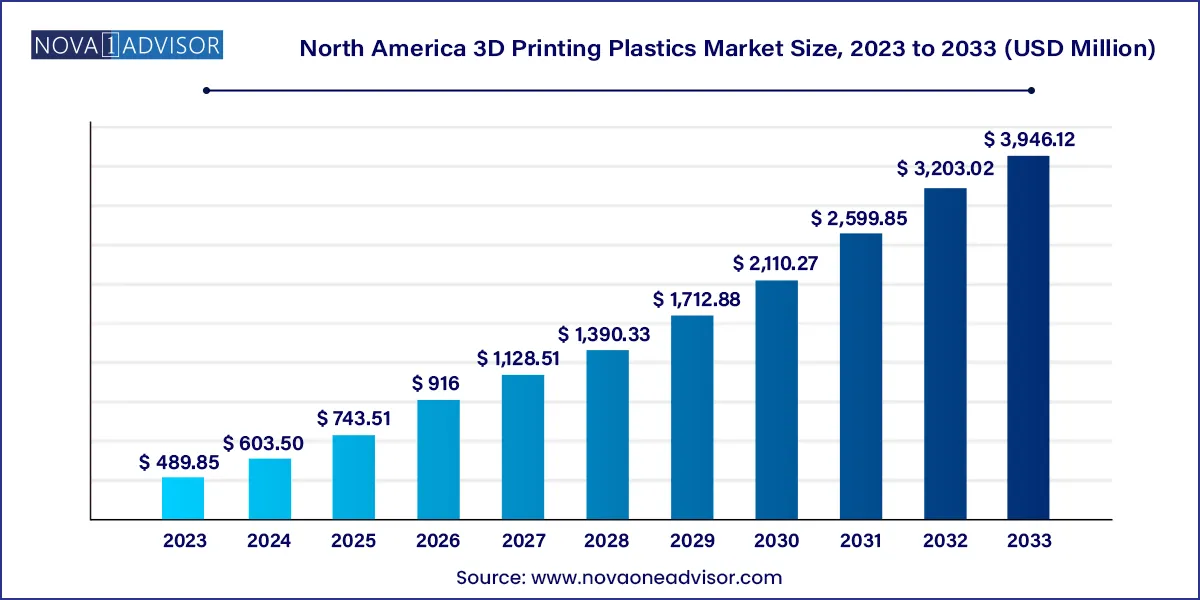

The North America 3D printing plastics market size was exhibited at USD 489.85 million in 2023 and is projected to hit around USD 3,946.12 million by 2033, growing at a CAGR of 23.2% during the forecast period 2024 to 2033.

The North America 3D Printing Plastics Market has emerged as a crucial enabler in the region’s digital manufacturing ecosystem, powering innovations across sectors such as aerospace, medical, automotive, defense, and consumer electronics. 3D printing (additive manufacturing) has transformed the way products are designed, prototyped, and manufactured, and plastics remain the foundational material for many 3D printing processes due to their lightweight properties, material versatility, cost-efficiency, and broad thermomechanical range.

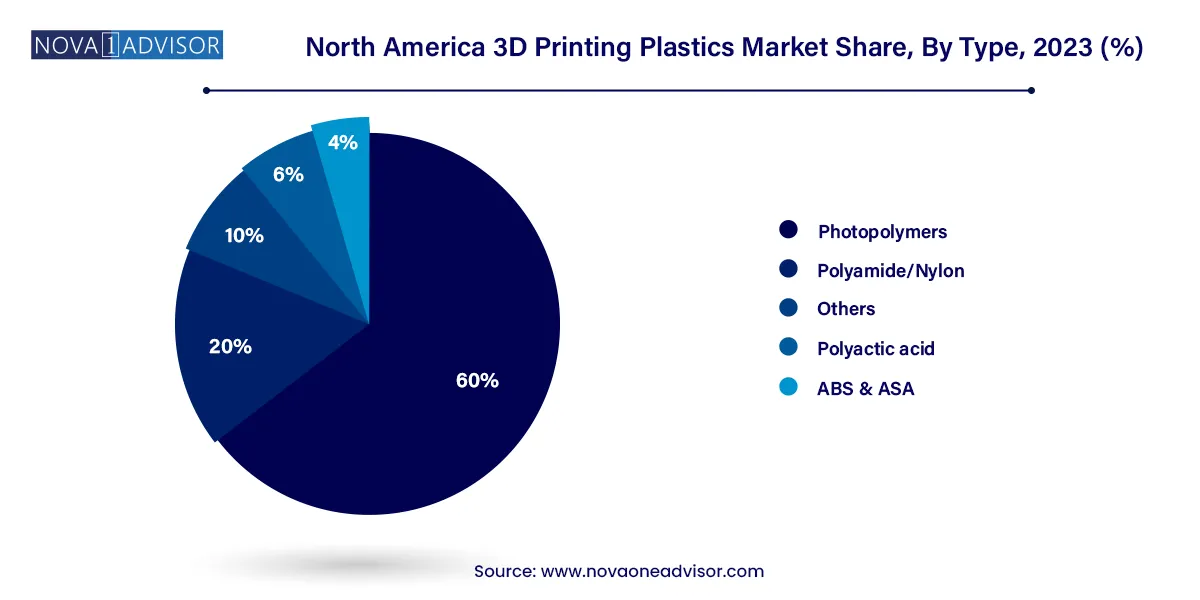

In North America, particularly the United States, the 3D printing landscape has seen exponential growth. The adoption of Industry 4.0, rising demand for rapid prototyping, and significant government and private sector investments in advanced manufacturing technologies have been pivotal in driving market expansion. The 3D printing plastics segment, comprising materials like photopolymers, ABS, ASA, polyamides, and PLA, plays a critical role in enabling functional prototyping, tooling, end-use part production, and customization.

Additionally, advances in 3D printer technology, including higher resolution printing, multi-material capabilities, and post-processing automation, are unlocking newer applications for 3D printable plastics. From orthopedic implants and dental trays to aerospace ducts and consumer wearables, polymer-based additive manufacturing is enabling faster time-to-market, reduced material waste, and design freedom that traditional methods struggle to match.

Surge in Bio-based and Recyclable Plastics: There is a growing shift toward using sustainable 3D printing plastics like bio-PLA, recycled PETG, and biodegradable polymers to meet ESG targets.

Medical Device Customization Using Photopolymers: Dental aligners, surgical guides, and hearing aids are increasingly made with medical-grade photopolymers for precision and biocompatibility.

Growth of High-performance Nylon and ABS Materials: These plastics are gaining ground in aerospace, automotive, and industrial tooling due to their strength, flexibility, and temperature resistance.

Desktop 3D Printing Boom Among SMEs and Schools: Accessible printers using filament-based plastics are being adopted for prototyping, STEM education, and hobbyist use.

Hybrid Materials and Composite Filaments: Innovations combining plastics with carbon fiber, glass, or metal nanoparticles are enhancing part performance for demanding applications.

Software-driven Print Optimization: AI and simulation tools are being integrated with slicing software to improve part strength, reduce support structures, and minimize material use.

Localized and On-Demand Manufacturing: North American companies are deploying 3D printing for localized production, reducing dependency on global supply chains and boosting responsiveness.

| Report Coverage | Details |

| Market Size in 2024 | USD 603.50 Million |

| Market Size by 2033 | USD 3,946.12 Million |

| Growth Rate From 2024 to 2033 | CAGR of 23.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Form, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Mexico; Canada |

| Key Companies Profiled |

3D Systems, Inc.; Arkema Inc.; Stratasys Ltd.; Avient Corporation; The ExOne Company; Huntsman Corporation; Proto Labs Inc.; Carbon3D Inc.; Formlabs inc.; HP Inc. |

The demand for rapid prototyping is a critical driver behind the growth of the 3D printing plastics market in North America. Industries like automotive, consumer electronics, and aerospace increasingly rely on quick-turn prototyping to iterate designs, reduce product development cycles, and improve functional testing.

Plastic-based 3D printing enables design engineers to produce complex geometries in a matter of hours using low-cost materials such as PLA or ABS. This agility helps manufacturers make real-time modifications, validate part fit and function, and move swiftly into small-batch production or tooling development.

Companies such as Ford and General Electric utilize 3D printing for prototype brackets, ducts, and housings using advanced plastic materials that mimic end-use behavior. In the startup ecosystem, entrepreneurs and design consultancies leverage low-cost desktop printers to create proof-of-concept models and functional mockups, democratizing access to industrial design.

As North American businesses increasingly integrate agile manufacturing principles, 3D printing plastics serve as the bridge between concept and market-ready products, significantly lowering the barrier to innovation.

While plastic-based 3D printing offers substantial design flexibility and cost advantages, it faces a major restraint in terms of material performance constraints, particularly for end-use parts subjected to extreme mechanical, thermal, or chemical environments.

Conventional thermoplastics like PLA, ABS, and PETG may fall short when it comes to long-term heat stability, UV resistance, tensile strength, and chemical compatibility, especially in industries like aerospace, defense, or oil & gas where part failure can have serious consequences. For such applications, metal additive manufacturing or high-performance polymers like PEEK or ULTEM are preferred but these are expensive and often require specialized printers.

Moreover, printed plastic parts can exhibit anisotropic mechanical properties i.e., different strength along different axes—making performance prediction and quality assurance more complex. Warping, delamination, and shrinkage during cooling can also affect dimensional accuracy, requiring extensive post-processing or design compensations.

These material and technical limitations slow down full-scale production adoption of plastic 3D printing in high-spec industries, making ongoing R&D crucial to broaden the material palette.

A substantial growth opportunity lies in the use of 3D printed plastic parts for customized medical devices, including prosthetics, orthotics, dental devices, surgical tools, and anatomical models. The U.S. leads globally in medical device innovation, and 3D printing is increasingly becoming central to the personalization and digital transformation of care.

Photopolymers, medical-grade ABS, and flexible plastics are already used to print tailor-made hearing aids, dental crowns, and cranial implants, designed from patient scans with micron-level accuracy. With the FDA increasingly supporting additive manufacturing in healthcare, the adoption of on-demand, patient-specific plastic components is expanding, especially for outpatient and surgical use.

Major hospital systems and medical research institutes in the U.S. are investing in in-house 3D printing labs, where plastic-based materials allow for cost-effective, fast-turnaround parts without sterilization risks of metal. This opportunity is further fueled by the aging population, the rise of value-based care, and the trend toward decentralized manufacturing in healthcare.

Filament remained the dominant form of 3D printing plastic due to the popularity of fused deposition modeling (FDM) the most accessible and widely used 3D printing technology. Filaments like PLA, ABS, PETG, and specialty composites are used extensively in education, consumer, industrial, and design sectors across North America. Desktop printers from brands like Ultimaker, Prusa, and MakerBot use filament as the primary feedstock.

Powder is the fastest-growing form, enabled by the rise of SLS and multi-jet fusion (MJF) systems used for more robust and detailed parts. Powder-based plastic printing allows for batch production of parts with uniform properties, no need for support structures, and strong mechanical performance. Major service bureaus and OEMs are investing in powder-based polymer printing to serve automotive and aerospace clients demanding precision and strength.

Automotive dominated the end-use segment, reflecting the industry's extensive use of plastic 3D printing for design validation, jigs and fixtures, custom tooling, and lightweight components. Automakers in the U.S., such as Ford, GM, and Tesla, use 3D printing to accelerate product development and reduce tooling costs, while aftermarket suppliers use it for limited-run parts and interior components.

Medical is the fastest-growing end-use segment, thanks to its adoption of patient-specific devices, prosthetics, anatomical modeling, and surgical planning tools. Hospitals, dental labs, and prosthetic designers are increasingly integrating 3D printers into their workflows using biocompatible photopolymers and ABS variants. The FDA’s growing acceptance of additive manufacturing for Class I and II medical devices further supports this trend.

Photopolymers dominated the type segment due to their widespread use in stereolithography (SLA) and digital light processing (DLP)—high-resolution printing methods favored in dental, jewelry, electronics, and healthcare applications. These light-reactive resins offer excellent surface finish, fine feature reproduction, and a variety of formulations including flexible, tough, transparent, and biocompatible variants. Companies like Formlabs and 3D Systems have popularized photopolymer printing in U.S. labs and businesses.

Polyamide (Nylon) is the fastest-growing type, especially for use in selective laser sintering (SLS) and fused deposition modeling (FDM). Nylon's toughness, fatigue resistance, and thermal stability make it ideal for functional prototypes and end-use parts in automotive, aerospace, and industrial tooling. Nylon 12 and carbon-filled variants are gaining adoption for lightweight and load-bearing components.

The U.S. leads the North American market for 3D printing plastics due to its robust ecosystem of hardware manufacturers, material scientists, end-users, and educational institutions. States like California, Michigan, Texas, and Massachusetts are hotspots for additive manufacturing, supported by government R&D funding, defense contracts, and the presence of leading automotive and medical device companies.

The U.S. Department of Defense and NASA have funded numerous initiatives to develop advanced polymers for space-grade and battlefield-ready components, opening new material innovation avenues. Additionally, domestic OEMs and service providers are driving demand for eco-friendly, recyclable, and high-performance thermoplastics, giving rise to collaborations with chemical companies like Dow, BASF, and DuPont.

Canada is emerging as a regional R&D center, especially in universities and startups focused on bioplastics and functional polymers. Canadian industries, particularly in Quebec and Ontario, are adopting 3D printing plastics for medical implants, architectural modeling, and small-scale industrial tooling.

Mexico is a rising manufacturing hub, and 3D printing is being explored for rapid tooling and lightweight parts in its growing automotive and aerospace sectors. Domestic initiatives are also focusing on recycled and biodegradable plastics, aligning with the country’s increasing environmental regulations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America 3D printing plastics market

Type

Form

End-use

Country