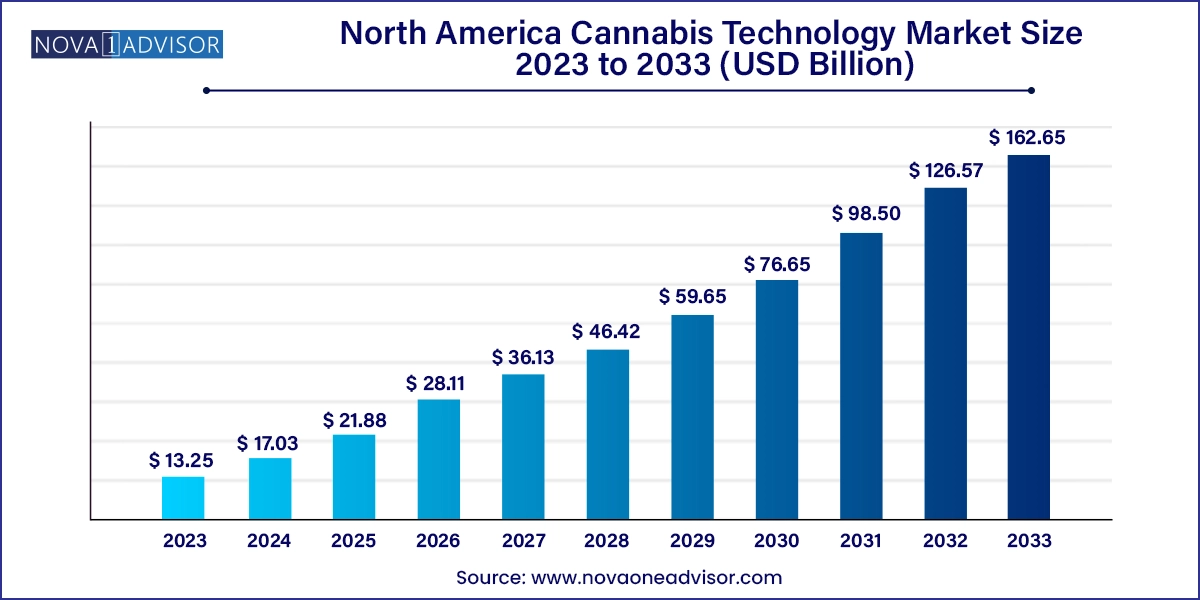

The North America cannabis technology market size was exhibited at USD 13.25 billion in 2023 and is projected to hit around USD 162.65 billion by 2033, growing at a CAGR of 28.5% during the forecast period 2024 to 2033.

The North America cannabis technology market is undergoing a profound transformation, catalyzed by the rapid expansion of legal cannabis cultivation, distribution, and consumption across the region. With progressive regulatory frameworks in countries like the United States, Canada, and Mexico, cannabis has moved from the fringes of legality to the center of a burgeoning, multi-billion-dollar economy. Technology has become the backbone of this evolution, driving efficiency, compliance, and scalability in a market that is becoming more complex, regulated, and competitive.

Cannabis technology in North America spans a wide array of solutions and products ranging from seed-to-sale software platforms, enterprise resource planning (ERP) tools, smart cultivation systems, automated trimming and packaging machinery, to cloud-based point-of-sale (POS) systems. These technologies are instrumental in managing the intricacies of cultivation (whether indoor, greenhouse, or outdoor), ensuring traceability in the supply chain, maintaining regulatory compliance, enhancing customer experience, and improving yield and quality through precision agriculture.

In cultivation, IoT-enabled hydroponics systems, AI-assisted climate control, and sensor-based nutrient delivery are optimizing resource use and maximizing plant health. In retail and dispensing, POS systems integrated with customer management tools enable dispensaries to manage inventory, sales, and customer preferences while complying with state-level tracking mandates. Processing and manufacturing facilities increasingly depend on automation, especially in trimming, drying, packaging, and labeling processes, to keep pace with demand while reducing manual labor costs and minimizing human error.

The legalization momentum in the U.S., full federal legalization in Canada, and recent medical cannabis reforms in Mexico have laid the groundwork for a continent-wide surge in demand. As a result, cannabis operators are under increasing pressure to adopt scalable, secure, and regulatory-aligned technologies that can ensure both competitiveness and compliance. Venture capital funding, mergers and acquisitions, and strategic collaborations are further accelerating the adoption of cannabis-specific technologies across the region.

Shift Toward Automation in Cultivation and Processing: Technologies such as robotic trimmers, automated watering systems, and AI-enabled climate control are reducing labor costs and enhancing operational consistency.

Expansion of Cloud-Based Software Ecosystems: Cloud-integrated ERP and POS platforms are streamlining operations, enabling multi-state operators (MSOs) to unify processes across different jurisdictions.

Precision Agriculture with IoT and AI: Smart sensors, drones, and machine learning algorithms are being employed for data-driven decision-making in crop management.

Growing Use of Blockchain in Supply Chain: Blockchain is being explored for immutable seed-to-sale tracking, enhancing transparency and trust in the cannabis supply chain.

Rise of Cannabis eCommerce and Digital POS: The pandemic accelerated the demand for online ordering, delivery integrations, and digital menus, pushing cannabis retail toward omnichannel commerce.

Sustainability and Energy-Efficiency Tech Adoption: Growers are seeking energy-saving LED grow lights, closed-loop hydroponics, and water recycling systems to reduce environmental impact and operating costs.

Integration of CRM and Loyalty Solutions: Dispensaries are increasingly leveraging customer relationship management tools and digital loyalty programs to enhance retention and personalization.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.03 Billion |

| Market Size by 2033 | USD 162.65 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 28.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Application, and Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico |

| Key Companies Profiled | 365 Cannabis; dutchie; Akerna Agrify; Nugistics; Ample Organics; Simplifya; GrowerIQ; Distru Greenline; BioTrackTHC |

The primary driver of the cannabis technology market in North America is the legalization and subsequent commercialization of cannabis across the region. Canada became the first G7 country to legalize recreational cannabis in 2018, establishing a federal model for production, distribution, and sales. In the U.S., over 20 states have legalized recreational use and 38 states allow some form of medical cannabis, with increasing bipartisan support for federal reform. Meanwhile, Mexico decriminalized cannabis for personal use and is in the process of establishing its regulatory and commercial framework.

This legalization wave has triggered explosive growth in the number of licensed cannabis businesses—retailers, cultivators, processors, and delivery services—all of which must operate within a strict regulatory environment. As a result, cannabis technology is not a luxury but a necessity. Seed-to-sale tracking, inventory management, lab testing integration, and compliance reporting are all technology-driven requirements. Legalization not only legitimizes market operations but also mandates accountability, pushing operators to adopt reliable and scalable technology platforms.

A significant restraint in the North American cannabis technology market is the regulatory fragmentation and the complexity of compliance across jurisdictions. In the U.S., the cannabis industry operates under a patchwork of state laws, each with unique rules on tracking, labeling, reporting, packaging, and security. A cannabis business operating in California must navigate a very different legal and technological environment than one in Florida, Colorado, or New York.

This fragmented landscape makes it difficult for technology providers to build one-size-fits-all solutions. Instead, they must continuously adapt and customize their platforms to accommodate changing regulations at the state and municipal levels. Moreover, the lack of federal legalization in the U.S. restricts access to banking, insurance, and federal trade protections—forcing many companies to operate in cash-heavy environments that require specialized security and compliance technology.

In Mexico, the evolving legal landscape is still being structured, creating uncertainty for tech vendors and operators alike. Even in Canada, where federal regulation is consistent, each province has autonomy over retail models (public vs. private), resulting in additional layers of complexity. These regulatory hurdles raise development costs, delay go-to-market timelines, and create challenges in standardizing technology across North America.

One of the most compelling opportunities in the North America cannabis technology market is the integration of artificial intelligence (AI) and big data analytics into cultivation, retail, and supply chain operations. Cannabis is a data-rich industry whether it’s genetic profiles, environmental conditions, consumer preferences, or sales patterns and AI tools can unlock tremendous value by making sense of this complexity.

In cultivation, AI-powered platforms are being used to predict optimal harvest times, detect pests and diseases through image recognition, and adjust environmental parameters to maximize yields. In retail, predictive analytics can optimize inventory management, personalize product recommendations, and forecast customer demand based on seasonality and trends. Across the supply chain, data analytics can ensure traceability, reduce waste, and improve operational efficiency.

With the rise of vertically integrated companies, multi-state operators, and eCommerce platforms, the need for centralized data visibility is greater than ever. Cannabis businesses that embrace AI and data analytics will not only gain a competitive edge but also improve compliance, sustainability, and profitability. Technology vendors that can offer integrated, AI-ready platforms tailored to the cannabis industry stand to capture significant market share.

Retail & Dispensing dominated the North America cannabis technology market by application, owing to the rapid expansion of legal dispensaries and the growing sophistication of cannabis retail operations. Retailers are adopting POS systems, customer relationship management (CRM) tools, loyalty programs, inventory tracking, and compliance software to manage day-to-day operations. The surge in cannabis eCommerce and delivery services, accelerated by the COVID-19 pandemic, has also made online ordering systems and digital menus integral to retail technology infrastructure. Retailers increasingly rely on integrated platforms to manage omni-channel transactions, monitor in-store traffic, and enhance customer engagement through personalized promotions.

Cultivation & agriculture is the fastest-growing segment, particularly in indoor and greenhouse settings, where yield optimization, climate control, and resource efficiency are critical. Growers are adopting smart hydroponics systems, automated nutrient delivery, and sensor-based climate monitoring to ensure consistent quality and reduce environmental impact. Indoor cultivation especially benefits from advanced technologies such as LED grow lighting, AI-enabled CO2 monitoring, and real-time plant health analytics. As more growers seek to scale operations and meet quality control standards, the adoption of tech-enhanced cultivation solutions is rising exponentially.

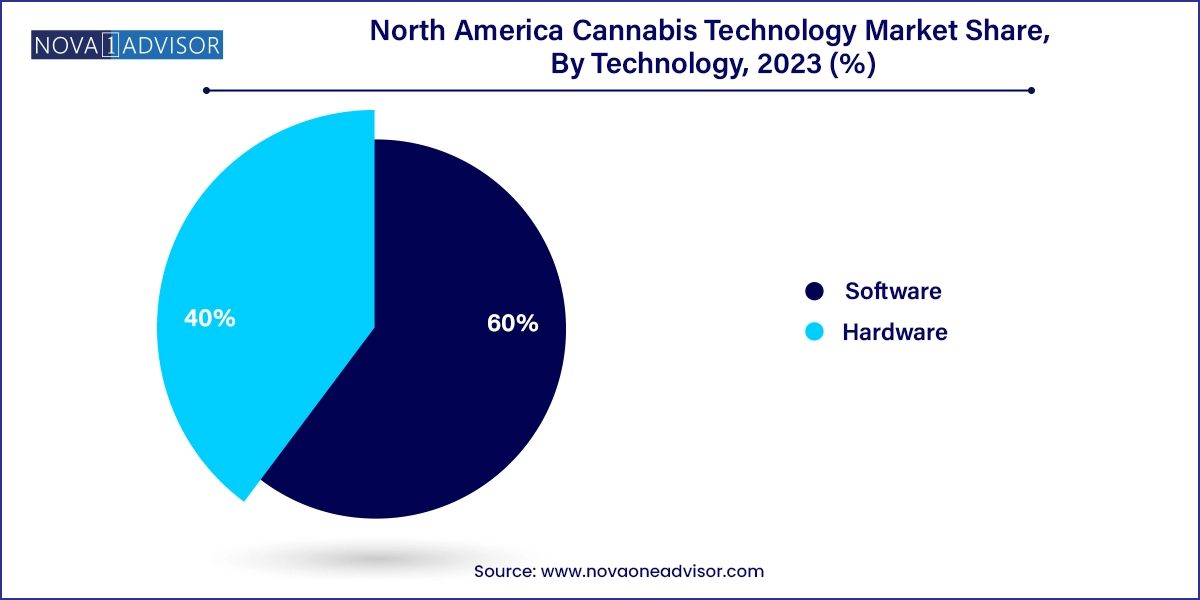

Software solutions dominated the North American cannabis technology market, due to their role in managing compliance, operations, and customer engagement. ERP platforms, POS systems, inventory tracking, and CRM tools are now indispensable to cannabis businesses of all sizes. States with strict track-and-trace requirements like California’s METRC system necessitate software platforms that can automate compliance and generate real-time reports. POS software integrated with patient/customer management capabilities is especially vital for dispensaries operating both brick-and-mortar and online stores.

Hardware technology is the fastest-growing segment, driven by the increasing demand for automation and precision equipment in cultivation and processing. Key hardware components include LED grow lights, trimming machines, packaging and labeling equipment, and hydroponic systems. Trimming machines, for example, help reduce manual labor in high-volume operations, while automated packaging ensures uniformity and compliance with labeling laws. As competition increases and margins tighten, cannabis businesses are turning to hardware investments to scale operations, reduce errors, and increase efficiency.

United States

The United States is the dominant country in the North America cannabis technology market, with the largest number of licensed operators, dispensaries, and technology vendors. Although cannabis remains federally illegal, the patchwork of state legalization has created fertile ground for innovation in compliance software, POS systems, and cultivation technologies. Companies like Dutchie, Weedmaps, and Flowhub have become leaders in cannabis-specific SaaS platforms, while hardware manufacturers are developing LED lighting and vertical farming equipment tailored for U.S. growers.

In high-growth states such as California, Michigan, Massachusetts, and New York, demand for end-to-end cannabis tech solutions is accelerating. Multi-state operators (MSOs) require centralized software systems that can adapt to varying regulatory landscapes, driving adoption of modular ERP platforms and cloud-based data analytics tools. The U.S. also leads in cannabis R&D, with universities and private labs exploring new genetics, biopesticides, and machine learning tools to enhance yields and sustainability.

March 2025 – Dutchie announced the launch of its next-generation POS and eCommerce platform, integrating customer loyalty, inventory management, and AI-driven analytics into a single cloud-based system tailored for dispensaries.

February 2025 – Akerna Corp. released a new ERP module designed to integrate METRC compliance reporting across all legal states, streamlining multi-state cannabis operations for vertically integrated companies.

January 2025 – Agrify Corporation introduced its VX-300 Smart Cultivation Pod, a modular, AI-controlled indoor growing system that uses environmental sensors and cloud connectivity to optimize plant health and yields.

December 2024 – Weedmaps expanded its services to Mexico, launching a Spanish-language marketplace platform in anticipation of the country's medical cannabis commercialization.

November 2024 – Fluence by OSRAM partnered with a Canadian grower to deploy spectrum-optimized LED grow lights, improving terpene production in medical-grade cannabis strains.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America cannabis technology market

Application

Technology

Country