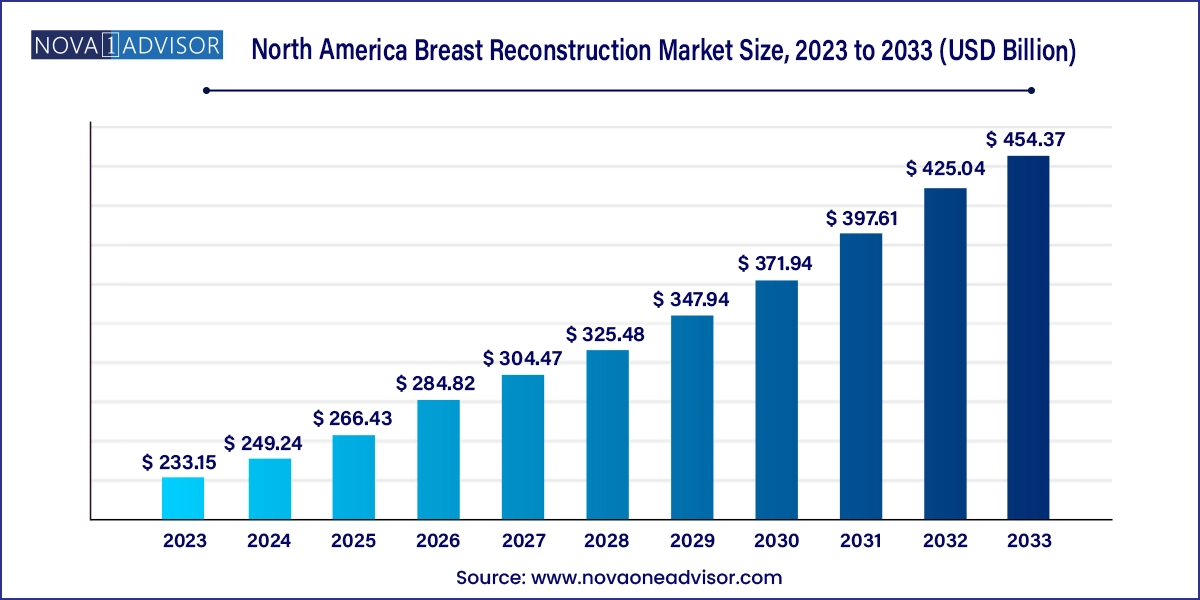

The North America breast reconstruction market size was exhibited at USD 233.15 billion in 2023 and is projected to hit around USD 454.37 billion by 2033, growing at a CAGR of 6.9% during the forecast period 2024 to 2033.

The North America breast reconstruction market plays a critical role in the post-mastectomy care continuum. With breast cancer being one of the most diagnosed cancers among women, especially in the United States and Canada, breast reconstruction has become an integral part of comprehensive cancer recovery plans. This market covers a spectrum of medical devices and procedures, including implants, tissue expanders, acellular dermal matrices (ADM), and reconstructive techniques, all aimed at restoring the aesthetic and psychological well-being of patients following mastectomy.

The demand for breast reconstruction has surged due to the rising incidence of breast cancer, increased awareness of reconstructive options, and legislative mandates like the U.S. Women’s Health and Cancer Rights Act, which requires health plans to cover breast reconstruction following mastectomy. Additionally, technological innovations, such as air tissue expanders and 3D imaging, have enhanced surgical outcomes and improved patient satisfaction.

Cosmetic surgeons, oncological specialists, and plastic surgery centers in North America are increasingly emphasizing patient-centered reconstructive strategies, encouraging bilateral reconstruction, oncoplastic procedures, and minimally invasive implant placement. As the healthcare industry embraces value-based care, breast reconstruction is being recognized not merely as an aesthetic procedure but as a key element of post-cancer healing.

Rising popularity of pre-pectoral implant placement reducing post-op pain and recovery time

Growing use of acellular dermal matrices (ADM) for improved implant support

Surge in demand for air-based tissue expanders for faster and less painful expansion

Increased focus on patient-specific, 3D-planned reconstructive surgeries

Collaboration between plastic surgeons and oncologists driving multidisciplinary care models

Adoption of round and anatomical implant options to meet aesthetic preferences

Regulatory approval of newer materials and surgical protocols for tissue regeneration

Growing use of social media and patient advocacy in reconstructive decision-making

| Report Coverage | Details |

| Market Size in 2024 | USD 249.24 Billion |

| Market Size by 2033 | USD 454.37 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Shape, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada |

| Key Companies Profiled | Mentor Worldwide LLC; AbbVie Inc.; Integra LifeSciences; Sientra, Inc.; Stryker; Establishment Labs; RTI Surgical; MTF Biologics; Surgical Innovation Associates; TELA Bio, Inc. |

A principal driver of the North American breast reconstruction market is the rising incidence of breast cancer and increasing awareness of reconstruction as a care option. In the United States alone, approximately 1 in 8 women are diagnosed with invasive breast cancer during their lifetime. Following mastectomy, many women consider reconstruction to regain physical and emotional confidence.

Government mandates and support from healthcare institutions have fueled awareness campaigns to inform women about reconstructive options post-mastectomy. For example, in the U.S., the Breast Reconstruction Awareness (BRA) Campaign—supported by the American Society of Plastic Surgeons—has led to increased patient education and earlier engagement with reconstructive surgeons, often at the diagnosis stage.

Furthermore, psychological studies support the notion that breast reconstruction improves mental health, body image, and quality of life for survivors. These insights have led oncologists to include reconstruction consultations as standard practice in cancer treatment plans, thereby broadening the market for reconstructive products and services.

Despite advancements in reconstructive technologies, a significant restraint in the market is the high cost of procedures and uneven access to services, especially in rural or underserved regions. Reconstructive surgery, while covered by many insurance plans, may still involve out-of-pocket costs for implants, revisions, or cosmetic symmetry procedures.

In addition, not all hospitals or community clinics have qualified plastic surgeons trained in complex breast reconstruction, particularly microsurgical flap techniques. This leads to geographic disparities, where urban patients benefit from specialized care centers, while rural patients face limited choices and longer wait times.

Another issue is that lower-income women and ethnic minorities are statistically less likely to receive breast reconstruction after mastectomy, often due to socioeconomic barriers, lack of awareness, or cultural perceptions of cosmetic surgery. These disparities highlight the need for policy reform, reimbursement incentives, and telemedicine-based pre-op consultations to expand market access.

A compelling opportunity within the market lies in technological advancements in implant design and tissue expansion systems, which are transforming the patient experience and surgical outcomes. Companies are investing in customizable, form-stable implants, air-based tissue expanders, and bioengineered matrices that facilitate faster healing, natural aesthetics, and fewer complications.

For instance, air-based tissue expanders offer rapid expansion without painful saline injections, reducing the number of clinical visits. Similarly, 3D printed implant molds and pre-surgical simulations allow for greater surgical precision, minimizing the need for revisions. In combination with minimally invasive surgical techniques, these innovations appeal to both surgeons and patients, encouraging uptake of reconstruction services.

Moreover, the integration of wearable postoperative sensors and telehealth follow-up tools ensures that patients can receive real-time monitoring and guidance after discharge, improving safety and satisfaction. These developments open pathways for premium product lines, bundled care packages, and long-term partnerships between providers and suppliers.

Among the product categories, silicone breast implants hold the dominant share due to their natural texture, long-term durability, and lower risk of visible rippling compared to saline alternatives. Silicone implants have been FDA-approved for reconstructive use and are preferred in over 80% of breast reconstruction procedures in North America.

Patients often opt for silicone implants for their realistic feel and contouring benefits, particularly in delayed reconstruction cases. The evolution of form-stable or “gummy bear” implants has enhanced their safety and shape retention over time. Silicone implants are also increasingly used in pre-pectoral placement, requiring less muscular manipulation and reducing recovery time.

Air tissue expanders are the fastest-growing segment due to their minimally invasive inflation process and improved patient comfort. Unlike traditional saline expanders, air expanders eliminate the need for multiple clinic visits for expansion, allowing patients to control inflation remotely under clinical supervision.

These devices not only reduce procedural pain and hospital resource usage but also align with patient-centric care models. Surgeons benefit from time-efficient procedures and fewer complications, while patients experience greater autonomy and faster completion of the reconstructive journey.

Round-shaped implants are the leading choice for breast reconstruction due to their uniform fullness and lower risk of malrotation, especially in high-volume surgeries. These implants offer symmetrical results and can be customized for projection, profile, and texture, providing plastic surgeons with flexibility based on patient anatomy.

Round implants are often used in cases of bilateral reconstruction or where the patient prefers enhanced upper pole volume, delivering a more youthful appearance. Their ease of placement and alignment with existing incision techniques also make them a surgeon’s favorite for immediate reconstruction.

Anatomical or teardrop-shaped implants are growing rapidly, especially among patients seeking a natural slope and less fullness at the top of the breast. These are particularly popular in unilateral reconstruction, where the goal is to match the natural shape of the remaining breast.

As 3D simulation tools and patient preference for natural aesthetics evolve, surgeons are offering anatomical implants more frequently, despite their slightly more complex placement requirements. Advanced texturing and cohesive gel filling have mitigated the historical concerns of implant rotation or capsular contracture.

Hospitals lead the market in terms of reconstructive procedures performed, particularly academic medical centers and cancer institutes where multidisciplinary teams coordinate cancer and reconstructive care. Hospitals often conduct both immediate and delayed reconstructions, using advanced surgical suites and post-op care units.

They are also the primary sites for complex procedures such as flap-based reconstructions (e.g., DIEP, TRAM), which require microvascular surgical expertise. Furthermore, hospitals benefit from reimbursement contracts, government grants, and cancer-focused charitable funding to offer reconstruction services at reduced patient cost.

Cosmetology clinics are the fastest-growing end-use category, particularly in Canada and metro areas of the U.S. where elective reconstructions, symmetry procedures, and revision surgeries are increasingly performed in outpatient settings. These clinics offer a premium, concierge-style experience for patients seeking aesthetic enhancements post-mastectomy.

Equipped with board-certified plastic surgeons, digital planning tools, and recovery lounges, cosmetology clinics attract patients who prioritize personalization and privacy. Their agile business models allow them to rapidly adopt innovative implant types, skin substitutes, and minimally invasive techniques.

The United States dominates the North American breast reconstruction market, accounting for the largest share due to its high breast cancer prevalence, advanced healthcare system, and supportive insurance mandates. Laws such as the Women’s Health and Cancer Rights Act (WHCRA) mandate that insurance plans covering mastectomies must also cover reconstruction, driving widespread accessibility.

The U.S. is home to leading cancer centers and plastic surgery networks, many of which conduct clinical trials and publish reconstructive best practices. Public-private partnerships, foundations like Susan G. Komen, and national campaigns such as Breast Reconstruction Awareness (BRA) Day have further contributed to patient awareness and demand.

Canada is witnessing rapid growth, bolstered by its universal healthcare coverage and national breast cancer screening programs. Provinces like Ontario and British Columbia have expanded reconstructive services under public health plans, while Quebec recently enhanced funding for immediate reconstruction following mastectomy.

Efforts by Canadian plastic surgery associations to improve training, rural outreach, and teleconsultations have increased the number of patients accessing reconstruction. The presence of public education programs and multi-disciplinary breast units within hospitals is helping normalize the conversation around breast reconstruction.

April 2025 – Mentor Worldwide LLC (Johnson & Johnson) launched its new round cohesive gel breast implant in the U.S., offering enhanced durability and a natural look.

March 2025 – Establishment Labs received FDA IDE approval to begin trials of its Motiva Implants® for reconstruction in the North American market.

February 2025 – AirXpander Inc. announced a pilot project in Canadian hospitals to deploy its next-gen air-based expansion system for post-mastectomy patients.

January 2025 – Sientra Inc. introduced a line of anatomical implants with enhanced shell technology designed for post-surgical symmetry in unilateral reconstructions.

December 2024 – Allergan Aesthetics (AbbVie) expanded its partnership with nonprofit clinics across the U.S. to provide reconstructive implants at reduced costs for underserved communities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America breast reconstruction market

Product

Shape

End-use

Regional