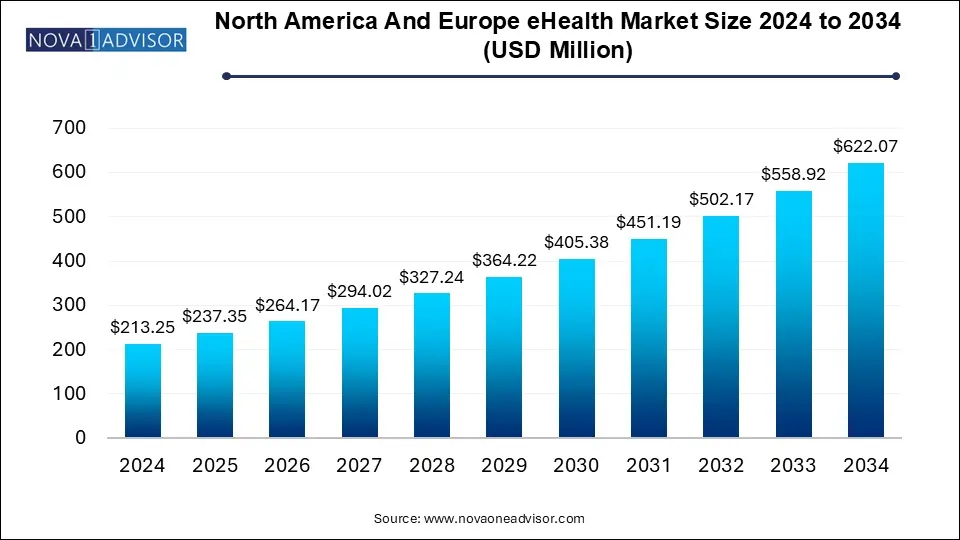

The North America and Europe eHealth market size was exhibited at USD 213.25 million in 2024 and is projected to hit around USD 622.07 million by 2034, growing at a CAGR of 11.3% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 237.35 Million |

| Market Size by 2034 | USD 622.07 Million |

| Growth Rate From 2025 to 2034 | CAGR of 11.3% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Service, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America and Europe |

| Key Companies Profiled | Allscripts Healthcare, LLC; IBM; Siemens Healthineers; Epic Systems Corporation; Hexoskin, Chronolife SAS; Koninklijke Philips N.V.; Apple Inc.; WHOOP; Silvertree; HealthWatch Ltd.; Athos; Biodevices SA; Emglare; GetEnflux; Bioserenity; AiQ; Athos; Medtronic; Team PRO; Sensori; Supa |

The growth of IoT and technological advances leading to an increase in the desire for mobile technology and the internet and increasing demand for population health management are all pushing factors for the e-health market. Over the projection period, lifestyle-related illnesses such as blood pressure and diabetes are expected to rise. As a result, the growing public awareness of eHealth and the rising acceptance of eHealth among healthcare professionals, together with evidence of the efficacy of adopting this technology, are anticipated to result in significant growth in this industry.

Over the projection period, the COVID-19 influence is projected to drive the market growth for eHealth solutions. Allscripts Healthcare, for example, launched a package of COVID-19 solutions for hospitals that addressed disease-specific requirements inside SunriseTM EHR, Allscripts Care Director, and Parago EHR to reduce screening and monitoring time. These screening steps helped identify and track patients who had confirmed or suspected coronavirus infection.

Cerner Corporation, GE Healthcare, and Allscripts are among the leading suppliers in the e-health sector. These suppliers have manufacturing facilities distributed across North America, Asia Pacific, Europe, South America, and the rest of the world. GE Healthcare and Microsoft expanded their established partnership in April 2020 to introduce a cloud-based COVID-19 patient intensive care software for health systems, which will help the e-health sector grow even faster.

The e-health industry is being driven by increasing government initiatives that support the use of e-health solutions and services which has resulted in an increasing requirement for managing regulatory compliance through the use of e-health solutions, and a shortage of healthcare professionals. In contrast, the market growth is being hampered by the resistance of medical professionals to adopt cutting-edge e-health solutions and the high cost of deployment and maintenance. The industry is likely to experience profitable growth opportunities due to the growth of mHealth, telehealth services, and remote monitoring of patients’ markets as well as the rising adoption of e-health options in outpatient care facilities.

The use of electronic health records and e-prescriptions has expanded in recent years and is anticipated to continue to grow in the coming years. These systems rely on interoperable digital platforms that allow the interchange of health operations, and such data is likely to move across borders in the future to improve healthcare administration. For instance, Americans who have flown to India for a vacation receive all their healthcare paperwork and drug prescriptions at an Indian pharmacy. Furthermore, the medical tourism business will benefit from this.

In terms of product, the health information system (HIS) segment held the largest revenue share of over 35.0% in 2024. The growing adoption of technologically advanced healthcare services is aiding the sector. Various IT firms and healthcare institutions have recently increased their collaboration to focus on producing high-utility services and solutions for better individualized care, data storage efficiency, and data analytics efficacy. Furthermore, the increased usage of EHR systems is expected to drive the market growth in the forecast period. NXGN Management, LLC announced the establishment of a joint venture with Doctible in January 2020. By integrating Doctible's service with NextGen Office's cloud-based EHR and practice management (PM) platforms, this agreement is expected to support small businesses in retaining clients, promoting expansion, and delivering superior patient care.

The big data for the health segment is anticipated to grow at a significant CAGR of 12.3% over the forecast period. This can be attributed to the increasing availability and use of electronic health records, the growing adoption of digital health tools, and advancements in big data analytics. Large and intricate datasets that cannot be processed using conventional techniques are referred to as "big data." The use of big data in healthcare can help with disease management, diagnosis, treatment, and prevention.

As the healthcare industry transitions to digitalization, EHR systems are becoming increasingly communal. Numerous government initiatives, including encouraging physicians to adopt EHR, investing in training healthcare Information Technology (IT) professionals, and building regional extension centers to provide technical and other help, are boosting the expansion of the EHR market. The European Commission, for instance, in March 2021 issued a recommendation on a European EHR exchange standard, allowing health data to move freely across borders. This policy enables European citizens to safely access and exchange health information regardless of where they are on the continent.

In terms of end-use, the provider segment held the largest revenue share in 2024. eHealth offers great convenience to healthcare professionals in terms of patient workflow and data management. Furthermore, rising demand for centralization and streamlining of healthcare administration will fuel market growth. For instance, the Community Care Plan of Eastern Carolina (CCP) stated that the installation of the telehealth program allowed clinicians and healthcare providers to see over 20 patients each week, up from only 10 patients before the installation. This is expected to contribute to segment growth during the forecast period. Based on end-use, the market is segmented into healthcare providers, insurers, government, and healthcare consumers.

Implementing home-based eHealth software is one method for providing more sustainable treatment for these patients. Such services, in collaboration with healthcare providers, enable patients to take a more active role as value-creating co-producers of their treatment. Furthermore, healthcare professionals play an important role in value creation: however, there is little known about value development in eHealth, particularly from their perspective. As a result, the goal of this study was to gain a better understanding of how an eHealth application could serve as a value-creating resource from the standpoint of healthcare providers.

In terms of services, the monitoring segment held the largest revenue share of over 67.0% in 2024 and it is anticipated to grow at the fastest CAGR of 11.6% over the forecast period. Patient monitoring has advanced over time, from hospital bedside monitors to wearable devices that can monitor patients and send data to medical servers over wireless networks. It is a method of determining if a patient's health is normal or deteriorating over time by evaluating their key vital signs. Vital signs data from a remote location can help healthcare providers immediately deliver aid to those whose health is in danger. The disadvantage of this form of remote monitoring system is that patients must usually be present at a certain location to assess their health or receive emergency assistance.

Wearable monitors have benefited from recent advancements in battery technology and wireless data transmission as well as the introduction of smartphones. Wearable monitors with various sensors, intelligent processing, and alerts have been created in the last 15 years to support medical decisions and interactions with health providers. Another important factor accelerating the market growth is the increased emphasis on using smart devices & wearables to improve personal health and fitness.

Based on region, North America dominated the market in 2024 with a revenue share of over 60.0%. This can be attributed to the surging demand for healthcare information technology solutions in the medical sector. Rapid technological advancements and the growing importance of providing quality healthcare services are further contributing to market growth in this region.

Europe is anticipated to grow at the fastest CAGR of 12.3% over the forecast period. This can be attributed to increasing investments in the healthcare sector in countries. Europe’s market is showing high potential due to increasing R&D expenditure by governments of key economies for increasing the penetration of information technology in the medical field. In addition, the increasing geriatric population is likely to serve as a key factor fuelling the Europe eHealth market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America and Europe eHealth market

By Product

By Services

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Service

1.1.3. End-use

1.1.4. Regional scope

1.1.5. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Service outlook

2.2.3. End-use outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. North America and Europe eHealth Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.4. North America and Europe eHealth Market Analysis Tools

3.4.1. Industry Analysis – Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. North America and Europe eHealth: Product Estimates & Trend Analysis

4.1. North America and Europe eHealth Market: Key Takeaways

4.2. North America and Europe eHealth Market: Movement & Market Share Analysis, 2022 & 2030

4.3. Big Data for Health

4.3.1. Big data for health market estimates and forecasts, 2018 to 2030 (USD Million)

4.4. Electronic Health Recorder (EHR)

4.4.1. Electronic health recorder market estimates and forecasts, 2018 to 2030 (USD Million)

4.5. Health Information Systems

4.5.1. Health Information Systems market estimates and forecasts, 2018 to 2030 (USD Million)

4.6. mHealth

4.6.1. mHealth market estimates and forecasts, 2018 to 2030 (USD Million)

4.7. Telemedicine

4.7.1. Telemedicine market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. North America and Europe eHealth: Service Estimates & Trend Analysis

5.1. North America and Europe eHealth Market: Key Takeaways

5.2. North America and Europe eHealth Market: Movement & Market Share Analysis, 2022 & 2030

5.3. Monitoring

5.3.1. Monitoring market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.2. Vital signs

5.3.2.1. Vital signs market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.2.2. Wristwear

5.3.2.2.1. Wristwear market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.2.3. Bodygear (garments)

5.3.2.3.1. Bodywear (garments) market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.2.4. Others

5.3.2.4.1. Others market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.3. Specialty

5.3.3.1. Specialty market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.4. Adherence monitoring

5.3.4.1. Adherence monitoring market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.5. Accessories

5.3.5.1. Accessories monitoring market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.5.2. Sensors

5.3.5.2.1. Sensors market estimates and forecasts, 2018 to 2030 (USD Million)

5.3.5.3. Other

5.3.5.3.1. Other market estimates and forecasts, 2018 to 2030 (USD Million)

5.4. Diagnostic

5.4.1. Diagnostic market estimates and forecasts, 2018 to 2030 (USD Million)

5.5. Healthcare Strengthening

5.5.1. Healthcare strengthening market estimates and forecasts, 2018 to 2030 (USD Million)

5.6. Other

5.6.1. Other market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. North America and Europe eHealth: End-use Estimates & Trend Analysis

6.1. North America and Europe eHealth Market: Key Takeaways

6.2. North America and Europe eHealth Market: Movement & Market Share Analysis, 2022 & 2030

6.3. Providers

6.3.1. Providers market estimates and forecasts, 2018 to 2030 (USD Million)

6.4. Insurers

6.4.1. Insurers delivery market estimates and forecasts, 2018 to 2030 (USD Million)

6.5. Healthcare Consumers

6.5.1. Healthcare Consumers market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. North America and Europe eHealth Market: Regional Estimates & Trend Analysis

7.1. Regional Outlook

7.2. North America and Europe eHealth Market by Region: Key Marketplace Takeaway

7.3. North America

7.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.3.2. U.S.

7.3.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.3.3. Canada

7.3.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4. Europe

7.4.1. UK

7.4.1.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.2. Germany

7.4.2.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.3. France

7.4.3.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.4. Italy

7.4.4.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.5. Spain

7.4.5.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.6. Sweden

7.4.6.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.7. Norway

7.4.7.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

7.4.8. Denmark

7.4.8.1. Market estimates and forecasts, 2018 - 2030 (Revenue, USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Market Participant Categorization

8.2.1. Allscripts Healthcare, LLC

8.2.1.1. Company overview

8.2.1.2. Financial performance

8.2.1.3. Product benchmarking

8.2.1.4. Strategic initiatives

8.2.2. Epic Systems Corporation

8.2.2.1. Company overview

8.2.2.2. Financial performance

8.2.2.3. Product benchmarking

8.2.2.4. Strategic initiatives

8.2.3. Chronolife

8.2.3.1. Company overview

8.2.3.2. Financial performance

8.2.3.3. Product benchmarking

8.2.3.4. Strategic initiatives

8.2.4. Koninklijke Philips N.V.

8.2.4.1. Company overview

8.2.4.2. Financial performance

8.2.4.3. Product benchmarking

8.2.4.4. Strategic initiatives

8.2.5. Apple Inc.

8.2.5.1. Company overview

8.2.5.2. Financial performance

8.2.5.3. Product benchmarking

8.2.5.4. Strategic initiatives

8.2.6. Whoop

8.2.6.1. Company overview

8.2.6.2. Financial performance

8.2.6.3. Product benchmarking

8.2.6.4. Strategic initiatives

8.2.7. Silvertree

8.2.7.1. Company overview

8.2.7.2. Financial performance

8.2.7.3. Product benchmarking

8.2.7.4. Strategic initiatives

8.2.8. Healthwatch Telediagnostics Private Limited

8.2.8.1. Company overview

8.2.8.2. Financial performance

8.2.8.3. Product benchmarking

8.2.8.4. Strategic initiatives

8.2.9. Athos

8.2.9.1. Company overview

8.2.9.2. Financial performance

8.2.9.3. Product benchmarking

8.2.9.4. Strategic initiatives

8.2.10. IBM Corporation

8.2.10.1. Company overview

8.2.10.2. Financial performance

8.2.10.3. Product benchmarking

8.2.10.4. Strategic initiatives

8.2.11. Medtronic

8.2.11.1. Company overview

8.2.11.2. Financial performance

8.2.11.3. Product benchmarking

8.2.11.4. Strategic initiatives

8.2.12. Siemens Healthcare GmBH

8.2.12.1. Company overview

8.2.12.2. Financial performance

8.2.12.3. Product benchmarking

8.2.12.4. Strategic initiatives

8.2.13. Hexoskin

8.2.13.1. Company overview

8.2.13.2. Financial performance

8.2.13.3. Product benchmarking

8.2.13.4. Strategic initiatives

8.2.14. Emglare Inc.

8.2.14.1. Company overview

8.2.14.2. Financial performance

8.2.14.3. Product benchmarking

8.2.14.4. Strategic initiatives

8.2.15. Bioserenity

8.2.15.1. Company overview

8.2.15.2. Financial performance

8.2.15.3. Product benchmarking

8.2.15.4. Strategic initiatives

8.2.16. GetenFlux

8.2.16.1. Company overview

8.2.16.2. Financial performance

8.2.16.3. Product benchmarking

8.2.16.4. Strategic initiatives

8.2.17. Sensoria

8.2.17.1. Company overview

8.2.17.2. Financial performance

8.2.17.3. Product benchmarking

8.2.17.4. Strategic initiatives

8.2.18. Polar Electro

8.2.18.1. Company overview

8.2.18.2. Financial performance

8.2.18.3. Product benchmarking

8.2.18.4. Strategic initiatives

8.2.19. Movesense

8.2.19.1. Company overview

8.2.19.2. Financial performance

8.2.19.3. Product benchmarking

8.2.19.4. Strategic initiatives

8.2.20. Myontec

8.2.20.1. Company overview

8.2.20.2. Financial performance

8.2.20.3. Product benchmarking

8.2.20.4. Strategic initiatives

8.2.21. Myzone

8.2.21.1. Company overview

8.2.21.2. Financial performance

8.2.21.3. Product benchmarking

8.2.21.4. Strategic initiatives