.3.2. Financial Performance

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Merck KGaA

8.4.4.1. Overview

8.4.4.2. Financial Performance

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Bio-Rad Laboratories

8.4.5.1. Overview

8.4.5.2. Financial Performance

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Altogen Biosystems

8.4.6.1. Overview

8.4.6.2. Financial Performance

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Lonza

8.4.7.1. Overview

8.4.7.2. Financial Performance

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. Sonidel

8.4.8.1. Overview

8.4.8.2. Financial Performance

8.4.8.3. Product Benchmarking

8.4.8.4. Strategic Initiatives

8.4.9. SIRION BIOTECH GmbH

8.4.9.1. Overview

8.4.9.2. Financial Performance

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

8.4.10. Innovative Cell Technologies, Inc.

8.4.10.1. Overview

8.4.10.2. Financial Performance

8.4.10.3. Product Benchmarking

8.4.10.4. Strategic Initiatives