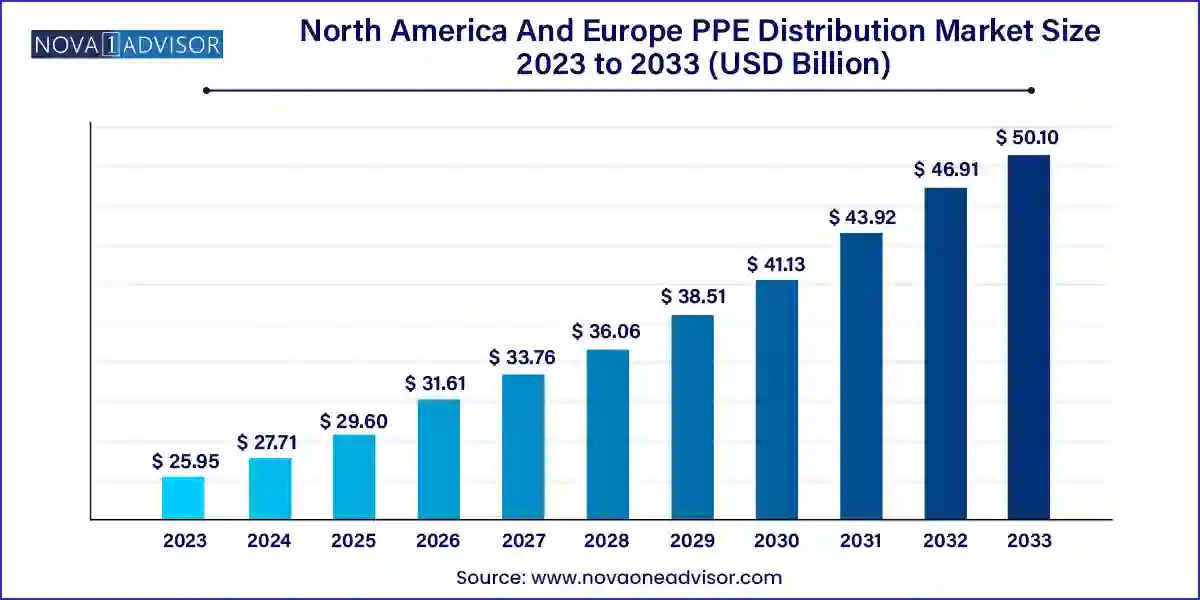

The North America and Europe PPE distribution market size was exhibited at USD 25.95 billion in 2023 and is projected to hit around USD 50.10 billion by 2033, growing at a CAGR of 6.8% during the forecast period 2024 to 2033.

The North America and Europe PPE (Personal Protective Equipment) Distribution Market has evolved into a strategically vital ecosystem supporting the safety infrastructure of a wide range of industries. From frontline healthcare workers to heavy industry operatives, PPE plays a crucial role in reducing occupational hazards and maintaining compliance with health and safety standards. In both regions, the market has witnessed a surge in demand not only due to regulatory enforcement but also driven by a cultural shift prioritizing workplace safety, especially in the aftermath of the COVID-19 pandemic.

Distributors of PPE function as a vital link in the supply chain, bridging the gap between manufacturers and end-users across sectors such as construction, healthcare, pharmaceuticals, food processing, manufacturing, and oil & gas. These entities offer customized procurement, inventory management, compliance consulting, and even training services. Distribution is no longer about simply moving products from point A to point B; it involves aligning offerings with the unique needs of end-users, integrating software tools for inventory management, and ensuring traceability and certification in line with OSHA (Occupational Safety and Health Administration) in the U.S. and the European Agency for Safety and Health at Work (EU-OSHA) in Europe.

With a combined market size exceeding several billion dollars and a trajectory fueled by digitization and sustainability initiatives, the PPE distribution market in these developed regions is expected to remain dynamic and innovation-driven. Key players are investing in advanced warehousing systems, ERP integrations, and mobile app-based ordering to enhance distributor responsiveness, minimize stockouts, and shorten lead times.

Digitalization of Distribution Channels: PPE distributors are increasingly leveraging e-commerce platforms, mobile apps, and cloud-based inventory systems to streamline procurement and expand their customer base.

Focus on Sustainable and Reusable PPE: There is growing demand for PPE that is not only effective but also environmentally friendly. Distributors are offering biodegradable or recyclable products, especially in healthcare and food industries.

Vendor Consolidation: Larger distributors are acquiring regional players to expand geographic coverage and gain access to niche industry verticals.

Integration of IoT in PPE: Smart PPE devices, such as connected helmets or wearables that monitor environmental conditions, are being introduced via tech-savvy distribution channels.

Customized Safety Solutions: Distributors are offering industry-specific PPE kits tailored to customer requirements, including bundled packages with training and compliance support.

Rise of Subscription-Based Models: Particularly in healthcare and manufacturing, distributors are offering PPE-as-a-service with automated resupply and cost-per-use models.

Automation in Warehousing: Distribution centers are integrating robotics and AI to manage storage, retrieval, and dispatching of PPE products efficiently.

| Report Coverage | Details |

| Market Size in 2024 | USD 27.71 Billion |

| Market Size by 2033 | USD 50.10 Billion |

| Growth Rate From 2024 to 203 | CAGR of 6.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe |

| Key Companies Profiled | Grainger, Protek PPE; J&K Ross; GenXtreme; AB Safet; Kellner & Kunz; Safety Management Italy s.r.l; Total Safety; Mallory Safety; J.J. Keller & Associates |

One of the most potent drivers of the North America and Europe PPE distribution market is the intensification of workplace safety regulations and the rising accountability of employers. Governments across both continents have been tightening mandates related to the use of PPE, making it a legal necessity rather than a voluntary practice. Agencies such as OSHA in the U.S. and EU-OSHA in Europe have been expanding compliance protocols, particularly for high-risk sectors like chemical manufacturing, construction, mining, and pharmaceuticals.

For example, in 2023, Germany introduced stricter protective gear requirements in hazardous chemical handling, driving PPE sales for respiratory and hand protection. Similarly, the U.S. Department of Labor initiated randomized inspections targeting PPE compliance in the transportation and logistics sector, leading to a significant spike in orders for fall protection and high-visibility clothing.

These regulatory pressures directly benefit PPE distributors, who are now positioning themselves as compliance partners, not just product suppliers. Distributors who offer certification tracking, usage training, and safety audits along with their PPE lines are gaining a competitive edge in this regulatory-first landscape.

A significant restraint faced by the PPE distribution market is the persistent vulnerability to supply chain disruptions and the volatility of raw material prices. The COVID-19 pandemic exposed the fragility of global supply lines, particularly for PPE products dependent on international manufacturing hubs in Asia. Even as conditions normalize, the geopolitical instability (such as the Russia-Ukraine conflict) and trade restrictions continue to affect transportation and material availability.

For instance, nitrile an essential material for gloves has seen price volatility due to shortages and environmental regulations affecting its production. These fluctuations create pricing instability and challenge distributors' ability to offer consistent and affordable supply, especially in contract-based deals with institutional buyers. Additionally, transportation bottlenecks, such as port congestions or trucker shortages in the U.S., delay deliveries, affecting the distributor's service levels and reputation.

Smaller distributors, in particular, lack the supply chain diversification and financial buffers to manage such volatility, leading to shrinking margins or even contract losses when they fail to meet SLA terms.

A strong market opportunity exists in the integration of technology and the provision of value-added services alongside PPE distribution. Distributors that go beyond traditional supply roles and invest in digital infrastructure, analytics, and training services are carving out premium market positions. Offering predictive resupply using usage data, integrating safety training modules, and linking inventory systems with client ERP platforms are examples of services that add tangible value.

In North America, large distributors like Fastenal and MSC Industrial Supply are pioneering vending-machine-based PPE solutions where clients can manage their inventory usage in real-time. Similarly, European distributors are integrating RFID tagging into PPE to track wear patterns and compliance, particularly in mining and manufacturing sectors.

The opportunity also includes mobile ordering apps for field-based operations, chat-based procurement support, and AI-driven dashboards for safety managers to monitor compliance trends across multi-site operations. These advancements not only elevate customer experience but also foster long-term client relationships and recurring revenue streams.

Hand protection dominated the North America and Europe PPE distribution market by product type. Gloves—ranging from disposable nitrile and latex to cut-resistant and chemical-resistant types—are among the most consumed PPE categories across almost every industry. High-frequency tasks, such as patient examinations, machinery operation, material handling, and laboratory testing, necessitate consistent use of gloves. Given their relatively short lifecycle and single-use nature in sectors like healthcare and food processing, hand protection products contribute significantly to recurring PPE orders. Moreover, strict hygiene protocols and advancements in glove coatings for enhanced grip and breathability continue to boost this segment.

Respiratory protection is the fastest-growing product category, fueled by heightened awareness of airborne hazards in both healthcare and industrial settings. During and after the COVID-19 pandemic, N95 respirators, half-face and full-face respirators, and PAPRs (Powered Air-Purifying Respirators) became essential. In the manufacturing and mining industries, rising concerns over silica dust, asbestos, and chemical fumes have led to stringent regulatory mandates, further accelerating adoption. Distributors offering fit-testing kits and custom respirator programs are gaining traction, especially among pharmaceutical and chemical companies.

Construction emerged as the dominant end-use segment in the PPE distribution market across North America and Europe. The industry has high demand for a wide range of PPE products, including hard hats, gloves, fall protection harnesses, and steel-toe boots. Governments across both regions have made it mandatory for workers in construction zones to be equipped with certified safety gear. As infrastructure investments surge—such as the U.S. Infrastructure Investment and Jobs Act—the demand for PPE through contractor and sub-contractor channels is multiplying. Distributors who specialize in rapid on-site delivery and replenishment are capitalizing on this opportunity.

Healthcare is the fastest-growing end-use segment, particularly due to post-pandemic preparedness strategies and hospital expansion. PPE in healthcare is no longer limited to gloves and masks; it now includes full-body suits, face shields, eye protection, and shoe covers. In Europe, national health systems have overhauled their PPE procurement models to include bulk purchasing through vetted distributors. In North America, private hospital chains and nursing homes are building long-term contracts with distributors that offer warehousing and emergency supply capabilities. These trends are further amplified by the expansion of home care and outpatient clinics, where safe disposal and usage training become key differentiators.

The U.S. is the largest market for PPE distribution in North America. Government regulations from OSHA, as well as state-level safety mandates, have made PPE procurement a non-negotiable for organizations across sectors. Large distributors like Fastenal and Grainger have built multi-billion-dollar supply networks with regional fulfillment centers, mobile vending solutions, and ERP integration with corporate buyers. In 2024, several major infrastructure projects in the Midwest created a surge in demand for fall protection and hearing protection devices, reflecting the influence of national-level legislation on regional PPE needs.

Canada's PPE distribution market is evolving rapidly, driven by the mining, oil & gas, and healthcare sectors. Provinces such as Alberta and British Columbia have stringent industry safety regulations that are driving demand. Canadian distributors are increasingly focused on bilingual packaging (English and French) and local compliance certifications. The federal government’s Build Back Better Plan is also directing funds into safe infrastructure, indirectly fueling PPE distribution across public-sector projects.

Germany remains a pivotal European market for PPE, supported by its strong manufacturing and chemical sectors. Distributors here emphasize CE-certified products and often collaborate with industry associations to co-develop safety programs. The German Federal Institute for Occupational Safety and Health is actively involved in compliance checks, boosting institutional reliance on trusted distribution networks. Digitized procurement is well advanced, with many companies automating orders based on usage data analytics.

France has seen a resurgence in industrial activity and increased investment in pharmaceuticals and biotech, both of which are key PPE-consuming sectors. French PPE distributors are leveraging cloud-based inventory platforms and subscription-based models for hospitals and labs. With strong labor unions advocating for improved worker safety, PPE usage across construction and transportation sectors remains high, making France a stronghold in the European PPE distribution market.

The UK's PPE distribution sector is transforming post-Brexit, as supply chains are restructured and domestic sourcing gains traction. Distributors are investing in domestic warehousing and direct partnerships with local manufacturers to mitigate import-related uncertainties. The NHS has become a dominant buyer, standardizing its PPE specifications across hospitals and care homes. Furthermore, construction and logistics companies in the UK are adopting AI-based tools to forecast PPE demand and reduce excess inventory.

In January 2025, Grainger expanded its PPE distribution center in Kentucky to handle a surge in demand from construction and manufacturing clients in the southeastern U.S., featuring automation systems for faster fulfillment.

In February 2025, Bunzl plc announced the acquisition of a local safety distributor in Belgium, enhancing its PPE footprint across Western Europe.

In March 2025, Fastenal launched a PPE-as-a-service subscription model aimed at healthcare facilities in Canada, bundling delivery, inventory tracking, and training services.

In December 2024, RS Group (formerly Electrocomponents) partnered with Ansell to offer a digital PPE compliance dashboard integrated with ERP systems across UK industrial sites.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America and Europe PPE distribution market

Product

End-use

Regional