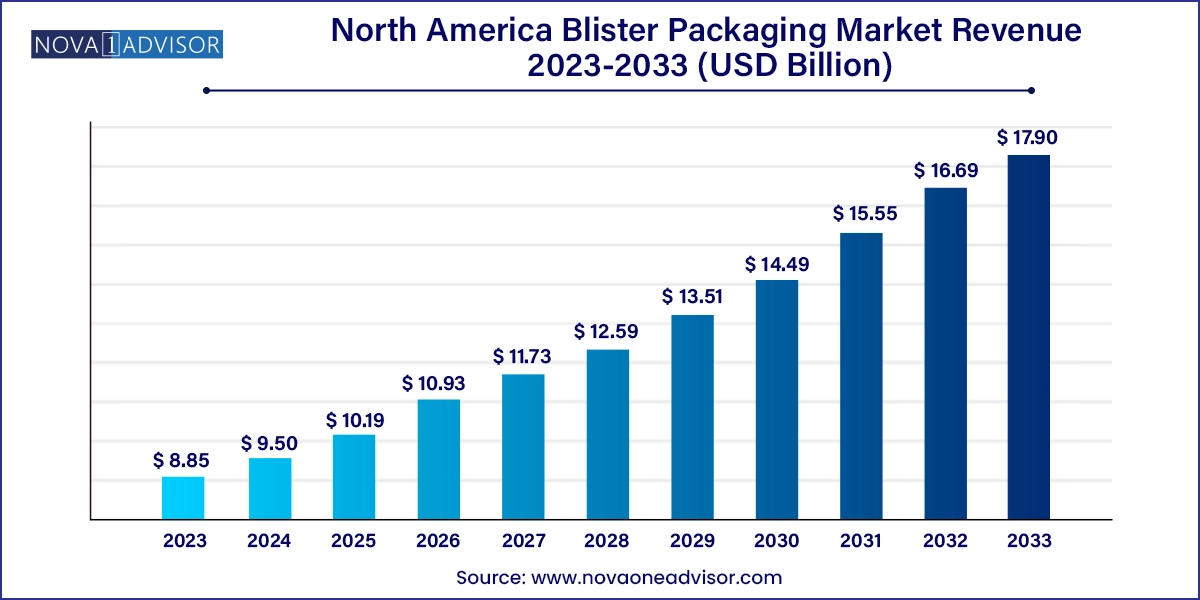

The North America blister packaging market size was exhibited at USD 8.85 billion in 2023 and is projected to hit around USD 17.90 billion by 2033, growing at a CAGR of 7.3% during the forecast period 2024 to 2033.

The North America blister packaging market has emerged as a crucial segment within the broader packaging industry, driven by rising demand across healthcare, consumer goods, and electronics sectors. Characterized by its lightweight structure, product visibility, tamper resistance, and cost-effectiveness, blister packaging has become indispensable for safeguarding product integrity while offering aesthetic appeal and convenience to consumers. The region is witnessing increasing adoption of blister packaging for pharmaceuticals, small electronics, consumer accessories, and industrial components, fueled by the growth of e-commerce, aging population, and stringent regulatory environments, particularly in the United States and Canada.

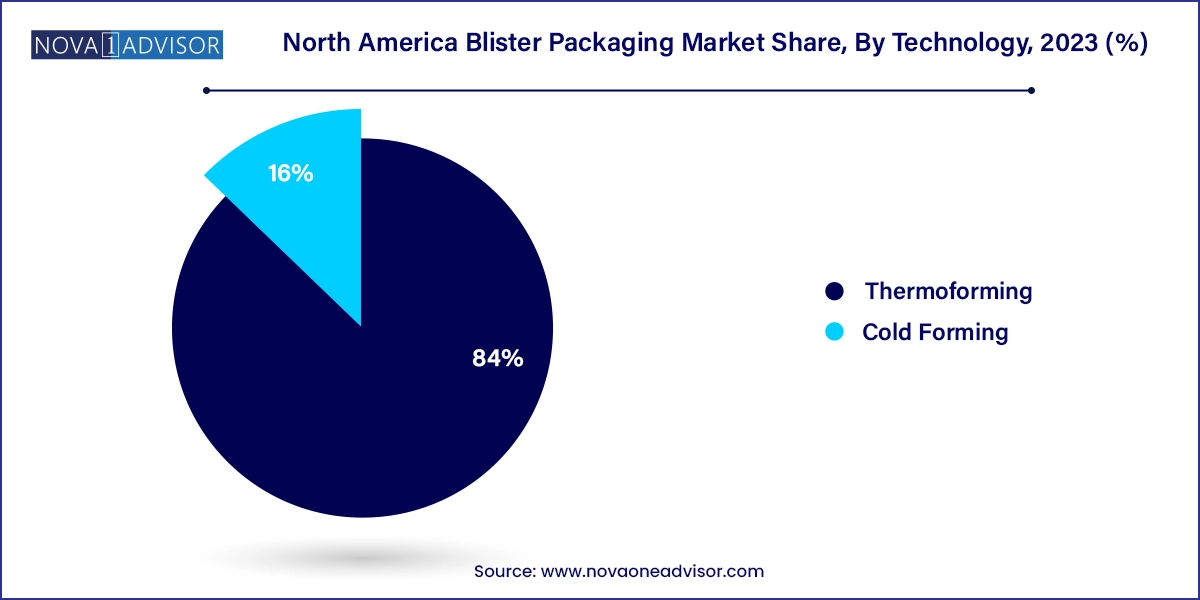

In a marketplace increasingly shaped by sustainability concerns and technological innovation, blister packaging solutions are being reimagined through the use of biodegradable materials, smart packaging elements, and automation-enabled production methods. The growing need to reduce packaging waste, ensure child resistance, and meet FDA/Health Canada compliance has led manufacturers to innovate both in materials and design. While thermoforming continues to dominate production due to its cost efficiency and versatility, cold forming technologies are gaining ground in niche pharmaceutical applications where enhanced barrier protection is essential.

Despite being mature, the North American market presents vast growth potential due to rising product safety standards, expanding healthcare coverage, and demand for single-dose packaging formats. With ongoing innovations from industry leaders like Amcor, Sonoco, and Berry Global, the blister packaging landscape in North America is set to evolve rapidly, addressing the varied needs of sectors ranging from healthcare to consumer electronics.

Sustainability and Eco-friendly Materials: A surge in the development of recyclable and biodegradable blister packs using plant-based plastics and paperboard alternatives is reshaping packaging strategies across industries.

Rise in Pharmaceutical Unit-dose Packaging: Especially in the U.S., an aging population and complex medication regimens have increased the demand for unit-dose blister packs that improve medication adherence and reduce dosing errors.

Integration of Anti-counterfeiting Technology: Smart blister packs embedded with QR codes and RFID tags are being increasingly adopted, particularly in the pharmaceutical and electronics segments.

Growth of E-commerce Influencing Design Innovations: Retail and electronics sectors are demanding tamper-evident, compact, and lightweight blister formats suitable for efficient logistics and attractive shelf display.

Automation and Smart Manufacturing: Packaging producers are investing in high-speed thermoforming equipment integrated with quality control systems, reducing human intervention while enhancing production scalability.

Premiumization of Consumer Goods Packaging: Companies in sectors like personal care and electronics are using high-gloss, custom-molded clamshell blister packs to elevate brand perception and consumer appeal.

Regulatory Compliance Driving Standardization: The U.S. FDA and Health Canada mandates around child-resistant and senior-friendly packaging are influencing design and material selection, particularly in healthcare.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.50 Billion |

| Market Size by 2033 | USD 17.90 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Material, Technology, Type, End-use, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Amcor plc; Constantia Flexibles; UFlex Limited; CCL Healthcare; Sonoco Products Company; WINPAK LTD.; WestRock Company; SteriPackGroup; Honeywell International Inc.; Klöckner Pentaplast; Südpack; TekniPlex; Blisterpak, Inc.; Nelipak; ACG |

One of the primary drivers of the North America blister packaging market is the escalating demand in the pharmaceutical sector, particularly for prescription and over-the-counter drugs. The U.S., being home to some of the world’s largest pharmaceutical companies, witnesses continuous drug development, clinical trials, and commercial launches. Blister packaging offers several advantages critical to this industry, including dose accuracy, extended shelf life, protection from external contaminants, and patient compliance monitoring.

Additionally, the shift toward personalized medicine and increased self-medication trends have bolstered the requirement for tamper-evident and easy-to-use single-dose packaging. As regulations grow stricter concerning drug packaging, particularly with serialization and anti-counterfeiting requirements under the Drug Supply Chain Security Act (DSCSA), blister packs are becoming the go-to solution. Moreover, blister formats minimize human contact, an essential feature underscored during the COVID-19 pandemic, thereby safeguarding both the medication and the end user.

Despite their widespread adoption, blister packs are under scrutiny due to their heavy reliance on plastic materials, particularly polyvinyl chloride (PVC), which poses environmental disposal challenges. As countries across North America push toward plastic reduction and circular economy goals, manufacturers face pressure to innovate or replace plastic-heavy formats. Unlike mono-material packaging, many blister packs combine PVC and aluminum or multilayer films, complicating recycling efforts.

This environmental concern is not only driving regulatory limitations but also affecting public perception. Consumers are increasingly conscious of sustainability, demanding alternatives that reduce plastic waste. However, transitioning to fully recyclable or compostable materials often involves higher costs and may compromise barrier properties—posing a trade-off challenge for manufacturers. Hence, the industry must strike a balance between ecological sustainability and functional performance to remain viable in a green-conscious marketplace.

An emerging opportunity lies in the expansion of cold forming technologies, particularly for high-barrier pharmaceutical applications. Cold-form blister packs, often using aluminum-based laminates, offer superior protection against moisture, light, and oxygen—attributes critical for biologics, vaccines, and temperature-sensitive drugs. While historically limited by their rigidity and cost, advancements in laminate engineering and forming precision have expanded their feasibility and reduced material wastage.

Moreover, with North America's burgeoning biologics and specialty drug market, especially in Canada and the U.S., the demand for cold-formed blister packs is expected to rise. These packs are ideal for safeguarding high-value pharmaceuticals and supporting patient safety by offering clear tamper evidence and unit-dose packaging. Manufacturers investing in new cold forming lines with enhanced design capabilities stand to benefit significantly from this untapped market segment.

Plastic films dominated the material segment, primarily due to their versatility, low cost, and compatibility with various thermoforming technologies. Among these, polyvinyl chloride (PVC) continues to be the most utilized, especially in the pharmaceutical sector, due to its high clarity and excellent formability. However, environmental concerns are causing a gradual shift toward alternatives like polyethylene terephthalate (PET), which offers better recyclability and strength. PET is witnessing fast growth across the consumer goods and electronics industries where clarity and impact resistance are valued.

The paper & paperboard category is the fastest-growing material segment, especially with brands adopting sustainable packaging formats. Solid bleached sulfate (SBS), for instance, is increasingly being used for blister card backing in pharmaceuticals and personal care products. Aluminum, though limited in flexibility, remains critical for high-barrier applications, particularly in cold-form blister packs for sensitive drugs and high-value electronics. As environmental regulations tighten, the material segment is expected to undergo further innovation and diversification.

Thermoforming is the dominant technology in the North American blister packaging market, accounting for the lion’s share of production. The process offers cost efficiency, high throughput, and the ability to use a variety of plastic films. It is widely applied in the manufacturing of blister packs for pharmaceuticals, personal care products, and consumer electronics. The ability to mold intricate shapes and incorporate transparent viewing windows makes it an ideal choice for product visibility and protection.

On the other hand, cold forming technology is growing rapidly, driven by demand for high-barrier pharmaceutical packaging. It is particularly suited for medications sensitive to moisture and light, including antibiotics, biologics, and vaccines. Although it requires a higher investment in machinery and materials, manufacturers are leaning into this segment to serve premium pharmaceutical clients seeking extended shelf life and higher product security.

Carded blister packs remain the most prevalent type, especially in the healthcare and retail sectors. These packs offer customizable shapes, clear product visibility, and space for branding, making them ideal for over-the-counter drugs, cosmetics, batteries, and toys. Their low cost and efficient production also make them attractive to high-volume applications.

However, clamshell blister packs are gaining popularity in the consumer goods and electronics markets. Known for their tamper resistance and reusability, clamshells are increasingly used for items like headphones, USB devices, and cosmetic kits. They provide better protection during shipping and handling, a factor critical for e-commerce-driven retail. The aesthetic appeal and perceived value also contribute to their rising adoption, particularly in Canada and the U.S.

The healthcare sector dominates the end-use segment, driven by extensive use of blister packs for prescription drugs, OTC medications, and medical devices. The aging population, increased chronic disease prevalence, and regulations surrounding child-resistant packaging continue to sustain this dominance. Blister packs ensure dosage accuracy, product integrity, and reduced contamination, making them a preferred choice across pharmacies and hospitals in the U.S. and Canada.

Retail and electronics are among the fastest-growing segments, particularly driven by e-commerce growth and demand for tamper-evident packaging. Electronics like batteries, earphones, and accessories are frequently sold in clamshell blister packs due to their durability and aesthetic appeal. Similarly, consumer goods brands in personal care, toys, and food supplements are utilizing blister packs for display and convenience. As brand competition intensifies, packaging becomes a key differentiator, fueling demand in these categories.

United States

The United States is the largest market for blister packaging in North America. The country’s massive pharmaceutical industry, accounting for nearly half of global drug spending, drives blister pack demand significantly. Regulatory frameworks from the FDA mandate unit-dose formats and child-resistant features, fostering the adoption of blister solutions. Additionally, a rise in chronic diseases, self-medication, and geriatric healthcare has increased demand for patient-centric packaging formats.

Beyond healthcare, the booming e-commerce and electronics markets are further accelerating blister pack use. U.S. manufacturers are investing in sustainable blister materials and smart packaging solutions like QR-code-enabled authentication. Rising environmental activism has also pushed companies to explore paperboard-based and mono-material blister formats. Key players are ramping up their R&D spending to balance performance with recyclability.

Canada

Canada is witnessing steady growth in blister packaging, especially in healthcare and retail sectors. With Health Canada pushing stringent packaging norms, especially around bilingual labeling and safety features, blister packs are becoming the format of choice. Local pharmaceutical companies and contract packaging providers are investing in thermoforming machinery and eco-friendly materials to meet both compliance and sustainability goals.

Moreover, the Canadian government's incentives for domestic pharmaceutical manufacturing and packaging innovation are encouraging local production capabilities. The country’s increasing focus on sustainable packaging through tax benefits and plastic reduction goals has also fueled the growth of recyclable and paperboard blister packs. Retailers in electronics and cosmetics are also turning to blister formats for enhanced product display and security.

Mexico

Mexico is emerging as a fast-growing market, owing to the expansion of pharmaceutical manufacturing, increased consumer goods exports, and growth in retail infrastructure. As more international pharma companies establish operations in Mexico, the demand for localized blister packaging has risen sharply. Mexican blister pack producers are adopting international quality standards and forming strategic partnerships with global packaging leaders.

Additionally, the electronics manufacturing boom in Mexico, particularly around border regions like Tijuana, has led to increased demand for clamshell blister packaging. With a growing middle class and modern retail formats like hypermarkets, consumer-facing blister solutions are seeing higher uptake. Government support for medical device and pharmaceutical exports has further opened avenues for cold-form blister formats tailored to international specifications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America blister packaging market

Material

Technology

Type

End-use

Country