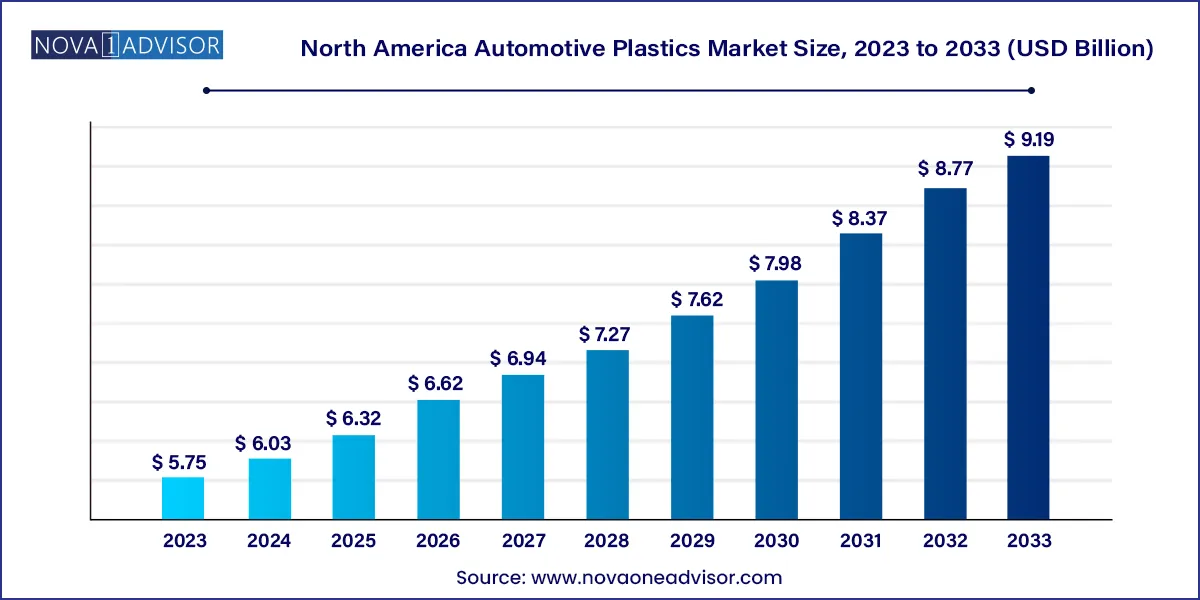

The North America automotive plastics market size was exhibited at USD 5.75 billion in 2023 and is projected to hit around USD 9.19 billion by 2033, growing at a CAGR of 4.8% during the forecast period 2024 to 2033.

The North America Automotive Plastics Market has emerged as a foundational pillar in the transformation of the regional automotive industry. With increasing pressure on automakers to reduce vehicle weight, enhance fuel efficiency, meet regulatory standards, and support electrification trends, plastics have become indispensable across both structural and functional automotive components. Unlike metals, which have traditionally dominated automotive production, plastics offer the advantage of lightweighting, design flexibility, corrosion resistance, and cost efficiency, while enabling complex part geometries through advanced molding techniques.

In the United States, Canada, and Mexico the three key players in the North American automotive ecosystem vehicle design and manufacturing are being reshaped by the integration of polypropylene (PP), acrylonitrile butadiene styrene (ABS), polyamide (PA), polycarbonate (PC), polyurethane (PU), and a suite of other engineering plastics. These materials are no longer confined to interior trims but are now being extensively used in powertrains, under-hood applications, chassis elements, and electrical systems.

Additionally, with the rise of electric vehicles (EVs) and connected cars, the need for lightweight yet thermally stable and electrically insulating materials has grown significantly. Automotive plastics also support innovations in aesthetic customization (e.g., in-mold decoration), sensor integration, and modular component design essential for next-generation vehicles.

Rising Vehicle Lightweighting Mandates: Government regulations pushing for improved fuel efficiency and reduced emissions are accelerating the substitution of metals with plastics.

Electrification and e-Mobility: EVs demand lighter components and thermally resistant plastic enclosures for battery packs, electronic control units, and wiring systems.

Increased Use of Glass Fiber Reinforced PP: PP LGF 20/30/40 composites are replacing metal components in chassis and under-the-hood applications.

Shift Toward Recyclable and Bio-based Plastics: Sustainability goals are encouraging OEMs to explore recycled PC, PA, and bio-based PE and PP variants.

Aesthetic and Functional Interior Innovation: Automakers are investing in advanced molding techniques like IMD (In-Mold Decoration) and soft-touch materials for interior customization.

Plastic Integration in Advanced Driver Assistance Systems (ADAS): Plastics enable sensor housing, lightweight radar covers, and compact electronic module enclosures.

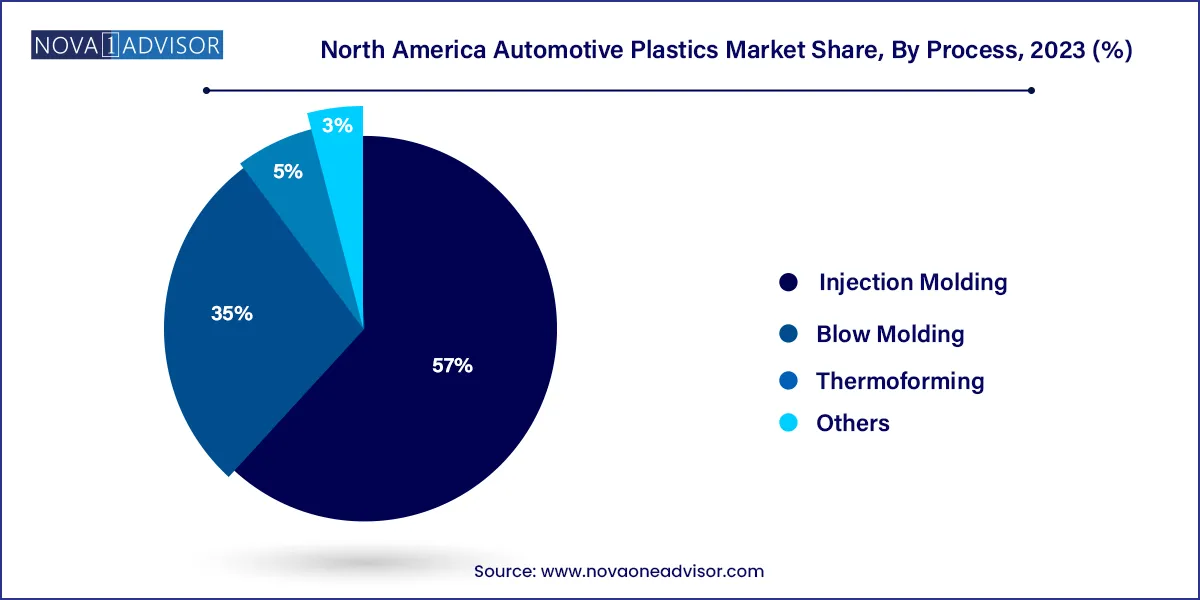

Growth of Injection and Blow Molding Technologies: These processes dominate the production of complex geometries, multi-material parts, and hollow structural components.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.03 Billion |

| Market Size by 2033 | USD 9.19 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.8% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Process, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | Dow, Inc.; Hanwha Azdel Inc.; Lear Corporation; Owens Corning; Magna International, Inc.; Momentive Performance Materials, Inc.; DuPont de Nemours, Inc.; Industrias Cazel; Axiom Group Inc.; Amra Plastic Moulders Inc. |

The foremost driver of the automotive plastics market in North America is the urgent industry requirement for lightweighting. Automakers are under constant regulatory and market pressure to increase fuel efficiency and reduce carbon emissions. Replacing metal components with advanced plastics significantly reduces vehicle mass, leading to better mileage and lower tailpipe emissions.

For every 10% reduction in vehicle weight, fuel efficiency improves by approximately 6–8%, according to the U.S. Department of Energy. Plastics like PP, PA, and PC blends offer the strength-to-weight ratio necessary for structural parts, while PU foams are used in seats and dashboards for cushioning and thermal insulation. The growth in multi-material vehicle designs, which strategically combine plastics with aluminum and composites, is also reinforcing demand for automotive-grade polymers.

This demand is particularly strong in light-duty trucks, SUVs, and electric vehicles, which require careful mass management to optimize battery performance and range. As OEMs continue to explore modular platforms and design optimization tools, the strategic role of plastics becomes even more pronounced.

Despite their advantages, plastics face a significant restraint when it comes to thermal, chemical, and mechanical stability under extreme conditions. Unlike metals, many polymers can degrade or deform at high temperatures, limiting their application in engine components, exhaust systems, or high-load structural elements.

For example, while PP and ABS are widely used for interior and exterior trims, they may not withstand prolonged exposure to temperatures above 100°C, which are common in under-the-hood environments. Although engineering plastics such as PA66, PEEK, and PPS offer higher performance, they come at a significantly higher cost, posing challenges for mass-market vehicle applications.

In EVs, battery components generate substantial heat and require fire-retardant, high-durability housings criteria not always met by conventional plastics. These technical constraints necessitate material substitution, multi-layer assemblies, or hybrid solutions, which can increase complexity and offset the benefits of lightweighting.

A prominent opportunity lies in the expansion of electric vehicles (EVs) and ADAS (Advanced Driver Assistance Systems). EVs, which require compact, lightweight, thermally stable, and electrically insulating materials, are ideal candidates for advanced plastics.

For instance, plastic housings for battery management systems (BMS), cooling modules, and motor enclosures are becoming critical components in EV architecture. Similarly, radar domes, LIDAR sensor casings, and camera brackets for ADAS are increasingly fabricated from engineering plastics like PC/ABS blends and glass-filled nylons, which provide the necessary dimensional stability and EMI shielding.

North American automakers are investing heavily in smart mobility and EV platforms, creating a substantial growth path for suppliers of custom plastic compounds, 3D printed polymer parts, and injection-molded electronic enclosures. In the context of autonomous driving, the potential for plastics in interior modularity, occupant monitoring, and dashboard interfaces is immense.

Interior furnishing held the dominant position, encompassing dashboard panels, seat trims, instrument clusters, door trims, and center consoles. The demand is driven by consumer expectations for aesthetically pleasing, durable, and lightweight interiors. IMD (In-Mold Decoration) technology is increasingly used to integrate decorative films, logos, and textures into plastic panels, offering premium finishes and customization without increasing part count or weight.

Under-the-hood applications are the fastest-growing segment, owing to the increased complexity and thermal management needs in modern engines and EVs. Plastics are now being used for cylinder head covers, intake manifolds, oil pans, and cooling reservoirs, often made from PA66 or high-performance blends. The trend toward downsized turbocharged engines and electrified drivetrains is further pushing OEMs to rely on materials that offer heat resistance, chemical compatibility, and dimensional stability—capabilities well delivered by engineering plastics.

Polypropylene (PP), particularly PP LGF 30, dominated the market, due to its superior mechanical strength, low density, moldability, and cost-effectiveness. Long glass fiber reinforced PP offers excellent impact resistance and dimensional stability, making it ideal for instrument panels, front-end modules, door panels, and battery covers. In North America, OEMs and tier-1 suppliers are increasingly replacing metal brackets and structures with PP LGF 30 to achieve meaningful weight reductions without compromising performance.

Meanwhile, Polyamide (PA) is the fastest-growing product, especially Nylon 6 and 66, due to their high-temperature resistance, chemical inertness, and mechanical strength. They are widely used in engine covers, intake manifolds, cooling system components, and electrical connectors. With EVs requiring thermal stability and lightweight properties for battery housings and motor encapsulation, PA’s role is becoming increasingly critical. Additionally, advances in bio-based and recycled PA are further enhancing its adoption in eco-conscious applications.

Injection molding dominated the process segment, accounting for the highest volume share across all plastic automotive applications. This process allows for the mass production of high-precision, repeatable components with complex geometries, often using multi-cavity molds. Interior components such as instrument panels, air vents, handles, cup holders, and console trims are mostly produced via injection molding using ABS, PP, or PC blends.

Thermoforming is the fastest-growing process, primarily due to its increasing use in producing large, lightweight body panels and underbody shields for electric vehicles and commercial trucks. Thermoforming is particularly well-suited for low- to medium-volume runs, enabling faster design iteration and material savings. This is becoming a popular approach among niche vehicle makers and aftermarket suppliers, especially for EV startups and specialty vehicle segments in the U.S. and Canada.

United States

The United States is the largest and most advanced automotive plastics market in North America, driven by a high concentration of OEM headquarters, design centers, material suppliers, and manufacturing facilities. States like Michigan, Ohio, Tennessee, and South Carolina are major automotive hubs, housing facilities for Ford, GM, Tesla, Toyota, BMW, and numerous Tier 1 and Tier 2 suppliers.

The U.S. is leading in the development of sustainable plastics, with investments from companies like Dow, DuPont, and BASF Corporation focused on creating recyclable, lightweight polymer grades for next-gen vehicles. Federal EV incentives and emissions regulations are also fueling demand for plastics in EV manufacturing.

Canada

Canada plays a supporting role, especially in engineering services, precision component manufacturing, and materials R&D. Canadian firms are collaborating with global players on bio-based and recyclable plastic alternatives, aligned with the country's zero-emission targets. Ontario remains a central hub for automotive plastic applications due to its proximity to U.S. OEMs and supplier networks.

Mexico

Mexico is emerging as a production and export hub, thanks to its cost advantages, skilled labor, and integration into the USMCA trade framework. Automotive plastics are used extensively in interior modules, underbody components, and electrical connectors for vehicles assembled in cities like Monterrey and Puebla. OEMs are increasingly investing in injection molding capabilities and localized plastic compounding in the region.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America automotive plastics market

Product

Process

Application

Country