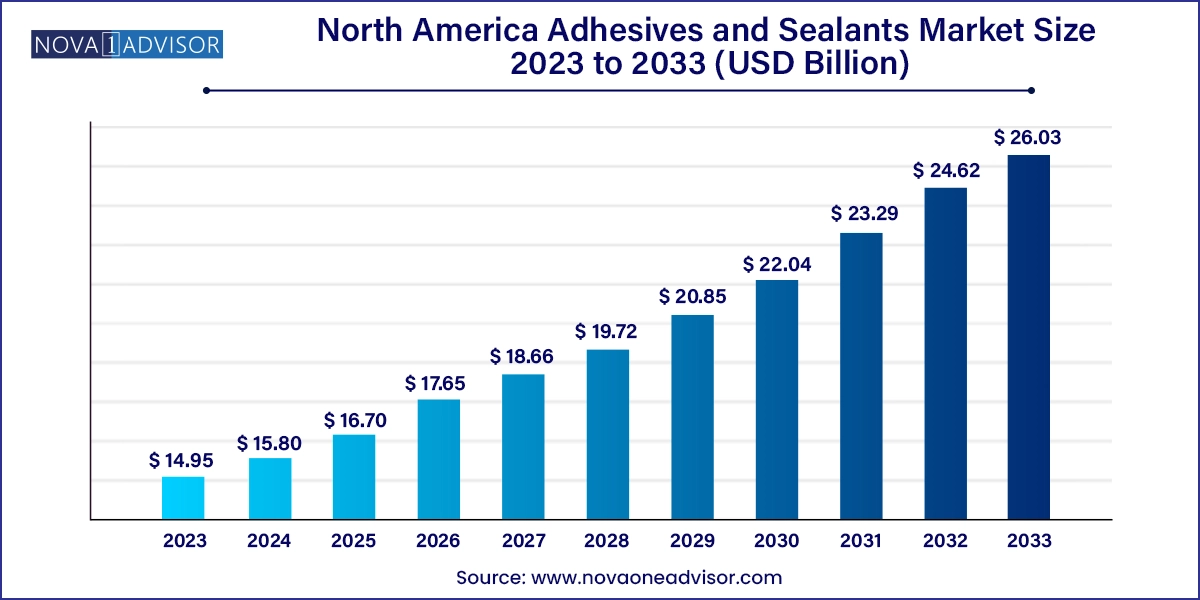

The North America adhesives and sealants market size was exhibited at USD 14.95 billion in 2023 and is projected to hit around USD 26.03 billion by 2033, growing at a CAGR of 5.7% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 15.80 Billion |

| Market Size by 2033 | USD 26.03 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Product, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Henkel Corporation; Sika AG; 3M; H.B. Fuller Company; Evonik Industries; RPM International Inc.; Dow; Wacker Chemie AG; Arkema; Arkema Group |

The growth is attributed to a confluence of factors such as advancements in chemical engineering, an uptick in manufacturing and construction activities, and a heightened demand for sustainable and high-performance materials. As industries seek more efficient and durable bonding solutions, the market is set to adhere to an upward path, sealing its importance in the fabric of North American commerce.

Regulations have a significant impact on the market in North America. For instance, the United States Environmental Protection Agency (USEPA) has enforced stringent regulations that have compelled manufacturers to produce eco-friendly products with no or low Volatile Organic Compound (VOC) levels. This is because VOCs contribute to air pollution, which can lead to health issues such as respiratory and cardiovascular diseases.

In response to these regulations, manufacturers are shifting towards the production of environmentally friendly adhesives and sealants. This shift, while aligning with the industry’s commitment to sustainability, has also created opportunities for companies to expand their business. However, it’s worth noting that these environmentally conscious alternatives often come at a higher cost, which can affect the profit margins of manufacturers.

Water-based dominated the market with the highest revenue share of 23.5% in 2023. These are preferred due to their non-flammable nature, making them safer to handle and store. They find extensive applications in the packaging, construction, automotive, leather, and furniture industries. The demand for water-based adhesives in North America is driven by their environmental benefits and compliance with stringent regulations. The market for water-based adhesives is projected to witness the fastest growth, attributed to advancements in emulsion technology and the development of water-based inks and adhesives as sustainable alternatives to solvent-based systems.

Solvent-based are expected to experience a notable growth rate of 7.8% from 2024 to 2033. These adhesives offer unique characteristics and performance advantages, leading to their extensive applications across various industries. However, they face challenges due to environmental concerns and regulatory pressures to reduce volatile organic compound (VOC) emissions. Despite these challenges, the solvent-based adhesives market is anticipated to grow, driven by improvements in the economy and the alleviation of supply chain concerns.

Acrylic adhesives dominated the market with a revenue share of 36.7% in 2023. These adhesives are known for their excellent environmental resistance and fast-setting times, making them ideal for a wide range of applications. They are extensively used in industries such as packaging, construction, automotive, leather, and furniture. The increase in the number of construction projects, as well as the expansion of the packaging industry, are also driving demand for acrylic adhesives.

Ethylene Vinyl Acetate (EVA) adhesives are projected to experience the second-fastest growth in revenue in the North America adhesives market, with a CAGR of 6.5% from 2024 to 2033. EVA adhesives are known for their versatility and are used in a variety of applications, including cardboard sealing, joining paper packaging, and laminating films. The growth of the EVA adhesives market can be attributed to the increasing demand for food and beverage packaging and the rapid growth of sustainable packaging solutions. Despite the challenges posed by environmental concerns and regulatory pressures, the EVA adhesives market is anticipated to grow, driven by improvements in the economy and the alleviation of supply chain concerns.

The paper and packaging sector dominated the market with a revenue share of 29.4% in 2023. This dominance can be attributed to the extensive use of adhesives in various packaging applications, including carton sealing, labeling, and flexible packaging. The growth in e-commerce and the increasing demand for packaged food and beverages are likely to drive the demand for adhesives in this sector. Moreover, the shift towards sustainable packaging solutions is expected to further boost the market for adhesives in the paper and packaging industry.

The furniture and woodworking segment is projected to witness the fastest growth in terms of revenue, with a CAGR of 9.6% from 2024 to 2033. Adhesives play a crucial role in this industry, being used in a wide range of applications such as panel lamination, edge banding, doweling, and veneering. The growth in this segment can be attributed to the increasing demand for furniture due to urbanization and the rise in residential and commercial construction activities. Furthermore, the trend towards DIY furniture and the growing popularity of engineered wood products are likely to fuel the demand for adhesives in the furniture and woodworking industry.

Silicones dominated the market with the highest revenue share of 34.0% in 2023. This dominance can be attributed to the extensive use of silicone sealants in various applications due to their excellent properties such as high flexibility, chemical stability, and weather resistance. Silicones are widely used in construction, automotive, and electronics industries. Moreover, the silicone segment is also projected to witness the fastest growth in the market. This is due to the growing need for silicone sealants in the rising construction industry, particularly in residential and commercial building projects.

.webp)

Acrylic sealants are projected to witness the second-fastest growth in terms of revenue, with a CAGR of 6.2% from 2024 to 2033. Acrylic sealants are popular due to their easy application, paintability, and compatibility with most materials. They are widely used in sealing and bonding applications in the construction industry, such as in joints, cracks, and gaps in building components. The growth in this segment can be attributed to the increasing construction activities in North America and the growing demand for high-quality and durable sealants in the construction industry. Furthermore, the trend toward sustainable and green building practices is likely to fuel the demand for acrylic sealants.

The construction sector dominated the market with the highest revenue share in 2023. This dominance can be attributed to the extensive use of sealants in various construction applications, including glazing, waterproofing, and insulation. The growth in the construction industry, particularly in residential and commercial building projects, is likely to drive the demand for sealants. Moreover, the shift towards sustainable construction practices and the increasing demand for energy-efficient buildings are expected to further boost the market for sealants in the construction industry.

The packaging segment is projected to witness the second-fastest growth in terms of revenue, with a CAGR of 7.9% from 2024 to 2033. Sealants play a crucial role in this industry, being used in a wide range of applications such as carton sealing, labeling, and flexible packaging. The growth in this segment can be attributed to the increasing demand for packaged food and beverages and the growth in e-commerce. Furthermore, the trend towards sustainable packaging solutions and the increasing need for tamper-evident and leak-proof packaging are likely to fuel the demand for sealants in the packaging industry.

In North American adhesives and sealants market, the U.S. holds the largest market share. Specifically, it accounts for around 83% of the total revenue in the adhesives market and around 80% in the sealants market. This dominance can be attributed to the extensive use of adhesives and sealants in various industries such as construction, automotive, and packaging that are thriving in the U.S. The growth in these industries, particularly in residential and commercial building projects, is likely to drive the demand for adhesives and sealants in the U.S.

Adhesives and sealants market in Mexico, on the other hand, is projected to witness the fastest growth in terms of revenue with a CAGR of 9.7% and 9.1% from 2024 to 2033, respectively. The growth in this country can be attributed to the increasing industrialization and the growth in the manufacturing sector. Furthermore, the trend toward sustainable and green manufacturing practices is likely to fuel the demand for adhesives and sealants in Mexico. The shift towards sustainable construction practices and the increasing demand for energy-efficient buildings are expected to further boost the market for sealants in Mexico.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America adhesives and sealants market

North America Adhesives Technology

North America Adhesives Product

North America Adhesives Application

North America Sealants Product

North America Sealants Application

North America Sealants Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Information Analysis

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. North America Adhesives And Sealants Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Sales Channel Analysis

3.3. Manufacturing/Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunities

3.6. PORTER’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. North America Adhesives Market: Technology Outlook Estimates & Forecasts

4.1. North America Adhesives Market Estimates & Forecast, By Technology, 2021 to 2033

4.2. Water Based

4.2.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

4.3. Solvent Based

4.3.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

4.4. Hot Melt

4.4.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

4.5. Other Technologies

4.5.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

Chapter 5. North America Adhesives Market: Product Outlook Estimates & Forecasts

5.1. North America Adhesives Market Estimates & Forecast, By Product, 2021 to 2033

5.2. Acrylic

5.2.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

5.3. PVA

5.3.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

5.4. Polyurethanes

5.4.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

5.5. Styrenic Block

5.5.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

5.6. Epoxy

5.6.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

5.7. EVA

5.7.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

5.8. Others

5.8.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

Chapter 6. North America Adhesives Market: Application Outlook Estimates & Forecasts

6.1. North America Adhesives Market Estimates & Forecast, By Application, 2021 to 2033

6.2. Construction

6.2.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3. Consumer & DIY

6.3.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.4. Building & Construction

6.4.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.5. Furniture & Woodworking

6.5.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.6. Footwear & Leather

6.6.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.7. Automotive & Transportation

6.7.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.8. Medical

6.8.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.9. Others

6.9.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

Chapter 7. North America Sealants Market: Product Outlook Estimates & Forecasts

7.1. North America Adhesives Market Estimates & Forecast, By Product, 2021 to 2033

7.2. Silicones

7.2.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

7.3. Polyurethanes

7.3.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

7.4. Acrylic

7.4.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

7.5. Polyvinyl Acetate

7.5.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

7.6. Other

7.6.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

Chapter 8. North America Sealants Market: Application Outlook Estimates & Forecasts

8.1. North America Adhesives Market Estimates & Forecast, By Application, 2021 to 2033

8.2. Construction

8.2.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

8.3. Automotive

8.3.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

8.4. Packaging

8.4.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

8.5. Assembly

8.5.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

8.6. Consumers

8.6.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

8.7. Other

8.7.1. Market estimates and forecasts, 2021 - 2033 (Kilotons) (USD Million)

Chapter 9. North America Adhesives And Sealants Market: Country Outlook Estimates & Forecasts

9.1. Country Market Snapshot

9.2. U.S.

9.2.1. Market estimates and forecast, 2021 - 2033 (USD Million) (Kilotons)

9.2.2. Adhesives Market estimates and forecast, by technology, 2021 - 2033 (USD Million) (Kilotons)

9.2.3. Adhesives Market estimates and forecast, by product, 2021 - 2033 (USD Million) (Kilotons)

9.2.4. Adhesives Market estimates and forecast, by application, 2021 - 2033 (USD Million) (Kilotons)

9.2.5. Sealants Market estimates and forecast, by product, 2021 - 2033 (USD Million) (Kilotons)

9.2.6. Sealants Market estimates and forecast, by application, 2021 - 2033 (USD Million) (Kilotons)

9.3. Canada

9.3.1. Market estimates and forecast, 2021 - 2033 (USD Million) (Kilotons)

9.3.2. Adhesives Market estimates and forecast, by technology, 2021 - 2033 (USD Million) (Kilotons)

9.3.3. Adhesives Market estimates and forecast, by product, 2021 - 2033 (USD Million) (Kilotons)

9.3.4. Adhesives Market estimates and forecast, by application, 2021 - 2033 (USD Million) (Kilotons)

9.3.5. Sealants Market estimates and forecast, by product, 2021 - 2033 (USD Million) (Kilotons)

9.3.6. Sealants Market estimates and forecast, by application, 2021 - 2033 (USD Million) (Kilotons)

9.4. Mexico

9.4.1. Market estimates and forecast, 2021 - 2033 (USD Million) (Kilotons)

9.4.2. Adhesives Market estimates and forecast, by technology, 2021 - 2033 (USD Million) (Kilotons)

9.4.3. Adhesives Market estimates and forecast, by product, 2021 - 2033 (USD Million) (Kilotons)

9.4.4. Adhesives Market estimates and forecast, by application, 2021 - 2033 (USD Million) (Kilotons)

9.4.5. Sealants Market estimates and forecast, by product, 2021 - 2033 (USD Million) (Kilotons)

9.4.6. Sealants Market estimates and forecast, by application, 2021 - 2033 (USD Million) (Kilotons)

Chapter 10. North America Adhesives And Sealants Market - Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company Categorization

10.3. Company Market Share/Position Analysis, 2024

10.4. Company Heat Map Analysis

10.5. Kraljic Matrix

10.6. Strategy Mapping

10.7. Company Profiles/Listings

10.7.1. Henkel Corporation

10.7.1.1. Participant’s overview

10.7.1.2. Financial performance

10.7.1.3. Product benchmarking

10.7.1.4. Recent developments

10.7.2. Sika AG

10.7.2.1. Participant’s overview

10.7.2.2. Financial performance

10.7.2.3. Product benchmarking

10.7.2.4. Recent developments

10.7.3. 3M

10.7.3.1. Participant’s overview

10.7.3.2. Financial performance

10.7.3.3. Product benchmarking

10.7.3.4. Recent developments

10.7.4. H.B. Fuller Company

10.7.4.1. Participant’s overview

10.7.4.2. Financial performance

10.7.4.3. Product benchmarking

10.7.4.4. Recent developments

10.7.5. Evonik Industries

10.7.5.1. Participant’s overview

10.7.5.2. Financial performance

10.7.5.3. Product benchmarking

10.7.5.4. Recent developments

10.7.6. RPM International Inc.

10.7.6.1. Participant’s overview

10.7.6.2. Financial performance

10.7.6.3. Product benchmarking

10.7.6.4. Recent developments

10.7.7. Dow

10.7.7.1. Participant’s overview

10.7.7.2. Financial performance

10.7.7.3. Product benchmarking

10.7.7.4. Recent developments

10.7.8. Wacker Chemie AG

10.7.8.1. Participant’s overview

10.7.8.2. Financial performance

10.7.8.3. Product benchmarking

10.7.8.4. Recent developments

10.7.9. Arkema

10.7.9.1. Participant’s overview

10.7.9.2. Financial performance

10.7.9.3. Product benchmarking

10.7.9.4. Recent developments

10.7.10. Arkema Group

10.7.10.1. Participant’s overview

10.7.10.2. Financial performance

10.7.10.3. Product benchmarking

10.7.10.4. Recent developments