The North America aerosol market size was exhibited at USD 19.15 billion in 2023 and is projected to hit around USD 29.74 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 20.01 Billion |

| Market Size by 2033 | USD 29.74 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Type, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | S. C. Johnson & Son, Inc.; Procter & Gamble; Honeywell International Inc.; Crabtree & Evelyn; Estée Lauder Inc.; Sluyter Company Ltd.; PLZ Corp; CCL Container; Sprayway Inc.; Trivium Packaging |

The market is primarily driven by the rising number of aerosol applications such as hair sprays, insecticides, shaving gels, deodorants, fabric care, air fresheners, oven cleaners, furniture polish, leather care, and other personal care products. Furthermore, the high disposable income in the U.S. and Canada is propelling the cosmetics and personal care products consumption.

Aerosol is widely used in the production of sprays that are used to treat insect bites, sunburn, and dermatitis. Pain relief drugs and ointments are typically packed in aerosol form due to their ease of application. Furthermore, the increased prevalence of respiratory disorders such as asthma in North America is driving the use of aerosols in inhalers. According to the Asthma and Allergy Foundation of America’s (AAFA) updated September 2023 data, approximately 26 million people in the U.S. have asthma. The occurrence of the disease is highest amongst the Hispanic, native Alaskans, American Indians, and black communities in the region. The high migration of ethnic communities in the U.S. and Canada is a major factor attributing to the growing cases of asthma, thereby driving the market.

The market is extensively regulated owing to the adverse effect of Hydrofluorocarbon (HFC) used in aerosols. Ozone-depleting HFCs are used in aerosols, refrigeration and air conditioning, solvents, fire suppression, foam blowing, and semiconductor manufacturing. Regulations such as the Montreal Protocol on Substances that Deplete the Ozone Layer also known as Kigali Amendment to phasedown of the production and consumption of HFCs. In October 2022, the U.S. ratified the Kigali Amendment. According to the World Meteorological Organization’s Scientific Assessment of Ozone Depletion 2022 study, the implementation of the Kigali Amendment has shown considerable improvements in the stratosphere. Due to the long lifetime of toxic compounds like HFC, their effect on the atmosphere, as measured by their radiative forcing will only substantially reduce after 2040 and is estimated to be approximately 50% of its maximum by 2100.

Personal care segment accounted for the largest revenue share of 31.0% in 2023. The segment includes products used for grooming such as deodorants, hair mousse, hair spray, and shaving mousse. Increasing focus on self-grooming has been driving the demand for various personal care products across the region.

The household segment is expected to expand at the fastest CAGR of 5.1% from 2024 to 2033. Aerosols are used in various household products including stain removers, shoe polish, starch, water repellents for fabric & leather, pre-wash sprays, furniture polishes & waxes, cleaning agents for fabrics, rugs & household surfaces, room disinfectants & fresheners, air fresheners, and anti-static sprays. In 2023, household was the second-largest segment of the aerosol market, in terms of revenue. This can be attributed to the benefits such as no leakage, easy application, and negligible wastage offered by household aerosol products. These factors make aerosols a preferred choice in household applications.

Aluminum led the market, accounting for a revenue share of 58.9% in 2023. Aluminum offers numerous advantages including lighter weight, high strength, and corrosion resistance. In addition, aluminum cans are 100% recyclable which makes them a preferred material. However, manufacturing costs of aluminum aerosol are higher than steel due to the increasing tariffs on aluminum and growing power rates. Therefore, the manufacturers have been launching lightweight aluminum aerosol cans in the market to maintain cost advantage.

Steel is projected to emerge as the second-fastest growing segment during the forecast period. Steel has a pressure resistance of 12 to 18 bars and steel-based aerosols are manufactured either by tin-plating or TFS (tin-free steel), which is also called electrolytic chromium-coated steel. A tin plate is a thin steel sheet that is coated by a tin layer. Tin-free steel is a steel plate with an electrolytic chromium coating. Among these tin-plated has been the most preferred raw material type owing to high corrosion solderability, strength, resistance, and weldability. Moreover, 3-piece cans are the key can types that are used in the steel-based aerosol, with diameters ranging from 45mm to 65mm.

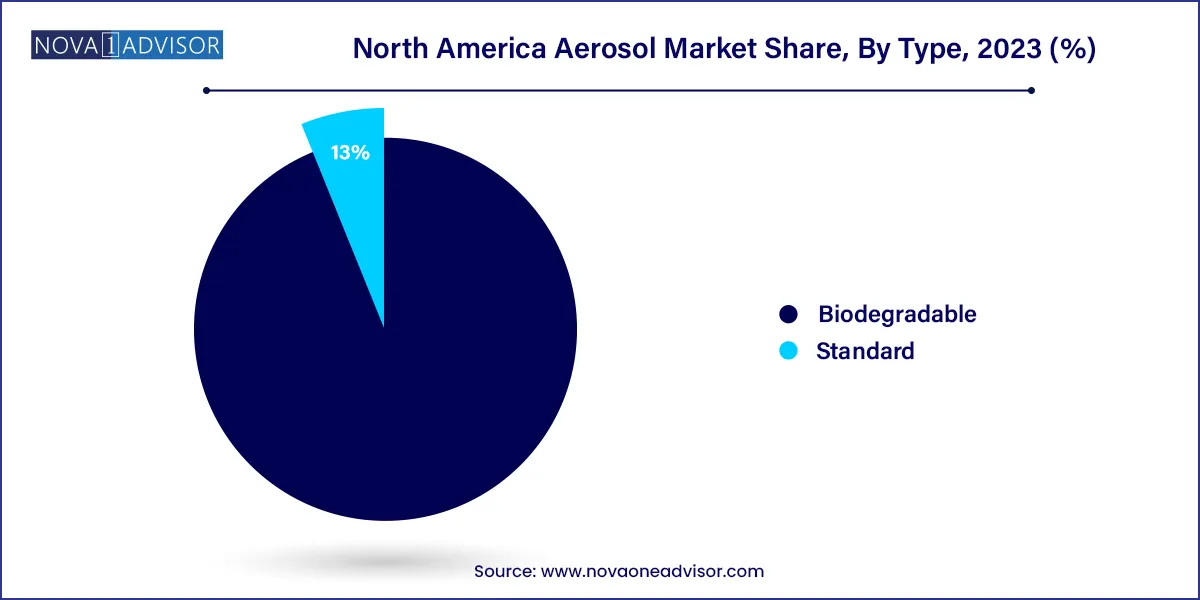

The standard valve segment dominated the market, with a revenue share of 87.0% in 2023 owing to the high adoption of standard valve-based food products and homecare products such as insecticides, decoration products, and rodenticides. The standard valves are used for personal care products including high-end fragrances and deodorants, pharmaceutical applications, and air fresheners. These are preferred for the efficient dispensing of metered doses of pharmaceutical products and insecticides is fueling the segment expansion.

Bag-in valve is expected to expand at the fastest CAGR from 2024 to 2033. Bag-in-valve technology is typically used for viscous liquid products. It is a barrier packaging technology and has an aerosol valve attached to a multi-layer laminated aluminum bag. It is suitable for dispensing liquid, cream, gel, or highly viscous formulation in both upright and inverted positions while preserving the product from external contaminations. Furthermore, no preservative needs to be added to the product as the content is completely sealed from any contact with air. Consumers looking for innovative technologies are opting for bag-in valves as these provide a safe, effective, and convenient during solution dispensing.

The North America aerosol marketheld a revenue share of 22.2% in the global aerosol market. North America has a high demand and adoption of personal care and cosmetic products. Suncare products such as self-tanning products, after-sun products, and sun protection products are widely popular in the U.S. and Canada. The increasing prevalence of skin-related diseases including skin cancer in the U.S. is expected to drive the demand for products capable of protection against UV radiation. Furthermore, hand-free application has been the key driver for aerosol sun care products offering convenience and hassle-free experience to the customers. Increasing demand for these products from Gen Z and millennials owing to growing awareness and increasing disposable incomes is expected to have a positive impact on the aerosol market. Higher consumer demand in the developed for sun care products is expected to drive the demand for aerosol products during the forecast period.

U.S. Aerosol Market Trends

Aerosol market in the U.S. dominates both personal care and household industries for the past several years. This is due to macro factors including the presence of a large number of personal care manufacturers coupled with the increasing demand for premium and natural personal care products. The rising importance of hygiene and grooming among the millennial population is affecting the growth of the skincare products market positively.

Mexico Aerosol Market Trends

Mexico aerosol market is anticipated to register the fastest CAGR of 7.1% from 2024 to 2033. Mexico is the fastest-growing economy in the North American region and is emerging as a key manufacturing hub. Growing urbanization, increasing per capita income, and changing consumer preferences are expected to drive the aerosol market in personal care applications. The high penetration of grooming products by the male population base in the country is expected to boost the demand for hair care and shaving foam products.

Skin diseases like facial post-inflammatory hyperpigmentation, melasma, and solar dermatitis are some of the frequently occurring diseases in Mexico. Increasing awareness regarding skin protection from UV radiation is expected to have a positive impact on sun care products like sunscreen, after-sun products, and self-tanning products over the forecast period which is expected to drive the aerosol market in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America aerosol market

Material

Type

Application

Aerosol Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. North America Aerosol Market Variables, Trends, & Scope

3.1. North America Aerosol Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Vendor Matrix

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Drivers Analysis

3.5.2. Market Restraints Analysis

3.5.3. Market Opportunity Analysis

3.5.4. Market Challenges Analysis

3.6. North America Aerosol Market Analysis Tools

3.6.1. Porter’s Analysis

3.6.1.1. Bargaining power of the suppliers

3.6.1.2. Bargaining power of the buyers

3.6.1.3. Threats of substitution

3.6.1.4. Threats from new entrants

3.6.1.5. Competitive rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political landscape

3.6.2.2. Economic and Social landscape

3.6.2.3. Technological landscape

3.6.2.4. Environmental landscape

3.6.2.5. Legal landscape

3.7. Economic Mega Trend Analysis

Chapter 4. North America Aerosol Market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. North America Aerosol Market: Application Movement Analysis, 2024 & 2033 (USD Million, Million Units)

4.3. Personal Care

4.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.3.2. Deodorants

4.3.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million, Million Units)

4.3.3. Hair Mousse

4.3.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million, Million Units)

4.3.4. Hair Spray

4.3.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million, Million Units)

4.3.5. Shaving Mousse/Foam

4.3.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million, Million Units)

4.3.6. Suncare

4.3.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million, Million Units)

4.3.7. Others

4.3.7.1. Market estimates and forecasts, 2021 - 2033 (USD Million, Million Units)

4.4. Household

4.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.2. Insecticides

4.4.2.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.3. Plant Protection

4.4.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.4. Air Fresheners

4.4.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.5. Furniture & Wax Polishes

4.4.5.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.6. Disinfectants

4.4.6.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.7. Surface care

4.4.7.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.4.8. Others

4.4.8.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.5. Automotive & Industrial

4.5.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.5.2. Greases

4.5.2.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.5.3. Lubricants

4.5.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.5.4. Spray Oils

4.5.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.5.5. Cleaners

4.5.5.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.6. Food

4.6.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.6.2. Oils

4.6.2.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.6.3. Whipped Cream

4.6.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.6.4. Edible Mousse

4.6.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.6.5. Spryable Flavours

4.6.5.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.7. Paints

4.7.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.7.2. Industrial

4.7.2.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.7.3. Consumer

4.7.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.8. Medical

4.8.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.8.2. Steel

4.8.2.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.8.3. Aluminum

4.8.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.8.4. Others

4.8.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

4.9. Others

4.9.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

Chapter 5. North America Aerosol Market: Material Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. North America Aerosol Market: Material Movement Analysis, 2024 & 2033 (USD Million, Million Units)

5.3. Steel

5.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

5.4. Aluminum

5.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

Chapter 6. North America Aerosol Market: Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. North America Aerosol Market: Type Movement Analysis, 2024 & 2033 (USD Million, Million Units)

6.3. Bag-in-valve

6.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

6.4. Standard

6.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

Chapter 7. North America Aerosol Market: Country Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. North America Aerosol Market: Country Movement Analysis, 2024 & 2033 (USD Million, Million Units)

7.3. U.S.

7.3.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

7.3.2. Market Estimates and Forecasts, by application, 2021 - 2033 (USD Million, Million Units)

7.3.3. Market Estimates and Forecasts, by material, 2021 - 2033 (USD Million, Million Units)

7.3.4. Market Estimates and Forecasts, by type, 2021 - 2033 (USD Million, Million Units)

7.4. Canada

7.4.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

7.4.2. Market Estimates and Forecasts, by application, 2021 - 2033 (USD Million, Million Units)

7.4.3. Market Estimates and Forecasts, by material, 2021 - 2033 (USD Million, Million Units)

7.4.4. Market Estimates and Forecasts, by type, 2021 - 2033 (USD Million, Million Units)

7.5. Mexico

7.5.1. Market Estimates and Forecasts, 2021 - 2033 (USD Million, Million Units)

7.5.2. Market Estimates and Forecasts, by application, 2021 - 2033 (USD Million, Million Units)

7.5.3. Market Estimates and Forecasts, by material, 2021 - 2033 (USD Million, Million Units)

7.5.4. Market Estimates and Forecasts, by type, 2021 - 2033 (USD Million, Million Units)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Key Company/Competition Categorization

8.3. Company Market Positioning

8.4. Competitive Dashboard Analysis

8.5. Company Market Share Analysis, 2024

8.6. Company Heat Map Analysis

8.7. Strategy Mapping

8.7.1. Expansion

8.7.2. Mergers & Acquisition

8.7.3. Partnerships & Collaborations

8.7.4. New Product Launches

8.7.5. Research And Development

8.8. Company Profiles

8.8.1. S. C. Johnson & Son, Inc.

8.8.1.1. Participant’s Overview

8.8.1.2. Financial Performance

8.8.1.3. Product Benchmarking

8.8.1.4. Recent Developments

8.8.2. Procter & Gamble

8.8.2.1. Participant’s Overview

8.8.2.2. Financial Performance

8.8.2.3. Product Benchmarking

8.8.2.4. Recent Developments

8.8.3. Honeywell International Inc.

8.8.3.1. Participant’s Overview

8.8.3.2. Financial Performance

8.8.3.3. Product Benchmarking

8.8.3.4. Recent Developments

8.8.4. Crabtree & Evelyn

8.8.4.1. Participant’s Overview

8.8.4.2. Financial Performance

8.8.4.3. Product Benchmarking

8.8.4.4. Recent Developments

8.8.5. Estée Lauder Inc.

8.8.5.1. Participant’s Overview

8.8.5.2. Financial Performance

8.8.5.3. Product Benchmarking

8.8.5.4. Recent Developments

8.8.6. Sluyter Company Ltd.

8.8.6.1. Participant’s Overview

8.8.6.2. Financial Performance

8.8.6.3. Product Benchmarking

8.8.6.4. Recent Developments

8.8.7. PLZ Corp

8.8.7.1. Participant’s Overview

8.8.7.2. Financial Performance

8.8.7.3. Product Benchmarking

8.8.7.4. Recent Developments

8.8.8. CCL Container

8.8.8.1. Participant’s Overview

8.8.8.2. Financial Performance

8.8.8.3. Product Benchmarking

8.8.8.4. Recent Developments

8.8.9. Sprayway Inc.

8.8.9.1. Participant’s Overview

8.8.9.2. Financial Performance

8.8.9.3. Product Benchmarking

8.8.9.4. Recent Developments

8.8.10. Trivium Packaging

8.8.9.5. Participant’s Overview

8.8.9.6. Financial Performance

8.8.9.7. Product Benchmarking

8.8.9.8. Recent Developments