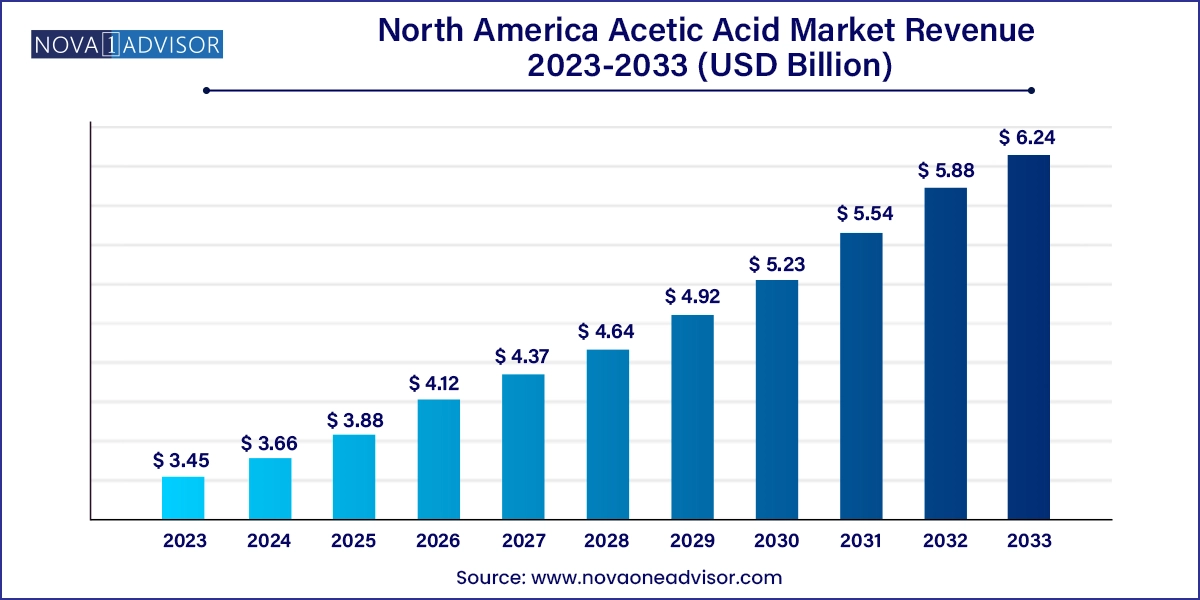

The North America acetic acid market size was exhibited at USD 3.45 billion in 2023 and is projected to hit around USD 6.24 billion by 2033, growing at a CAGR of 6.11% during the forecast period 2024 to 2033.

The North America acetic acid market has grown significantly over the past few years, driven by robust demand across multiple end-use sectors such as chemicals, textiles, paints and coatings, and food and beverage. Acetic acid serves as a vital chemical building block, finding applications in the production of vinyl acetate monomer (VAM), acetic anhydride, acetate esters, and purified terephthalic acid (PTA). In particular, the region benefits from a well-established chemical infrastructure and proximity to a stable supply of raw materials, making North America a key player in the global acetic acid industry.

The market is characterized by large-scale industrial facilities, technological advancements in production methods, and a growing shift toward sustainability. In response to environmental concerns, manufacturers are exploring bio-based acetic acid production processes. The interplay between traditional and green production methods, coupled with rising demand in both industrial and consumer-facing applications, underscores the importance of acetic acid in North America’s chemical landscape.

Growing Demand for VAM: The extensive use of vinyl acetate monomer in adhesives, paints, and coatings continues to bolster demand.

Shift Toward Bio-based Production: Increasing research into bio-based acetic acid reflects the market’s alignment with environmental sustainability goals.

Expansion of Downstream Applications: Acetic acid derivatives are gaining prominence in electronics, textiles, and packaging materials.

Rising Investments in Technological Innovation: Manufacturers are implementing advanced catalytic and energy-efficient processes.

Regulatory Influence: Stricter emission standards are driving the adoption of eco-friendly acetic acid products.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.66 Billion |

| Market Size by 2033 | USD 6.24 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Eastman Chemical Company; Celanese Corporation; LyondellBasell Industries Holdings B.V.; SABIC; HELM de México, S.A.; DAICEL CORPORATION; Dow; INEOS |

One of the primary drivers of the North America acetic acid market is the increasing demand for vinyl acetate monomer (VAM). VAM is a critical intermediate in the production of polyvinyl acetate and polyvinyl alcohol, both of which are extensively used in adhesives, coatings, and sealants. The construction industry, in particular, has a substantial appetite for VAM, as adhesives and sealants play a crucial role in ensuring structural integrity and durability. Additionally, packaging manufacturers utilize VAM in producing flexible and sustainable materials, meeting both consumer demand and regulatory requirements.

The growing emphasis on infrastructure development, coupled with the rise of lightweight and eco-friendly packaging solutions, has amplified the need for VAM. This upward trend ensures a steady demand for acetic acid as a key feedstock, thereby driving market growth.

While the acetic acid market continues to grow, it faces challenges related to environmental and safety concerns. High concentrations of acetic acid can be harmful to human health, causing skin and respiratory irritation. Additionally, improper handling or disposal can lead to environmental contamination, affecting soil and water quality. Regulatory agencies have established stringent guidelines to address these issues, requiring companies to implement robust safety protocols and invest in advanced waste management systems.

These regulatory requirements, while necessary, increase production costs and may limit the adoption of acetic acid in certain industries. Furthermore, public awareness of chemical safety has prompted end-users to explore alternative, less hazardous materials, thereby potentially restricting market growth.

The rising interest in sustainability presents a significant opportunity for bio-based acetic acid. As industries seek to reduce their carbon footprint, the production of acetic acid from renewable feedstocks such as agricultural waste and biomass is gaining traction. Bio-based acetic acid aligns with regulatory initiatives promoting green chemistry and appeals to environmentally conscious consumers.

For example, bio-based acetic acid can be used in food preservation and flavoring, offering a natural alternative to traditional synthetic additives. In the packaging sector, it supports the development of biodegradable materials, addressing the growing demand for sustainable packaging solutions. With ongoing research and development, bio-based acetic acid has the potential to open new market segments, enhance profitability, and strengthen industry reputation.

Vinyl acetate monomer (VAM) is the dominant application segment, accounting for a significant share of the North America acetic acid market. Its widespread use in adhesives, paints, and coatings, particularly within the construction and packaging industries, underpins its leadership position. VAM’s role in the production of polyvinyl acetate and polyvinyl alcohol makes it indispensable for industrial and consumer applications alike. Furthermore, ongoing infrastructure projects in the U.S. and Canada are expected to sustain VAM’s market dominance over the coming years.

The acetate esters segment is poised to be the fastest-growing application category. Acetate esters, such as ethyl acetate and butyl acetate, are widely employed as solvents in paints, coatings, and printing inks. The automotive and electronics industries, in particular, have seen increasing adoption of acetate esters due to their superior performance and low environmental impact. As industries shift towards sustainable and eco-friendly materials, the demand for high-quality acetate esters is set to rise, driving growth in this segment.

The United States dominates the North America acetic acid market due to its advanced chemical manufacturing infrastructure and high demand across multiple end-use sectors. The country’s well-established production facilities, coupled with substantial investments in research and development, ensure a reliable supply of high-quality acetic acid. In addition, the U.S. chemical sector benefits from robust regulatory frameworks, enabling the production of both conventional and bio-based acetic acid to meet diverse industry needs.

Canada represents the fastest-growing country-level market for acetic acid in North America. The expansion of chemical production capacities, particularly in provinces like Ontario, has bolstered the country’s position in the regional market. Furthermore, Canada’s commitment to environmental sustainability and its adoption of green production methods align with the growing demand for bio-based acetic acid. These factors contribute to Canada’s strong growth trajectory within the North America acetic acid market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America acetic acid market

Application

Country