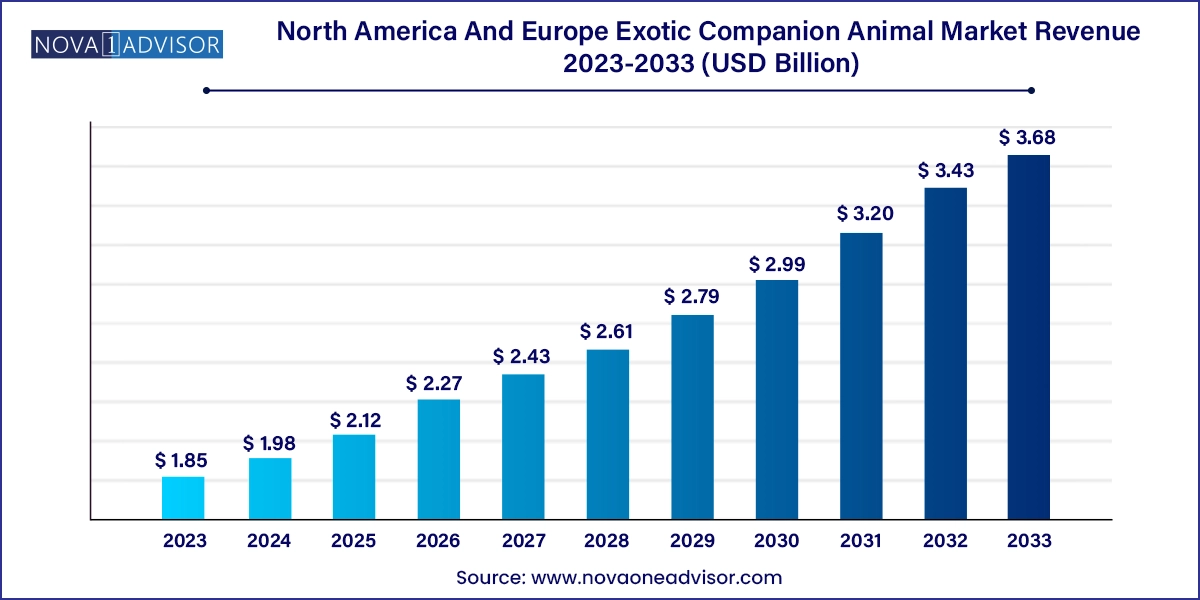

The North America and Europe exotic companion animal market size was exhibited at USD 1.85 billion in 2023 and is projected to hit around USD 3.68 billion by 2033, growing at a CAGR of 7.11% during the forecast period 2024 to 2033.

The exotic companion animal market in North America and Europe is undergoing a transformative evolution, shaped by shifting pet ownership preferences, enhanced veterinary healthcare, and rising awareness about animal well-being. Unlike traditional companion animals such as dogs and cats, exotic pets include small mammals (hamsters, ferrets, rabbits), reptiles (snakes, lizards, turtles), and birds (parrots, cockatiels, macaws). These species, once confined to wildlife exhibits or specialty zoos, are now becoming mainstream choices for households seeking unique, intelligent, and sometimes hypoallergenic alternatives.

In North America and Europe, a cultural shift toward individualism and novelty has contributed to the rising popularity of these non-traditional pets. Millennials and Gen Z, in particular, are embracing reptiles and birds not just as pets but as companions offering low-maintenance lifestyles and lower spatial needs. This has led to an uptick in the demand for dedicated healthcare services, specialized feeds, medicated products, and accessories tailored to the biological needs of exotic species.

Countries like the U.S., UK, Germany, and France have witnessed a surge in exotic pet ownership, driven in part by social media influence, pet expos, and increasing education around exotic animal care. Parallelly, veterinary science has advanced significantly to accommodate this demand, with more clinics offering specialized services, and pharmaceutical companies rolling out products that cater exclusively to non-canine and non-feline animals.

This market is unique in its regulatory complexity, requiring compliance with wildlife conservation laws, veterinary approval, and distribution frameworks. Nevertheless, the economic potential is immense—especially as lifestyle diseases, infections, and age-related conditions in exotic pets spur demand for healthcare products and preventive medicine.

Humanization of Exotic Pets: Exotic pets are increasingly treated like family members, leading to greater spending on their healthcare, insurance, and premium foods.

Rising Popularity of Reptiles and Birds: Due to lower maintenance costs, less space requirement, and novelty factor, reptiles and birds are gaining traction in urban settings.

Growth in E-Commerce Distribution: Pet medications, food, and supplements for exotic species are seeing robust growth through online channels, offering convenience and wider selection.

Tailored Nutrition Solutions: Increasing awareness of species-specific dietary requirements is fostering the development of custom feed formulations for parrots, iguanas, ferrets, etc.

Veterinary Specialization: More veterinarians are receiving training in exotic animal medicine, creating an ecosystem of specialized clinics and services.

Preventive Health Products Surge: There's an uptick in preventive products like dewormers, immune boosters, and supplements tailored to exotic animals.

Regulatory Tightening on Exotic Animal Imports: Governments across North America and Europe are enforcing stricter regulations on the import, sale, and care of exotic pets.

Digital Pet Health Monitoring: The integration of digital health monitoring devices for exotic pets, such as smart terrarium thermometers and feeding timers, is on the rise.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.98 Billion |

| Market Size by 2033 | USD 3.68 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.11% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Animal Type, By Route of Administration, By Product, By Indication, By Distribution Channel and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway |

| Key Companies Profiled | AdvaCare Pharma; Merck & Co., Inc., ; VETARK (Candioli Srl); Vetafarm; VioVet Ltd (Pethealth); Mazuri; Earth Paws Private Limited. ; Versele Laga; CROCdoc ; Zoetis; Vetnil |

Increasing Popularity of Exotic Pets Among Urban Millennials

One of the most influential drivers of market growth is the rising trend of exotic pet ownership among urban millennials and Gen Z consumers. These demographics are seeking companionship that is non-conventional and less resource-intensive than dogs or cats. Exotic pets such as ferrets, bearded dragons, sugar gliders, and African grey parrots offer a unique aesthetic appeal, intellectual stimulation, and in some cases, hypoallergenic qualities that make them ideal for apartments or limited-living spaces.

Urban millennials often have fast-paced lifestyles, and exotic pets such as reptiles and birds demand less day-to-day involvement than traditional pets, yet still offer rewarding engagement. Social media has further accelerated this trend, with influencers showcasing exotic pet ownership as part of a modern, stylish lifestyle. This growing interest has directly translated into demand for exotic animal care products, pharmaceuticals, and services, fueling overall market expansion.

Lack of Standardized Veterinary Guidelines and Product Availability

Despite growing demand, one major constraint is the lack of standardized veterinary treatment protocols and limited product options for exotic species. Unlike dogs and cats, exotic animals have widely varying biological systems that require specialized treatment regimens. Unfortunately, the veterinary infrastructure and R&D investment into these animals still lags behind. Many veterinarians receive minimal training in exotic pet medicine, resulting in misdiagnoses or reliance on off-label drug use.

Moreover, product availability remains uneven. Most pharmaceutical companies prioritize mainstream animal health products, which means that exotic pet owners often have to rely on repurposed or imported medications, making consistent treatment difficult. This not only impacts the quality of care but also introduces risks related to dosage misalignment, drug toxicity, or inefficacy.

Expansion of Preventive and Nutritional Health Products

The emerging focus on preventive care and specialized nutrition for exotic animals presents a robust growth opportunity. Owners of parrots, snakes, rabbits, and other exotic species are increasingly investing in prophylactic treatments and dietary supplements to prevent common ailments such as metabolic bone disease, parasitic infections, and bacterial imbalances. Companies that develop high-quality medicated feeds, herbal immune boosters, and condition-specific supplements are poised to capture a growing share of the market.

Additionally, advancements in product delivery—such as flavored oral syrups for birds or slow-release topical sprays for reptiles—can enhance product compliance and effectiveness. With pet parents seeking holistic wellness for their animals, businesses offering integrative solutions that combine diet, preventive care, and environmental enrichment will have a significant edge.

Small mammals led the market in terms of revenue share, owing to their widespread popularity in both North America and Europe. Pets such as rabbits, guinea pigs, and ferrets are considered ideal starter pets for families with children due to their sociable nature and relatively manageable care requirements. In addition, their longer lifespans compared to rodents and lower upkeep than dogs or cats make them attractive to first-time pet owners. Veterinary care, deworming, and grooming products for small mammals are widely available, further facilitating their popularity.

However, the reptile segment is expected to grow at the fastest rate during the forecast period. Reptiles such as geckos, pythons, and tortoises are gaining popularity among urban consumers due to their low space requirements, hypoallergenic nature, and exotic appeal. The rise of terrarium setups and advanced heating, feeding, and lighting solutions has made reptile care more accessible. Additionally, the market is witnessing a surge in demand for calcium supplements, UVB lights, and topical antifungal sprays tailored to reptile physiology.

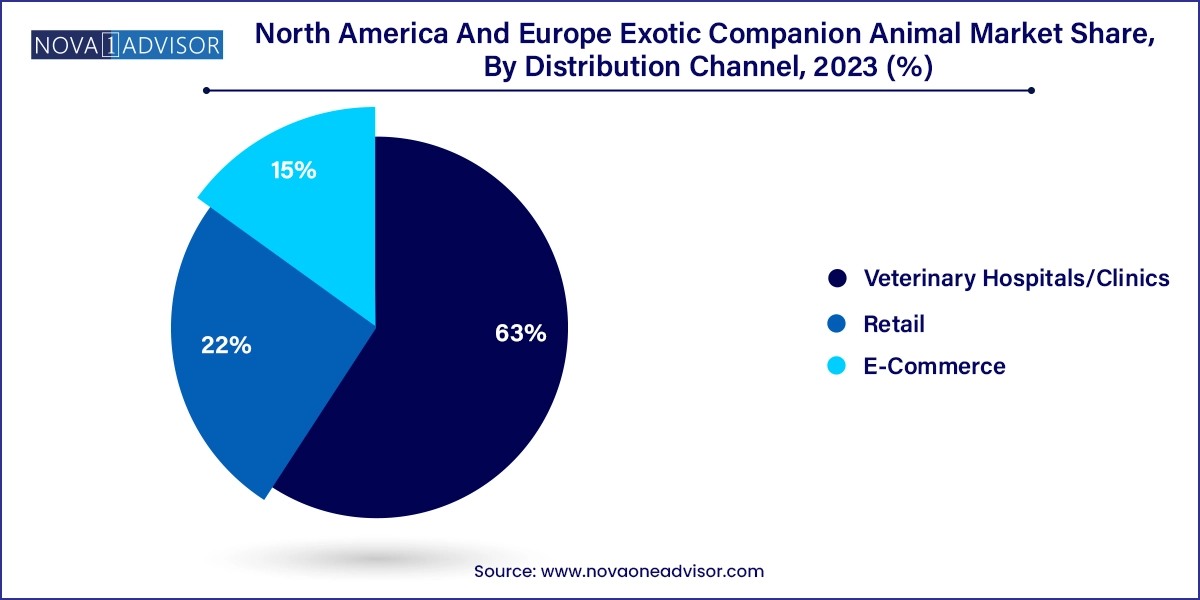

Veterinary hospitals and clinics have historically dominated the distribution landscape, primarily because exotic pet care requires specialized knowledge that general retailers may not possess. Clinics not only dispense medications but also offer guidance on proper usage, dosage, and handling. Moreover, exotic pet owners tend to rely heavily on professional consultation, reinforcing clinic-based product sales.

E-commerce, however, is emerging as the fastest-growing distribution channel. Online platforms offer convenience, product comparisons, and doorstep delivery of specialized foods, supplements, and non-prescription medications. Dedicated portals like Chewy, Zooplus, and specialty retailers have expanded their exotic pet sections, driving growth. Subscription-based services for recurring deliveries of feed and dewormers are also gaining popularity, particularly in urban areas.

Oral administration emerged as the leading segment, supported by the broad range of medications and supplements available in chewable, syrup, or feed-integrated formats. Oral routes are generally preferred for small mammals and birds, where injections are more stressful and topical treatments are less effective. The accessibility and safety of oral formats, particularly when designed to taste appealing to exotic pets, make them highly favored by both veterinarians and pet owners.

Conversely, the injectable segment is experiencing rapid growth, especially for use in clinical settings. Conditions like parasitic infestations or bacterial infections that require immediate intervention are often treated via injectables. Increasing surgical procedures in exotic animals, such as dental corrections in rabbits or tumor removals in ferrets, also require injectable anesthetics and post-op antibiotics. This segment’s growth is further supported by an expanding network of exotic pet-specialist veterinary clinics.

Pharmaceuticals, particularly parasiticides and antibacterials, dominate the product landscape due to the frequent need for medical intervention in exotic pets. Birds and reptiles are often susceptible to mites, protozoan parasites, and bacterial infections due to environmental fluctuations or poor husbandry. Parasiticides are widely used in treating mite infestations in reptiles and coccidiosis in birds. Medicated feed additives, while a smaller subset, are increasingly used in rodents and small mammals for long-term gut health maintenance.

The foods & supplements segment is poised to expand rapidly, especially among proactive pet owners focused on preventive care. High-protein feed for ferrets, calcium supplements for reptiles, and fortified seed blends for birds are gaining traction. Furthermore, probiotic-enriched treats and immunity boosters are seeing higher demand in the wake of increased awareness about pet health, mirroring trends in human wellness.

Parasitic infections represented the most common indication for product use. Due to their natural environments and varied husbandry practices, exotic pets are particularly vulnerable to mites, ticks, internal worms, and protozoa. Routine use of dewormers and anti-parasitic sprays has become essential in preventive care, especially in birds and reptiles. Additionally, many owners source exotic animals from breeders or pet expos where cross-contamination risks are higher.

While parasitic infections are dominant today, orthopedic diseases are expected to grow significantly as owners seek surgical and therapeutic interventions for issues like metabolic bone disease in reptiles and joint deterioration in aging rabbits or ferrets. The rise of orthopedic dietary supplements, calcium injections, and even physical therapy services points to a growing sophistication in exotic pet care.

U.S.: The U.S. leads the North American market, with a strong culture of pet ownership and a rising trend of adopting exotic animals. The country hosts numerous exotic pet expos, breeder associations, and exotic veterinary programs. Products like ivermectin sprays, fortified seed mixes, and reptile supplements are in high demand.

Canada: Canada is seeing growing interest in exotic pets, especially birds and reptiles. Regulatory clarity and rising disposable incomes have allowed exotic pet care clinics to flourish in urban centers.

Mexico: Exotic pet ownership is increasing, albeit slowly, in Mexico. Limited access to specialized products has created opportunities for international brands to expand their retail and e-commerce presence.

UK: The UK has a well-regulated exotic animal trade and a growing base of veterinary professionals trained in avian and reptilian care. Government-approved medicated feeds and antiparasitic treatments are widely available.

Germany: Germany emphasizes animal welfare, and this extends to exotic pets. The country has a robust network of veterinary schools offering exotic pet specializations.

France: France’s market is supported by strong cultural interest in birds and reptiles, with local manufacturing of feeds and grooming products.

Italy & Spain: Both countries have a growing community of exotic pet hobbyists and active online marketplaces for exotic pet products.

Nordic Countries (Sweden, Norway, Denmark): While overall pet ownership is lower due to environmental factors, these countries show high awareness of pet well-being, and exotic pet ownership is growing through regulated channels.

In February 2024, Zoetis introduced a new line of flavored oral antiparasitic tablets for small mammals and birds in Europe.

In November 2023, Vetark Professional expanded its range of reptile multivitamins and calcium supplements across major online platforms in the UK and Germany.

In September 2023, Exotic Nutrition launched a new subscription-based service for fortified sugar glider foods in the U.S.

In June 2023, Elanco Animal Health announced R&D investment in a new line of injectable medications for avian orthopedic care, expected to be available by late 2025.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America and Europe exotic companion animal market

Animal Type

By Route of Administration

By Product

By Indication

By Distribution Channel

Regional Outlook (Revenue, USD Billion, 2018 - 2033)