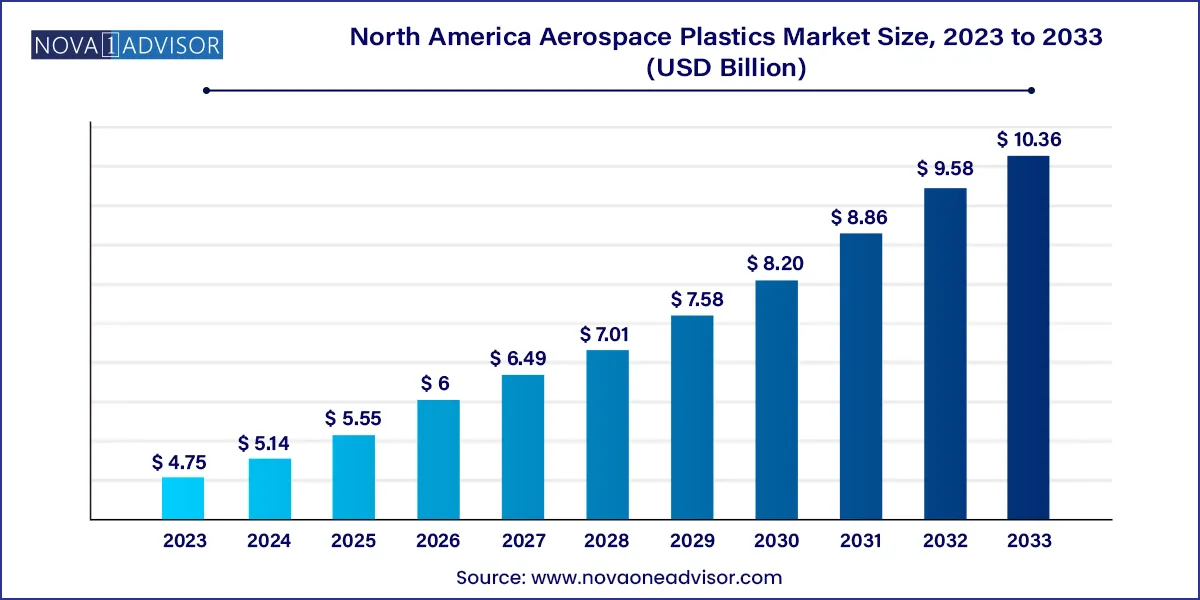

The North America aerospace plastics market size was exhibited at USD 4.75 billion in 2023 and is projected to hit around USD 10.36 billion by 2033, growing at a CAGR of 8.11% during the forecast period 2024 to 2033.

The North America aerospace plastics market is a critical enabler of innovation in modern aircraft design and manufacturing. Plastics and polymer composites are no longer viewed as auxiliary materials but rather as essential components that meet the rigorous demands of weight reduction, thermal stability, impact resistance, and corrosion prevention. These lightweight yet durable materials have become vital across various aerospace applications—from cabin interiors and electronic enclosures to structural frames and propulsion systems.

With the evolution of next-generation aircraft emphasizing fuel efficiency, noise reduction, and carbon emission control, aerospace-grade plastics are replacing traditional metal components at an accelerating pace. In the North American context, this market is deeply influenced by the strategic advancements of aerospace giants like Boeing, Lockheed Martin, Raytheon Technologies, Bombardier, and Gulfstream Aerospace, as well as hundreds of Tier 1 and Tier 2 suppliers.

North America remains the world’s largest aerospace manufacturing base, with the United States being the epicenter of innovation, production, and exports. The demand for aerospace plastics is closely tied to new aircraft deliveries, maintenance, repair, and overhaul (MRO) activities, and the emergence of Urban Air Mobility (UAM) vehicles and electric vertical take-off and landing (eVTOL) aircraft.

Plastics used in aerospace applications must meet stringent FAA and DOD standards regarding flame retardancy, smoke density, toxicity (FST), and long-term mechanical performance. These requirements drive the need for high-performance thermoplastics and thermosets, such as PEEK, PPSU, PEI, and PMMA, among others.

Shift Toward High-Performance Thermoplastics: Aerospace OEMs are prioritizing materials like PEEK and PEI for structural and electronic components due to their mechanical strength and chemical resistance.

Rise of Additive Manufacturing (3D Printing): The use of aerospace-grade plastics in 3D-printed components is increasing due to rapid prototyping benefits and low-volume customization.

Miniaturization and Lightweighting of Avionics: Plastics are being used to miniaturize and reduce the weight of control panels, wire casings, and sensors, improving aircraft energy efficiency.

Sustainability and Recyclability Initiatives: The market is seeing growing demand for recyclable composites and bio-based plastic alternatives as OEMs focus on sustainability goals.

Increased Military Aircraft Modernization Programs: Lightweight, impact-resistant plastics are being integrated into the interiors and exteriors of upgraded military and rotary aircraft across North America.

Surge in Urban Air Mobility (UAM): eVTOL aircraft under development rely heavily on aerospace plastics for fuselage, rotors, and cabin interiors, opening new growth avenues.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.14 Billion |

| Market Size by 2033 | USD 10.36 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Plastic Type, Process, Application, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | SABIC; Victrex plc; Drake Plastics Ltd; Solvay S.A; BASF SE; Evonik Industries AG; DuPont de Nemours, Inc; 3P - Performance Plastics Products; Vantage Plane Plastics; and Paco Plastics, Inc |

A primary driver for the North American aerospace plastics market is the growing demand for lightweight, fuel-efficient aircraft, particularly in the context of rising fuel costs and regulatory pressure to reduce carbon emissions. Reducing aircraft weight is directly correlated with improved fuel efficiency, longer range, and lower operating costs.

Plastics such as PEEK, PPS, and PEI offer superior strength-to-weight ratios compared to metals like aluminum or titanium. In commercial aviation, cabin interiors including seat components, overhead bins, tray tables, and lighting panels are increasingly made from plastics to reduce overall cabin weight. In structural applications, thermoplastics are replacing aluminum for brackets, ducts, and access panels without compromising mechanical strength or safety.

Military aircraft and next-gen unmanned aerial vehicles (UAVs) also benefit from plastics that enhance stealth, reduce radar signature, and enable faster maneuverability. The push toward sustainability and long-haul efficiency evident in Boeing's 777X or Bombardier’s Global series is accelerating this materials transformation.

Despite their advantages, high-performance aerospace plastics come with a significant cost, which can be a barrier for widespread adoption. Materials such as polyetheretherketone (PEEK), polyimides, and fluoropolymers are expensive to produce due to complex polymerization and processing techniques.

Moreover, the specialized manufacturing processes required like precision injection molding, autoclaving, or CNC machining add to the cost. In smaller fleets, general aviation, or cost-sensitive MRO operations, metal parts often continue to be preferred due to their cost advantage and familiarity.

In addition, the supply chain for aerospace-grade plastics is relatively concentrated, leading to potential shortages or price volatility. While ongoing innovation is focused on reducing cost and improving scalability, these challenges restrain rapid substitution of metals in certain applications.

A major opportunity lies in the emergence of Urban Air Mobility (UAM), electric aircraft, and hybrid propulsion platforms. These futuristic aircraft—ranging from eVTOLs to autonomous cargo drones—prioritize lightweight structures, low maintenance, and modular design, all of which align with the properties of aerospace plastics.

Companies like Joby Aviation, Archer Aviation, and Beta Technologies in the U.S., and SkyDrive in Canada, are pioneering the use of carbon-reinforced thermoplastics, PMMA canopies, and high-strength lightweight polymers for airframes, rotor assemblies, and interior components.

As these aircraft move from prototypes to commercial deployment, demand for high-temperature resistant, vibration-dampening, and crash-tolerant plastic components is expected to rise significantly. This growing segment also calls for 3D-printed plastic parts, integrated avionics housed in non-metallic enclosures, and recyclable materials to align with sustainability goals.

Polyetheretherketone (PEEK) dominates the plastics type segment, owing to its unparalleled mechanical strength, chemical resistance, and thermal stability. PEEK is used extensively in structural parts, engine components, seals, and cable insulation. Its flame-retardant properties and resistance to radiation make it ideal for both commercial and defense aircraft. As a semi-crystalline thermoplastic, PEEK also withstands exposure to aviation fuels and hydraulic fluids, reinforcing its versatility in aerospace conditions.

Polyetherimide (PEI) and Polyphenylsulfone (PPSU) are among the fastest-growing plastics types. PEI is particularly suited for avionic housings, window bezels, and aircraft seating, offering high impact strength and dimensional stability. Meanwhile, PPSU is gaining traction for its superior hydrolytic stability, making it valuable in high-moisture or chemically exposed environments, such as aircraft lavatories or medical evacuation aircraft.

Injection molding leads the processing segment, due to its ability to produce complex, high-precision parts with repeatability. It is the preferred method for creating small to medium-sized plastic components in large volumes. Aircraft cabin interior parts—such as tray tables, air vents, and sidewall panels—are predominantly injection molded. The aerospace sector's need for tight tolerances and surface finishes reinforces the dominance of this technique.

3D printing (additive manufacturing) is the fastest-growing processing method, revolutionizing prototyping and low-volume production. Aerospace OEMs are increasingly using PEEK, PEI, and nylon-based filaments for lightweight structures, internal ducts, and tools. For example, Boeing and Northrop Grumman are already deploying 3D-printed plastic brackets in flight-certified aircraft. As regulations around 3D-printed components mature, this trend will significantly alter traditional processing dynamics.

Cabin interiors are the dominant application, as airlines and aircraft OEMs strive to reduce cabin weight while enhancing aesthetics and functionality. Plastics are extensively used in overhead bins, light panels, partitions, armrests, seat frames, lavatories, and galley units. They provide design flexibility, fire resistance, and compliance with aerospace standards such as FAR 25.853 for flammability.

Structural components and window/windshield applications are the fastest-growing, driven by the adoption of PMMA and polycarbonate (PC) for transparency, durability, and impact resistance. Aircraft canopies, observation windows, and domes in military jets and helicopters are now increasingly crafted from plastics instead of glass. These applications also benefit from improved scratch resistance and UV stability, enhancing passenger experience and aircraft longevity.

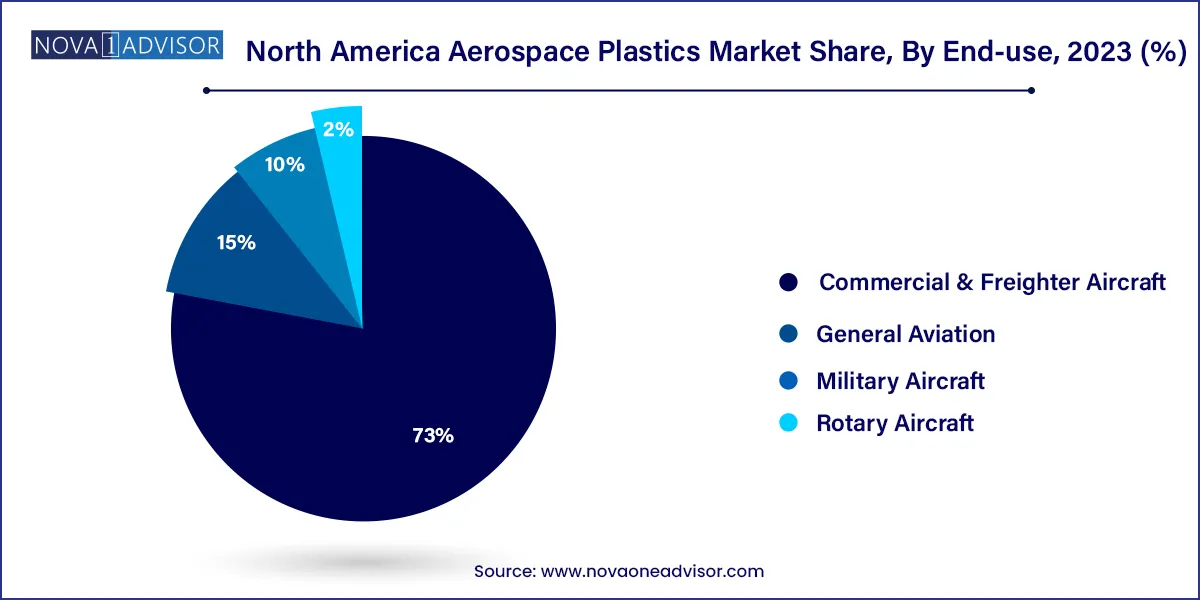

Commercial & freighter aircraft lead the end-use category, reflecting the sheer scale of fleet size and air traffic volumes in North America. Major OEMs like Boeing and Bombardier are embedding lightweight plastics into both narrow- and wide-body aircraft to reduce fuel consumption. Additionally, retrofitting older fleets with lightweight interior components has become a key market driver in the commercial segment.

Rotary aircraft is the fastest-growing segment, particularly for military and emergency response applications. Helicopters used for medical evacuation, search and rescue, and surveillance are incorporating polycarbonate canopies, lightweight rotors, and modular interiors made from aerospace plastics. With growing emphasis on low-vibration, high-durability designs, rotorcraft manufacturers are adopting more plastic-based components than ever before.

The United States dominates the North America aerospace plastics market, owing to its unmatched aerospace manufacturing base, defense budget, and R&D intensity. Home to aerospace giants like Boeing, Lockheed Martin, Raytheon, and Gulfstream, the U.S. drives global trends in aircraft material design. Federal initiatives like NASA’s Sustainable Flight Demonstrator project and the U.S. Air Force’s Next-Generation Air Dominance (NGAD) program further fuel demand for lightweight, high-temperature resistant plastics.

Additionally, the U.S. is a global hub for cellular composite and thermoplastic research, supported by institutions such as MIT, Georgia Tech, and various National Labs. The FAA and DoD material certification processes, while rigorous, have paved the way for large-scale adoption of advanced polymers. U.S.-based suppliers like Solvay, DuPont, and Victrex dominate the high-performance plastics supply chain.

Canada is experiencing steady growth, supported by key aerospace clusters in Quebec, Ontario, and British Columbia. Bombardier’s business jet programs and Pratt & Whitney Canada’s engine manufacturing operations contribute significantly to domestic plastics demand. The Canadian government’s focus on green aviation and indigenous aircraft innovation has encouraged R&D in recyclable thermoplastics and hybrid composite structures.

Mexico is emerging as a cost-effective aerospace manufacturing hub, particularly for interiors and wiring systems. Companies like Safran and Honeywell operate significant facilities in Querétaro and Baja California. With increasing investment in aerospace education and infrastructure, Mexico is seeing growing use of thermoplastics and molded plastic components for cabin, control panel, and electrical insulation applications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America aerospace plastics market

Plastics Type

Process

Application

End-use

Country