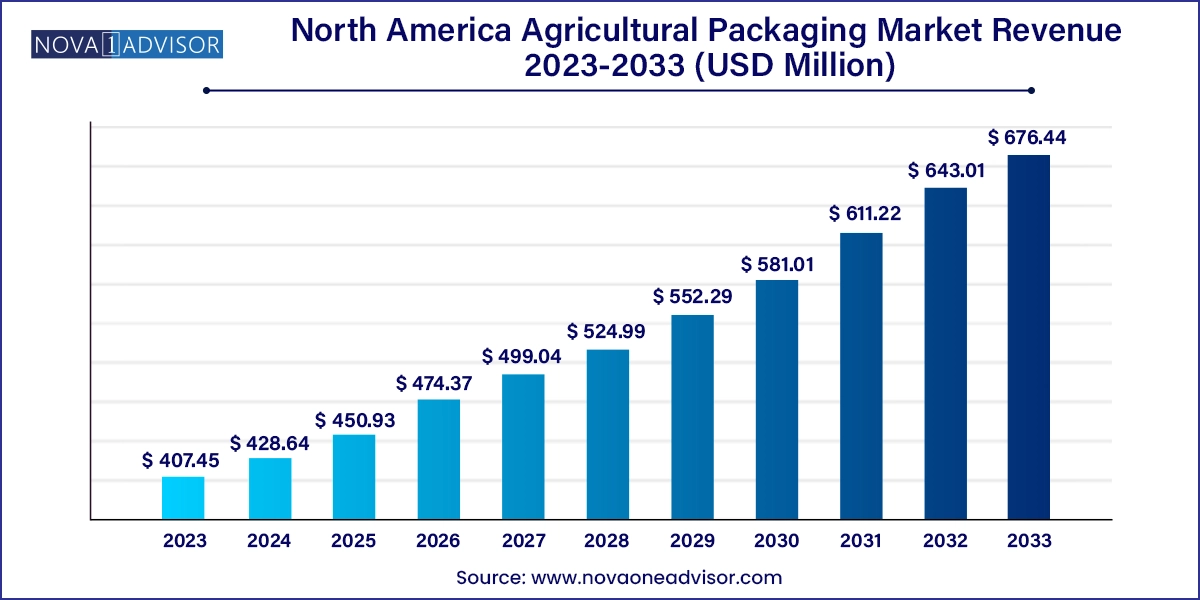

The North America agricultural packaging market size was exhibited at USD 407.45 million in 2023 and is projected to hit around USD 676.44 million by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 428.64 Million |

| Market Size by 2033 | USD 676.44 Million |

| Growth Rate From 2024 to 2033 | CAGR of 5.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Amcor plc; FormTight, Inc.; DS Smith; Mondi; Atlantic Packaging; FLAIR Flexible Packaging Corporation; PPC Flexible Packaging LLC; Flexpack; Transcontinental Inc.; Tekni-Plex, Inc.; Sealed Air; Sonoco Products Company; Huhtamaki Oyj; CLONDALKIN GROUP; ProAmpac; Genpak; Sambrailo Packaging; WINPAK LTD. |

Growing consumption of poultry products and rising horticulture sector across the North America is accelerating the demand for agricultural packaging in the North America.

North America agricultural packaging market experienced a significant boost in recent years, primarily attributed to the growing consumption of poultry products in the region. According to the U.S. Department of Agriculture (USDA), in 2022, the total per capita poultry consumption increased by 18.39% from 2015 to 2023 in the country. This increase in consumption of poultry is due to perceived health benefits of poultry products and eggs as an economical protein source compared to other protein food options. This surge in demand for poultry has propelled the need for efficient and reliable packaging solutions. Poultry products, such as eggs and meat, are sensitive to environmental conditions, which drive the requirement for packaging that provides the required protection from the external contaminants and environment. This is expected to contribute to the growth of North America agricultural packaging market. The increase in total per capita poultry consumption of the U.S. from 2015 to 2023 has been represented in the below-mentioned bar graph obtained from USDA.

According to the USDA, U.S. poultry products have secured dominant positions in both the global and domestic meat commodity markets, propelled by competitive production structures, advanced poultry genetics, abundant domestic feed resources, and a robust appeal to consumers. As per USDA, from 2013 to 2022, broiler chickens were responsible for nearly all U.S. chicken meat, maintained an average share of 67.0% in total poultry sector sales. Chicken eggs, primarily intended for human consumption, accounted for an average of 22.0%, while turkeys accounted for 11.0% of the overall poultry sales during this period. This outlook is expected to increase the need for packaging solutions that ensure the freshness, safety, and shelf life of these products. Therefore, this landscape has driven the demand for agricultural packaging products such as egg trays, flat trays, containers, and others.

The rise in e-commerce and online retail channels has further fueled the demand for efficient poultry packaging products in the region. Consumers are increasingly turning to online platforms for their grocery shopping, and this shift has prompted packaging manufacturers to develop solutions that can withstand the challenges of transportation and storage while maintaining product integrity.

According to the National Agricultural Statistics Service (NASS), in 2022, the total production of the 26 vegetable and melon crops in the U.S. amounted to 658 million cwt. Besides, in 2022, the three largest crops, in terms of total production, were tomatoes, sweet corn, and onions, collectively representing 53% of the total vegetable production, as per reported by NASS. The value of utilized production for vegetable crops reached USD 16.5 billion in 2022, indicating a substantial 27% increase from the previous year. This outlook is expected to create the demand for packaging solutions that are capable of preventing fresh produce from bruising and spoilage during transit and handling. This is anticipated to drive the demand for agricultural packaging products such as punnets, trays, tills, and containers over the forecast period.

On the basis of material, the North America agricultural packaging market has been segmented into plastics, paper & paperboard, and molded pulp. Plastics is anticipated to dominate the overall market with a market share of over 64.0% in 2023. Plastic is an important raw material in the manufacturing of agricultural packaging products such as trays, clamshells, tills, heat-sealing bags, stand-up pouches, and others. Polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS) are major plastics used in the manufacturing of agricultural packaging products. These plastic-based agricultural packaging products offer various benefits such as durability, flexibility, and cost-effectiveness.

Furthermore, paper & paperboard material segment is expected to grow at a fastest CAGR of 5.8% over the forecast period. Agricultural packaging made from paper and paperboard offers various advantages. It provides adequate protection for a wide range of agricultural products including fruits and vegetables. The packaging can be customized to meet specific requirements, offering options such as different weights, thicknesses, and barrier coatings to protect against moisture, air, and light. In addition, paper-based packaging is cost-effective and easily accessible, making it an attractive choice for both small-scale and large-scale agricultural operations.

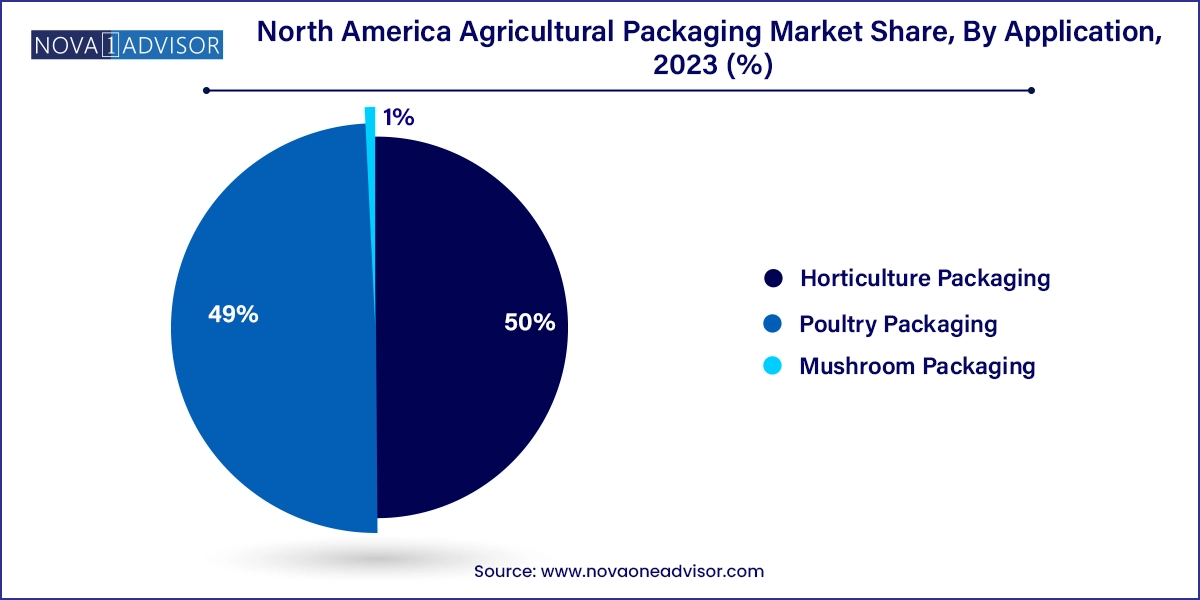

Based on the application, the North America agricultural packaging market is segmented into horticulture packaging, poultry packaging, and mushroom packaging. Poultry packaging application segment dominated market and accounted for largest revenue share of over 50.0% in 2023 and is expected to grow at a fastest CAGR of 5.2% over the forecast period. This positive outlook can be attributed to an increasing consumption of poultry products, such as eggs and meat of chickens, turkeys, quails, ducks, and geese.

In horticulture packaging, products such as trays, punnets, heat-seal bags, and seedling flat trays are used to preserve the quality and freshness of perishable products, including fruits, vegetables, flowers, and ornamental plants, throughout the supply chain. Moreover, Mushroom packaging is designed to pack edible mushrooms. Punnets, tills, and containers are different mushroom packaging products. These products play a crucial role in preserving the freshness of delicate mushrooms, extending their shelf life, and protecting them from damage.

U.S. Agriculture Packaging Market Trends

U.S. dominated the market and accounted for the largest revenue share of over 48.0% in 2023. The agricultural packaging market in North America is highly influenced by the growing poultry sector. Rising production and consumption of poultry products such as eggs and meat of chicken and turkey is expected to accelerate the demand for agricultural packaging products such as egg trays, shrink films, clamshells, trays, and over-wrapped trays.

Advanced packaging materials and techniques that enhance product shelf life, reduce environmental impact, and improve the overall efficiency of packaging solutions are likely to be key drivers for the agricultural packaging market in the U.S. For instance, in September 2021, Wegmans Food Markets introduced sustainable packaging for its store brand eggs. All Wegmans brand eggs now come in a paper pulp carton that is completely recyclable, biodegradable, and compostable. The new cartons are made of 100% post-consumer recycled newsprint and paper products. The company estimates that it will eliminate 625,000 pounds of foam from its stores annually.

Canada Agricultural Packaging Market Trends

According to the Agriculture and Agri-Food Canada (AAFC), in 2022, Canada exported over 5.4 million kilograms of processed eggs worth USD 23 million and over 24.2 million shell eggs worth over USD 3.6 million. In addition, in 2022, Canada exported over 38.8 million hatching eggs of different species, worth over USD 77.4 million, to 20 countries. U.S. was the largest market for Canada’s egg export, accounting for 69% of its value, while other primary countries included Russia, Brazil, and Chile. This export outlook is anticipated to trigger the demand for agricultural packaging products, particularly egg trays, during the forecast period.

Mexico Agricultural Packaging Market Trends

The agricultural packaging market in the Mexico is expected to witness significant growth, owing to the high per capita egg consumption rate. According to the United States Department of Agriculture (USDA), in 2021, per capita egg consumption in Mexico reached 21.4 kg, witnessing an increase of 1.52% over the 2020.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America agricultural packaging market

Material

Application

Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Materials & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2. Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.2.1. Material Outlook

2.2.2. Application Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. North America Agricultural Packaging Market Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends

3.2.3. Profit Margin Analysis

3.2.4. Sales Channel Analysis

3.3. Technology Overview/ Timeline

3.4. Regulatory Framework

3.4.1. Standard & Compliance

3.4.2. Safety

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

3.6.3. Market Entry Strategies

3.7. Latest Trends & Technologies in the North America Agricultural Packaging Market

3.8. Unmet Needs & Challenges in North America Agricultural Packaging Market

3.9. Impact of Environmental, Social, and Governance (ESG) initiatives on the North America Agricultural Packaging Market

Chapter 4. North America Agricultural Packaging Market: Market Supplier Intelligence

4.1. Kraljic Matrix (Portfolio Analysis)

4.1.1. Non-Critical Items

4.1.2. Leverage Items

4.1.3. Bottleneck Items

4.1.4. Strategic Items

4.2. Engagement Model

4.3. Negotiation Strategies

4.4. Sourcing Best Practices

4.5. Vendor Selection Criteria

Chapter 5. North America Agricultural Packaging Market: Material Estimates & Trend Analysis

5.1. Definition & Scope

5.2. Material Movement Analysis & Market Share, 2024 & 2033

5.3. Plastics

5.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

5.4. Paper & Paperboard

5.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

5.5. Molded Pulp

5.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

Chapter 6. North America Agricultural Packaging Market: Application Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Application Movement Analysis & Market Share, 2024 & 2033

6.3. Horticulture Packaging

6.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

6.4. Poultry Packaging

6.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

6.5. Mushroom Packaging

6.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

Chapter 7. North America Agricultural Packaging Market: Country Estimates & Trend Analysis

7.1. Key Takeaways

7.2. Country Movement Analysis & Market Share, 2024 & 2033

7.3. North America

7.3.1. market estimates and forecasts, 2021 - 2033 (USD Million, Kilotons)

7.3.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million, Kilotons)

7.3.3. market estimates and forecasts, by application, 2021 - 2033 (USD Million, Kilotons)

7.3.4. U.S.

7.3.4.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

7.3.4.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

7.3.4.3. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

7.3.5. Canada

7.3.5.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

7.3.5.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

7.3.5.3. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

7.3.6. Mexico

7.3.6.1. market estimates and forecasts, 2021 - 2033 (USD Million) (Kilotons)

7.3.6.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million) (Kilotons)

7.3.6.3. market estimates and forecasts, by application, 2021 - 2033 (USD Million) (Kilotons)

Chapter 8. Start-up Ecosystem Evaluation, 2024

8.1. List of Start-up Companies

8.1.1. Progressive Companies

8.1.2. Responsive Companies

8.1.3. Dynamic Companies

8.1.4. Starting Blocks

8.2. Government Funding for Start-ups across the globe

Chapter 9. Competitive Landscape

9.1. Key Global Players & Recent Developments & Their Impact on the Industry

9.2. Key Company/Competition Categorization (Key innovators, Market leaders, emerging players)

9.3. List of key Raw Material Distributors and Channel Partners

9.4. List of Potential Customers, by Application

9.5. Company Market Share Analysis, 2024

9.6. Company Heat Map Analysis

9.7. Competitive Dashboard Analysis

9.8. Company-Wise Product Prices

9.9. Strategy Mapping

9.9.1. Expansion

9.9.2. Collaboration/ Partnerships/ Agreements

9.9.3. New Product launches

9.9.4. Mergers & Acquisitions

9.9.5. Divestment

9.9.6. Research & Development

9.9.7. Others

Chapter 10. Company Listing / Profiles

10.1. Amcor plc

10.1.1. Company Overview

10.1.2. Financial Performance

10.1.3. Product Benchmarking

10.2. FormTight, Inc.

10.2.1. Company Overview

10.2.2. Financial Performance

10.2.3. Product Benchmarking

10.3. DS Smith

10.3.1. Company Overview

10.3.2. Financial Performance

10.3.3. Product Benchmarking

10.4. Mondi

10.4.1. Company Overview

10.4.2. Financial Performance

10.4.3. Product Benchmarking

10.5. Atlantic Packaging

10.5.1. Company Overview

10.5.2. Financial Performance

10.5.3. Product Benchmarking

10.6. FLAIR Flexible Packaging Corporation

10.6.1. Company Overview

10.6.2. Financial Performance

10.6.3. Product Benchmarking

10.7. PPC Flexible Packaging LLC

10.7.1. Company Overview

10.7.2. Financial Performance

10.7.3. Product Benchmarking

10.8. Flexpack

10.8.1. Company Overview

10.8.2. Financial Performance

10.8.3. Product Benchmarking

10.9. Transcontinental Inc.

10.9.1. Company Overview

10.9.2. Financial Performance

10.9.3. Product Benchmarking

10.10. Tekni-Plex, Inc.

10.10.1. Company Overview

10.10.2. Financial Performance

10.10.3. Product Benchmarking

10.11. Sealed Air

10.11.1. Company Overview

10.11.2. Financial Performance

10.11.3. Product Benchmarking

10.12. Sonoco Products Company

10.12.1. Company Overview

10.12.2. Financial Performance

10.12.3. Product Benchmarking

10.13. Huhtamaki Oyj

10.13.1. Company Overview

10.13.2. Financial Performance

10.13.3. Product Benchmarking

10.14. CLONDALKIN GROUP

10.14.1. Company Overview

10.14.2. Financial Performance

10.14.3. Product Benchmarking

10.15. ProAmpac

10.15.1. Company Overview

10.15.2. Financial Performance

10.15.3. Product Benchmarking

10.16. Genpak

10.16.1. Company Overview

10.16.2. Financial Performance

10.16.3. Product Benchmarking

10.17. Sambrailo Packaging

10.17.1. Company Overview

10.17.2. Financial Performance

10.17.3. Product Benchmarking

10.18. WINPAK LTD.

10.18.1. Company Overview

10.18.2. Financial Performance

10.18.3. Product Benchmarking

Chapter 11. Strategic Recommendations/ Analyst Perspective