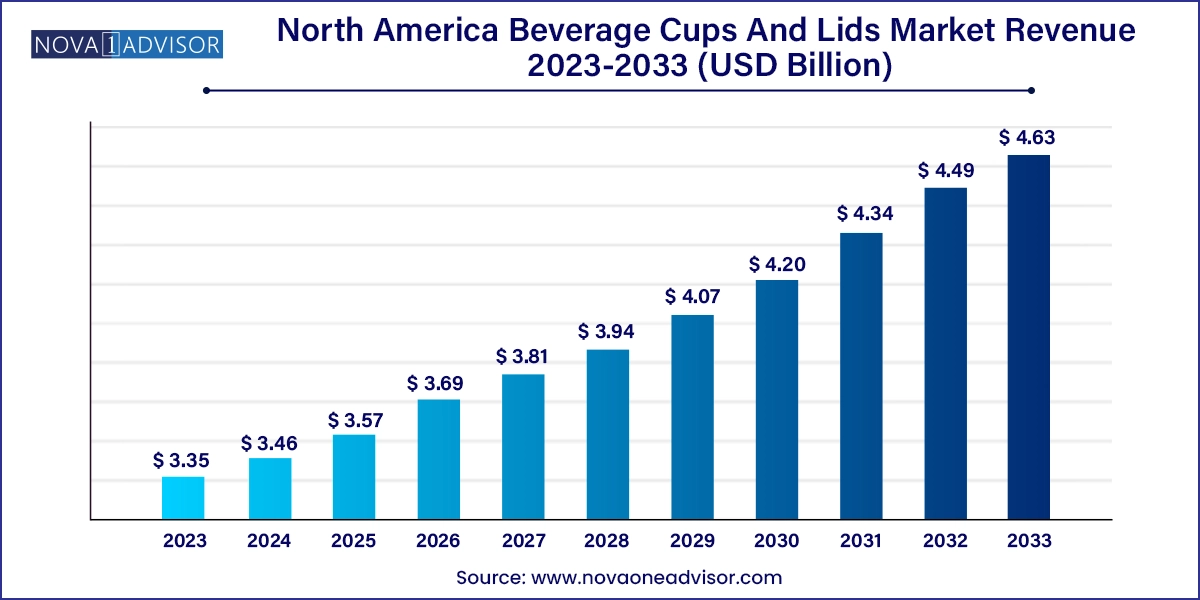

The North America beverage cups and lids market size was exhibited at USD 3.35 billion in 2023 and is projected to hit around USD 4.63 billion by 2033, growing at a CAGR of 3.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.46 Billion |

| Market Size by 2033 | USD 4.63 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 3.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Product, Application, Distribution Channel, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Georgia-Pacific; Amhil; Huhtamaki Oyj; Printpack; Dart Container Corporation; WinCup; Graphic Packaging International, LLC; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc.; Evanesce Inc.; Karat by Lollicup |

Growing coffee consumption and flourishing food service industry across the North America is triggering the demand for beverage cups & lids in the North America.

The food service industry in North America encompasses a wide range of establishments that provide food to customers outside their homes. This includes hotels, canteens, university canteens, catering service companies, food bars, and restaurants. The significant factors contributing to the growth of the food service industry in the region include rising demand for personalized services, as well as the easy accessibility of customers to a multitude of food products.

In addition, the rise in the popularity of new restaurant formats, such as virtual kitchens, cloud kitchens, and ghost kitchens, is also contributing to the growth of the food service industry in North America. Therefore, the flourishing food service industry is expected to benefit food service-related companies offering ready-to-eat (RTE) food, beverages, food & beverage packaging, cutlery, etc. This, in turn, is anticipated to increase the demand for beverage cups & lids across the food service industry in the region during the forecast period.

North America has the presence of major food service companies such as KFC Corporation, Domino's, Starbucks Corporation, Pizza Hut, McDonald's, Dunkin' Donuts, Tim Hortons, The Coca-Cola Company, Taco Bell IP Holder, LLC, Wendy's, Burger King Company LLC, Subway, Chick-fil-A, and Arby's IP Holder, LLC. These companies operate a vast number of restaurants and outlets for serving a wide range of beverages to their customers. Therefore, cups & lids are used by them for offering various beverages, including coffee, soft drinks, juices, and others. Hence, the presence of major food service companies in the region is expected to drive the demand for beverage cups & lids in North America over the forecast period.

Furthermore, according to the National Coffee Data Trends (NCDT) report of 2023, approximately 81% of American coffee drinkers consume coffee with breakfast. It is followed by 38% in the morning, 15% with lunch, 19% in the afternoon, 7% with dinner, and 10% in the evening. This demographic landscape highlights the prevalence of coffee consumption throughout the day by Americans which is anticipated to fuel the demand for coffee cups and lids in the region in the coming years. Hence, this outlook is ultimately expected to benefit the overall growth of the beverage cups & lids market in North America during the forecast period.

Moreover, companies operating in the North America beverage cups & lids market are striving to develop plastic-free and biodegradable cups & lids to reduce plastic waste and offer sustainable products in the market. For instance, in November 2023, SOFi Products introduced a 100% plastic-free, biodegradable cup for hot beverages that feature three flaps, which can be folded together to form a spill-proof lid. This eliminates the requirement of a separate lid to seal the cups, which would help counter the packaging waste problem.

The paper segment is anticipated to dominate the overall market with a share of over 51.0% in 2023. This is attributed to the growing trend toward the usage of recyclable products, which has propelled the demand for paper-based beverage cups & lids across North America.

The plastic segment is expected to grow at a moderate CAGR over the forecast period as the countries across North America are implementing new regulations for reducing plastic waste. For instance, in June 2022, the U.S. Department of the Interior announced a ban on single-use plastic products in national parks and other public lands by 2032. The department issued an order to decrease the procurement and distribution of plastic packaging. Moreover, this initiative is expected to help reduce over 14 million tons of plastic that end up in the ocean every year.

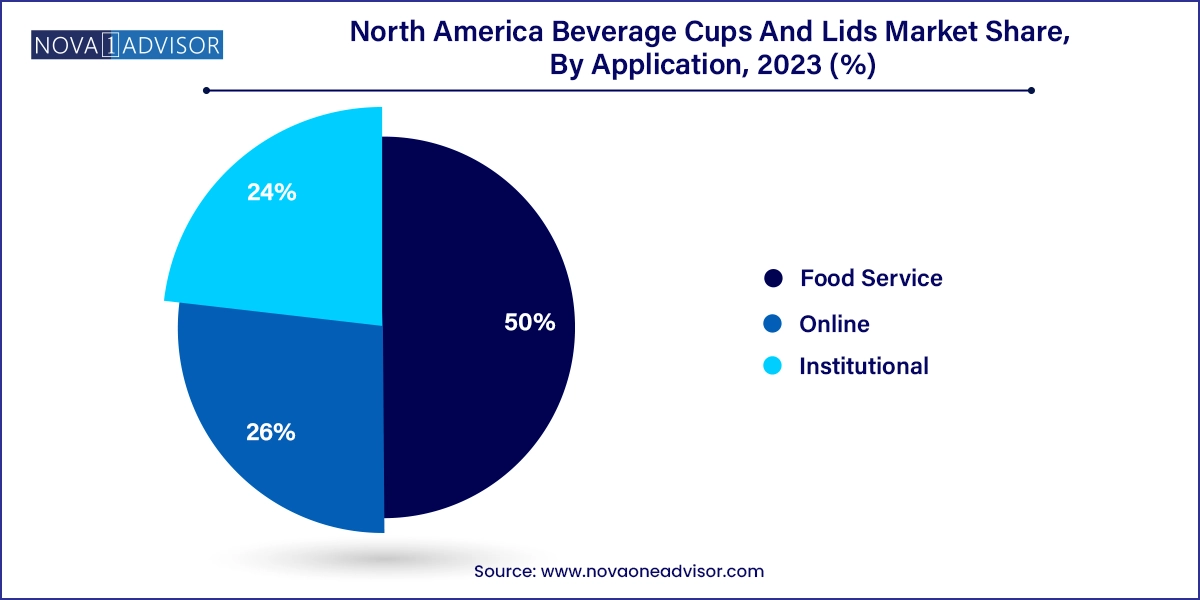

Based on the application, the North America beverage cups & lids market is segmented into food service, online, and institutional. Food service application segment dominated market and accounted for largest revenue share of over 50.0% in 2023. This positive outlook is attributed to rising number of fast-food outlets and increasing adoption of various expansion initiatives by fast-food companies across the North America.

The online application segment is projected to progress at the fastest CAGR of 4.6% over the forecast period. This positive outlook is attributed to the rapid expansion of online food delivery companies and cloud-based quick service restaurants. For instance, in January 2024, DoorDash announced its expansion plans of its restaurant business in the U.S. Furthermore, DoorDash achieved USD 6.3 billion in sales in the first nine months of 2023, up by 33% from the same period in 2022.

The cups segment dominated the market and accounted for largest revenue share of over 67.0% in 2023. The cafe culture and the well-established fast-food industry in the U.S., Canada, and Mexico have positively contributed to the growth of cups segment of the market in the region. The high disposable income and the fast-paced lifestyle of the masses in the U.S. are contributing to the growth of coffee market in the country. This, in turn, leads to the increased demand for cups & lids in the U.S.

On the other hand, lids play a crucial role in the functionality and convenience of beverage cups. The primary purpose of a lid is to prevent the contents of the cup from spilling out during transportation or consumption. Besides, lids are designed with an insulating layer or air pocket to help maintain the temperature of the beverage, keeping hot drinks hot and cold drinks cold for a longer period. Moreover, many lids are designed with a pre-cut or fold-back section to accommodate a straw, making it easier to consume thicker beverages such as milkshakes or smoothies.

The direct distributors segment dominated the distribution channel segment and accounted for largest revenue share of over 45.0% in 2023. Direct distributors better manage their inventory levels and respond quickly to fluctuations in demand from end-users, such as restaurants, cafeterias, and other foodservice establishments. This ensures a consistent supply of beverage cups and lids.

The group purchasing organizations (GPOs) distribution channel segment is anticipated to witness the fastest CAGR of 4.3% from 2024 to 2033. GPOs offer discounted bulk purchases and enhanced negotiating power as well as support services, such as advice, spend analysis, and advocacy. The penetration of beverage cups & lids through GPOs is increasing, due to the above-mentioned advantage, and is expected to witness significant growth over the forecast period in North America.

U.S. Beverage Cups And Lids Market Trends

The U.S. dominated the market and accounted for the largest revenue share of over 65.0% in 2023. This can be attributed to the surge in ready-to-drink beverages, particularly coffee and other beverages. Furthermore, the increasing demand for environmentally friendly packaging solutions and the flourishing food & beverage industry in the country is expected to propel the demand for beverage cups & lids in the near future.

The rapid growth of e-commerce food delivery platforms, such as Uber Eats, Grubhub, and others, due to high consumer spending and changing eating habits, is expected to support the growth of the beverage cups & lids market in the country. For instance, in October 2023, Dominos announced its plans to expand the Uber Eats partnership from Las Vegas to corporate and franchised stores in Miami, Houston, and Seattle.

Canada Beverage Cups And Lids Market Trends

The Canada beverage cups & lids market is expected to grow during the forecast period. In July 2023, Coca-Cola announced its plans to launch 100% recycled plastic bottles and refillable cups for fountain dispensers in Canada. All new reusable beverage utensils are expected to be manufactured by Coke Canada facilities located in Ontario, Brampton, Alberta, Quebec, British Columbia, and Calgary. Market players are focused on adopting various strategies to replace single-use plastic beverage utensils with paper-based beverage cups & lids, which is expected to propel the market growth in the country over the forecast period.

Mexico Beverage Cups And Lids Market Trends

The beverage cups & lids market is expected to witness significant growth, owing to the growth of the restaurant industry in the country, which is dominated by micro and small food service businesses. In addition, the share of international, as well as domestic food chains, is increasing, owing to the presence of favorable government regulations in the country. Online food delivery is an emerging trend in the country while the trend of take-out/home delivery is becoming more popular in Mexico. This is expected to drive the growth of the beverage cups & lids market in the country over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America beverage cups and lids market

Material

Product

Distribution Channel

Application

Country

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Materials & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2. Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.2.1. Material Outlook

2.2.2. Product Outlook

2.2.3. Distribution Channel Outlook

2.2.4. Application Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. North America Beverage Cups & Lids Market Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Trends

3.2.2. Manufacturing Trends

3.2.3. Profit Margin Analysis

3.2.4. Sales Channel Analysis

3.3. Technology Overview/ Timeline

3.4. Regulatory Framework

3.4.1. Standard & Compliance

3.4.2. Safety

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Market Challenges Analysis

3.5.4. Market Opportunity Analysis

3.6. Business Environment Analysis

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

3.6.3. Market Entry Strategies

3.7. Latest Trends & Technologies in the North America Beverage Cups & Lids Market

3.8. Unmet Needs & Challenges in North America Beverage Cups & Lids Market

3.9. Impact of Environmental, Social, and Governance (ESG) initiatives on the North America Beverage Cups & Lids Market

Chapter 4. North America Beverage Cups & Lids Market: Market Supplier Intelligence

4.1. Kraljic Matrix (Portfolio Analysis)

4.1.1. Non-Critical Items

4.1.2. Leverage Items

4.1.3. Bottleneck Items

4.1.4. Strategic Items

4.2. Engagement Model

4.3. Negotiation Strategies

4.4. Sourcing Best Practices

4.5. Vendor Selection Criteria

Chapter 5. North America Beverage Cups & Lids Market: Material Estimates & Trend Analysis

5.1. Definition & Scope

5.2. Material Movement Analysis & Market Share, 2024 & 2033

5.3. Paper

5.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.4. Plastics

5.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.5. Foam

5.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

5.6. Others

5.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

Chapter 6. North America Beverage Cups & Lids Market: Product Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Product Movement Analysis & Market Share, 2024 & 2033

6.3. Cups

6.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

6.4. Lids

6.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

Chapter 7. North America Beverage Cups & Lids Market: Distribution Channel Estimates & Trend Analysis

7.1. Definition & Scope

7.2. Distribution Channel Movement Analysis & Market Share, 2024 & 2033

7.3. Corporate Distributors

7.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

7.4. Individual Distributors

7.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

7.5. Group Purchasing Organizations (GPOs)

7.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

7.6. Direct Distributors

7.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

7.7. Others

7.7.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

Chapter 8. North America Beverage Cups & Lids Market: Application Estimates & Trend Analysis

8.1. Definition & Scope

8.2. Application Movement Analysis & Market Share, 2024 & 2033

8.3. Food Service

8.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

8.4. Online

8.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

8.5. Institutional

8.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

Chapter 9. North America Beverage Cups & Lids Market: Country Estimates & Trend Analysis

9.1. Key Takeaways

9.2. Country Movement Analysis & Market Share, 2024 & 2033

9.3. North America

9.3.1. market estimates and forecasts, 2021 - 2033 (USD Million)

9.3.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million)

9.3.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million)

9.3.4. market estimates and forecasts, by distribution channel, 2021 - 2033 (USD Million)

9.3.5. market estimates and forecasts, by application, 2021 - 2033 (USD Million)

9.3.6. U.S.

9.3.6.1. market estimates and forecasts, 2021 - 2033 (USD Million)

9.3.6.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million)

9.3.6.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million)

9.3.6.4. market estimates and forecasts, by distribution channel, 2021 - 2033 (USD Million)

9.3.6.5. market estimates and forecasts, by application, 2021 - 2033 (USD Million)

9.3.7. Canada

9.3.7.1. market estimates and forecasts, 2021 - 2033 (USD Million)

9.3.7.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million)

9.3.7.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million)

9.3.7.4. market estimates and forecasts, by distribution channel, 2021 - 2033 (USD Million)

9.3.7.5. market estimates and forecasts, by application, 2021 - 2033 (USD Million)

9.3.8. Mexico

9.3.8.1. market estimates and forecasts, 2021 - 2033 (USD Million)

9.3.8.2. market estimates and forecasts, by material, 2021 - 2033 (USD Million)

9.3.8.3. market estimates and forecasts, by product, 2021 - 2033 (USD Million)

9.3.8.4. market estimates and forecasts, by distribution channel, 2021 - 2033 (USD Million)

9.3.8.5. market estimates and forecasts, by application, 2021 - 2033 (USD Million)

Chapter 10. Start-up Ecosystem Evaluation, 2024

10.1. List of Start-up Companies

10.1.1. Progressive Companies

10.1.2. Responsive Companies

10.1.3. Dynamic Companies

10.1.4. Starting Blocks

10.2. Government Funding for Start-ups across the globe

Chapter 11. Competitive Landscape

11.1. Key Global Players & Recent Developments & Their Impact on the Industry

11.2. Key Company/Competition Categorization (Key innovators, Market leaders, emerging players)

11.3. List of key Raw Material Distributors and Channel Partners

11.4. List of Potential Customers, by Application

11.5. Company Market Share Analysis, 2024

11.6. Company Heat Map Analysis

11.7. Competitive Dashboard Analysis

11.8. Company-Wise Product Prices

11.9. Strategy Mapping

11.9.1. Expansion

11.9.2. Collaboration/ Partnerships/ Agreements

11.9.3. New Product launches

11.9.4. Mergers & Acquisitions

11.9.5. Divestment

11.9.6. Research & Development

11.9.7. Others

Chapter 12. Company Listing / Profiles

12.1. Georgia-Pacific

12.1.1. Company Overview

12.1.2. Financial Performance

12.1.3. Product Benchmarking

12.2. Amhil

12.2.1. Company Overview

12.2.2. Financial Performance

12.2.3. Product Benchmarking

12.3. Huhtamaki Oyj

12.3.1. Company Overview

12.3.2. Financial Performance

12.3.3. Product Benchmarking

12.4. Printpack

12.4.1. Company Overview

12.4.2. Financial Performance

12.4.3. Product Benchmarking

12.5. Dart Container Corporation

12.5.1. Company Overview

12.5.2. Financial Performance

12.5.3. Product Benchmarking

12.6. WinCup

12.6.1. Company Overview

12.6.2. Financial Performance

12.6.3. Product Benchmarking

12.7. Graphic Packaging International, LLC

12.7.1. Company Overview

12.7.2. Financial Performance

12.7.3. Product Benchmarking

12.8. Mondi

12.8.1. Company Overview

12.8.2. Financial Performance

12.8.3. Product Benchmarking

12.9. Airlite Plastics

12.9.1. Company Overview

12.9.2. Financial Performance

12.9.3. Product Benchmarking

12.10. Reynolds Consumer Products

12.10.1. Company Overview

12.10.2. Financial Performance

12.10.3. Product Benchmarking

12.11. Material Motion, Inc.

12.11.1. Company Overview

12.11.2. Financial Performance

12.11.3. Product Benchmarking

12.12. CMG Plastics

12.12.1. Company Overview

12.12.2. Financial Performance

12.12.3. Product Benchmarking

12.13. Berry Global Inc.

12.13.1. Company Overview

12.13.2. Financial Performance

12.13.3. Product Benchmarking

12.14. Evanesce Inc.

12.14.1. Company Overview

12.14.2. Financial Performance

12.14.3. Product Benchmarking

12.15. Karat by Lollicup

12.15.1. Company Overview

12.15.2. Financial Performance

12.15.3. Product Benchmarking

Chapter 13. Strategic Recommendations/ Analyst Perspective