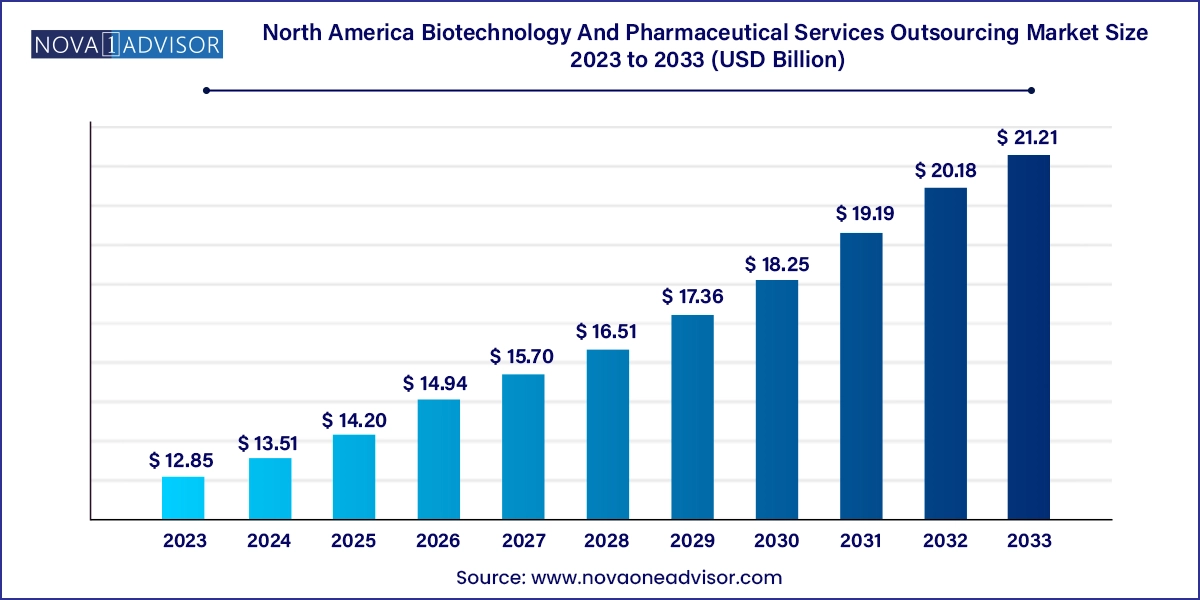

The North America biotechnology and pharmaceutical services outsourcing market size was exhibited at USD 12.85 billion in 2023 and is projected to hit around USD 21.21 billion by 2033, growing at a CAGR of 5.14% during the forecast period 2024 to 2033.

The North America biotechnology and pharmaceutical services outsourcing market represents a strategically critical and rapidly expanding segment of the healthcare ecosystem. As pharmaceutical and biotech companies face mounting pressures to accelerate innovation, reduce operational costs, and navigate a highly complex regulatory landscape, outsourcing has become a preferred model for a wide range of functions spanning clinical development, regulatory affairs, product design, quality assurance, training, and strategic consulting.

Traditionally, large pharmaceutical corporations in the U.S. and Canada retained in-house resources for key R&D and compliance functions. However, the increasing intricacy of drug development, coupled with rising costs and a push for lean operations, has catalyzed the shift toward external service providers. These include Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), and specialized consulting firms offering modular and integrated outsourcing solutions.

Outsourcing also plays a vital role in addressing the gaps faced by small and mid-sized biotechnology firms that lack the infrastructure and expertise to manage complex global trials or multi-jurisdictional regulatory submissions. From regulatory writing to Good Manufacturing Practice (GMP) audits and new drug applications, service providers streamline processes and ensure compliance with ever-evolving guidelines from agencies such as the FDA, Health Canada, and COFEPRIS (Mexico).

North America, home to a robust biotechnology hub and leading pharmaceutical multinationals, serves as a primary global driver of the services outsourcing market. The COVID-19 pandemic further validated the model, as outsourcing facilitated rapid development, approval, and manufacturing of diagnostics, therapeutics, and vaccines under accelerated timelines.

Shift Toward End-to-End Service Partnerships: Pharma companies increasingly seek long-term outsourcing partners who offer integrated regulatory, clinical, and commercial support.

Regulatory Complexity Fuels Consulting Demand: Expanding FDA scrutiny and global harmonization have boosted demand for regulatory strategy and compliance expertise.

Digital Technologies in Outsourced Solutions: Adoption of AI, automation, and cloud-based systems enhances data accuracy and trial management efficiency.

Growth of Virtual Biotech Model: Small biotechs operate with minimal infrastructure and rely almost entirely on outsourced R&D, manufacturing, and regulatory affairs.

Increased Due Diligence and Auditing Services: M&A activity and cross-border collaborations are driving demand for mock audits, inspections, and quality assessments.

Training & Education as a Compliance Tool: Organizations are outsourcing professional development programs to meet ongoing regulatory and safety training mandates.

Rising Demand for Post-Approval Product Maintenance: Lifecycle management of approved drugs is driving continued reliance on outsourced document management and regulatory submissions.

| Report Coverage | Details |

| Market Size in 2024 | USD 13.51 Billion |

| Market Size by 2033 | USD 21.21 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.14% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Service, End use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico; Puerto Rico |

| Key Companies Profiled | The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; LabCorp; Charles River Laboratories; ICON plc; Syneos Health; Lonza; Catalent Inc.; Samsung Biologics |

Surging R&D Complexity and Need for Specialized Expertise

A principal driver of market expansion is the growing complexity of R&D pipelines, which increasingly involve biologics, gene therapies, cell-based treatments, and personalized medicine. These therapies require specialized handling, novel clinical trial designs, targeted patient recruitment, and customized regulatory submissions. As these demands escalate, even large pharma companies turn to niche experts to provide critical support at every development stage.

Outsourced service providers bring deep domain knowledge and established infrastructure to navigate such challenges. For instance, clinical development consultants guide protocol design and trial optimization, while regulatory experts manage filings and engagement with authorities. The scalability of outsourcing models allows clients to respond swiftly to project fluctuations, ultimately enhancing cost efficiency and accelerating time to market.

Data Confidentiality and Intellectual Property Concerns

Despite clear benefits, a significant restraint is concerns over data security and intellectual property (IP) protection when outsourcing sensitive operations. Whether it's clinical trial data, regulatory dossiers, or proprietary molecular structures, outsourcing requires sharing critical information with external parties. This raises fears of data misuse, leaks, or IP theft—especially in cross-border arrangements or with new vendors.

Stringent data governance, cybersecurity protocols, and contract safeguards are necessary, but not foolproof. These concerns are particularly acute for startups and biotechs whose core value lies in their proprietary technology. As a result, some companies limit outsourcing scope or remain cautious in fully externalizing high-stakes operations, especially during early development stages.

Emergence of AI-Driven Outsourcing Models

A transformative opportunity lies in AI-enabled outsourcing services, which are revolutionizing how data is analyzed, interpreted, and reported. From AI-powered risk-based monitoring in clinical trials to automated regulatory intelligence gathering and document authoring, outsourcing firms are deploying advanced technologies to improve turnaround times and reduce human error.

AI solutions can assist in trial simulation, adaptive protocol modifications, and pharmacovigilance by sifting through vast data repositories quickly. For instance, service providers can flag adverse events faster, generate signal detection reports, and automate eCTD dossier assembly. Companies offering AI-infused consulting, regulatory, and auditing services are poised to disrupt traditional outsourcing norms, offering a competitive edge to clients aiming for agility and innovation.

Regulatory affairs services dominate the North American biotechnology and pharmaceutical outsourcing landscape. With increasingly stringent compliance expectations from the FDA, Health Canada, and other global authorities, pharmaceutical companies outsource everything from regulatory submissions and legal representation to regulatory writing and operations management. These services are mission-critical, especially during product development, approval, and lifecycle maintenance. Firms like IQVIA and Parexel provide end-to-end regulatory support including pre-IND meetings, NDA submissions, and post-approval variations.

Consulting services are the fastest-growing category, driven by rising demand for strategic planning, quality management systems, and clinical development consulting. These services are especially important for early-stage biotechs, which may need support designing trials, securing funding, and aligning with market access strategies. Strategic consulting that integrates clinical, regulatory, and commercial dimensions is increasingly viewed as a growth catalyst, particularly as companies seek to differentiate their assets in crowded therapeutic landscapes.

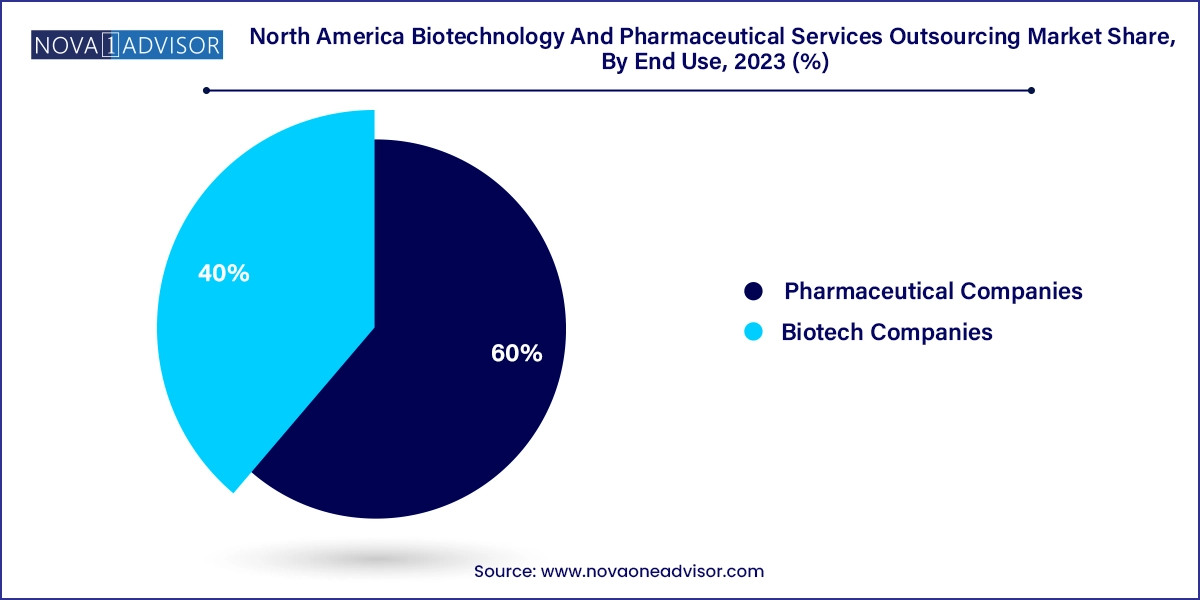

Pharmaceutical companies are the primary consumers of outsourced services, accounting for the largest market share. With extensive pipelines and pressure to maximize productivity, these companies increasingly externalize non-core functions. Regulatory writing, gap assessments, training compliance, and product maintenance are often outsourced to reduce overheads. Big pharma firms like Pfizer and Merck frequently rely on global service partners to manage submissions in multiple countries, ensuring speed and regulatory alignment.

Biotechnology companies are emerging as the fastest-growing end-use segment. These firms, often focused on a single or few asset pipelines, operate with lean internal teams. From clinical trial management to manufacturing transfer and strategic regulatory planning, biotechs outsource nearly all value chain activities. The virtual biotech model—where the company owns IP but outsources execution—has taken strong root in North America, accelerating market growth.

United States

The U.S. remains the epicenter of outsourcing demand, home to the world’s largest pharmaceutical market and an unrivaled biotechnology innovation hub. Major CROs and consultants are headquartered or operate extensive networks across the U.S. The FDA's complex regulatory ecosystem, combined with fast-evolving therapeutic areas like immuno-oncology and gene therapy, makes outsourcing essential for both compliance and competitiveness. Leading firms also offer FDA liaison services and training for sponsor teams to streamline reviews and audits.

Canada

Canada has emerged as a supportive environment for outsourcing services, particularly in regulatory affairs and clinical development. With a robust talent pool and proximity to U.S. markets, Canadian consulting firms offer cost-effective solutions for early-phase studies, ethics submissions, and Health Canada engagements. Montreal, Toronto, and Vancouver are key life science hubs where outsourcing firms are scaling services for biotech and generic pharma clients.

Mexico

Mexico offers growth potential in the outsourcing of manufacturing transfer, training, and regulatory submissions related to Latin America. As COFEPRIS modernizes its regulatory framework, North American companies increasingly partner with local consultants to streamline product registration and compliance audits. Outsourcing providers facilitate bridging studies, local pharmacovigilance, and labeling reviews to support regional commercialization.

Puerto Rico

With its strong pharma manufacturing base, Puerto Rico is a niche but important contributor. Many U.S.-based companies outsource GMP audits, mock inspections, and quality management support for their Puerto Rican facilities. Service providers offer bilingual training, regulatory operations support, and inspection readiness consulting specific to FDA requirements.

February 2025 – IQVIA launched an AI-powered regulatory document automation platform in North America aimed at accelerating IND and NDA submissions for biotech firms.

January 2025 – Parexel expanded its regulatory consulting footprint in Canada by acquiring a Montreal-based life sciences advisory firm specializing in Health Canada submissions.

December 2024 – Syneos Health partnered with a leading U.S. biotech startup to co-develop early-phase oncology trials under an end-to-end service model.

October 2024 – ICON plc introduced a new audit management suite targeting small-to-mid sized pharmaceutical manufacturers in Mexico, integrating real-time risk assessments.

August 2024 – Charles River Laboratories invested in expanding its U.S.-based consulting unit to support biosafety and GMP compliance for cell and gene therapy developers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America biotechnology and pharmaceutical services outsourcing market

Service

End Use

Country